Table of Contents

Overview

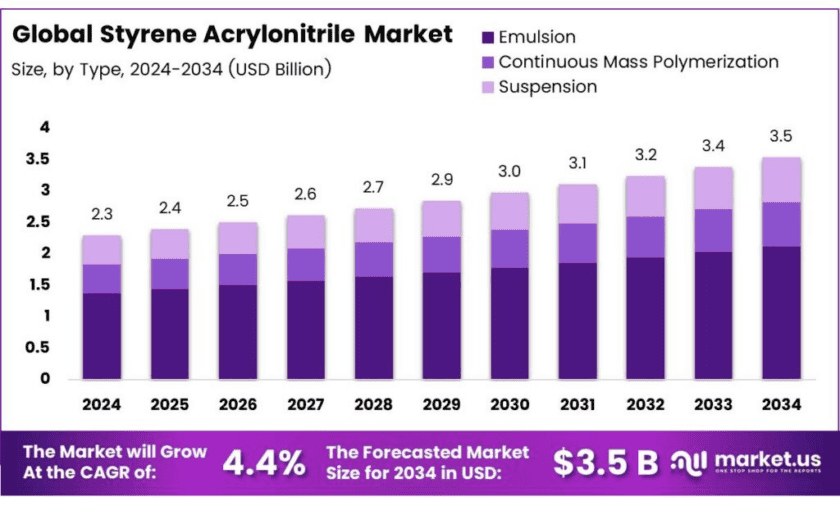

New York, NY – Oct 28, 2025 – The Styrene Acrylonitrile (SAN) market serves durable household goods, cosmetic packaging, electricals, and medical labware because SAN offers clarity, stiffness, heat resistance, and strong chemical resistance—qualities that help parts keep shape and gloss in daily use. The Global Styrene Acrylonitrile Market size is expected to be worth around USD 3.5 billion by 2034, from USD 2.3 billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Growth is supported by steady appliance production, rising demand for premium personal-care packaging, and substitution where SAN’s transparency and dimensional stability beat commodity resins, reducing scrap and enabling thin-wall moulding. Product data from producers highlight SAN’s property balance—good transparency, high stiffness, heat resistance, and dimensional stability—making it a practical choice for injection moulding and extrusion in consumer and cosmetics parts.

At the same time, cost competitiveness swings with feedstocks: acrylonitrile and styrene. In early 2025, U.S. acrylonitrile averaged about $1,350/MT (down ~2.3% from Q4 2024), while industry trackers described styrene prices as lower through 2024 with only modest recovery into 2025—both reflecting muted downstream demand and softer feedstock costs. These shifts can compress margins for SAN converters when prices rebound.

Another challenge is cyclical volatility tied to construction and consumer durables, which affects order patterns across appliances and electronics. Still, producers are refreshing portfolios to lift value: for example, INEOS Styrolution’s Luran® (SAN) line targets durable g oods and cosmetics, emphasising clarity and chemical resistance for high-gloss, stress-resistant parts—supporting premium packaging and small-appliance housings.

A notable recent market development with numbers: on October 2, 2025, Trinseo announced a price decrease of EUR 10/ton for TYRIL™ SAN grades in Europe, signalling ongoing softness and inventory balancing in styrenics chains; such adjustments can spur short-term demand recovery and renegotiations in converter contracts.

Key Takeaways

- The Global Styrene Acrylonitrile (SAN) market is projected to grow from USD 2.3 billion in 2024 to USD 3.5 billion by 2034, at a CAGR of 4.4%.

- Emulsion polymerization dominates the SAN market with a 46.8% share due to its uniform particle distribution and superior material properties.

- Packaging applications lead the SAN market with a 31.2% share, driven by SAN’s clarity, chemical resistance, and rigidity for containers and films.

- Asia-Pacific holds a 42.8% market share, valued at USD 0.9 billion, fueled by its robust manufacturing and growing electronics and automotive sectors.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-styrene-acrylonitrile-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.3 Bn |

| Forecast Revenue (2034) | USD 3.5 Bn |

| CAGR (2025-2034) | 4.4% |

| Segments Covered | By Type (Emulsion, Continuous Mass Polymerization, Suspension), By End Use (Packaging, Electrical and Electronics, Medical, Automotive and Transportation, Others) |

| Competitive Landscape | SABIC, INEOS Styrolution, LG Chem, BASF SE, Trinseo, Chi Mei Corporation, Asahi Kasei Corporation, ENI, INEOS Group, Ravago Group |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161146

Key Market Segments

Emulsion Type Dominates the Styrene Acrylonitrile Market – 46.8% Share

In 2024, the Emulsion type held a leading position in the global Styrene Acrylonitrile (SAN) market, accounting for 46.8% of the total market share. The emulsion polymerization process ensures uniform particle distribution and precise control over molecular weight, resulting in SAN with enhanced transparency, toughness, and chemical resistance. These features make it widely used in automotive components, household goods, and electronic housings. Continuous demand from consumer goods and electronics industries, along with manufacturers’ focus on improving production efficiency, is expected to sustain the dominance of emulsion-based SAN.

Packaging End Use Leads the Styrene Acrylonitrile Market – 31.2% Share

The Packaging segment led the SAN market by end use in 2024, securing a 31.2% share of the global market. The segment’s growth is driven by SAN’s clarity, rigidity, and chemical resistance, which make it ideal for transparent containers, cosmetic jars, food trays, and durable packaging films. Its high heat resistance and form stability enhance its suitability for both consumer and industrial applications. Increasing demand for lightweight, recyclable, and sustainable packaging materials is expected to further reinforce SAN’s strong position in the global packaging industry.

List of Segments

By Type

- Emulsion

- Continuous Mass Polymerization

- Suspension

By End Use

- Packaging

- Electrical and Electronics

- Medical

- Automotive and Transportation

- Others

Emerging Trends in Styrene Acrylonitrile (SAN)

Premium clarity & chemical-resistant grades for beauty and appliances

Brand owners are choosing SAN for a “glass-like” look with stronger chemical resistance than GPPS. Current product lines explicitly target cosmetics packaging, small-appliance housings, and profiles—emphasizing transparency, stiffness, and dimensional stability. Supplier pages highlight these attributes for SAN (e.g., Luran®) and list end uses such as cosmetic jars and appliance parts, confirming steady design-in across consumer goods.

Visible circularity shift: SAN made with recycled monomers (mass balance)

Circular feedstock is moving from pilots to commercial availability. In October 2025, Trinseo said its TYRIL™ SAN can be produced using chemically recycled styrene monomer via depolymerization, certified through mass balance—marketed as a drop-in to fossil grades, including for food-contact applications. This validates a supply-chain route for lower-footprint SAN without tooling or process changes.

Price normalization points to softer Europe demand in 2H-2025

Styrenics price signals turned accommodative. Trinseo announced a price decrease of €10/ton for SAN in Europe effective October 1, 2025 (with larger cuts for PS), indicating inventory balancing and cautious downstream offtake. For converters, this can temporarily improve margins and support restocking.

Growing use in medical & labware due to clarity and sterilization stability

Hospitals and diagnostics labs continue to specify SAN for test tubes, Petri dishes, inhaler components, and medical containers, citing clarity, chemical resistance, and sterilization stability. This broadens SAN beyond household goods into regulated settings and supports steady baseline demand.

Quantified performance data enable “design-for-purpose” selection

Detailed datasheets for general-purpose SAN grades (e.g., Luran® 368R) report values such as MVR 10 cm³/10 min at 220 °C/10 kg and Izod notched impact ≈ 2 kJ/m² at 23 °C, helping engineers optimize wall-thickness and cycle time in injection molding and extrusion. The data support SAN’s positioning between commodity PS and higher-cost engineering resins.

Manufacturer messaging underscores consumer-facing applications

Major producers (e.g., LG Chem) continue to promote SAN’s transparency, gloss, and chemical resistance for refrigerator shelves, office goods, and cosmetic containers, reinforcing SAN’s role in durable consumer products where look and stress-crack resistance both matter.

Top Use Cases

Utility-scale plants in high-sun regions (maximize yield & cut LCOE)

Single-axis trackers (SATs) boost annual energy by ~15–25% vs. fixed-tilt in sunny zones, lowering levelized cost of electricity (LCOE). IEA-PVPS finds bifacial + SAT systems can deliver up to 35% higher energy and ~16% lower LCOE than fixed-tilt monofacial systems, making them the most cost-effective setup across most geographies.

Bifacial PV on trackers for premium output

Pairing bifacial modules with SATs unlocks additional back-side gains. NREL measurements show ~6–7% bifacial gain on 1-axis trackers (module-dependent), on top of the tracker uplift. Other NREL work reports ~4–15% average bifacial energy gains depending on albedo/site—supporting higher net MWh/acre.

Low-capex, bankable utility builds (cost benchmarks)

NREL’s 2024 ATB models a $1.56/W_AC overnight capital cost for a 100-MW_DC one-axis-tracking utility PV plant (Q1-2023 quote basis), underscoring why developers standardize on SATs for large projects targeting sub-$50/MWh PPA bands in many regions.

Production smoothing and higher capacity factors for grid integration

Because trackers follow the sun, output extends longer into mornings/evenings, improving plant shape and capacity factor relative to fixed-tilt. IEA-PVPS states that tracker gains of 15–20% plus bifacial gains of 2–10% are additive—useful where grid operators value steadier ramps and higher midday-to-shoulder energy.

Diffuse-light optimization in variable climates

Modern SAT control adds “diffuse tracking” and smarter backtracking to recover energy in cloudy or complex-terrain sites. Field/control studies show real-time controls add ~2–6% energy in challenging conditions; current R&D is tuning algorithms that react to diffuse fraction and row-to-row shading to capture extra kWh.

Fast-growing utility additions (global scale-up context)

Trackers dominate new utility PV because the segment is expanding quickly: the IEA notes utility-scale PV additions more than doubled in 2023, led by China, reinforcing the global standardization on SATs for new large-scale builds.

Harsh-environment builds (deserts & arid zones)

In high-DNI deserts, SATs extract superior insolation across the day. Industry O&M evidence indicates ~20–30% energy uplift versus fixed-tilt when properly maintained—supporting use cases like desert utility hubs where trackers’ added yield outweighs modest O&M overhead.

Recent Developments

SABIC – SABIC is actively strengthening its plastics portfolio although publicly direct SAN-specific launches are less frequent. One headline item: SABIC launched its LNP™ ELCRES™ CXL copolymer resins in December 2024, focused on high chemical resistance, which signals a broader move into specialty styrenics and high-performance materials. Moreover, SABIC is cited in industry reports as part of a joint venture with INEOS Styrolution (see below) to establish a global SAN producer with combined capacity over 1 million tons per annum, which would significantly scale SAN production. For the SAN market this means SABIC is preparing to ramp up capacity and secure a stronger share by leveraging its feed-stock access and global footprint.

INEOS Styrolution – As a specialist in styrenics, INEOS Styrolution has several relevant recent developments. For example, in July 2025 it launched a 100% bio-attributed polystyrene material (Styrolution® PS ECO 158K BC100) that claims a 172% reduction in carbon emissions compared to fossil-based equivalents. While this is polystyrene rather than SAN, it shows the company’s sustainability push and capacity for innovation in styrenic copolymers. Additionally, the company announced new SAN grade “Luran® 2555” for masterbatches and compounding in May 2024. On strategic capacity, reports indicate the joint venture with SABIC aims to cover SAN capacity in excess of 1 million tons per year. For a market research perspective: INEOS Styrolution is positioning itself as a technology leader and scaling up for volume, which means competitive pressure on supply and potential margin compression unless differentiation occurs.

LG Chem – LG Chem is another key player in the SAN market and wider chemical & plastics arena. A for-SAN specific move: In July 2023 it entered into a partnership with BASF SE aimed at advancing SAN technology, targeting automotive applications. Although not giving exact capacity or launch numbers, the collaboration points to development of next-gen SAN grades and shared production/marketing. Separately, LG Chem announced in August 2025 that it will build a bio-feedstock plant (HVO/SAF) processing approximately 400,000 tons annually by 2027 in South Korea, signalling that LG is shifting feedstock strategy—relevant because raw material strategy influences SAN economics. For the SAN market this means LG Chem may gain a feed-stock cost advantage and develop bio-based SAN or materials that use recycled feedstocks. Their partnership with BASF further increases their technological leverage.

BASF SE – Although BASF’s public announcements specific to SAN are less prominent in recent years, it is mentioned as part of the LG Chem partnership (July 2023) to push SAN technology in automotive segments. Also, while not SAN-specific, BASF announced in January 2023 a capacity expansion for polymer dispersions at its Merak (Indonesia) site to support regional growth in Southeast Asia. From a market research view: BASF plays a dual role – as a materials innovator, and as a strategic partner in SAN value chain. Their alliance with LG Chem means they are committed to staying relevant in the evolving SAN market even if they are not the headline SAN producer.

Conclusion

In conclusion, the global market for Styrene Acrylonitrile (SAN) continues to present a steady and promising growth trajectory thanks to its unique blend of transparency, rigidity, heat and chemical resistance, and suitability across diverse end‐use industries.

That said, the market is also subject to key challenges including volatility in feedstock costs (styrene, acrylonitrile), competitive pressure from alternative polymers, and rising sustainability/regulatory requirements that may necessitate reformulations or recycling investment. In sum, for investors and industry players alike, SAN offers a solid growth platform anchored in value‐added applications (such as cosmetics packaging, medical devices, appliance parts), and those who innovate in higher-performance grades, recycled content or downstream integration are likely to capture the most upside as the market matures.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)