Table of Contents

Overview

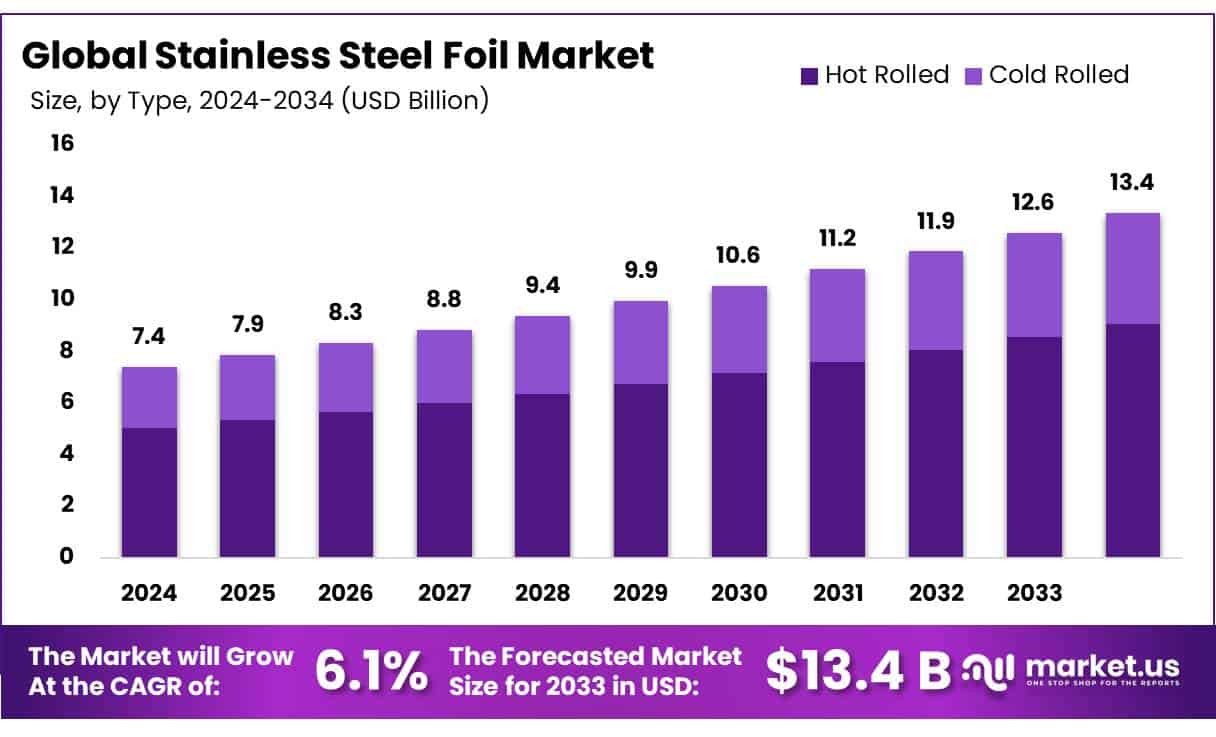

New York, NY – June 23, 2025 – The global stainless steel foil market is projected to grow from USD 7.4 billion in 2024 to around USD 13.4 billion by 2034, expanding at a (CAGR) of 6.1%. This growth is fueled by increasing demand for lightweight, durable materials across industries such as aerospace, automotive, electronics, healthcare, and energy. Stainless steel foil is particularly valued for its exceptional corrosion resistance, strength-to-weight ratio, and performance in extreme conditions—making it ideal for applications like heat exchangers, sensors, flexible circuits, and surgical instruments. Its popularity is supported by rising investments in electric vehicles, renewable energy infrastructure, miniaturization of electronic devices, and advanced medical technologies.

Market opportunities include the development of specialized thin-gauge and precision foils tailored for next generation batteries, semiconductor packaging, and fuel cells. Expansion is also being driven by manufacturing capacity growth in Asia-Pacific and increased focus on high‑performance materials in North America and Europe. Overall, the stainless steel foil market is poised for ongoing growth, driven by innovation and rising application demand globally.

In 2024, the global stainless steel foil market was dominated by the hot rolled segment, which accounted for 67.9% of the market due to its cost-effectiveness, high strength, and suitability for heavy-duty industrial applications. By grade, the 300 Series led with a 53.1% share, driven by superior corrosion resistance and versatility in sectors like automotive, aerospace, and healthcare.

In terms of thickness, the 0.1–0.3 mm range held the largest share at 38.8%, offering an optimal balance between flexibility and mechanical strength across electronics, insulation, and medical uses. The electrical & electronics end-use segment led the market with a 45.5% share, fueled by rising demand for stainless steel foil in sensors, shielding materials, battery components, and flexible circuits amid ongoing miniaturization and growth in semiconductors and renewable energy systems.

How Growth is Impacting the Economy

The growth of the stainless steel foil market is positively influencing various industrial sectors, including electronics, automotive, energy, and healthcare. Rising adoption of foil in high-tech applications—such as battery components, shielding layers, and heat exchangers—is driving innovation in manufacturing and creating demand for precision materials. This expansion supports job creation in rolling mills, metallurgy, and component assembly across Asia-Pacific, Europe, and North America. In electronics, stainless steel foil plays a critical role in miniaturized components, flexible circuits, and heat management, driving technological advancement and improving the global competitiveness of device manufacturers.

In automotive and aerospace, its use contributes to lightweighting and improved fuel efficiency. As production increases, related industries such as specialty steel processing, automation, and recycling benefit from value chain growth. Overall, the stainless steel foil market is contributing to GDP growth, industrial modernization, and supply chain diversification in countries investing in clean technology, digital infrastructure, and advanced manufacturing.

To succeed in the stainless steel foil market, businesses should focus on expanding high-purity and precision-grade foil production, especially in the 0.1–0.3 mm range. Investing in advanced rolling and surface treatment technologies will help meet growing demand from electronics and medical sectors. Companies should also establish strong supply chains for raw materials and build long-term relationships with EV, semiconductor, and battery manufacturers.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/stainless-steel-foil-market/free-sample/

Key Takeaways

- The global stainless steel foil market was valued at USD 7.4 billion in 2024 and is projected to grow at a CAGR of 6.1% and is estimated to reach USD 13.4 billion by 2034.

- Among types, hot rolled accounted for the largest market share of 67.9%.

- Among grades, 300 Series accounted for the majority of the market share at 53.1%.

- By thickness, 1-0.3 mm accounted for the largest market share of 38.8%.

- By end-use, electrical & electronic accounted for the majority of the market share at 45.5%.

- Asia Pacific is estimated as the largest market for stainless steel foil with a share of 43.7% of the market share.

Experts Review

The stainless steel foil market is well-positioned for sustained growth, driven by rising demand from compact electronics, medical devices, and clean energy systems. Analysts observe that the dominance of the 300 Series and the popularity of hot rolled foils highlight the market’s strength in both high-performance and large-scale industrial applications.

The shift toward electric vehicles, energy-efficient infrastructure, and miniaturized technology will continue to boost demand. Innovation in alloy composition, thickness control, and surface coatings will enhance product performance and open new markets. Overall, stainless steel foil is expected to remain a critical material in global industrial transformation.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=151180

Key Market Segments

By Type

- Hot Rolled

- Cold Rolled

By Grade

- 200 Series

- 300 Series

- 301

- 304

- 316

- 321

- Others

- 400 Series

- 900 series

By Thickness

- Upto 0.05 mm

- 0.06-0.09 mm

- 0.1-0.3 mm

- Greater than 0.3 mm

By End-use

- Electrical & Electronic

- Automotive

- Aerospace

- Healthcare

- Others

Regional Analysis

In 2024, Asia Pacific held the largest share of the global stainless steel foil market, accounting for 43.7% of the total market. This dominance was driven by rapid economic growth and industrial expansion in countries like China, India, and across Southeast Asia. Accelerated urbanization and increased manufacturing activity have significantly boosted demand for stainless steel foil.

Additionally, rising investments in healthcare have further contributed to market growth, as stainless steel foil—valued for its biocompatibility and precision—is widely used in diagnostic equipment, surgical instruments, and implantable medical components throughout the region.

Top Use Cases

Battery & Energy Storage Components: Stainless steel foil is used in lithium-ion battery packs as current collectors and safety barriers. Its high electrical conductivity, corrosion resistance, and thin form factor provide efficient energy flow, mechanical stability, and protection—critical for electric vehicles and stationary energy storage systems.

Flexible Printed Electronics & Sensors: With excellent conductivity and formability, stainless steel foil is ideal for flexible circuits, printed sensors, and RFID tags. It enables compact, bendable designs in consumer electronics, wearables, and industrial detection systems, supporting lightweight assembly and durable performance.

Medical Devices & Surgical Tools: In medical equipment, stainless steel foil is used for implantable devices, diagnostic instruments, and sterile components due to its biocompatibility and corrosion resistance. Its smooth surface and precision thickness make it suitable for micro-fabricated surgical tools and sterile contact applications.

Heat Exchangers & Thermal Management: Stainless steel foil is widely used in heat exchanger fins, radiators, and thermal insulation systems. Its strength under high temperatures and excellent heat transfer properties make it ideal for HVAC systems, automotive radiators, and industrial heat recovery units.

Packaging & Food Processing: In food and pharmaceutical industries, stainless steel foil is employed for high-grade packaging, capsules, and hermetic seals. Its non-toxic, corrosion-resistant, and hygienic surface ensures food safety, extended shelf life, and compliance with strict industry standards.

Recent Developments

Nippon Steel’s Chemical & Material division has advanced its high-precision foil capabilities, rolling stainless steel down to 10 µm thick (up to 460 mm wide) with high strength and spring characteristics, and has developed ultra high-temperature foil (withstands over 1000°C) for automotive applications like catalytic converters. Additionally, it has pioneered planarized stainless foil suitable for flexible OLED substrates, enabling thickness of 50 µm and near atomically smooth surfaces—ideal for next-gen electronics.

Posco continues its innovation in stainless steel materials through green steel initiatives and advanced alloy development. The company is working with Primetals Technologies to build a hydrogen-based hot metal (HyREX) pilot plant targeting carbon-neutral steel by 2027. Additionally, Posco recently commercialized its 430DP stainless grade, which offers 50% higher strength and 20% reduced thickness, optimizing cost and performance for home appliance applications.

Jindal Stainless initiated India’s first stainless steel park in Odisha with a ₹1,500 crore investment over six years to boost production capacity. In May 2025, it launched an industry-first supply-chain digitization project to streamline foil and related product traceability. Moreover, export targets for stainless products have been raised by 30% for FY2025–26.

Finland’s Outokumpu unveiled its “EVOLVE” strategy for 2026–2030, which includes a €200 million investment in a new annealing/pickling line in Tornio, Finland. It is also constructing a €40 million biocarbon plant and optimizing U.S. capacity through debottlenecking. These moves reinforce its leadership in sustainable, high-grade stainless steel—including foil products.

Ulbrich has been identified as a key player in the ultrathin precision stainless steel foil market, valued at USD 1.2 billion in 2024 with an expected CAGR of 6.5%. The company’s portfolio includes ultra-thin foils (<0.1 mm) for aerospace, electronics, and medical application.

Conclusion

The stainless steel foil market is experiencing strong and steady growth, supported by rising demand in electronics, automotive, healthcare, and industrial applications. Segments such as hot rolled foil, 300 Series grades, and 0.1–0.3 mm thickness are leading due to their adaptability and performance.

Regional strength in Asia-Pacific and innovation across all end-use sectors indicate a promising future. Companies that invest in technology, sustainability, and strategic partnerships will be best positioned to capture long-term value in this expanding global market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)