Table of Contents

Introduction

The global sports sponsorship market is projected to reach approximately USD 144.9 billion by 2034, up from an estimated USD 64.1 billion in 2024. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 8.5% during the forecast period spanning from 2025 to 2034.

Sports sponsorship refers to the strategic investment by companies in sports properties, including teams, athletes, events, and leagues, to enhance brand visibility, engage targeted audiences, and strengthen consumer loyalty. It functions as a mutually beneficial relationship, where the sponsor gains exposure and marketing leverage, while the sponsored entity receives financial or material support. The sports sponsorship market encompasses all commercial arrangements where rights holders (sports organizations or individuals) grant access to their assets for brand promotion, typically involving naming rights, endorsements, media exposure, and event partnerships.

The global sports sponsorship market has witnessed robust expansion, driven by rising global viewership, digitization of sports content, and increasing integration of social media platforms to engage fans. Major sports leagues such as the NFL, English Premier League, and the Olympics continue to attract multinational brands, thereby intensifying sponsorship spending. Furthermore, the growing popularity of niche sports and e-sports has diversified sponsorship avenues, extending market penetration beyond traditional formats. Demand is being significantly supported by advertisers aiming to leverage emotional connections that fans establish with their favorite sports entities, ensuring deeper brand recall.

Growth has also been propelled by the shift toward data-driven sponsorship strategies, allowing for more measurable outcomes and targeted activation campaigns. Opportunities abound in emerging markets such as India, Brazil, and Southeast Asia, where rising middle-class income, increasing sports participation, and government support are fueling the commercialization of sports ecosystems. Moreover, the integration of sustainability themes and socially responsible sponsorships is creating new dimensions for brands seeking alignment with global consumer values.

Key Takeaways

- The Sports Sponsorship Market was valued at USD 64.1 Billion in 2024 and is projected to reach USD 144.9 Billion by 2034, expanding at a CAGR of 8.50% during the forecast period.

- Broadcast Sponsorship accounted for the largest share in 2024, capturing 34.5% of the market. This dominance can be attributed to its broad audience reach and premium visibility during high-profile tournaments and televised events.

- Football emerged as the leading sport type in 2024, representing 35.2% of the market. Its dominance is driven by its universal appeal, expansive fan base, and high engagement levels, making it a prime choice for sponsors seeking global exposure.

- The Automotive sector led the end-user segment with a 29.7% share in 2024. This leadership is supported by long-standing brand partnerships and the sector’s strategic use of sports sponsorship to reach performance-oriented and loyal audiences.

- North America dominated the regional landscape, contributing USD 22.11 Billion, which translates to 34.5% of the global market in 2024.

Evaluate Business Risks and Opportunities Stemming from US Tariff Policies at https://market.us/report/sports-sponsorship-market/request-sample/

Tariffs Disrupt U.S. Sports Sponsorship

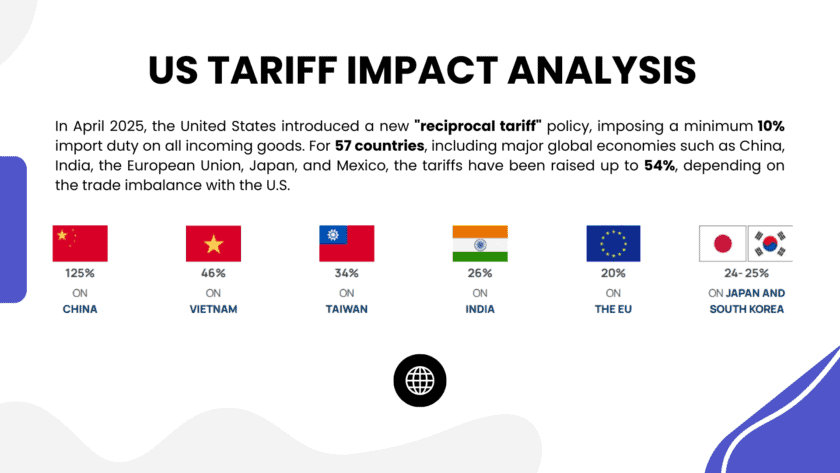

The imposition of U.S. tariffs under the Trump administration has significantly influenced the sports sponsorship market, introducing both direct and indirect challenges across various sectors.

Impact on Sportswear and Sponsorship Budgets

Tariffs on imports from countries like China, Vietnam, and Indonesia have escalated production costs for major sportswear brands such as Nike, Adidas, and Under Armour. These companies, heavily reliant on Asian manufacturing, have experienced stock declines—Nike by 11% and Adidas by 9%—reflecting investor concerns over increased operational expenses .

The heightened costs have compelled brands to reassess their marketing expenditures, including athlete sponsorships. There is a trend toward renegotiating existing contracts and prioritizing cost-effective, regionally focused partnerships .

Automotive Sponsorship Disruptions

Automotive companies, significant contributors to sports sponsorships, have also been affected. Audi, for instance, suspended its U.S. imports in response to tariffs, jeopardizing its $28.99 million annual investment in U.S. sports sponsorships . Other automakers like Hyundai, Kia, Toyota, and BMW, with substantial sponsorships in leagues such as the NBA, NFL, and MLB, may also reconsider their commitments amid trade uncertainties.

Infrastructure and Stadium Development Challenges

Tariffs on construction materials, notably steel and aluminum, have inflated costs for stadium projects. Teams like the Oklahoma City Thunder and the Oakland Athletics face potential delays or cancellations of new arenas due to these increased expenses . College athletic departments are similarly impacted, with rising costs for imported construction materials potentially leading to budget overruns and project postponements .

Fan Engagement and Consumer Spending

The increased costs of merchandise and game-day experiences, resulting from tariffs, have the potential to dampen fan engagement. As prices for jerseys, equipment, and tickets rise, consumers may reduce discretionary spending, affecting revenue streams for teams and leagues . Leagues heavily reliant on ticket sales and concessions, such as MLS and the NHL, are particularly vulnerable to these shifts in consumer behavior .

Strategic Adaptations in Marketing

In response to financial pressures, sports organizations are adopting innovative marketing strategies. These include enhancing digital fan engagement through personalized content and leveraging artificial intelligence to deliver tailored experiences. Such approaches aim to maintain fan loyalty and compensate for reduced in-person attendance and merchandise sales .

Outlook for Major Sporting Events

Upcoming events like the 2026 FIFA World Cup and the 2028 Los Angeles Olympics face uncertainties due to the current trade climate. Tariffs affecting co-host nations Canada and Mexico have introduced diplomatic tensions, potentially complicating collaborative efforts required for these international events.

Emerging Trends

- Integration of Artificial Intelligence (AI): AI is increasingly utilized to personalize fan experiences and optimize sponsorship strategies. Brands are leveraging AI to analyze fan behavior, enhancing engagement and return on investment.

- Hyper-Personalization and Interactive Engagement: Sponsors are moving beyond traditional advertising, focusing on creating interactive and personalized experiences for fans, thereby increasing brand loyalty and engagement.

- Rise of Sports Influencers: Athletes and sports personalities are becoming influential brand ambassadors, with their personal brands offering new avenues for sponsorship and marketing.

- Integration of Gaming and Esports: The convergence of traditional sports with gaming and esports is opening new sponsorship opportunities, attracting younger demographics and expanding brand reach.

- Focus on Sustainability and Social Responsibility: Brands are aligning sponsorships with social causes and sustainability initiatives, reflecting consumer demand for corporate responsibility.

Top Use Cases

- Brand Visibility and Awareness: Sponsorships provide brands with exposure to large audiences, enhancing visibility and brand recognition during high-profile sporting events.

- Targeted Marketing Campaigns: Brands utilize sponsorships to reach specific demographics, tailoring messages to align with the interests and values of particular fan bases.

- Product Launches and Promotions: Sporting events serve as platforms for launching new products or services, leveraging the excitement and attention surrounding these events.

- Corporate Hospitality and Networking: Sponsorships offer opportunities for businesses to engage clients and partners through exclusive events and experiences, fostering relationships and loyalty.

- Community Engagement and Development: Brands sponsor local sports initiatives to demonstrate community involvement and support grassroots development, enhancing public perception.

Major Challenges

- Measuring Return on Investment (ROI): Quantifying the direct impact of sponsorships on sales and brand equity remains complex, making it challenging to justify expenditures.

- Changing Consumer Behavior: Shifts in how audiences consume sports content, including the rise of streaming and on-demand viewing, require sponsors to adapt strategies to maintain effectiveness.

- Economic Uncertainty: Fluctuating economic conditions can lead to reduced marketing budgets, affecting sponsorship investments and long-term commitments.

- Brand-Safety Concerns: Associations with sports entities involve risks, including potential scandals or controversies that can negatively impact brand image.

- Market Saturation: The proliferation of sponsorships in sports can lead to clutter, making it difficult for individual brands to stand out and achieve desired impact.

Top Opportunities

- Digital and Virtual Engagement: Advancements in technology enable immersive experiences, such as virtual reality and augmented reality, offering innovative ways for brands to engage fans.

- Emerging Markets: Growth in sports popularity in regions like Asia and Africa presents new opportunities for brands to tap into expanding fan bases.

- Women’s Sports: Increasing visibility and investment in women’s sports provide avenues for brands to support diversity and reach new audiences.

- Data Analytics and Insights: Utilizing data analytics allows brands to tailor sponsorship strategies effectively, enhancing targeting and measuring outcomes.

- Sustainability Initiatives: Aligning sponsorships with environmental and social governance (ESG) goals can enhance brand reputation and appeal to socially conscious consumers.

Key Player Analysis

The global sports sponsorship market in 2024 is marked by the strategic engagement of prominent multinational corporations, with athletic wear giants and consumer brands driving significant investments. Adidas AG, Nike, Inc., and Puma SE continue to lead the segment through high-value endorsements and event partnerships, leveraging their global brand visibility to enhance fan engagement. Under Armour, Inc., and New Balance Athletics, Inc. have intensified their focus on niche sports and regional sponsorships to gain competitive ground. Reebok International Ltd., now repositioning post-ownership transitions, is actively rebuilding its presence through grassroots sports initiatives.

Asics Corporation remains committed to performance sports, particularly in running and athletics, while Red Bull GmbH dominates experiential and extreme sports sponsorships with its media-driven strategy. Beverage leaders Coca-Cola Company and PepsiCo, Inc. sustain their stronghold through long-term Olympic and FIFA affiliations. Financial service providers Visa Inc. and Mastercard Inc. emphasize global sporting events for brand trust and consumer outreach. Meanwhile, Toyota Motor Corporation and Mercedes-Benz Group AG utilize motorsport and Olympic partnerships to promote mobility innovation. Rolex SA upholds its elite brand stature through tennis and golf sponsorships, maintaining high prestige and exclusivity.

Major Companies in the Market

- Adidas AG

- Nike, Inc.

- Puma SE

- Under Armour, Inc.

- New Balance Athletics, Inc.

- Reebok International Ltd.

- Asics Corporation

- Red Bull GmbH

- Coca-Cola Company

- PepsiCo, Inc.

- Visa Inc.

- Mastercard Inc.

- Toyota Motor Corporation

- Mercedes-Benz Group AG

- Rolex SA

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=138589

Regional Analysis

North America Leads Sports Sponsorship Market with 34.5% Share in 2024

North America emerged as the dominant region in the global sports sponsorship market in 2024, commanding a substantial 34.5% share and generating revenues of USD 22.11 billion. This leadership is underpinned by the region’s robust sports culture, extensive media rights agreements, and a high concentration of major sports leagues and franchises.

The United States, in particular, plays a pivotal role, with its well-established leagues such as the NFL, NBA, MLB, and NHL attracting significant sponsorship investments. These leagues benefit from long-term contracts and a loyal fan base, ensuring consistent revenue streams even amidst economic fluctuations.

However, the introduction of new U.S. tariffs in 2025 has introduced complexities into the sports sponsorship landscape. Tariffs, including a 125% levy on Chinese exports and additional duties on goods from other countries, have the potential to indirectly impact the sector. While core operations remain resilient due to domestic supply chains and fixed player salaries, there are concerns about increased costs for merchandise and infrastructure projects. For instance, the construction of new stadiums may face budgetary pressures due to rising prices of imported materials like steel and aluminum. Moreover, brands heavily reliant on imported goods may reassess their sponsorship budgets in response to shifting economic conditions.

Recent Developments

- In 2023, Dream11 secured the official jersey sponsorship for Team India, covering all matches from July 2023 to March 2026. The fantasy sports company obtained the rights at a base value of ₹358 crore, marking a significant step in its ongoing association with cricket in India.

- In 2025, The Coca-Cola Company reaffirmed its long-term partnership with FIFA by joining the FIFA Club World Cup 2025™. As a key sponsor, Coca-Cola will provide unique fan experiences across U.S. cities during the tournament scheduled for June and July.

- In 2024, LVMH entered into a major sponsorship agreement with Formula One, taking over from Rolex. The French luxury conglomerate will showcase its key brands, including Louis Vuitton and TAG Heuer, starting with the 2025 racing season.

- On April 21, 2025, WWE revealed its acquisition of Mexican wrestling promotion AAA. The deal was announced during WrestleMania 41 weekend in Las Vegas, in collaboration with Mexican sports and entertainment firm Fillip.

- In 2025, UEFA confirmed that Relevent Sports will become the exclusive commercial partner for its men’s club competitions beginning from the 2027-28 season. This long-term agreement will run through 2033 and will reshape UEFA’s commercial strategies globally.

- In 2025, the Portland Thorns signed a record-breaking kit sponsorship deal in the NWSL with Ring, a company owned by Amazon. Although the exact amount remains undisclosed, the deal exceeds previous league benchmarks and highlights growing commercial interest in women’s football.

Conclusion

The global sports sponsorship market is experiencing significant growth, driven by the expansion of digital platforms, increased fan engagement, and the rising popularity of emerging sports such as esports and women’s competitions. Technological advancements, particularly in artificial intelligence and data analytics, are enabling brands to personalize fan experiences and optimize sponsorship strategies . Emerging markets in Asia and Latin America are contributing to this growth, with increased sports participation, infrastructure development, and government support attracting multinational sponsors . Additionally, the integration of sustainability and social responsibility into sponsorships is aligning with consumer values, enhancing brand reputation and loyalty . Despite challenges such as measuring return on investment and market saturation, the market’s trajectory remains positive, supported by innovative engagement strategies and the diversification of sponsorship avenues .

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)