Table of Contents

Overview

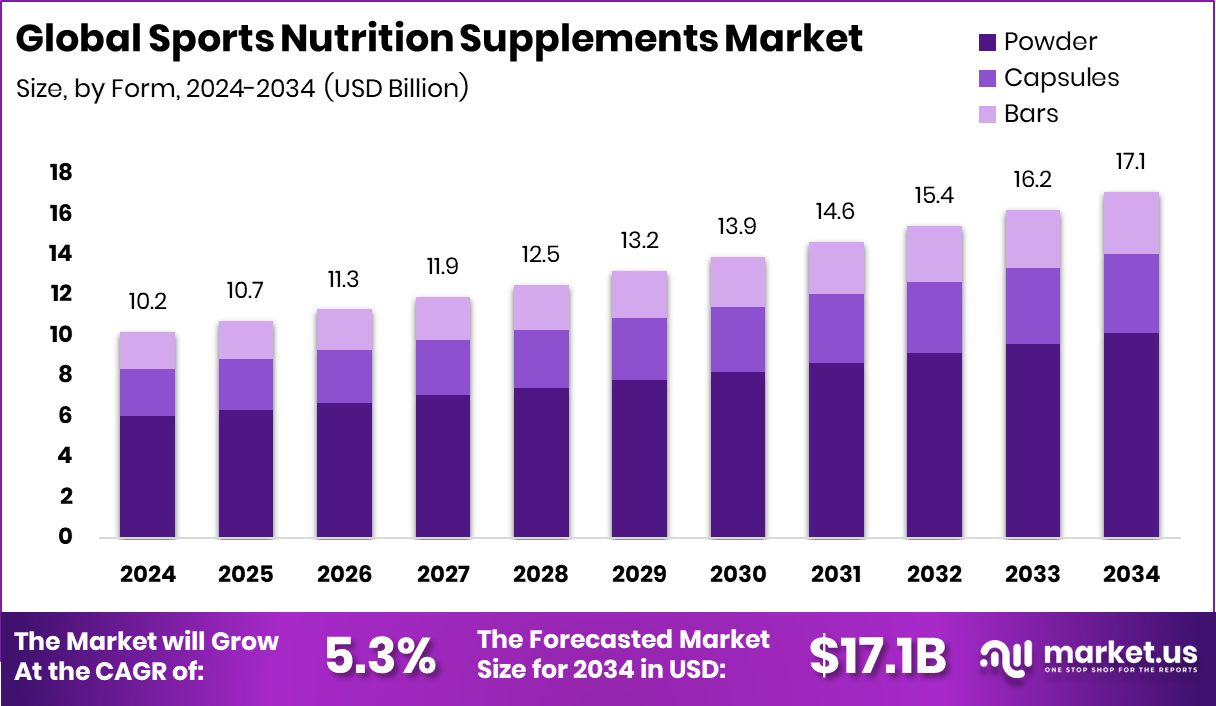

New York, NY – Nov 21, 2025 – The sports nutrition supplements market is expanding steadily as global consumers embrace fitness, preventive health, and performance-focused lifestyles. The market is set to rise from USD 10.2 billion in 2024 to USD 17.1 billion by 2034, growing at a 5.3% CAGR, with Asia-Pacific holding 45.20% of the market due to strong fitness adoption and better wellness infrastructure. These supplements—ranging from proteins and amino acids to vitamins and hydration blends—are now essential tools for athletes, gym-goers, and everyday health-conscious users seeking improved strength, stamina, and recovery.

A significant shift toward natural, clean-label, and biotech-driven ingredients is reshaping product innovation. Companies are investing heavily in sustainable formulations, highlighted by GRObio’s USD 60.3 million Series B to scale protein therapeutics and Biosyntia’s €11.5 million to produce the first bio-based vitamin B7. These breakthroughs show a clear industry push toward functional, eco-friendly nutrition.

Personalised and gender-specific products are also creating strong growth avenues. The sector is attracting solid investor interest, reflected in Unilever Ventures’ USD 6 million support for Perelel Health, YOUVIT’s USD 6 million Series B in Indonesia, and Just Herbs’ USD 1.5 million to expand holistic nutrition solutions. Combined, these investments reveal rising confidence in tailored, clean, and accessible wellness products that meet diverse consumer needs.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-sports-nutrition-supplements-market/request-sample/

Key Takeaways

- The Global Sports Nutrition Supplements Market is expected to be worth around USD 17.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- Powder form dominates the sports nutrition supplements market with 59.3%, offering easy mixing and fast absorption.

- Amino acids and derivatives hold a 38.4% share in the sports nutrition supplements market, enhancing muscle performance.

- Athletes represent 44.9% of the sports nutrition supplements market, reflecting their growing reliance on performance-boosting nutrition.

- The Asia-Pacific market value reached USD 4.6 Bn, reflecting strong consumer adoption.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165338

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.2 Billion |

| Forecast Revenue (2034) | USD 17.1 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Form (Powder, Capsules, Bars), By Product (Amino Acids / Derivatives, Herbal Products, Vitamins / Minerals, Others), By Consumer Group (Athletes, Bodybuilders, Recreational Users) |

| Competitive Landscape | Abbott Nutrition, Bio-Synergy Ltd., Champion Performance, Clif Bar & Company, Future Nutrition, Glanbia Plc, GlaxoSmithKline Plc, GNC Holdings, Inc., Herbalife International of America, Inc., Maximum Human Performance, LLC |

Key Market Segments

By Form Analysis

In 2024, the Powder segment held a dominant position in the Sports Nutrition Supplements Market, capturing a 59.3% share. Its strong lead comes from high bioavailability, quick absorption, and easy mixing, making it ideal for muscle recovery, endurance, and overall performance goals. Fitness users favor powders because they allow flexible dosing and blend well with shakes or meals.

Rising demand for clean-label, nutrient-rich formulations has strengthened consumer confidence in powdered supplements. Innovations in flavors, smoother textures, and expanding plant-based protein options also continue to attract both athletes and everyday users. This steady dominance highlights powder’s versatility and its ability to adapt to modern health trends, ensuring its position as the most preferred form in sports nutrition.

By Product Analysis

In 2024, Amino Acids / Derivatives dominated the Sports Nutrition Supplements Market’s By Product segment with a 59.3% share. Their leadership comes from their essential role in muscle repair, growth, and energy metabolism, making them a preferred choice for athletes and regular fitness users. Supplements like BCAAs and glutamine help improve endurance, reduce fatigue, and support faster recovery, driving steady adoption across sports and training routines.

The segment’s strength also reflects rising interest in targeted nutrition that directly enhances performance outcomes. As more consumers understand the specific benefits of amino acids for muscle health and overall athletic efficiency, this category continues to expand its reach. Its dominance highlights how performance-focused formulations are shaping modern sports nutrition preferences.

By Consumer Group Analysis

In 2024, Athletes led the Sports Nutrition Supplements Market’s By Consumer Group segment with a 44.9% share, reflecting their strong and consistent reliance on supplements for performance and recovery. Professional and competitive athletes regularly use protein powders, amino acids, and energy-focused formulas to support intense training schedules and meet high physical demands.

This segment’s dominance is also linked to the global rise in organized sports, competitive events, and structured training programs. As awareness grows around muscle repair, hydration, and endurance, athletes are increasingly integrating specialized supplements into their daily routines. Their ongoing need for precise, performance-enhancing nutrition firmly establishes athletes as the most influential consumer group driving market demand.

Regional Analysis

In 2024, the Asia-Pacific dominated the global Sports Nutrition Supplements Market with a 45.20% share, valued at USD 4.6 billion. This leadership is driven by the region’s fast-growing fitness ecosystem, rising gym enrollments, and strong interest in muscle health among younger consumers. Increasing disposable incomes and a broader shift toward preventive wellness continue to boost supplement usage across key Asian markets.

North America maintains a steady demand supported by a strong sports culture and widespread use of protein and amino acid-based products. Europe shows sustained growth as consumers increasingly choose clean-label, plant-based formulations. Latin America and the Middle East & Africa are expanding gradually, with rising awareness of fitness and nutrition shaping early-stage adoption.

Top Use Cases

- Custom performance nutrition for specific training phases: During different training phases (e.g., high volume vs. tapering), your nutritional needs change. Supplements let you adjust format, dosage and type (plant-based protein, clean-label formulas) to align with your specific goal or phase.

- Rapid post-exercise nutrient replenishment: After intense effort, replenishing glycogen (energy stored in muscle) and providing amino acids immediately helps recovery. Taking a supplement soon after exercise can enhance this process.

- Nutrition support when diet alone is insufficient: Sometimes your diet may not deliver enough of certain nutrients (protein, amino acids, minerals) especially when training is heavy. Supplements can fill those gaps to support performance and health.

- Targeted muscle growth or strength gain: If you’re aiming to increase strength or build lean muscle, supplements that provide key amino acids or proteins support those goals by helping your body adapt to resistance training.

- Endurance support during long or intense exercise: For athletes doing long workouts or endurance events, nutrients like amino acids and specific performance supplements help maintain stamina and delay fatigue.

- Muscle repair and recovery after workouts: When you finish a tough workout, your muscles have small damage and need nutrients to rebuild. Supplements rich in protein and amino acids (for example, whey protein) help promote muscle protein synthesis and speed up recovery.

Recent Developments

- In May 2024, Clif Bar launched a new advertising campaign titled “The Most Important Ingredient is You”. This campaign emphasizes the consumer’s role—whether in hiking, biking or playing sports—and highlights how Clif’s energy bars help fuel active moments.

- In March 2024, Bio-Synergy announced a new partnership with Eastbourne Borough FC (an English football club). The collaboration is aimed at providing the club with Bio-Synergy’s sports-supplement products and supporting its performance-nutrition programme.

- In January 2024, Abbott launched a new nutrition brand named PROTALITY, focused on high-protein shakes aimed at adults on weight-loss journeys.

Conclusion

The Sports Nutrition Supplements Market is steadily evolving as consumers place greater value on health, strength, and active lifestyles. Growing interest in fitness, clean-label ingredients, and personalized nutrition continues to reshape product development and consumer habits. Brands are expanding into plant-based, functional, and performance-focused formulations that support endurance, recovery, and overall well-being.

Rising participation in sports, increasing gym culture, and wider access to digital fitness platforms are further strengthening demand. With continuous innovation in formulations and greater awareness of holistic wellness, the market is positioned for sustained growth across different user groups and global regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)