Table of Contents

Overview

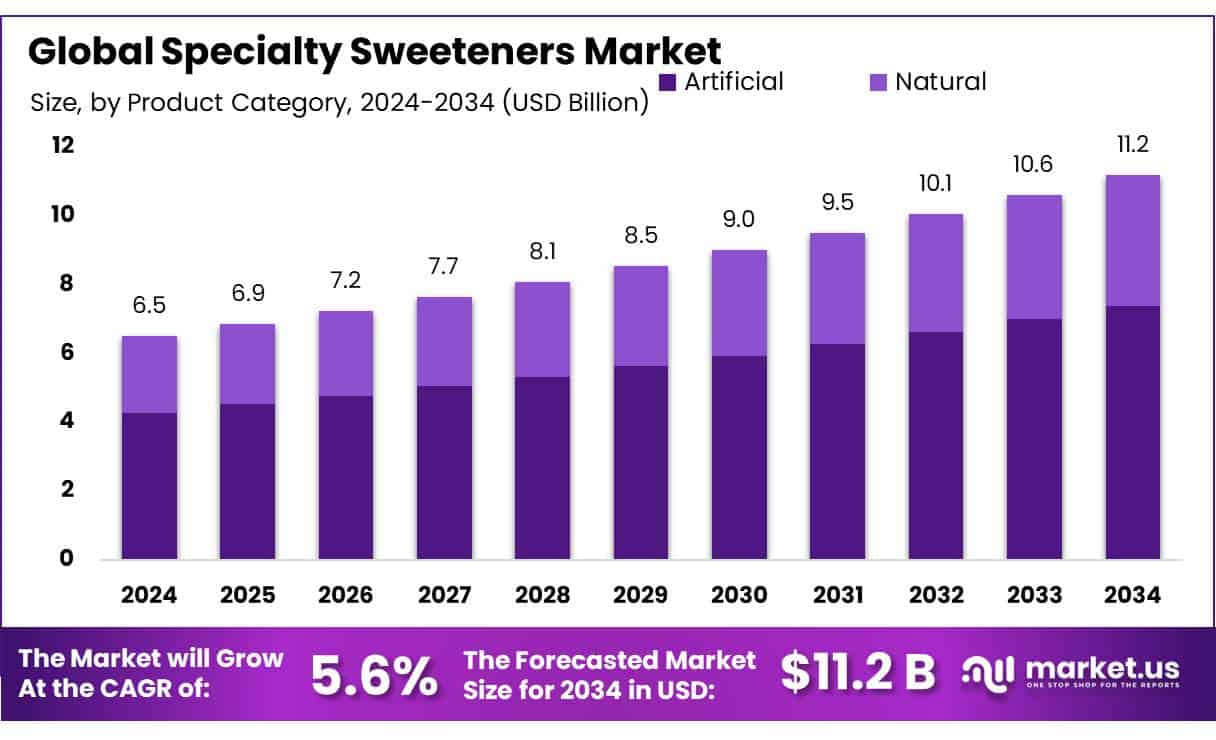

The Global Specialty Sweeteners Market is projected to reach approximately USD 11.2 billion by 2034, rising from an estimated USD 6.5 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 5.6% between 2025 and 2034. In 2024, North America led the market, accounting for over 43.7% of the total share and generating around USD 2.8 billion in revenue.

The specialty sweetener concentrates market includes a wide range of high-intensity and naturally derived sugar alternatives such as stevia, erythritol, monk fruit, sucralose, and aspartame. These sweeteners offer intense sweetness with minimal or zero calories, making them ideal for the food and beverage industry’s ongoing shift toward low-sugar and healthier product formulations. For example, aspartame is nearly 200 times sweeter than conventional sugar, while steviol glycosides and sucralose can be up to 200-600 times sweeter, allowing for significant sugar reduction using only small quantities.

Government statistics highlight the growing reliance on these alternatives. According to the USDA’s Economic Research Service, sugar deliveries for food and beverage applications in the U.S. are expected to reach 12.125 million short tons by the 2025/26 period, while the total sugar supply is forecast at 13.773 million short tons. These figures indicate a trend toward substituting traditional sugar with alternative sweeteners, as reflected in the increasing stocks-to-use ratio, projected at 11.7%.

Data from global packaged food and beverage consumption between 2007 and 2019 further illustrates this trend. Non-nutritive sweetener (NNS) intake rose by 2 grams per capita globally, with North America seeing a significant increase of 31.2 grams per capita. This shift is largely attributed to regulatory policies and public health initiatives aimed at reducing sugar intake.

The market’s growth is primarily driven by increasing health concerns related to obesity and diabetes. In response, governments worldwide have implemented measures such as sugar-sweetened beverage (SSB) taxes, enhanced nutrition labeling, and dietary guidelines for public institutions. Between 2007 and 2019, more than 22 SSB taxes and 15 front-of-pack labeling policies were introduced globally. These efforts have been associated with a global reduction of added sugar consumption by 1.1 kg per capita, while NNS consumption especially in high-income regions like North America continues to rise.

Key Takeaways

- The global specialty sweeteners market is projected to grow from USD 6.5 billion in 2024 to approximately USD 11.2 billion by 2034, registering a CAGR of 5.6% during the forecast period.

- Artificial sweeteners dominated the market, accounting for over 65.9% of the total specialty sweeteners segment.

- Starch-based sweeteners and sugar alcohols led their segment with a commanding 59.2% market share.

- The beverages sector remained the largest application area, representing more than 56.8% of total specialty sweetener usage.

- Hypermarkets and supermarkets were the leading distribution channels, contributing to over 48.4% of global market sales.

- North America emerged as the top regional market, holding a significant 43.7% share, valued at approximately USD 2.8 billion in 2024.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-specialty-sweeteners-market/free-sample/

Report Scope

| Market Value (2024) | USD 6.5 Bn |

| Forecast Revenue (2034) | USD 11.2 Bn |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Product Category (Artificial, Natural), By Product Type (Starch Sweeteners and Sugar Alcohols, High Intensity Sweeteners (HIS)), By Application (Food, Beverages), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Pharmacies, Others) |

| Competitive Landscape | Tate and Lyle PLC, Cargill Incorporated, Archer Daniels Midland Company, DuPont, PureCircle Limited, Ingredion Incorporated, Stevia First Corporation, NutraSweet Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152818

Key Market Segments

- By Product Category Analysis: Artificial sweeteners dominated the specialty sweeteners market in 2024, accounting for over 65.9% of total market share. This leadership is attributed to the extensive use of sweeteners such as aspartame, sucralose, saccharin, and acesulfame potassium across a wide array of food and beverage products. These sweeteners are favored for their intense sweetness, affordability, and extended shelf life, making them ideal for products like carbonated beverages, sugar-free gums, dairy substitutes, and low-calorie desserts.

- By Product Type Analysis: In 2024, starch-based sweeteners and sugar alcohols secured a significant 59.2% share of the specialty sweeteners market. These types are widely utilized in processed foods, baked goods, and confectionery. Popular sugar alcohols such as sorbitol, xylitol, and erythritol offer reduced calorie content and are commonly found in sugar-free candies and chewing gums. Meanwhile, starch-derived options like high fructose corn syrup and glucose syrup continue to be essential in beverages and sauces, owing to their functional versatility and cost-effectiveness.

- By Application Analysis: The beverage sector emerged as the leading application area for specialty sweeteners in 2024, capturing over 56.8% of the market. This trend is driven by the increasing consumer shift towards low- and zero-calorie drink options. Products such as diet sodas, sugar-free juices, flavored waters, and functional beverages have seen rising demand, prompting manufacturers to reformulate recipes with healthier sweetener alternatives to align with evolving dietary preferences.

- By Distribution Channel Analysis: Hypermarkets and supermarkets led the distribution landscape in 2024, holding a 48.4% share of the specialty sweeteners market. Their dominance stems from extensive shelf space, high consumer traffic, and product visibility. These retail outlets provide shoppers the convenience to compare brands, read nutritional labels, and take advantage of promotions making them a preferred channel for both established and emerging sweetener products.

Regional Analysis

North America Leads the Global Specialty Sweeteners Market

In 2024, North America established itself as the dominant player in the global specialty sweeteners market, holding a substantial 43.7% market share, valued at approximately USD 2.8 billion. This leadership is largely driven by increasing consumer awareness of the health risks associated with excessive sugar intake, including obesity and diabetes, along with a well-developed market for low-calorie and functional food products.

Government regulations have also played a pivotal role in accelerating the shift toward sugar alternatives. For example, the U.S. Food and Drug Administration (FDA) requires added sugars to be clearly labeled on nutritional panels, prompting many manufacturers to reformulate their products using low- or zero-calorie sweeteners. Additionally, organizations such as the American Heart Association continue to advocate for reduced sugar consumption, reinforcing demand for healthier sweetening options.

The growing focus on health, wellness, and clean-label trends has further fueled interest in natural sweeteners like steviol glycosides and monk fruit extract. As consumers increasingly seek plant-based and minimally processed ingredients, demand for specialty sweeteners continues to rise. Supported by a strong retail network and a culture of food innovation, North America is expected to retain its leading market position in 2025, with sustained growth driven by product innovation and evolving consumer preferences across the U.S. and Canada.

Top Use Cases

1. Diabetic-Friendly Formulations: Specialty sweeteners like stevia, erythritol, and sucralose are popular in diabetic-friendly foods and beverages because they don’t raise blood glucose. Manufacturers use them to create sugar-free juices, yogurts, and snacks that support blood sugar management without sacrificing sweetness or taste.

2. Low-Calorie Beverages: Brands of diet sodas, energy drinks, and flavored sparkling waters use high-intensity sweeteners (e.g., aspartame, Ace-K) to offer a sweet taste with almost zero calories. This meets growing consumer demand for low-sugar refreshment often seen in increasing sales of no‑sugar beverage lines.

3. Clean-Label “Natural” Products: Clean-label trends drive use of natural sweeteners like monk fruit extract and steviol glycosides. These are used in health-oriented foods and premium beverages to enhance sweetness while aligning with consumer preferences for simple, recognizable plant-based ingredients.

4. Bakery & Confectionery Sugar Replacement: Starch sweeteners and sugar alcohols like maltitol and xylitol are used in sugar-free chocolates, gummies, and baked goods. They provide bulk, moisture retention, and sweetness crucial for replacing sugar without compromising texture or melting behavior.

5. Improved Palatability in Pharmaceuticals: Specialty sweeteners enhance the taste and compliance of chewable tablets, syrups, and pediatric medicines. For instance, ace-K or stevia can mask bitterness in medications, improving patient acceptance especially among children and elderly patients sensitive to unpleasant flavors.

6. Dental Health Products: Sugar alcohols such as xylitol are featured in chewing gums and toothpastes because they don’t promote tooth decay. They help maintain oral health by inhibiting bacterial growth while offering a sweet taste boosting appeal in dental care products.

7. Functional & Wellness Beverages: Innovative drinks such as those with added fiber, vitamins, or enzyme blends use specialty sweeteners to balance flavors without calories. This supports brands targeting weight management or digestive health, like enzyme‑enhanced beverages or prebiotic fiber drinks.

Recent Developments

- Tate & Lyle PLC: In July 2023, Tate & Lyle introduced TASTEVA® SOL, a new stevia sweetener boasting over 200× solubility compared to standard Reb M/D extracts. This patent-protected innovation addresses solubility issues in beverages, syrups, and dairy fruit preparations, enabling high sugar replacement with better taste and formulation flexibility. Additionally, the July 2024 launch of Optimizer Stevia 8.10 offers a cost-effective, sugar-like taste for applications including gummies, bars, and shakes reinforcing their leadership in clean-label, low-calorie sweetener solutions.

- Cargill Incorporated: In early 2024, Cargill secured positive regulatory feedback for its EverSweet® stevia sweetener, which combines high-purity Reb M and Reb D to deliver clean, sugar-like sweetness. This ingredient enables brands to significantly reduce or eliminate added sugars in beverages and foods without compromising taste. The announcement underscores Cargill’s investment in advanced stevia technologies and expands their natural sweetener portfolio, aligning with growing demand for healthy, plant-based alternatives.

- Archer Daniels Midland Company (ADM): ADM’s PureCircle™ stevia division continues innovation by partnering with farmers and brands to optimize Reb M-rich stevia extracts. Though no major announcement happened in 2024, ADM has actively been enhancing supply-chain traceability and adding new stevia blends to help customers reduce sugar with minimal aftertaste. They also expanded technical support through pilot labs to accelerate clean-label sweetener reformulations across beverages and confectionery.

- DuPont: DuPont has been strengthening its sweetener tech offerings via FilmTec™ ion-exchange resins and membrane systems to refine allulose, glucose, fructose, and sorbitol production processes. These innovations improve yield, purity, and consistency enabling food and beverage manufacturers to adopt natural and low-calorie sweeteners more efficiently. Their ongoing R&D in separation and decolorization supports scalable, cost-effective production of next-gen sweetener ingredients.

- PureCircle Limited: PureCircle, now part of Ingredion, continues to lead in stevia innovation, offering high-purity steviol glycoside blends tailored for clean-label sweetener solutions. Their focus remains on delivering Reb M-rich extracts with consistent taste profiles for global brands. They also collaborate with Cargill and ADM to expand stevia adoption, leveraging proprietary cultivation and processing methods even though no public 2024 launch was reported.

- Ingredion Incorporated: In May 2023, Ingredion released a five-part educational video series on stevia usage and sugar reduction techniques. These resources explain new steviol glycosides (e.g. Reb M), formulation methods, sensory balance, and functional build-back ingredient strategies. Aimed at manufacturers, the initiative enhances stevia adoption in clean-label, low-sugar foods and beverages by improving taste, texture, and nutrition.

- Stevia First Corporation: While specific 2024 announcements are limited, Stevia First has continued refining its proprietary stevia extract blends targeting superior taste and stability in beverages and tabletop formats. They’ve also expanded technical collaborations with food manufacturers to integrate their stevia products into clean-label applications. These updates reflect their ongoing focus on improving sensory consistency and reducing bitterness in natural sweetener solutions.

- NutraSweet Company: In 2024, NutraSweet introduced next-gen aspartame blends aimed at refining taste and stability in powders and liquids. Their R&D efforts focus on reducing off-notes and improving solubility, making aspartame blends more suitable for modern low-calorie products. Technical services also assist beverage and tabletop sweetener manufacturers in optimizing formulations, reflecting NutraSweet’s commitment to enhancing classic artificial sweeteners for clean-label consumer demands.

Conclusion

The global specialty sweeteners market is on a strong upward trajectory, expected to grow from approximately USD 6.5 billion in 2024 to around USD 11.2 billion by 2034, at a steady CAGR of about 5.6% This expansion is driven by a shift toward low- and no-sugar formulations, propelled by health concerns, regulatory interventions, and clean-label trends.

Artificial sweeteners currently dominate, while starch-based sweeteners and sugar alcohols maintain a major share. Beverages remain the top application, and hypermarkets/supermarkets serve as the leading distribution channel. North America leads regionally with a 43.7% market share, equating to USD 2.8 billion in 2024 As consumer demand continues to pivot toward healthier, reduced-calorie products, the specialty sweetener sector is poised for robust long-term growth and ongoing innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)