Table of Contents

Overview

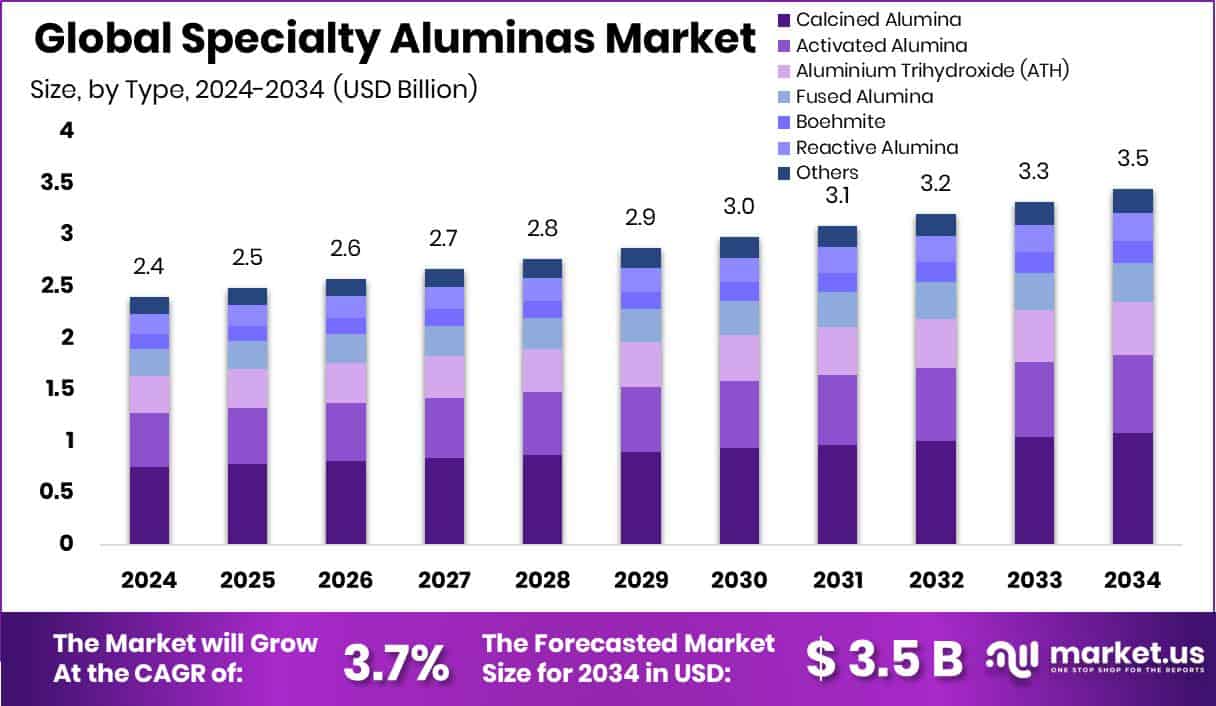

New York, NY – August 08, 2025 – The global specialty aluminas market is projected to reach approximately USD 3.5 billion by 2034, rising from USD 2.4 billion in 2024, with an expected compound annual growth rate (CAGR) of 3.7% between 2025 and 2034. A significant portion of this growth is being driven by the Asia-Pacific region, which currently holds a dominant 45.8% market share, valued at around USD 1.09 billion.

Specialty aluminas, including high-purity and engineered variants, are essential for advanced industrial applications such as ceramics, abrasives, catalysts, refractories, and electronic components. These materials are distinguished by their custom-designed physical and chemical properties, such as controlled particle size and phase composition, which are achieved through precise manufacturing processes.

In India, alumina production has seen steady growth, underpinned by the country’s expanding industrial infrastructure and technological progress. As per the Indian Minerals Yearbook 2022, the country produced 7.23 million tonnes of alumina (including calcined alumina) in 2021–22, an increase from 6.52 million tonnes the previous year. Major players like Hindalco Industries, Vedanta Aluminium, and NALCO have played a pivotal role in this output. Hindalco’s Utkal Alumina contributed 3.15 million tonnes, Vedanta’s Lanjigarh refinery accounted for 1.97 million tonnes, and NALCO’s Damanjodi unit produced 2.11 million tonnes during the same period.

Government initiatives have further strengthened the specialty alumina sector in India. The Ministry of Mines is supporting projects aimed at developing cost-effective technologies for producing 99.9% pure alumina, especially for use in high-tech applications like LEDs and semiconductors. In addition, national policies such as the Non-Ferrous Metal Scrap Recycling Policy and the Resource Efficiency Policy are promoting sustainable resource use and improved recycling practices. With growing demand from industries like electric vehicles, renewable energy, and advanced electronics, India’s specialty alumina market is expected to experience strong and sustained growth in the coming years.

Key Takeaways

- The global specialty aluminas market is projected to reach approximately USD 3.5 billion by 2034, increasing from USD 2.4 billion in 2024, with an anticipated CAGR of 3.7% from 2025 to 2034.

- Calcined alumina accounted for 31.3% of the market, driven by its wide-ranging industrial uses.

- Fine particle specialty aluminas held a 31.6% share, attributed to their excellent dispersion capabilities and enhanced surface characteristics.

- The refractory materials segment dominated the market with a 37.1% share, supported by demand for materials capable of withstanding high temperatures.

- The Asia-Pacific region led global demand, with specialty aluminas sales valued at USD 1.09 billion, representing 45.8% of the market.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-specialty-aluminas-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.4 Billion |

| Forecast Revenue (2034) | USD 3.5 Billion |

| CAGR (2025-2034) | 3.7% |

| Segments Covered | By Type (Calcined Alumina, Activated Alumina, Aluminium Trihydroxide (ATH), Fused Alumina (White, Brown), Boehmite, Reactive Alumina, Others), By Particle Size (Coarse, Fine, Ultra-fine, Medium), By Application (Refractory Materials, Ceramics, Abrasives, Polishing, Catalyst, Others) |

| Competitive Landscape | Almatis, Alteo Alumina, Traxys S.à.r.l., Huber Engineered Materials, Imerys Fused Minerals Villach GmbH, Nabaltec AG, Silkem d.o.o., MOTIM Electrocorundum Ltd., Sasol Germany GmbH, Hindalco, Resonac, NICHE Fused Alumina, Carborundum Universal Limited, Axens Group, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146567

Key Market Segments

1. By Type Analysis

- In 2024, calcined alumina led the Specialty Aluminas Market by type, holding a 31.3% market share. This dominance is driven by its widespread use in ceramics, refractories, and polishing applications, thanks to its hardness, wear resistance, and ability to maintain stability under high temperatures. Its chemical inertness and consistent performance make it a preferred material in technical ceramics and electronic substrates. The strong share also reflects ongoing advancements in refining processes and increased investments in high-performance materials that demand consistent grain size and durability.

2. By Particle Size Analysis

- Fine particle specialty alumina accounted for a leading 31.6% market share in 2024 within the particle size segment. This preference is due to its enhanced surface area, reactivity, and superior dispersion qualities, which are vital in applications like precision ceramics, catalyst supports, and polishing compounds. Its ability to ensure material uniformity and improve end-product quality makes it especially valuable in the automotive, electronics, and semiconductor industries. The rising trend of miniaturization and demand for fine finishes across high tech sectors continue to fuel its adoption.

3. By Application Analysis

- Refractory materials emerged as the dominant application segment in 2024, capturing a 37.1% share of the specialty aluminas market. This reflects the crucial role of alumina in industries that require high-temperature resilience, such as steel, cement, glass, and non-ferrous metals. Its thermal stability, strength, and corrosion resistance make it essential for producing refractory bricks, castables, and monolithics used in kilns, furnaces, and reactors. The continued expansion of energy, infrastructure, and heavy industries especially in developing regions has further boosted demand for alumina based refractories, ensuring their top position in the application segment.

Regional Analysis

- In 2024, the Asia-Pacific region led the global Specialty Aluminas Market, accounting for 45.8% of the total market share, with a value of USD 1.09 billion. This dominance is largely attributed to strong demand from key industries such as refractories, ceramics, and electronics, supported by well established manufacturing bases in countries like China, Japan, South Korea, and India.

- The region’s rapid pace of industrialization and infrastructure development has significantly increased the consumption of specialty aluminas for high-performance applications across multiple sectors.

- In comparison, North America and Europe continued to hold steady positions in the market, driven by advancements in automotive and aerospace manufacturing where specialty aluminas are essential. Meanwhile, Latin America and the Middle East & Africa are showing moderate growth, fueled by expanding industrial activity and growing construction investments in emerging economies.

Top Use Cases

- Catalyst Support & Chemical Processing: Specialty aluminas like activated alumina and low‑soda alumina are used as catalyst supports and desiccants in refining, petrochemicals and water treatment. Their high surface area, purity and chemical stability make them vital for enabling efficient reactions and removing moisture in industrial chemical processes.

- Refractories & High‑Temperature Ceramics: Tabular and white‑fused alumina serve in refractory linings for steel furnaces, kilns and incinerators. Their superior thermal shock resistance, density and purity extend life of industrial linings at high temperatures and help maintain structural integrity under cyclic heat.

- Abrasives & Polishing Media: Calcined and fused aluminas are widely used in grinding wheels, sandpapers and polishing powders. Their hardness and uniform particle shape deliver precise abrasive action, improved surface finish and consistency in semiconductor polishing, glass, ceramics and precision metal finishing.

- Electronics & Substrates: Specialty alumina is used in electronic substrates, insulating layers, thermal interface materials and ceramic packages. Its excellent electrical insulation, thermal conductivity and purity make it ideal for microelectronics, LEDs, power modules and heat‑management applications.

- Automotive & Spark Plug Ceramics: In the automotive industry, alumina ceramics are used for spark plug insulators, sensor housings, braking components and wear‑resistant engine parts. Their mechanical strength, high temperature stability, and electrical insulation support reliable performance under harsh engine conditions.

- Aerospace Components & Metal Casting Molds: Aerospace and foundry sectors use specialty alumina for high‑temperature molds, inert filters, and casting dies. These materials resist deformation, chemical attack and slag contamination, ensuring clean metal processing and weight‑efficient mold structures in aircraft and precision casting.

Recent Developments

1. Almatis

- Almatis is executing major global capacity expansions. In April 2024, it signed an MoU to build a new calcined alumina facility in the Qingdao Economic & Technological Development Zone (China), doubling its capacity by early 2026. Additionally, Almatis has ramped up calcined alumina production in North America (Benton, Arkansas) to meet increased demand in semiconductors, EVs and thermal‑management ceramics. Earlier investments include expansion of tabular alumina capacity in Falta, India. These strategic moves solidify Almatis’ leadership across Asia, Europe and North America.

2. Alteo Alumina

- Alteo completed its fourth grinding capacity expansion in Korea and a second expansion at its Gardanne (France) site by September 2024, boosting super‑grinding capability by ~50 %. These expansions support growth in its HYCal (semiconductor) and SEPal (battery) product lines. In October 2024, Alteo Holding acquired Niche Fused Alumina, integrating it into its core operations to deepen capacity for aerospace, EV battery and refractory ceramics markets. In mid‑2024, Alteo partnered with the Government of Guinea and UNIDO to develop a bauxite/alumina refinery project in Boke, Guinea, linking skills development and local value addition.

3. Huber Engineered Materials (J.M. Huber Corp.)

- In May 2025, Huber acquired R.J. Marshall Company’s alumina trihydrate (ATH), antimony‑free flame retardant and molybdate smoke suppressant assets. These additions deepen its North American capabilities in fire‑retardant specialty materials and align with its Huber Advanced Materials (HAM) business unit. This enhances its position in halogen‑free flame retardancy, serving plastics, coatings and electronics. The move supports Huber’s ambition to offer cleaner, more sustainable alternatives to traditional antimony‑based systems across industrial and consumer sectors.

4. Nabaltec AG

- In H1 2024, Nabaltec reported stable specialty alumina revenues (~€14.8 M in Q2), though slightly down year-on-year, while functional fillers rose by ~15.5 %. Full‑year 2024 revenues are expected slightly higher compared to 2023, with EBIT margin forecast of 7–9 %. Additionally, Nabaltec launched a new viscosity‑optimized reactive alumina variant (NABALOX® NO 530) for castables offering low water demand and free‑flow properties. These developments reflect operational stability and ongoing product innovation in specialty alumina and refractory ceramics fields.

5. Carborundum Universal Limited (CUMI)

- CUMI recently introduced a new range of monocrystalline alumina, developed via in‑house R&D and launched at GrindTec in Leipzig (March 2023). This specialty product offers exceptional cutting performance for thin cut‑off wheels and hard‑to‑grind materials. The move showcases CUMI’s focus on innovation within specialty alumina for abrasive and precision applications. Financially, its FY‑2025 profit from ceramics rose, although overall earnings dipped year on year; the company stressed minimal impact (<2 %) from external export sanctions and continues to emphasize domestic market growth in India.

Conclusion

The specialty aluminas market is growing steadily, driven by strong demand from advanced ceramics, electronics, refractories, and clean energy applications. Companies like Almatis, Alteo, and Huber are investing in new facilities, expanding grinding capacities, and developing high-purity products to meet evolving industrial needs.

As electric vehicles, semiconductors, and sustainable technologies rise, the market is shifting towards more engineered and environment-friendly alumina grades. Despite some regional supply challenges, innovation and strategic partnerships are helping major players maintain a competitive edge. Going forward, the market is expected to benefit from cleaner technologies and robust industrial infrastructure development across Asia, Europe, and North America.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)