Table of Contents

Overview

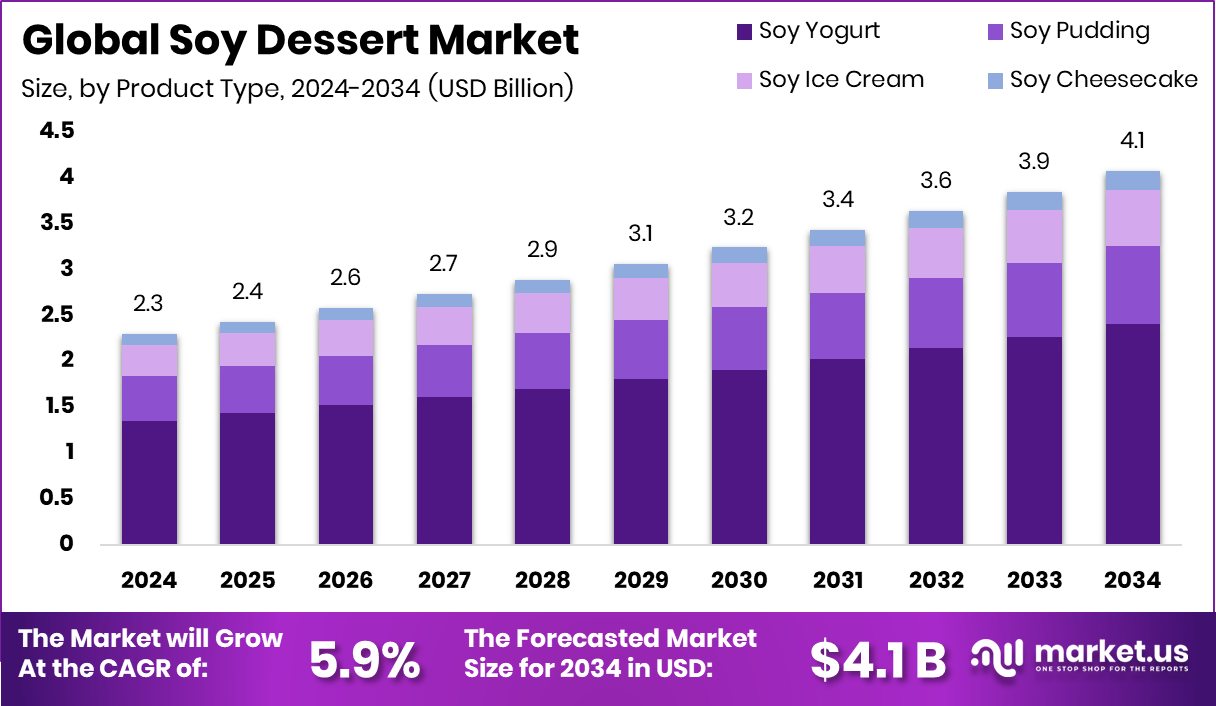

New York, NY – October 06, 2025 – The Global Soy Dessert Market is projected to reach USD 4.1 billion by 2034, rising from USD 2.3 billion in 2024, at a CAGR of 5.9% between 2025 and 2034. North America plays a key role, accounting for 37.9% of the market and generating USD 0.8 billion in revenue in 2024.

Soy desserts are sweet treats that feature the main ingredient derived from soybeans, such as soy milk, tofu, or soy protein. Products like silken tofu, soy custard, or soy-based puddings replace dairy to deliver a creamy texture. These options are especially attractive to consumers seeking plant-based, vegan, or lactose-free desserts. Alongside taste, they provide health benefits like being rich in protein and low in saturated fat.

The growth of soy desserts is strongly supported by the rising availability of soy worldwide. According to the Food and Agriculture Organization, global soybean production reached about 350 million metric tons in 2022. India has also become a major producer, with output climbing to around 12.5 million tonnes. This steady supply makes soy-based ingredients more affordable, encouraging innovation in desserts. Advances in processing, such as silk tofu or flavored soy gels, further expand the product range.

Consumer demand is also shifting. Rising health awareness, lactose intolerance concerns, and the need to cut cholesterol and saturated fat are pushing people toward plant-based desserts. In India, soy is especially important as a leading oilseed and protein source. The country’s soybean production of 130.5 lakh tonnes in 2023–24 formed nearly one-third of its total oilseed output. With soy products already a staple, soy-based desserts are gaining cultural acceptance.

The high production volume of soy creates opportunities to introduce desserts into both retail and foodservice markets. Competitive pricing of soy ingredients allows manufacturers to offer affordable products. Localized innovations, such as soy-based kheer or halwa in India, could help broaden appeal. Moreover, fortifying desserts with micronutrients or blending them with regional flavors offers room for further growth.

Key Takeaways

- The Global Soy Dessert Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Soy yogurt holds the largest share in the soy dessert market, accounting for 58.9%.

- Chocolate flavor is the most popular in soy desserts, capturing a 32.7% market share.

- Supermarkets dominate the distribution channel for soy desserts, holding a 36.5% market share.

- North America’s Soy Dessert Market at USD 0.8 Bn reflected 37.9% regional dominance in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/soy-dessert-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.3 Billion |

| Forecast Revenue (2034) | USD 4.1 Billion |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Product Type (Soy Yogurt, Soy Pudding, Soy Ice Cream, Soy Cheesecake), By Flavor (Vanilla, Chocolate, Strawberry, Mango, Others), By Distribution Channel (Online, Supermarkets, Health Food Stores, Convenience Stores, Others) |

| Competitive Landscape | THE HERSHEY COMPANY, Danone S.A., The Hain Celestial Group, Inc., AFC American Food Company, ADM, NOW Foods, Kerry Group plc, Gluten Intolerance Group |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158011

Key Market Segments

By Product Type Analysis

Soy yogurt leads the soy dessert market, commanding a 58.9% share in 2024. Its dominance stems from the rising demand for dairy-free, plant-based alternatives, fueled by health-conscious consumers seeking lactose-free and vegan options. Soy yogurt’s creamy texture, high protein content, and probiotic benefits, combined with customizable flavors and fortified nutrients, make it a preferred choice. As preferences shift toward healthier dessert options, soy yogurt is poised to retain its market leadership.

By Flavor Analysis

Chocolate-flavored soy desserts hold a 32.7% share in the flavor segment in 2024. Chocolate’s universal appeal and rich taste complement the creamy texture of soy-based desserts, driving its popularity among consumers seeking plant-based alternatives to dairy chocolate treats. The growing demand for healthier options, including reduced-sugar or nutrient-enhanced products, further bolsters this segment. Chocolate-flavored soy desserts are expected to maintain their leading position as interest in plant-based treats continues to grow.

By Distribution Channel Analysis

Supermarkets dominate the soy dessert market’s distribution channel segment with a 36.5% share in 2024. Their extensive reach, convenience, and high foot traffic make them the primary choice for consumers. Supermarkets offer a wide variety of soy dessert brands and flavors, often featuring dedicated plant-based or health-focused sections that cater to the rising demand for dairy-free and vegan options. As consumer interest in plant-based products grows, supermarkets are likely to remain the leading distribution channel for soy desserts.

Regional Analysis

North America led the global soy dessert market with a 37.9% share, generating USD 0.8 billion in revenue. This dominance is driven by heightened awareness of lactose intolerance, a growing vegan and flexitarian consumer base, and a strong retail and foodservice infrastructure supporting plant-based innovations. North American manufacturers are advancing product offerings, launching premium soy-based yogurts, puddings, and frozen treats that align with demands for clean-label and high-protein products.

Europe follows with steady growth, fueled by sustainability priorities and regulatory support for plant-based foods. The Asia-Pacific region is gaining traction rapidly, particularly in urban areas where rising disposable incomes and shifting dietary preferences boost soy dessert demand, though it trails North America in market share.

Latin America and the Middle East & Africa are emerging markets, showing promising growth potential due to increasing health awareness, expanding distribution channels, and greater availability of soy desserts, despite their smaller current market share compared to North America.

Top Use Cases

- Vegan alternative: Soy desserts like yogurt and puddings offer a creamy treat without dairy, perfect for vegans or those avoiding animal products. Made from soy milk, they provide plant-based indulgence with a smooth texture that mimics traditional sweets, helping people enjoy desserts guilt-free while supporting ethical eating habits.

- Health-conscious snack: These treats deliver protein and probiotics from fermented soy, aiding digestion and overall wellness. Ideal for fitness lovers seeking low-fat options, soy yogurts and ice creams satisfy sweet cravings without heavy calories, making them a smart choice for daily nutrition in busy lifestyles.

- Lactose-free option: For folks with dairy sensitivities, soy-based yogurts and puddings provide relief from bloating while keeping the fun of dessert alive. Their mild flavor and customizable toppings like fruits make them easy to incorporate into meals, ensuring everyone can partake in family gatherings or personal treats.

- Baking ingredient: Use soy yogurt in recipes for moist cakes, brownies, or muffins to add tenderness and reduce fat content naturally. It acts as a binder and adds subtle nutrition, allowing bakers to create healthier versions of classics that appeal to diverse dietary needs without compromising taste.

- Innovative frozen delights: Soy ice creams and popsicles bring refreshing coolness with plant power, great for hot days or as fun snacks. Blended with fruits or nuts, they offer variety and creativity, turning simple soy milk into exciting, dairy-free frozen treats that kids and adults love alike.

Recent Developments

1. THE HERSHEY COMPANY

Hershey has been expanding its Reese’s brand into plant-based territory. A key recent development is the launch of Reese’s Oat and Soy Dessert Cups. This product directly targets the growing demand for vegan and dairy-free chocolate alternatives, leveraging one of its most powerful brands to capture market share in the plant-based dessert category, which includes soy-based options.

2. Danone S.A.

Danone, through its Alpro brand, continues to be a leader in soy-based desserts in Europe. A significant recent focus is on health and indulgence, reformulating recipes to reduce sugar while maintaining taste. Alpro has also expanded its popular ‘No Sugars’ range of soy desserts and yogurts, emphasizing its commitment to providing healthier plant-based choices and responding to consumer demand for clean-label, low-sugar options.

3. The Hain Celestial Group, Inc.

Hain Celestial’s recent developments in soy desserts are channeled through its Dream brand. The company has been focusing on renovating its portfolio to meet clean-label demands. This includes using non-GMO soy and removing artificial ingredients from its Dream Soy Pudding line. The strategy is to revitalize this established product line by aligning with contemporary consumer preferences for simple, recognizable ingredients in plant-based desserts.

4. AFC American Food Company

AFC American Food Company specializes in private label and contract manufacturing. Its recent development in soy desserts involves expanding its capacity to produce custom, store-brand soy puddings and mousses for major retailers. By offering cost-effective, high-quality private-label solutions, AFC is capitalizing on the retail trend of expanding its in-house plant-based dessert lines to compete with branded leaders without significant R&D investment.

5. ADM

ADM’s developments are upstream, focusing on ingredients. The company is advancing its soy protein isolates and textured vegetable proteins specifically for dessert applications. A key innovation is creating bland-tasting, highly soluble soy proteins that allow for a cleaner, less “beany” flavor profile in delicate desserts like mousses and puddings, enabling brands to improve the sensory experience of their final soy-based products.

Conclusion

Soy Desserts stand out as a versatile and appealing category in the evolving food landscape, driven by rising interest in plant-based choices and healthier indulgences. As consumers prioritize wellness and sustainability, these products meet demands for dairy-free options that deliver creamy satisfaction and nutritional perks, promising continued growth and innovation for brands catering to mindful eaters worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)