Table of Contents

Overview

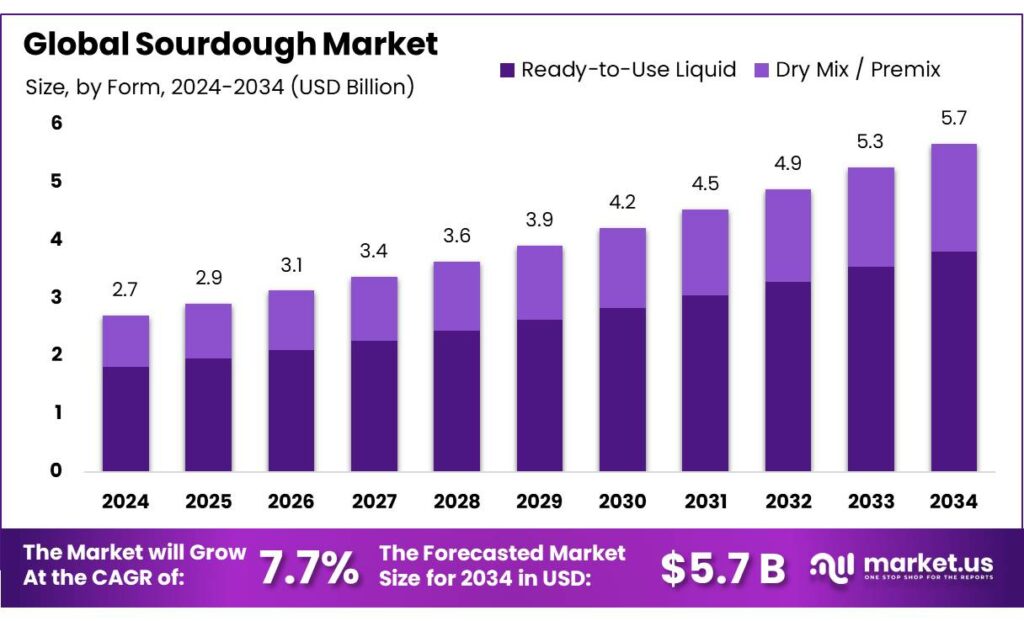

New York, NY – October 10, 2025 – The Global Sourdough Market is projected to reach USD 5.7 billion by 2034, up from USD 2.7 billion in 2024, expanding at a CAGR of 7.7% (2025–2034). In 2024, Europe held the leading position with a 39.2% market share, accounting for USD 1 billion in revenue.

Sourdough represents a naturally fermented bread process that utilizes wild yeasts and lactic acid bacteria rather than commercial yeast. This traditional fermentation enhances flavor, improves digestibility, and increases nutritional value while reducing the need for additives.

Studies such as Chemical and Nutritional Characterization of Sourdoughs have shown that using sprouted or unsprouted whole-wheat flour in spontaneous fermentation increases yeast and lactic acid bacteria counts, boosts phenolic and antioxidant content, and lowers phytic acid levels. Moreover, substituting about 20% sprouted flour improves bread softness and volume, promoting product quality.

Government initiatives are driving industry growth by supporting small and medium bakery enterprises. The Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, launched in 2020, offers 35% capital subsidies (up to ₹10 lakh) and seed funding for Self-Help Groups, alongside branding and marketing support.

Additionally, the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY), managed by the Ministry of Food Processing Industries, facilitated the setup of 28 bakery processing projects as of 2023. Under the PMFME program, over 2,000 bakery units have received modernization support, strengthening production capacity and enhancing value addition in the sourdough and bakery sector.

Key Takeaways

- Sourdough Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 7.7%.

- Ready-to-Use Liquid held a dominant market position in the “By Form” segment of the Sourdough Market, capturing more than a 67.3% share.

- Type I held a dominant market position in the “By Type” segment of the Sourdough Market, capturing more than a 45.2% share.

- Wheat held a dominant market position in the “By Ingredient” segment of the Sourdough Market, capturing more than a 59.6% share.

- Breads & Buns held a dominant market position in the “By Application” segment of the Sourdough Market, capturing more than a 45.1% share.

- Food Processing held a dominant market position in the “By Distribution Channel” segment of the Sourdough Market, capturing more than a 52.9% share.

- Europe dominated with a 39.2% share, translating to about USD 1 billion

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/sourdough-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.7 Billion |

| Forecast Revenue (2034) | USD 5.7 Billion |

| CAGR (2025-2034) | 7.7% |

| Segments Covered | By Form (Ready-to-Use Liquid, Dry Mix / Premix), By Type (Type I, Type II, Type III), By Ingredient (Wheat, Barley, Oats, Others), By Application (Breads and Buns, Cookies, Cakes, Pizza, Others), By Distribution Channel ( Food Processing, Foodservice, Retail, Supermarkets / Hypermarkets, Online Retail Stores, Other) |

| Competitive Landscape | Puratos, AB Mauri, IREKS GMBH, Lallemand Inc, Lesaffre, GOLD COAST BAKING COMPANY, BOUDIN BAKERY, Goodmills, Emst BÖCKER GmbH & Co. KG, Bake With Brolite |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158235

Key Market Segments

By Form Analysis

Ready-to-Use Liquid commands a 67.3% share in the Sourdough Market’s “By Form” segment in 2024, driven by its convenience and reliability. Ideal for industrial and commercial bakeries, it eliminates lengthy fermentation, ensuring consistent quality and flavor at scale. This form integrates seamlessly into dough, preserving sourdough’s signature tangy profile and texture. In 2025, its dominance is expected to persist, fueled by demand for efficient, uniform baking solutions in foodservice and retail.

By Type Analysis

Type I Sourdough holds a 45.2% share in the “By Type” segment in 2024, favored for its traditional long fermentation and clean-label appeal. Using wild yeasts and lactic acid bacteria without commercial additives, it resonates with artisanal and health-conscious consumers. Despite requiring more time and care, its authentic flavor and natural profile drive demand. In 2025, Type I is expected to maintain steady growth, supported by interest in wholesome, gut-friendly bread options.

By Ingredient Analysis

Wheat leads the “By Ingredient” segment with a 59.6% share in 2024, valued for its reliable baking performance and versatility. Its balanced gluten content ensures optimal structure, elasticity, and fermentation, delivering the classic sourdough tang and chewy crumb. Despite competition from alternative flours like rye or spelt, wheat remains the preferred choice for both artisanal and industrial bakers. In 2025, wheat-based sourdough is expected to dominate, backed by robust global supply chains.

By Application Analysis

Breads & Buns dominate the “By Application” segment with a 45.1% share in 2024, driven by rising demand for healthier, flavorful alternatives to white bread. Sourdough’s natural fermentation enhances digestibility, shelf life, and taste, appealing to households, cafes, and premium foodservice. In 2025, this segment is projected to grow as bakeries and supermarkets expand sourdough offerings, including sandwich buns and artisan loaves, to meet consumer preferences.

By Distribution Channel Analysis

Food Processing leads the “By Distribution Channel” segment with a 52.9% share in 2024, driven by sourdough’s integration into packaged and frozen goods like breads, pizzas, and ready-to-bake products. Its natural preservation, flavor, and clean-label appeal make it a favorite for large-scale production. In 2025, this segment is expected to expand as manufacturers innovate with sourdough in snacks, wraps, and specialty baked goods to cater to health-conscious consumers.

Regional Analysis

In 2024, Europe led the global sourdough market with a 39.2% share, equating to approximately USD 1 billion in revenue, establishing it as the foremost region in market size and influence. This leadership stems from Europe’s rich bakery heritage, heightened consumer awareness of health benefits and artisanal quality, and advanced industrial bakery and food processing infrastructure.

European consumers favor sourdough for its health benefits, including improved digestibility and clean-label ingredients, alongside its distinctive taste and alignment with traditional baking methods. Both industrial and retail channels drive demand, with supermarkets, artisan bakeries, and foodservice sectors attracting a broad consumer base to sourdough products.

Advancements in fermentation control, starter cultures, and freshness-preserving packaging have bolstered market scalability. Key markets include Germany, France, and the UK, with Germany excelling in sales and traditional rye/wheat sourdough production, while France and the UK lead in premium and clean-label sourdough innovations.

Top Use Cases

- Artisanal Bread Production: Artisanal bakers use sourdough starters to craft fresh loaves with a tangy flavor and chewy texture. This natural fermentation process draws in customers who love handmade goods and want better digestion from the bread. It fits small shops focusing on local tastes, helping them stand out in busy markets by offering daily fresh options that build loyal fans.

- Home Baking Kits: Busy home cooks turn to easy sourdough kits for fun weekend baking. These include simple starters and recipes that let families make tasty loaves without hassle. The rise in do-it-yourself trends makes this popular, as people enjoy the pride of fresh bread and share tips online, boosting everyday use in kitchens worldwide.

- Pizza Crust Innovation: Restaurants swap plain dough for sourdough bases to create chewy, flavorful pizzas that wow diners. The mild sour note pairs well with toppings, and it keeps longer without spoiling. This draws food lovers seeking unique meals, helping eateries add premium items to menus and attract crowds for casual nights out.

- Gluten-Free Snacks: Food makers blend sourdough with special flours to bake cookies and crackers that suit sensitive eaters. The gentle fermentation breaks down parts for easier tummy comfort, making it a go-to for health-focused treats. This opens doors in stores for grab-and-go options, meeting the call for clean eats that taste great, too.

- Frozen Dough for Cafes: Cafes use ready frozen sourdough dough to whip up buns and rolls on demand without waste. It thaws quickly and bakes evenly, saving time for busy spots. This smart choice keeps flavors fresh while cutting costs, letting owners focus on service and serving warm goods that keep customers coming back often.

Recent Developments

1. Puratos

Puratos continues to deepen its commitment to sourdough authenticity and transparency with its Sourdough Library, now preserving over 140 starters globally. Recent focus includes the “Taste Tomorrow” consumer study, revealing drivers behind sourdough’s popularity. They are also innovating with clean-label solutions like Sapore CI, which uses long fermentation to enhance flavor and shelf-life naturally, meeting demand for both artisan quality and industrial efficiency in bakery production.

2. AB Mauri

AB Mauri is driving sourdough innovation with its stable, easy-to-use Sour Dough Concepts (SDC) range, designed for consistent results in industrial baking. Their recent development highlights include new dried sourdoughs targeting specific flavor profiles, from mild to tangy. A key initiative is their global “Sourdough Hub” in the UK, serving as a center for application support and R&D, helping bakers of all scales optimize their processes and create high-quality sourdough products.

3. IREKS GMBH

IREKS has expanded its Komplet sourdough bases and powders, focusing on clean-label, organic, and non-GMO options to simplify authentic sourdough production. A significant recent development is the enhancement of their “Aro-Vital” line, which uses lactic acid bacteria to impart a robust, traditional sourdough flavor and improved crumb structure in less time. They are also providing extensive application expertise to help bakers achieve a perfect, consistent bake with a pronounced aroma.

4. Lallemand Inc

Lallemand is at the forefront of sourdough science with its extensive library of pure microbial strains. A key recent development is the introduction of new generation sourdough starters, such as the LALPACK S series, which offer exceptional fermentation stability and defined acidification. Their research focuses on selecting specific lactic acid bacteria and yeasts to create customizable flavor profiles and improve the nutritional quality of sourdough, including reduced FODMAP and increased fiber content.

5. Lesaffre

Lesaffre is leveraging its global “Sourdough & More” platform to launch innovative starter cultures and fermented ingredients. Recent developments include the creation of targeted solutions for specific regional tastes and textures, from San Francisco-style tang to European rye profiles. A major focus is on fermentation to enhance nutritional benefits, such as developing sourdoughs with lower acrylamide formation potential and improved digestibility, supporting both artisan bakers and large-scale industrial producers.

Conclusion

Sourdough is a bright spot in the baking world, blending old ways with fresh needs. Its natural tang and gut-friendly perks keep pulling in health fans and food explorers alike. From cozy home ovens to big factory lines, it’s weaving into daily eats like pizzas and pastries, riding waves of clean living and bold tastes. With clever twists like easy kits and green methods, sourdough promises steady buzz, helping brands connect deeper with shoppers who crave real flavor and feel-good choices in a fast world.