Table of Contents

Overview

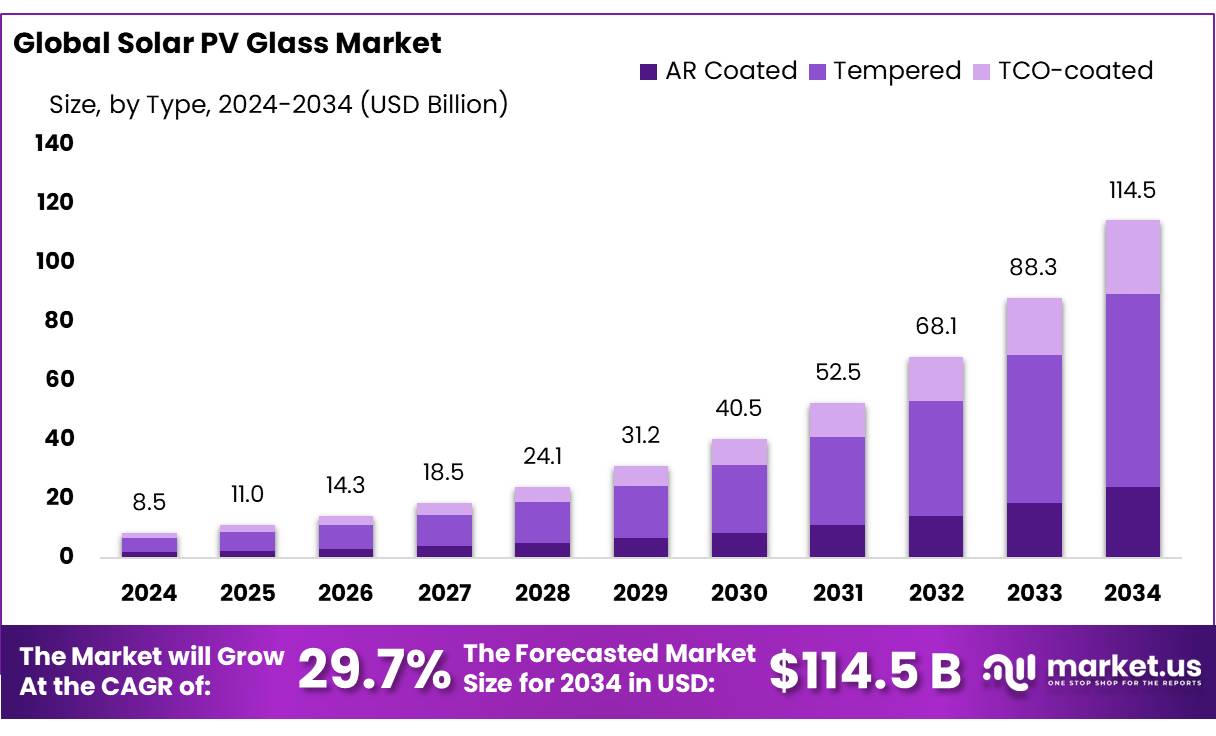

New York, NY – August 21, 2025 – The Global Solar PV Glass Market is projected to grow from USD 8.5 billion in 2024 to USD 114.5 billion by 2034, achieving a CAGR of 29.7% during the 2025–2034 forecast period. In 2024, North America led the market, holding a 42.9% share with USD 3.6 billion in revenue.

The Solar PV Glass sector focuses on ultra-low-iron glass used in photovoltaic (PV) modules, crucial for optimizing light transmission, durability, and energy conversion efficiency. This glass serves as a vital component in the PV module manufacturing supply chain, linking raw materials like polysilicon and ingots to final module assembly. Market growth is driven by declining PV module costs, rising demand for building-integrated photovoltaics (BIPV), and increasing adoption of renewable energy. Global solar installations reached 456 GW in 2023, reflecting robust sector expansion.

Government policies have significantly influenced the market. In China, industrial strategies have spurred large-scale production, cost reductions, and supply-chain efficiencies. In the U.S., the SunShot Initiative, launched in 2011 by the Department of Energy, targeted residential PV costs of $0.05/kWh and utility-scale costs of $0.03/kWh. It achieved 90% of its 2020 cost-reduction goal, driving solar installations to 14.8 GW in 2016—a 97% increase from 2015—backed by ~$30 billion in investments.

In India, the National Solar Mission (2010) initially aimed for 20 GW of solar capacity, later revised to 100 GW. Utility-scale solar capacity grew from 2,650 MW in May 2014 to 12,288.8 MW, with 9,362.7 MW added in 2017–18, marking a peak growth year. By December 2023, India’s manufacturing capacity reached 6 GW for solar cells and 37 GW for modules, with projections of 25 GW (cells) and 60 GW (modules) by the end of 2025. A June 2026 mandate will require solar projects to use locally manufactured cells, supporting India’s goal of 500 GW in non-fossil fuel capacity (up from ~156 GW), with current capacities at 80 GW for modules and over 7 GW for cells.

Key Takeaways

- Solar PV Glass Market size is expected to be worth around USD 114.5 billion by 2034, from USD 8.5 billion in 2024, growing at a CAGR of 29.7%.

- Tempered held a dominant market position, capturing more than a 57.1% share of the global solar PV glass market.

- Crystalline Solar PV Module held a dominant market position, capturing more than a 73.4% share of the global solar PV glass market.

- Utility held a dominant market position, capturing more than a 49.5% share of the global solar PV glass market.

- North America accounts for a substantial 42.9% market share, valued at approximately USD 3.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-solar-pv-glass-market/request-sample/

Report Scope

| Market Value (2024) | USD 8.5 Billion |

| Forecast Revenue (2034) | USD 114.5 Billion |

| CAGR (2025-2034) | 29.7% |

| Segments Covered | By Type (AR Coated, Tempered, TCO-coated), By Technology (Crystalline Solar PV Module, Thin Film Module, Perovskite Module), By Application (Utility, Residential, Commercial) |

| Competitive Landscape | First Solar Inc., Xinyi Solar Holding Ltd, Nippon Sheet Glass Co., Ltd, Yingli Green Energy Holding Company Ltd, Sun Power Corporation, ReneSola Ltd, Hanwha Q CELLS Co., Saint-Gobain S.A, Guardian Industries, Borosil Glass Works Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154955

Key Market Segments

By Type Analysis

Tempered Solar PV Glass leads with a 57.1% share due to its superior strength and widespread use in PV modules. In 2024, Tempered Solar PV Glass held a commanding 57.1% share of the global solar PV glass market. Its preference in photovoltaic module production stems from its high mechanical strength, impact resistance, and ability to endure harsh weather conditions. This makes it ideal for both rooftop and ground-mounted solar systems exposed to long-term environmental stress.

By Technology Analysis

In 2024, Crystalline Solar PV Modules captured a 73.4% share of the global solar PV glass market, driven by their widespread use in residential and utility-scale solar projects. Renowned for high energy conversion efficiency, long lifespan, and a well-established manufacturing base, crystalline modules remain the top choice across major solar markets.

By Application Analysis

In 2024, the Utility segment held a 49.5% share of the global solar PV glass market, fueled by the rapid growth of utility-scale solar power plants to meet rising electricity demands and renewable energy goals. These large solar farms require significant quantities of PV modules, boosting demand for durable, high-performance PV glass.

Regional Analysis

North America holds a 42.9% Share (USD 3.6 billion) in the Global Solar PV Glass Market

In 2025, North America accounted for a 42.9% share of the global Solar PV Glass market, valued at USD 3.6 billion, making it the second-largest regional market. This growth is driven by strong solar energy adoption, supportive policies like the U.S. Inflation Reduction Act, and rising demand for building-integrated photovoltaics (BIPV) in residential and commercial sectors.

The Asia-Pacific (APAC) region leads globally with a 59.3% market share, propelled by major solar initiatives in China, India, and Japan, alongside robust manufacturing and cost-competitive production. Europe follows, with steady growth fueled by stringent environmental regulations, sustainability targets, and widespread BIPV adoption, particularly in Germany, France, and Spain, supported by EU clean energy programs.

Top Use Cases

- Building-Integrated Photovoltaics (BIPV): Solar PV glass is used in building facades, windows, and roofs, generating electricity while serving as a structural component. It blends seamlessly with architecture, enhancing aesthetics and reducing reliance on traditional energy sources, making it ideal for sustainable commercial and residential buildings.

- Utility-Scale Solar Farms: Solar PV glass is critical in large-scale solar plants, protecting solar cells and boosting energy efficiency. Its durability and high light transmission support reliable power generation, meeting growing electricity demands and renewable energy targets in regions like Asia and North America.

- Residential Rooftop Installations: Solar PV glass is integrated into home rooftops to produce clean energy. Its strength and weather resistance ensure long-term performance, while anti-reflective coatings improve efficiency, making it a popular choice for homeowners seeking cost savings and sustainability.

- Commercial Skylights and Windows: Solar PV glass is used in commercial skylights and windows to generate power while allowing natural light. It reduces energy costs, enhances building aesthetics, and supports green certifications, appealing to businesses aiming for eco-friendly operations and reduced carbon footprints.

- Transparent Solar Windows: Emerging transparent solar PV glass is used in windows, capturing sunlight without blocking views. This technology suits urban settings, enabling buildings to generate electricity while maintaining design appeal, driving adoption in modern architecture and smart city projects.

Recent Developments

1. First Solar Inc.

First Solar is a leader in thin-film cadmium telluride (CdTe) PV modules, which use a different semiconductor technology than conventional crystalline silicon. Their recent developments focus on enhancing this platform. They are scaling production of their Series 7 modules, which utilize a larger form factor for increased power output and lower installation costs.

2. Xinyi Solar Holding Ltd.

As a major global manufacturer of solar glass, Xinyi Solar is heavily investing in capacity expansion to meet growing demand. A key recent development is the operational launch of new production lines for high-efficiency, large-format (over 2m x 2m) solar glass to serve the trend towards larger, higher-wattage panels.

3. Nippon Sheet Glass Co. Ltd. (NSG Group)

NSG Group, the parent company of Pilkington, is developing advanced functional glass for Building Integrated Photovoltaics (BIPV). A significant recent development is their focus on creating transparent and semi-transparent solar glass products that can be integrated into windows and building facades without compromising aesthetics.

5. Yingli Green Energy Holding Company Ltd.

After undergoing a major financial restructuring, Yingli has shifted its strategy. Recent developments indicate a move away from large-scale panel manufacturing towards becoming a downstream project developer and operator, and a supplier of integrated solar energy solutions.

Conclusion

Solar PV glass is transforming the renewable energy landscape with its versatile applications in buildings, solar farms, and innovative transparent solutions. Its ability to combine energy generation with structural functionality drives market growth, fueled by global demand for clean energy and supportive policies. As technology advances and costs decline, solar PV glass will play a pivotal role in sustainable development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)