Table of Contents

Overview

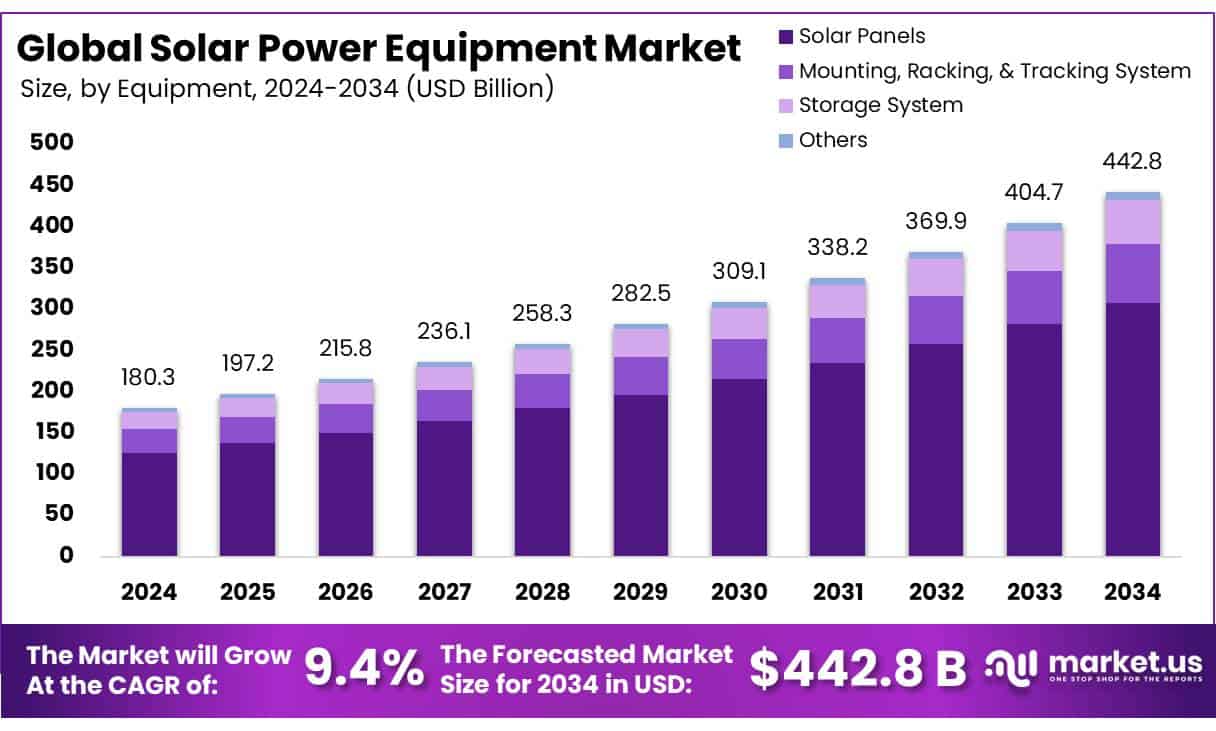

New York, NY – May 12, 2025 – The global Solar Power Equipment Market is growing fast, driven by rising demand for clean energy and government support for renewable projects. In 2024, the market was valued at USD 180.3 billion and is expected to reach USD 442.8 billion by 2034, growing at a strong 9.4% CAGR from 2025 to 2034.

In 2024, Solar Panels dominated the solar power equipment sector, securing over 69.6% of the market share. Declining costs, enhanced efficiency, and robust demand from residential and commercial sectors drove their widespread adoption. Global government subsidies and tax incentives further accelerated solar panel sales. The Utility sector led the solar power equipment market, commanding over 48.4% of the share. Large-scale solar farms and government-supported renewable energy initiatives fueled this dominance, prioritizing high-capacity installations.

US Tariff Impact on Solar Power Equipment Market

The Trump administration this week set tariffs up to 3,521% on the four countries in Southeast Asia that supply the U.S. with the majority of its solar imports, making yet another change to its trade policy. The U.S., and not even these tariffs, will increase prices enough to change that, says Nichols. After the Inflation Reduction Act passed, solar installations jumped 51% year-over-year in 2023 and reached nearly 50 GW in 2024.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-solar-power-equipment-market/request-sample/

Earlier in April, the Trump administration announced a 90-day pause on plans to enforce reciprocal tariffs, but it still moved forward with implementing a 10% tariff on most global trading partners and a 145% tariff rate on China, putting additional pressure on the solar industry. Tariffs increase prices and disrupt supply chains, and solar manufacturing isn’t immune to these impacts. Despite the potential upside for domestic manufacturers, as the tariffs are enforced, the cost of going solar will increase for homeowners across the U.S.

Key Takeaways

- The Global Solar Power Equipment Market is expected to grow from USD 180.3 billion in 2024 to USD 442.8 billion by 2034 at a 9.4% CAGR.

- Solar panels dominate with a 69.6% market share, driven by cost reductions, efficiency gains, and government incentives.

- The utility sector leads with a 48.4% share, fueled by large-scale solar farms and cost-effective energy storage solutions.

- Asia-Pacific holds a 43.9% market share, valued at USD 79.1 billion, due to industrialization and strong renewable energy policies.

Analyst Viewpoint

The Solar Power Equipment Sector is thriving, fueled by global demand for renewable energy and favorable policies. Investment opportunities abound, particularly in solar panel production and cutting-edge technologies like bifacial and perovskite cells, which offer improved efficiency and reduced costs.

However, challenges persist, including high interest rates, labor shortages, and supply chain disruptions, such as delays in high-voltage equipment. Trade uncertainties, like potential tariffs on Southeast Asian imports, further complicate the landscape. Consumer sentiment shows cautious optimism, with homeowners and businesses increasingly drawn to solar for cost savings.

Innovations like smart inverters and blockchain-enabled peer-to-peer energy trading enhance solar’s appeal by improving efficiency and enabling direct energy transactions, aligning with tech-savvy consumer preferences. Regulatory support, notably the Inflation Reduction Act’s tax credits, has significantly accelerated deployment compared to pre-IRA forecasts.

Report Scope

| Market Value (2024) | USD 180.3 Billion |

| Forecast Revenue (2034) | USD 442.8 Billion |

| CAGR (2025-2034) | 9.4% |

| Segments Covered | By Equipment (Solar Panels, Mounting, Racking, and Tracking System, Storage System, Others), By Application (Utility, Residential, Commercial) |

| Competitive Landscape | ABB Group, Canadian Solar, Enphase Energy, Inc., First Solar Inc., GCL-Poly Energy Holdings Limited, Hanwha Q CELLS, JA Solar, JinkoSolar, Kyocera Corporation, LONGi Solar, REC Group, Renesola Ltd., Risen Energy Co. Ltd., Shunfeng International, SMA Solar Technology AG, SolarEdge Technologies, Inc., Sungrow Power Supply Co. Ltd., Sunrun Inc., Trina Solar, Vivint Solar |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146686

Key Market Segments

By Equipment

- In 2024, Solar Panels dominated the solar power equipment sector, securing over 69.6% of the market share. Declining costs, enhanced efficiency, and robust demand from residential and commercial sectors drove their widespread adoption. Global government subsidies and tax incentives further accelerated solar panel sales.

- While expected to retain its leading position, the segment may see slightly slower growth as emerging technologies, such as advanced thin-film and bifacial modules, gain momentum. Nevertheless, traditional solar panels will likely remain the preferred choice due to their proven reliability and well-established supply chains. The industry is also trending toward higher-wattage panels to optimize energy output per square foot. Although inverters and mounting systems are essential, solar panels continue to form the industry’s core.

By Application

- In 2024, The Utility sector led the solar power equipment market, commanding over 48.4% of the share. Large-scale solar farms and government-supported renewable energy initiatives fueled this dominance, prioritizing high-capacity installations. Lower solar panel costs and advancements in energy storage have made utility-scale projects increasingly cost-competitive, spurring further investment. The utility segment is poised to maintain its lead, but challenges like grid integration and limited land availability in certain regions may temper growth. Surging electricity demand and the global push for decarbonization will ensure utility-scale solar remains a priority. Innovations such as floating solar farms and hybrid renewable systems are also poised to create new growth opportunities.

Regional Analysis

- The Asia-Pacific (APAC) region dominates the global solar power equipment market, holding a 43.9% share with a market value of USD 79.1 billion. Rapid industrialization, rising energy needs, and strong government support for renewables drive this leadership. China, the world’s top solar equipment producer and consumer, exported a record 120,427 MW of solar modules in the first half of 2024, highlighting its manufacturing strength and renewable energy commitment.

- India significantly contributes to the region’s growth, advancing solar deployment through ambitious targets and incentives for residential, commercial, and industrial installations. APAC’s dominance is bolstered by its robust supply chain, covering raw materials, manufacturing, and distribution. This integrated system ensures cost efficiency and accelerates solar solution deployment to meet the region’s surging energy demands.

Top Use Cases

- Residential Solar Systems: Homeowners install solar panels to reduce electricity bills and gain energy independence. Pairing panels with battery storage ensures power during outages. Falling panel costs and government tax incentives make rooftop solar attractive, especially for suburban households seeking sustainable energy solutions.

- Utility-Scale Solar Farms: Large solar farms generate electricity for the grid, powering thousands of homes. Developers use high-wattage panels and trackers to maximize output. These projects benefit from economies of scale and supportive policies, driving significant investments in renewable energy infrastructure.

- Commercial Solar Installations: Businesses adopt solar to cut operational costs and meet sustainability goals. Rooftop panels and carport systems power offices, warehouses, and retail spaces. Smart inverters optimize energy use, appealing to companies aiming to reduce carbon footprints and attract eco-conscious customers.

- Community Solar Projects: Community solar allows multiple households to share a single solar array, lowering costs for renters and small homes. Subscribers receive bill credits for their share of generated power. This model expands access to clean energy in urban and rural areas.

- Agrivoltaics: Farmers integrate solar panels with crops or livestock, using panels for shade while generating energy. This dual-use approach boosts land efficiency and farm income. It’s gaining traction in regions with high sunlight, supporting both agriculture and renewable energy goals.

Recent Developments

1. ABB Group

- ABB has expanded its solar inverter portfolio with new string inverters for utility-scale projects, improving efficiency and grid stability. The company is also integrating AI-driven energy management systems to optimize solar power usage. ABB recently partnered with a European solar farm to deploy battery storage solutions, enhancing renewable energy storage capabilities.

3. Enphase Energy, Inc.

- Enphase introduced its IQ8P microinverters, designed for high-power solar panels, improving energy harvest. The company also expanded its home energy storage systems with the new IQ Battery 5P, offering enhanced capacity. Enphase partnered with SunPower to integrate its microinverters into residential solar systems.

4. First Solar Inc.

- First Solar announced an investment to build a new 3.5 GW solar panel factory in Louisiana, USA. The company also set a new efficiency record for its thin-film solar panels. First Solar secured a 2.4 GW module supply deal with a major European developer.

5. GCL-Poly Energy Holdings Limited

- GCL-Poly is advancing perovskite solar cell technology. The company also signed a deal to supply 2 GW of solar wafers to a leading Chinese manufacturer. Additionally, GCL-Poly is expanding its polysilicon production to support global solar growth.

Conclusion

The Solar Power Equipment Market is poised for robust growth, driven by global demand for clean energy, supportive policies, and technological advancements like high-efficiency panels and smart inverters. Despite challenges such as supply chain disruptions and trade uncertainties, the sector’s potential remains strong. The Asia-Pacific region, led by China and India, will continue to dominate, leveraging strong manufacturing and deployment capabilities to meet rising energy needs sustainably.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)