Table of Contents

Introduction

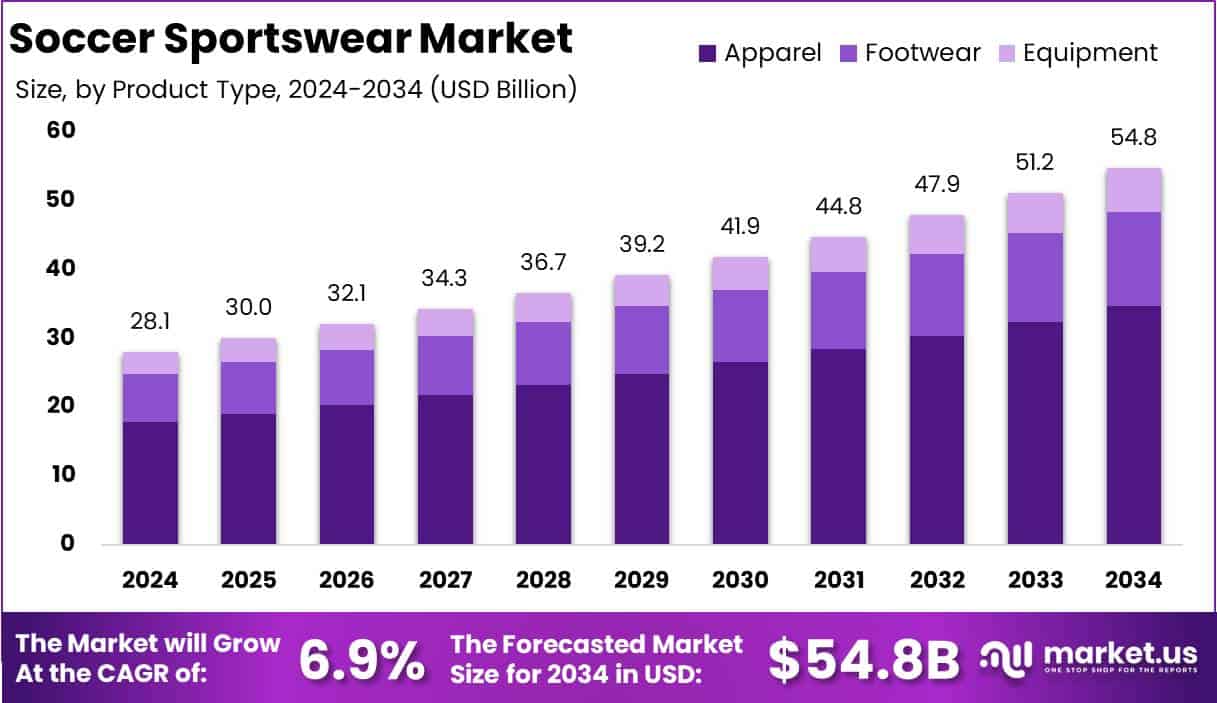

The Global Soccer Sportswear Market Size is projected to reach approximately USD 54.8 billion by 2034, up from USD 28.1 billion in 2024. This represents a compound annual growth rate (CAGR) of 6.9% over the forecast period from 2025 to 2034

Soccer sportswear encompasses the specialized apparel and equipment designed specifically for the sport of soccer, including jerseys, shorts, socks, cleats, and protective gear such as shin guards. This market segment addresses the needs of amateur and professional soccer players alike, catering to both performance enhancement and safety requirements.

The soccer sportswear market is a dynamic sector within the global sports apparel industry, driven by a growing global interest in soccer, increased participation at grassroots and professional levels, and an escalating focus on sports health and fitness trends. Growth factors for this market include technological advancements in fabric and material design that improve comfort and performance, which attract both active participants and fashion-conscious consumers.

Moreover, the market is bolstered by strategic endorsements and partnerships with renowned soccer stars and clubs, which enhance brand visibility and appeal. The rise in women’s participation in soccer globally also presents a significant opportunity for market expansion, as does the increasing influence of digital marketing campaigns that reach a global audience and stimulate demand.

This market is poised for growth, with opportunities for innovation in eco-friendly sportswear and expansion into emerging markets where soccer is gaining popularity, making it an attractive sector for investors and businesses aiming to leverage the sport’s global appeal.

Key Takeaways

- The global Soccer Sportswear market is projected to grow from USD 28.1 billion in 2024 to USD 54.8 billion by 2034, at a CAGR of 6.9%.

- Apparel leads the market with a 63.4% share in 2024, driven by innovation, team sponsorships, and material advancements.

- Fan Wear/Licensed Products dominate with a 57.4% market share, fueled by soccer’s global popularity and event-driven demand.

- Men’s soccer sportswear holds a 56.7% market share, reflecting higher participation at both amateur and professional levels.

- Individual Users (B2C) account for 72.3% of the market, driven by direct consumer demand and e-commerce expansion.

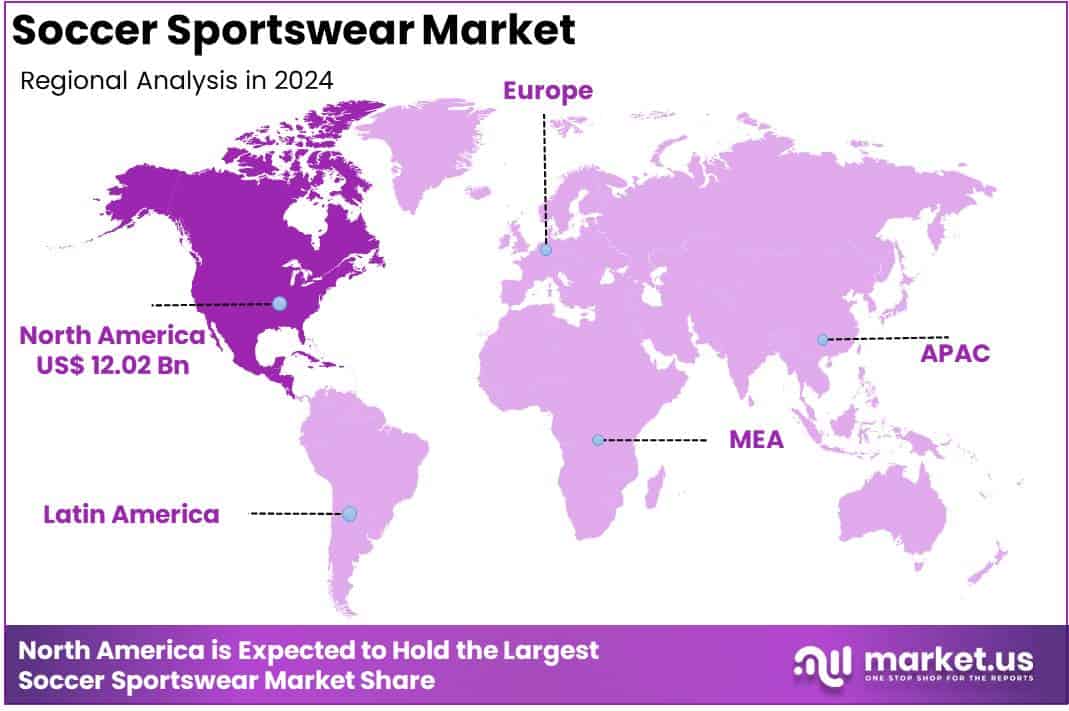

- North America leads with a 42.8% market share, benefiting from a strong soccer culture, high spending power, and major league presence.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 28.1 Billion |

| Forecast Revenue (2034) | USD 54.8 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Product Type (Apparel, Footwear, Equipment), By Purpose (Fan Wear/ Licensed Products, Non-Licensed Products), By Application (Men, Women, Kids), By End-User (Individual users (B2C), Teamwear (B2B)) By Distribution Channel (Online Soccer Specialists, Online Sports Generalists, Traditional Offline Retailers) |

| Competitive Landscape | 361sport, Adidas AG, Amer Sports, ANTA Sports Products Ltd., ASICS Corp., Billabong, Columbia Sportswear, Gap Inc., Hanesbrands, Kappa, LiNing, Li-Ning Company Limited, Lululemon Athletica, Mizuno Corp., NIKE Inc., PEAK, PUMA SE, Ralph Lauren, Under Armour Inc., VF, Xtep |

Emerging Trends

- Technological Integration: Apparel incorporating advanced technologies for better performance, such as moisture-wicking fabrics and improved thermal regulation, is becoming increasingly popular.

- Sustainability Focus: There is a growing demand for eco-friendly materials in sportswear production to appeal to environmentally conscious consumers.

- Customization and Personalization: Offering personalized options for sportswear to cater to individual preferences is a notable trend.

- Fashion Influence: The blending of fashion elements into sportswear to create stylish yet functional apparel is gaining traction.

- Growth in Women’s Segment: There is a significant increase in the availability and variety of women’s soccer sportswear, driven by the rising participation of women in sports.

Top Use Cases

- Professional Athletics: High-performance sportswear designed for competitive soccer players.

- Amateur and Recreational Use: Apparel suited for casual play and training by amateurs and children.

- Health and Fitness Activities: Gear used by individuals engaging in fitness activities that complement their soccer training.

- Fan Apparel: Sportswear that doubles as fan merchandise, allowing supporters to show team loyalty.

- Outdoor and Multi-Sport Use: Versatile sportswear that is suitable for various outdoor activities.

Major Challenges

- Counterfeit Products: The market faces challenges from counterfeit goods, which undermine brand credibility and reduce revenue.

- Price Sensitivity: Consumers are increasingly sensitive to price due to the wide availability of low-cost alternatives.

- Supply Chain Complexities: Disruptions in the supply chain can affect the availability and cost of sportswear.

- Intense Competition: The presence of established brands makes it difficult for new entrants to gain market share.

- Rapid Changes in Consumer Preferences: Keeping up with rapidly changing fashion and technology trends in sportswear can be challenging.

Top Opportunities

- Emerging Markets: Expanding into new geographical areas where soccer is growing in popularity offers significant growth opportunities.

- Innovative Products: Continual innovation in materials and design can attract consumers looking for the latest in sportswear technology.

- Direct-to-Consumer Sales Channels: Strengthening online sales channels to improve margins and customer relationships.

- Partnerships with Soccer Clubs: Collaborations with professional clubs can enhance brand visibility and credibility.

- Expansion into Related Sports Apparel: Leveraging existing technologies and designs to cater to adjacent sports markets.

Key Player Analysis

The global soccer sportswear market in 2024 is highly competitive, with key players continuing to innovate and expand their market presence. Nike Inc. and Adidas AG remain dominant, leveraging their strong brand recognition and expansive product portfolios to maintain leadership. Nike’s emphasis on performance and technology-driven designs aligns with the increasing demand for high-performance gear, while Adidas continues to benefit from its long-standing partnerships with top soccer teams and athletes.

PUMA SE and Under Armour Inc. also compete fiercely, focusing on differentiation through unique collaborations and product innovation. Companies like Lululemon Athletica and Columbia Sportswear are increasingly diversifying their offerings, capitalizing on the rising trend of athleisure and lifestyle sportswear. ANTA Sports Products and Li-Ning have expanded aggressively in Asia, seeking to challenge Western incumbents with affordable, high-quality options. Meanwhile, brands like Mizuno Corp., ASICS Corp., and PEAK are well-regarded for their specialized footwear and apparel, emphasizing comfort and durability. Overall, the market remains dynamic, driven by technological advancements and growing consumer demand for high-quality sports apparel.

Top Key Players in the Market

- 361sport

- Adidas AG

- Amer Sports

- ANTA Sports Products Ltd.

- ASICS Corp.

- Billabong

- Columbia Sportswear

- Gap Inc.

- Hanesbrands

- Kappa

- LiNing

- Li-Ning Company Limited

- Lululemon Athletica

- Mizuno Corp.

- NIKE Inc.

- PEAK

- PUMA SE

- Ralph Lauren

- Under Armour Inc.

- VF

- Xtep

Regional Analysis

North America Leads Soccer Sportswear Market with Largest Market Share of 42.8% in 2024

The North American region holds a commanding position in the soccer sportswear market, estimated to control 42.8% of the global market share by 2024. With a valuation projected to reach USD 12.02 billion, North America continues to dominate due to several key factors. This region benefits from a robust and growing interest in soccer, supported by significant investments in youth and professional leagues, and a strong presence of major sportswear brands that are continuously innovating and expanding their product lines.

The market’s expansion is further fueled by increasing awareness about fitness and the adoption of active lifestyles, making sportswear an essential part of everyday attire for many consumers. These elements combine to maintain North America’s leading position in the global soccer sportswear landscape, reflecting its substantial market potential and investment appeal.

Recent Developments

- In 2025, PUMA, the global sportswear giant, revealed its preliminary results for 2024, highlighting a strong performance with a 9.8% increase in sales, reaching €2.29 billion in the fourth quarter. The company’s full-year sales grew by 4.4%, totaling €8.82 billion, meeting expectations for the period.

- In February 2025, Soccerex announced a global partnership with Sports.com, a leading digital sports entertainment platform. The deal includes Sports.com becoming the title sponsor for major Soccerex events across the world, including those in Cairo, Amsterdam, and Miami throughout the year.

- In February 2023, DICK’S Sporting Goods confirmed its acquisition of Moosejaw, a prominent outdoor retailer previously owned by Walmart. This move is part of DICK’S strategy to expand its outdoor offerings, which already include Public Lands, positioning the company to capitalize on the growing outdoor market.

- In 2024, lululemon athletica reported strong results for Q2, with growth across its international markets and continued product optimization in the U.S. CEO Calvin McDonald expressed confidence in the company’s growth trajectory, supported by their “Power of Three ×2” plan.

- In 2024, Sports Endeavors, backed by Seawall Capital, acquired regional soccer retailer Ewing Sports, enhancing its portfolio that already includes Soccer.com. This acquisition strengthens their position in the soccer retail market.

- In 2025, Columbia Sportswear announced a positive end to 2024, with a return to sales growth in the fourth quarter. CEO Tim Boyle emphasized the company’s focus on cost-saving initiatives and inventory reduction, alongside its new ACCELERATE Growth Strategy for 2025 and beyond.

Conclusion

The global soccer sportswear market is poised for substantial growth, fueled by an increasing global interest in soccer, technological advancements in apparel, and a rising focus on health and fitness. Strategic endorsements and partnerships with soccer stars and clubs enhance brand visibility, while the surge in women’s participation and digital marketing expands market reach. Additionally, opportunities abound in eco-friendly innovations and emerging markets, where soccer’s popularity continues to rise. These factors collectively make the soccer sportswear sector a vibrant and promising arena for investors and businesses seeking to capitalize on the sport’s expanding global appeal.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)