Table of Contents

Introduction

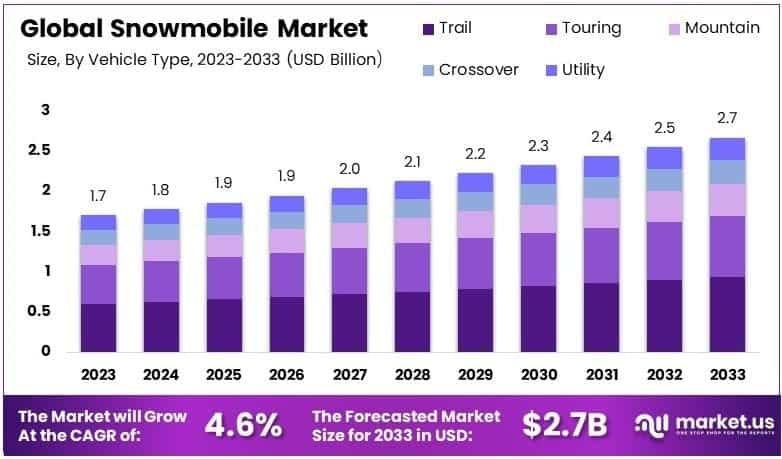

New York, NY – March 24 , 2025 – The Global Snowmobile Market is projected to reach approximately USD 2.7 billion by 2033, rising from an estimated USD 1.7 billion in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 4.6% during the forecast period from 2024 to 2033.

A snowmobile, also referred to as a sled or snow machine, is a motorized vehicle specifically designed for travel over snow and ice, equipped with skis at the front and a continuous track at the rear for propulsion. Unlike traditional vehicles, snowmobiles do not require a road or trail, making them essential for transportation, recreational activities, and utility functions in snow-covered regions. The snowmobile market comprises the global production, distribution, and sale of these vehicles, catering to both individual consumers and commercial users across sectors such as tourism, sports, emergency services, and forestry.

The market has been witnessing steady growth due to increasing participation in winter sports and recreational activities, particularly in North America and Northern Europe. Additionally, the rising popularity of adventure tourism in snow-dense regions has fueled demand, supported by favorable government initiatives to promote winter tourism. Technological advancements, such as the development of electric snowmobiles and enhanced vehicle ergonomics, have further broadened the customer base by attracting environmentally-conscious consumers and improving user experience.

Furthermore, robust aftermarket services, including accessories, maintenance, and customization, have contributed to recurring revenue streams for manufacturers and distributors. The growing adoption of snowmobiles for utility and rescue operations in rural and mountainous terrains also underscores their expanding functional importance. Opportunities remain strong in emerging markets with untapped winter tourism potential, while increasing environmental regulations are expected to accelerate innovation in sustainable snowmobile designs.

Overall, the snowmobile market is positioned for moderate yet resilient growth, driven by evolving recreational trends, expanding utility applications, and continuous product innovation.

Key Takeaways

- The global snowmobile market was valued at USD 1.7 billion in 2023 and is projected to reach USD 2.7 billion by 2033, expanding at a CAGR of 4.6% during the forecast period.

- Trail snowmobiles accounted for 38.3% of the market in 2023, primarily due to their versatility across varying terrains and widespread use in recreational activities.

- Snowmobiles equipped with 500cc to 900cc engines held a 75.8% share, attributed to the optimal balance they offer between power output and fuel efficiency for a range of applications.

- 2-stroke engines led the market with a 62.9% share in 2023, favored for their lightweight construction and superior power-to-weight ratio, making them suitable for performance-driven use.

- Single-seater snowmobiles represented 66.3% of the market, supported by their ease of maneuverability and strong appeal among recreational riders.

- The recreational end-user segment dominated in 2023, driven by an increasing interest in outdoor leisure activities and seasonal tourism across snow-covered regions.

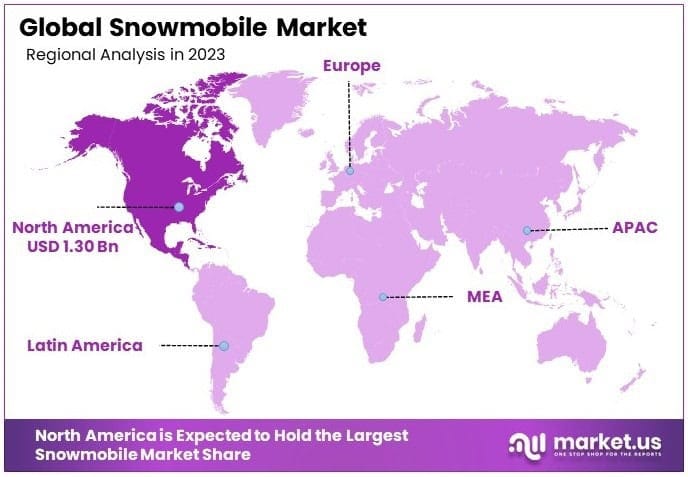

- North America captured 76.4% of the global market, underpinned by a deeply rooted snowmobiling culture, developed infrastructure, and extensive winter terrain conducive to snowmobile use.

Explore the Report Format with Our Sample PDF Download at https://market.us/report/snowmobile-market/request-sample/

Snowmobile Statistics

- There are over 135,000 miles of snowmobile trails in the United States.

- North America has more than 2 million active snowmobilers.

- Globally, over 4 million people ride snowmobiles, and the number is increasing.

- Each rider covers an average of 1,200 miles per year.

- North America is home to over 3,000 snowmobile clubs.

- A snowmobile applies only 0.5 pounds of pressure per square inch on the ground.

- Modern snowmobiles are 94% quieter than early models.

- The snowmobile industry contributes more than $26 billion to the U.S. economy.

- Canada’s snowmobile sector adds $9.3 billion annually to its economy.

- In Europe and Russia, the market generates $5 billion each year.

- More than 100,000 people in North America are employed full-time in this industry.

- Snowmobilers spend an average of $4,000 per year on the sport.

- The average household income of a snowmobiler is $68,000.

- Snowmobiling contributes over $175 million annually to Wyoming’s economy and supports over 1,000 jobs.

- There are 1.4 million registered snowmobilers in the United States.

- Canada has more than 600,000 registered snowmobile users.

- The average age of a snowmobiler is 44 years.

- Men make up 70% of the riders; women account for 30%.

- On average, snowmobilers in North America ride 1,111 miles yearly.

- The snowmobile community raises around $3 million each year for charitable causes.

- Over half of snowmobilers use trailers to reach riding locations.

- Nearly 47% have direct access to trails from home or property.

- Modern snowmobiles weigh between 500 to 600 pounds.

- These machines can exceed speeds of 90 miles per hour.

- Each year, there are approximately 200 deaths related to snowmobiling.

- Over 14,000 snowmobile-related injuries occur annually.

Emerging Trends

- Electric Snowmobiles: The shift towards environmentally friendly transportation has led to the development of electric snowmobiles. These vehicles offer reduced emissions and lower operating costs compared to traditional gasoline-powered models.

- Technological Integration: Modern snowmobiles are incorporating advanced technologies such as GPS navigation, digital displays, and enhanced safety features to improve user experience and safety.

- Lightweight Materials: Manufacturers are utilizing lightweight and durable materials to enhance performance, fuel efficiency, and maneuverability of snowmobiles.

- Customization and Personalization: There is a growing demand for customizable snowmobiles that allow users to tailor features and aesthetics to their preferences.

- Year-Round Utility: Design improvements are enabling snowmobiles to be used in various terrains and conditions, extending their utility beyond traditional winter months.

Top Use Cases

- Recreational Activities: Snowmobiles are widely used for leisure activities such as trail riding, mountain exploration, and backcountry adventures.

- Tourism: Winter tourism industries utilize snowmobiles to offer guided tours, attracting enthusiasts seeking unique experiences in snow-covered landscapes.

- Search and Rescue Operations: Emergency services employ snowmobiles to access remote and snowbound areas during rescue missions.

- Agricultural and Forestry Work: In snowy regions, snowmobiles assist in managing farmland and forests, facilitating transportation and operations in challenging terrains.

- Transportation in Remote Areas: Communities in isolated, snow-covered regions rely on snowmobiles for daily commuting and transporting goods.

Major Challenges

- Seasonal Demand: The reliance on snow conditions leads to fluctuating demand, impacting sales and production cycles.

- Environmental Regulations: Increasingly stringent emission and noise regulations require manufacturers to invest in cleaner technologies, potentially raising production costs.

- High Ownership Costs: The initial purchase price, maintenance, and operational expenses can deter potential buyers.

- Safety Concerns: The risk of accidents and injuries necessitates continuous improvements in safety features and rider education.

- Climate Variability: Unpredictable weather patterns and reduced snowfall in certain regions can adversely affect the usability and appeal of snowmobiles.

Top Opportunities

- Expansion into Emerging Markets: Identifying and entering regions with growing interest in winter sports can open new revenue streams.

- Development of Electric Models: Investing in electric snowmobile technology aligns with environmental trends and can attract eco-conscious consumers.

- Enhancing Rental Services: Offering rental options can cater to tourists and occasional users, broadening the customer base.

- Aftermarket Accessories: Providing a range of accessories and customization options can increase customer engagement and additional sales.

- Collaborations with Tourism Operators: Partnering with tourism businesses can promote snowmobile tours and experiences, boosting market visibility and adoption.

Key Player Analysis

The global snowmobile market in 2024 is significantly shaped by the strategic positioning and innovations of several key players. Polaris Inc. and BRP Inc. (Ski-Doo) continue to dominate with their extensive product lines, dealer networks, and investments in electric and hybrid snowmobile technologies. Yamaha Motor Co., Ltd. and Arctic Cat Inc. (a subsidiary of Textron Inc.) maintain strong market positions due to their reputation for engine performance, durability, and cross-functional vehicle engineering.

Taiga Motors Corporation, a pioneer in electric snowmobiles, is disrupting the traditional landscape by introducing zero-emission models aligned with global sustainability trends. Heritage brands like John Deere, Moto-Ski, Rupp Industries, and Scorpion Inc., though less active in recent decades, still hold historical brand equity in vintage and collector markets. European brands such as Lynx Snowmobiles and Alpina Snowmobiles have shown regional strength, while Japanese manufacturers like Suzuki, Kawasaki, and Honda demonstrate potential for re-entry through strategic innovation or niche targeting.

Top Key Players

- Arctic Cat Inc. (subsidiary of Textron Inc.)

- Polaris Inc.

- Yamaha Motor Co., Ltd.

- BRP Inc. (Ski-Doo)

- Taiga Motors Corporation

- Alpina Snowmobiles

- John Deere

- Bombardier Recreational Products

- Lynx Snowmobiles

- Moto-Ski

- Rupp Industries

- Scorpion Inc.

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- Honda Motor Co., Ltd.

Gain Immediate Access: Secure Your Copy of This Report Today! at https://market.us/purchase-report/?report_id=133755

Regional Analysis

North America Leads the Snowmobile Market with the Largest Market Share of 76.4% in 2024

North America has emerged as the leading region in the global snowmobile market, accounting for the largest market share of 76.4% in 2024, driven by strong demand, widespread recreational usage, and a well-established infrastructure for winter sports. The regional market is projected to be valued at approximately USD 1.30 billion in 2024, reflecting its dominant position. The United States and Canada represent the core contributors to regional growth, where snowmobiling is both a popular leisure activity and a functional means of transportation in snow-covered rural and mountainous areas.

The high concentration of snowmobile trails, frequent snow seasons, and robust presence of key industry players such as Polaris Inc., Arctic Cat, and BRP Inc. further strengthen the regional market dynamics. Additionally, the widespread popularity of winter tourism and snowmobile racing events in regions such as Quebec, Ontario, and northern U.S. states like Michigan, Minnesota, and Wisconsin supports consistent sales and aftermarket demand. Government investments in maintaining and expanding trail systems also contribute to sustained consumer interest and industry growth.

Recent Developments

- In 2023, Yamaha Motor Co., Ltd. shared its plan to gradually stop producing and selling snowmobiles. Sales in Japan were set to conclude with the 2022 models, while in Europe they would continue until 2024 models, and North American sales are expected to end after the 2025 models. This decision marks a major shift in Yamaha’s long-standing role in the snowmobile market.

- In 2023, Ontario’s government confirmed support to extend the snowmobile season in Northwestern Ontario. A grant of $76,823 was provided to the Sunset Trail Riders Snowmobile Club in Kenora. This funding is expected to improve the winter experience for snowmobile users and attract more visitors to the region, encouraging local tourism and economic activity.

- In 2024, Taiga Motors published its financial results for 2023. The company produced 243 Orca personal watercraft units in the last quarter. During the full year, 592 vehicles were sold, generating total revenue of $11.87 million—an increase from $2.4 million in the previous year. Fourth-quarter revenue stood at $4.5 million, supported by 242 unit sales, showing strong year-over-year growth.

- In 2024, Mountain Sports Distribution introduced a new booking opportunity for UTV Canada product dealers. The program allows dealers to access a range of UTV parts and accessories and is open until the end of October. This move aims to improve supply chain planning and offer early access to premium equipment.

- In 2025, Textron Inc. released its financial report for the last quarter of 2024. The company reported earnings of $0.76 per share from continuing operations, a decline from $1.01 per share in the same quarter of the previous year. When adjusted, the income stood at $1.34 per share, compared to $1.60 per share in Q4 of 2023, indicating a year-over-year decrease in adjusted profitability.

Conclusion

The global snowmobile market is projected to experience steady growth, driven by increasing participation in winter recreational activities, technological advancements, and expanding tourism in snow-prone regions. Manufacturers are focusing on developing cleaner, more efficient engines and enhancing comfort and design to meet evolving consumer preferences. Despite challenges such as environmental regulations and safety concerns, the market is expected to maintain a positive trajectory, with North America continuing to hold a significant share due to its established snowmobiling culture and infrastructure.