Table of Contents

Introduction

The Global Smart Washing Machine Market is projected to reach approximately USD 94.4 billion by 2034, up from USD 12.3 billion in 2024, reflecting a compound annual growth rate (CAGR) of 22.6% during the forecast period from 2025 to 2034.

A Smart Washing Machine is a next-generation home appliance equipped with advanced technology that allows users to control, monitor, and optimize their laundry processes remotely. These machines are integrated with Wi-Fi or Bluetooth connectivity, enabling them to be operated through mobile apps or voice assistants, such as Amazon Alexa or Google Assistant. Additionally, they often feature intelligent sensors that adjust wash cycles based on the load size, fabric type, and level of dirt, ensuring better performance and energy efficiency.

The Smart Washing Machine Market refers to the global market for these advanced laundry machines, which are increasingly being adopted due to their convenience, energy-saving features, and integration with smart home ecosystems. Growth in the Smart Washing Machine Market can be attributed to several factors, including the rising demand for smart home appliances, technological advancements in IoT (Internet of Things) and AI, and a growing consumer preference for convenience and energy-efficient solutions.

Additionally, increased disposable income and a shift toward premium, technologically enhanced household products are driving demand. Smart washing machines’ ability to reduce energy consumption and water wastage also appeals to environmentally conscious consumers. The market holds significant opportunities for innovation, particularly in enhancing user interfaces, improving energy efficiency, and integrating with other smart home systems.

Moreover, as connectivity improves and consumers become more accustomed to automated solutions, the adoption rate is expected to rise, providing further growth potential. Additionally, emerging economies offer lucrative opportunities due to increasing urbanization and the demand for modern home appliances.

Key Takeaways

- The global smart washing machine market is anticipated to reach USD 94.4 billion by 2034, with a compound annual growth rate (CAGR) of 22.6%.

- In 2024, front-load washing machines account for the largest market share, holding 55.1%, primarily due to their energy efficiency, advanced features, and superior cleaning performance.

- The 6-10 kg capacity segment leads the market in 2024, driven by its versatility, making it ideal for medium-sized households.

- The residential sector is the primary market driver in 2024, supported by the growing consumer preference for home automation and smart, connected devices.

- Asia Pacific is the dominant regional market, holding 46% of the total market share in 2024, valued at USD 5.6 billion. This growth is attributed to the increasing adoption of smart home technologies and economic expansion in countries such as China, India, and Japan.

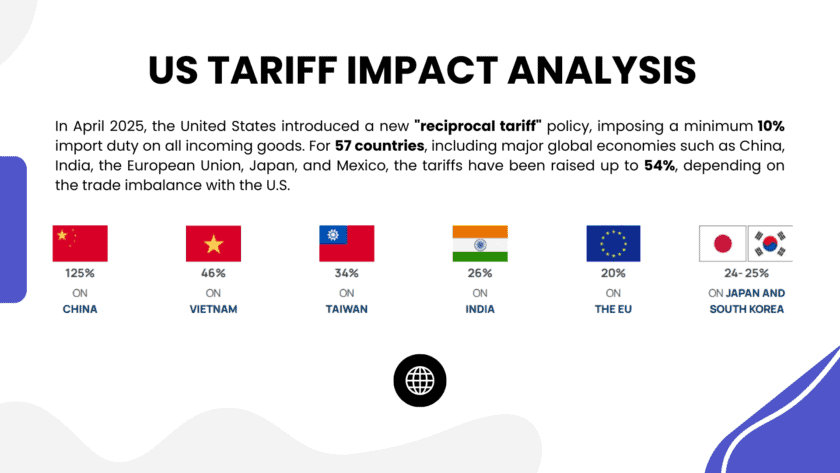

Impact of U.S. Tariffs on the Smart Washing Machine Market

The imposition of U.S. tariffs on washing machines has had multifaceted effects on the smart washing machine market, influencing both domestic manufacturing and consumer pricing.

Domestic Manufacturing and Investment

The 2018 tariffs, ranging from 20% to 50% on large residential washing machines, prompted significant shifts in manufacturing strategies. Notably, companies such as LG and Samsung established production facilities within the United States, leading to the creation of over 2,000 jobs and enhancing the competitiveness of the domestic washer industry . This phenomenon, often referred to as “tariff-jumping investment,” indicates that tariffs can effectively incentivize foreign manufacturers to localize production.

Consumer Pricing and Market Dynamics

In the immediate aftermath of the tariffs, there was a notable increase in appliance prices. A 2020 study reported a 12% rise in washer prices, with dryers—though not directly subjected to tariffs—experiencing similar price hikes. This suggests that tariffs can have broader inflationary effects beyond the targeted products. However, over time, washing machine prices stabilized and even fell below pre-tariff levels, indicating that the initial price surges were not sustained.

Impact on Smart Washing Machines

Smart washing machines, characterized by their advanced features and integration with home networks, are particularly sensitive to tariff-induced cost fluctuations. The tariffs led to increased production costs, which were partially passed on to consumers. Additionally, the broader economic environment influenced by tariffs, including potential inflationary pressures, may have affected consumer purchasing power and demand for high-end appliances

Emerging Trends

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): Manufacturers are embedding AI and ML algorithms into smart washing machines to optimize washing cycles, detect fabric types, and adjust water and detergent usage accordingly. This technology enhances washing efficiency and fabric care.

- Enhanced Connectivity Features: Smart washing machines are increasingly compatible with voice assistants and can be integrated into broader smart home ecosystems. This allows users to control and monitor their appliances remotely, providing greater convenience.

- Sensor-Based Technologies: The adoption of sensors to detect load size, fabric types, and water hardness levels is on the rise. These sensors enable machines to adjust settings automatically, ensuring optimal washing performance and resource efficiency.

- Focus on Energy Efficiency and Sustainability: There is a growing emphasis on developing energy-efficient washing machines that consume less water and electricity. This trend aligns with global sustainability goals and consumer demand for eco-friendly products.

- Development of Mobile Applications: Manufacturers are creating mobile applications that allow users to control washing machines remotely, receive maintenance alerts, and customize washing programs, thereby enhancing user experience.

Top Use Cases

- Urban Residential Areas: In densely populated urban centers, smart washing machines are favored for their space-saving designs and advanced features, catering to the needs of tech-savvy consumers.

- Commercial Laundry Services: Businesses such as hotels and laundromats utilize smart washing machines for their efficiency, durability, and ability to handle large volumes of laundry, ensuring consistent service quality.

- Eco-Conscious Households: Families aiming to reduce their environmental footprint adopt energy-efficient smart washing machines that minimize water and electricity consumption.

- Tech-Integrated Homes: Smart washing machines are integrated into homes equipped with other smart devices, allowing for seamless control and automation of household tasks.

- Remote Monitoring for Elderly Care: Smart washing machines with remote monitoring capabilities assist caregivers in managing laundry tasks for elderly individuals, ensuring their well-being and independence.

Major Challenges

- High Initial Cost: The advanced technology and features of smart washing machines contribute to their higher purchase price, which may deter budget-conscious consumers.

- Dependence on Stable Internet Connectivity: Smart washing machines require a reliable internet connection for optimal performance, which can be a limitation in areas with poor connectivity.

- Cybersecurity Concerns: As IoT-enabled devices, smart washing machines are susceptible to cyber threats, necessitating robust security measures to protect user data and privacy.

- Complexity in Operation: The multitude of features and settings in smart washing machines can overwhelm users who are not technologically inclined, leading to underutilization of the appliance’s capabilities.

- Maintenance and Repair Issues: The sophisticated technology in smart washing machines may complicate maintenance and repair processes, requiring specialized knowledge and potentially leading to higher service costs.

Top Opportunities

- Expansion into Emerging Markets: There is significant potential for growth in developing regions where urbanization and disposable income are increasing, leading to higher demand for advanced household appliances.

- Collaboration with Smart Home Ecosystem Providers: Partnerships with companies specializing in smart home technologies can enhance the interoperability of smart washing machines, offering consumers a more integrated home automation experience.

- Integration of AI and ML Technologies: Incorporating AI and ML into washing machines can lead to more personalized and efficient washing cycles, improving user satisfaction and appliance performance.

- Development of Energy-Efficient Models: Designing washing machines that consume less energy and water can attract environmentally conscious consumers and comply with global sustainability standards.

- Advancements in Mobile Application Features: Enhancing mobile applications to offer more functionalities, such as predictive maintenance alerts and advanced troubleshooting, can improve user engagement and satisfaction.

Key Player Analysis

In the global Smart Washing Machine Market, major players are strategically investing in innovative technologies to enhance consumer convenience and drive growth. Samsung Group and LG Electronics Inc. remain dominant, offering smart appliances with advanced connectivity features, such as Wi-Fi and app-based controls. These companies leverage their extensive R&D capabilities to integrate AI and IoT, improving energy efficiency and performance.

Siemens AG and Haier Group Corporation also capitalize on automation and smart features, focusing on ease of use and sustainability. Miele and Cie KG targets the premium segment with high-end, durable appliances, while AB Electrolux emphasizes energy-efficient models. TCL Corporation and Panasonic Corporation are enhancing product lines with smart technologies to attract cost-conscious consumers. Emerging brands like GIRABU and IFB Appliances continue to gain market share in regional markets by offering affordable smart solutions. Whirlpool Corporation and Bosch GmbH are also key players, combining innovation with reliable performance.

Key Players in the Market

- Samsung Group

- LG Electronics Inc.

- Siemens AG

- Haier Group Corporation

- TCL Corporation

- Miele and Cie KG

- AB Electrolux

- Techtronic Industries

- Panasonic Corporation

- Whirlpool Corporation

- GIRABU

- IFB Appliances

- Motorola Mobility LLC

- Robert Bosch GmbH

- GE Appliances

- Fisher and Paykel Industries Ltd.

- Indesit Co. S.p.A.

- Toshiba

Regional Analysis

Asia Pacific – Dominating Region in Smart Washing Machine Market with Largest Market Share of 46%

The Asia Pacific region holds a commanding position in the global Smart Washing Machine Market, accounting for 46% of the total market share in 2024. With a market value of USD 5.6 billion, this region is projected to maintain its dominance due to a combination of rapid technological advancements, a growing middle-class population, and increasing disposable incomes. The demand for smart home appliances, including washing machines with AI and IoT integration, has been rising steadily in countries like China, India, and Japan. These nations are experiencing a surge in urbanization and a strong shift towards automation, further driving the market growth. Moreover, Asia Pacific is home to major manufacturing hubs and key players in the industry, making it a vital region for the smart washing machine market.

The U.S. tariffs on certain electronics and appliances have had a significant impact on the import-export dynamics within the Asia Pacific region. As the U.S. is one of the largest consumers of smart home appliances, the tariffs could result in a rise in production costs, potentially leading to increased prices for consumers. This might affect the growth trajectory of the market, particularly in regions dependent on exports from Asia Pacific. Nonetheless, the region’s strategic investments in technology innovation and expansion of retail channels will likely sustain its dominant market position in the coming years.

Recent Developments

- In 2024, Electrolux introduced a new smart laundry series focused on saving water and energy while helping clothes last longer. These machines are designed to be easy to use, with features that adjust settings automatically for better care and less impact on the environment. The new models range from the 600 to 900 series in washing machines, washer dryers, and tumble dryers. The goal is to reduce waste and carbon footprint by extending the life of garments with smarter fabric care.

- In 2024, Whirlpool Corporation completed a key phase in its business transformation by finalizing a major deal with Arçelik A.Ş. This deal combined Whirlpool’s European appliance business with Arçelik’s appliance and electronics units to form a new company called Beko Europe B.V. Whirlpool now owns 25% of this new company, while Arçelik holds the remaining 75%. Whirlpool also kept control of InSinkErator and its EMEA KitchenAid appliance business, and separately completed the sale of its Middle East and Africa business to Arçelik.

- In 2024, Samsung launched ten large-capacity AI-powered washing machines specially designed for the Indian market. These new front-load machines come with smart features that simplify laundry by learning user preferences and adjusting settings for better wash quality. With this launch, Samsung aims to make everyday laundry more efficient and convenient for Indian households.

Conclusion

The global smart washing machine market is poised for substantial growth, driven by increasing urbanization, rising disposable incomes, and the growing adoption of smart home technologies. Consumers are increasingly favoring appliances that offer convenience, energy efficiency, and integration with IoT ecosystems. Technological advancements, such as AI and machine learning, are enhancing the functionality and user experience of smart washing machines. However, challenges like high initial costs, dependence on stable internet connectivity, and cybersecurity concerns may hinder market expansion. Despite these obstacles, the market presents significant opportunities, particularly in emerging economies where demand for modern, connected appliances is on the rise. Manufacturers focusing on innovation, sustainability, and user-friendly interfaces are likely to gain a competitive edge in this evolving landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)