Table of Contents

Overview

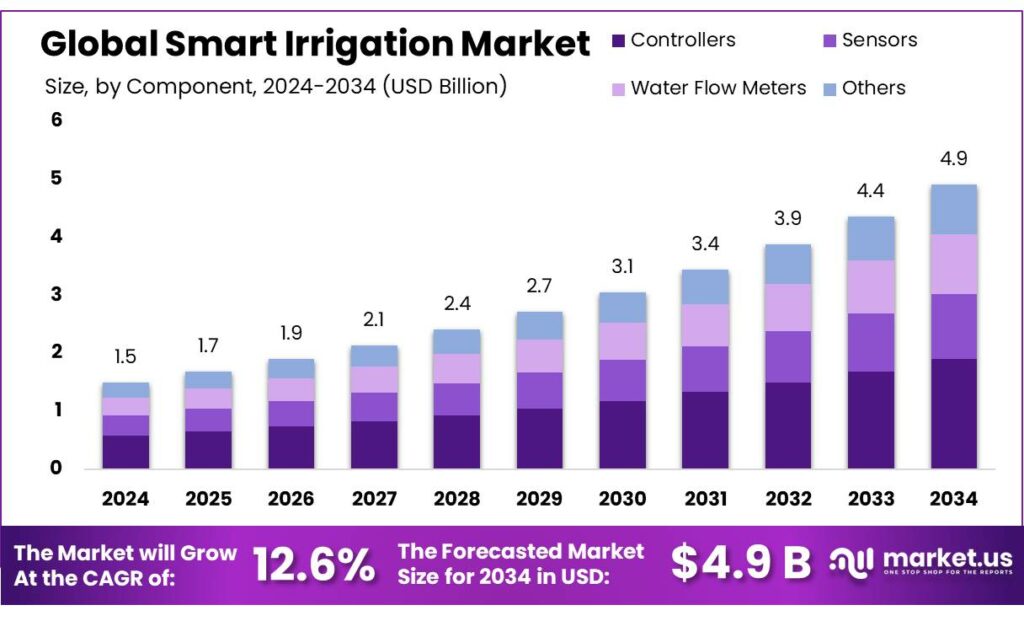

New York, NY – October 01, 2025 – The Global Smart Irrigation Market is projected to grow from USD 1.5 billion in 2024 to nearly USD 4.9 billion by 2034, advancing at a CAGR of 12.6% during 2025–2034. In 2024, North America led the market, holding over 37.8% share with revenues of about USD 0.5 billion.

In India, smart irrigation is becoming a vital tool to tackle pressing agricultural challenges such as water scarcity, unpredictable monsoon patterns, and the need for sustainable farming. Recognizing this, the government has introduced multiple initiatives to promote advanced irrigation practices. One of the key programs is the National Mission on Micro Irrigation (NMMI), which encourages the adoption of drip irrigation systems.

To strengthen these efforts, the government set up the Micro Irrigation Fund (MIF) with a budget of INR 5,000 crore, aiming to expand micro-irrigation coverage. Currently, only 10 million hectares are under such systems, against a potential of 70 million hectares, highlighting vast growth opportunities. Several state governments have also launched targeted initiatives. Uttar Pradesh’s ‘Khet Talab Yojana’ has successfully built 37,403 farm ponds since 2017–18.

These ponds, supported by subsidies, have enhanced farmers’ access to irrigation and boosted water conservation across rural areas. Technological innovation is another driving force in India’s smart irrigation growth. Solutions like Nano Ganesh, which enable farmers to remotely operate irrigation pumps using mobile phones, are helping reduce labor costs while ensuring timely and efficient water use.

Key Takeaways

- The Global Smart Irrigation Market size is expected to be worth around USD 4.9 billion by 2034, from USD 1.5 billion in 2024, growing at a CAGR of 12.6%.

- Controllers dominated the smart irrigation market, capturing more than a 38.6% share.

- Weather-based controller systems held a dominant position in the smart irrigation market, capturing more than a 59.1% share.

- Large and small enterprises collectively held a dominant position in the smart irrigation market, capturing more than a 69.8% share.

- The agricultural sector dominated the smart irrigation market, capturing more than a 64.2% share.

- North America held a dominant position in the global smart irrigation market, capturing a 37.8% share, valued at approximately USD 0.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/smart-irrigation-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 1.9 Billion |

| CAGR (2025-2034) | 12.6% |

| Segments Covered | By Component (Controllers, Sensors, Water Flow Meters, Others), By Type (Weather-Based Controller Systems, Sensor-Based Controller Systems), By Type of Enterprise (Large and Small, Medium Enterprise), By Application (Agricultural, Greenhouse, Open Field, Non Agricultural, Residential, Turf and Landscape, Golf Courses, Others) |

| Competitive Landscape | The Toro Company, Rain Bird Corporation, HUNTER INDUSTRIES INC., NETAFIM, HydroPoint, Manna Irrigation Ltd., Stevens Water Monitoring Systems Inc., Galcon, Rachio Inc., Weathermatic |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157502

Key Market Segments

Component Analysis

In 2024, controllers led the smart irrigation market, securing a 38.6% share. Their dominance stems from their critical role in automating irrigation, boosting water efficiency, and cutting labor costs. Weather-based and sensor-based controllers, in particular, are widely used in agricultural and non-agricultural settings, adjusting watering schedules with real-time data to support global sustainability efforts.

Type Analysis

Weather-based controller systems commanded a 59.1% share of the smart irrigation market in 2024. Their popularity is driven by their use of real-time weather data such as temperature, humidity, and rainfall, to optimize irrigation schedules. This ensures efficient water use, making them a top choice for residential and commercial applications.

Enterprise Type Analysis

In 2024, large and small enterprises together accounted for a 69.8% share of the smart irrigation market. This reflects widespread adoption across agriculture, landscaping, and municipal sectors. The integration of IoT, AI, and sensor-based technologies has enabled businesses of all sizes to enhance water efficiency, lower costs, and improve operational performance.

Application Analysis

The agricultural sector led the smart irrigation market in 2024 with a 64.2% share. This dominance highlights the growing use of smart irrigation technologies in farming to optimize water use, increase crop yields, and promote sustainable practices globally.

Regional Analysis

North America led the global smart irrigation market, securing a 37.8% share valued at around USD 0.5 billion, with the United States driving much of this dominance. The region’s leadership is fueled by rising water scarcity, strict environmental regulations, and a focus on sustainable agriculture.

Technological advancements significantly contribute to market growth. IoT sensors, weather-based controllers, and data analytics enable precise water management, minimizing waste and boosting crop yields. Additionally, the increasing popularity of smart homes and urban landscaping further boosts demand for smart irrigation systems in residential and commercial settings.

Top Use Cases

- Agriculture Optimization: Smart irrigation systems help farmers by using soil sensors and weather data to deliver just the right amount of water to crops. This setup cuts down on overwatering, boosts plant health, and raises yields without extra effort. Farmers save time and resources while keeping fields green and productive year-round, making farming smarter and more reliable.

- Residential Lawn Care: Homeowners use smart controllers linked to apps to water lawns based on local rain forecasts and soil dryness. These systems skip watering during wet weather, saving effort and keeping grass lush with minimal waste. It’s an easy way to maintain a beautiful yard while being kind to the planet and utility bills.

- Commercial Landscaping: Golf courses and parks rely on smart irrigation to manage large green areas efficiently. Sensors track moisture levels across zones, adjusting sprays to fit sunny spots or shaded ones. This keeps landscapes tidy, reduces manual checks, and ensures every inch stays vibrant without flooding or dry patches.

- Greenhouse Management: In greenhouses, automated systems monitor humidity, temperature, and plant needs to drip water precisely where required. Growers get alerts on their phones for tweaks, ensuring delicate plants thrive in controlled spaces. It simplifies daily tasks and helps produce high-quality veggies or flowers with steady results.

- Urban Greening Initiatives: Cities use smart setups for public gardens and rooftops, integrating IoT to water based on city weather apps and usage patterns. This keeps urban spaces fresh amid busy schedules, cuts city water bills, and promotes green living. It’s a simple tool for sustainable city vibes that everyone enjoys.

Recent Developments

1. The Toro Company

The Toro Company is advancing its smart irrigation ecosystem with the Precision Soil Sensor, which provides real-time soil moisture data to its Lynx smart irrigation controllers. This closed-loop system allows for watering based on actual plant needs, significantly improving water efficiency. Their focus is on integrating these sensors and weather data to create a fully autonomous, site-specific irrigation system for both golf and residential markets.

2. Rain Bird Corporation

Rain Bird continues to expand its IoT offerings with the ST8-2.0 Smart Timer and the Cloud-Connected Base Station. Recent developments emphasize the Rain Bird Mobile App, which now offers more intuitive scheduling, water-use reports, and smart watering based on integrated weather data. They are focused on making professional-grade smart water management accessible to homeowners and strengthening their cloud-based control platform for larger landscapes.

3. HUNTER INDUSTRIES INC.

Hunter Industries has significantly upgraded its cloud-based platform, Hydrawise. Recent developments include the new HC-1200e Hydrawise Controller and a partnership with Google’s Nest Renew program, offering “Water Shift” features to optimize irrigation schedules for energy grid cleanliness and cost savings. Their focus is on making smart irrigation a tool for both water conservation and broader environmental sustainability.

4. NETAFIM

Netafim is pioneering digital farming with its NetaSense platform, which integrates sensors, crop-modeling algorithms, and cloud-based data analysis. A key recent development is the expansion of their precision irrigation-as-a-service model, providing growers with actionable insights rather than just hardware. This approach allows farmers to make data-driven decisions to optimize water, fertilizer, and crop yield simultaneously, pushing the boundaries of precision agriculture.

5. HydroPoint

HydroPoint, the maker of WeatherTRAK, is leveraging its big data platform to enhance predictive irrigation. A major recent development is their partnership with the University of California, Division of Agriculture and Natural Resources, to validate and improve their evapotranspiration (ET) models. This collaboration aims to further refine their water-saving algorithms and provide customers with even more accurate irrigation schedules based on hyper-local climate conditions.

Conclusion

Smart Irrigation Emerges as a game-changer for water-wise living and farming. These systems blend simple tech like sensors and apps to make watering effortless, cutting waste while keeping plants happy. With growing interest in sustainability, they’re becoming a must-have for homes, farms, and cities alike, promising greener futures without the hassle.