Table of Contents

Overview

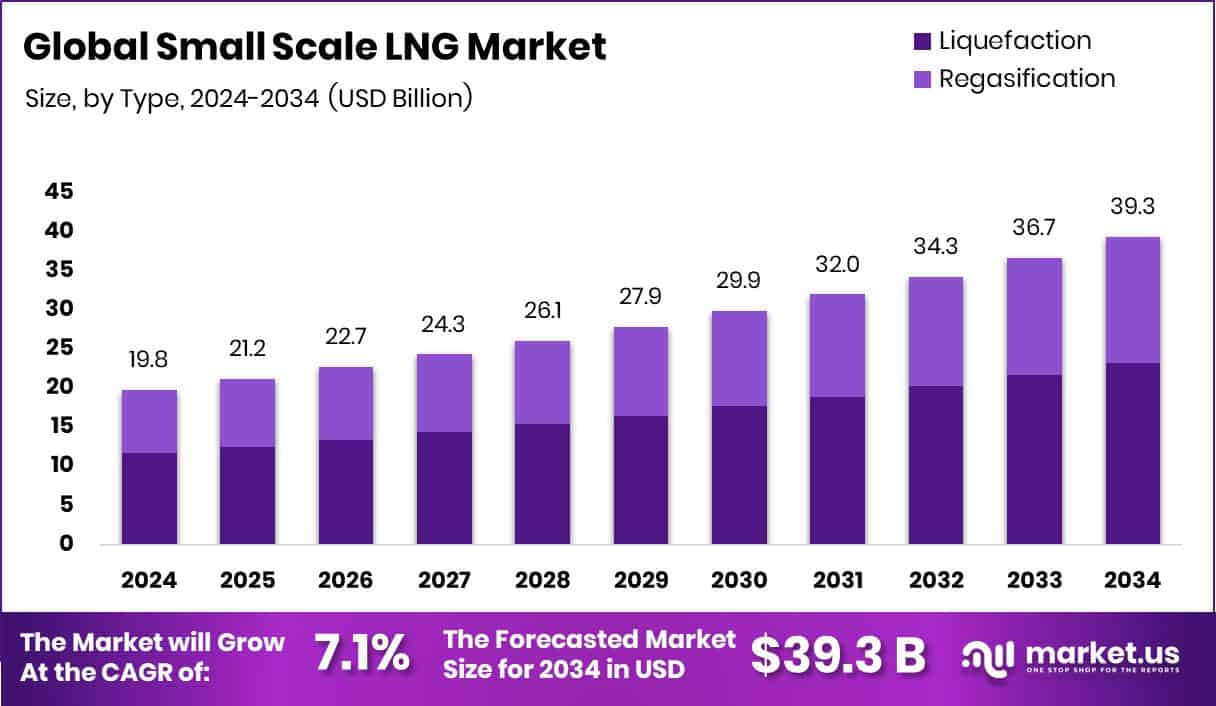

New York, NY – Nov 26, 2025 – The global small-scale LNG market is on a clear growth path, expected to rise from USD 19.8 billion in 2024 to USD 39.3 billion by 2034, growing at a steady pace of 7.1% CAGR between 2025 and 2034. Asia-Pacific leads this expansion with a 43.90% share, driven by rising energy demand and wider adoption of small-scale LNG across transport, power, and industrial uses.

Small-scale LNG covers localized liquefaction, storage, and distribution of LNG in lower volumes compared to large export terminals. It is especially useful for regions without pipeline access, offering a cleaner and more flexible alternative to diesel and heavy fuel oil. Compact plants, micro-liquefaction units, satellite storage, and distribution through trucks or small vessels make deployment faster and more cost-effective.

Investment momentum is strengthening this market. Large-scale commitments such as NextDecade’s USD 1.8 billion financing for the Rio Grande LNG project reflect strong confidence in future gas infrastructure, which indirectly boosts small-scale LNG networks. Similarly, Canada’s USD 49 million investment in hydrogen liquefaction highlights parallel growth in clean gas technologies that support LNG ecosystems.

The market is also benefiting from renewable gas integration. SUBLIME Energie’s €11.5 million funding for biogas liquefaction shows how low-carbon molecules are blending into small-scale LNG supply chains. In addition, a federal commitment of up to USD 200 million to support LNG exports to Asia strengthens trade routes, creating new opportunities for micro-LNG hubs and regional feeder terminals.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-small-scale-lng-market/request-sample/

Key Takeaways

- The Global Small Scale LNG Market is expected to be worth around USD 39.3 billion by 2034, up from USD 19.8 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- Small-scale LNG market sees strong momentum as liquefaction technologies capture 59.2% share today.

- Trucks dominate the small-scale LNG market supply modes, securing a significant 57.6% global share.

- Heavy-duty vehicles drive substantial fuel demand, holding 39.1% in the small-scale LNG market.

- The Asia-Pacific’s maintained strong LNG demand, supporting stable growth toward USD 8.6 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165842

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 19.8 Billion |

| Forecast Revenue (2034) | USD 39.3 Billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Type (Liquefaction, Regasification), By Mode of Supply (Trucks, Trans-shipment and Bunkering, Others), By Application (Heavy-duty Vehicles, Marine Transport, Industrial and Power, Others) |

| Competitive Landscape | LINDE PLC, WÄRTSILÄ CORPORATION, HONEYWELL INTERNATIONAL INC., ENGIE SA, SHELL PLC, GASUM OY, CHART INDUSTRIES, INC., TOTALENERGIES, EXCELERATE ENERGY, INC., SOFREGAZ |

Key Market Segments

By Type Analysis

In 2024, Liquefaction clearly led the By Type segment of the small-scale LNG market, holding a strong 59.2% share. This dominance reflects the growing need for flexible and decentralised LNG production systems that can serve regions lacking pipeline access. Liquefaction equipment enables natural gas to be converted into a compact, transportable form, making it practical for use in remote industrial sites, off-grid power generation, and small-scale transportation networks.

The segment benefited from increasing focus on cleaner fuel adoption, where small and modular LNG plants offer faster deployment and lower capital requirements than large-scale facilities. Rising investment activity across LNG and low-carbon fuel projects further strengthened liquefaction infrastructure, enhancing both upstream gas processing and midstream distribution capabilities.

As interest in micro-LNG and distributed energy solutions continued to grow, liquefaction remained the backbone of small-scale LNG supply chains in 2024. Its ability to support reliable fuel availability and regional energy flexibility positioned the segment as a key driver of overall market growth.

By Mode of Supply Analysis

In 2024, trucks dominated the By Mode of Supply segment of the Small-Scale LNG Market, capturing a 57.6% share. This leadership highlights their importance as the most adaptable and widely used delivery method for regions without pipeline connectivity. Truck-based LNG transport allows consistent fuel supply to remote industries, small power plants, and LNG-fueled vehicle fleets, supporting decentralized energy use.

The strength of this mode comes from its operational flexibility. LNG trucks are easy to deploy, can reach diverse locations, and require far less upfront infrastructure compared to fixed pipelines or marine transport. These advantages make them especially suitable for emerging markets and off-grid energy projects where demand locations may shift or scale over time.

As adoption of small-scale LNG continued to expand in 2024, trucks remained the key solution for last-mile delivery. Their ability to move LNG efficiently from liquefaction sites to end users reinforced their central role in keeping localised LNG supply chains active and reliable.

By Application Analysis

In 2024, heavy-duty vehicles led the by-application segment of the small-scale LNG Market, holding a 39.1% share. This dominance was driven by the transport sector’s shift toward cleaner and more economical fuel options. LNG gained strong traction among fleet operators aiming to lower emissions, reduce reliance on diesel, and comply with stricter environmental regulations.

Heavy trucks and long-haul commercial vehicles increasingly adopted LNG-powered engines due to their ability to deliver longer driving ranges and maintain consistent performance. Small-scale LNG networks ensured dependable fuel availability along regional freight routes, supporting smoother operations for large transport fleets.

The segment’s leadership also reflects strong interest from logistics companies and industrial transport users that require high-capacity and reliable fuel solutions. As LNG adoption expanded across major transport corridors in 2024, heavy-duty vehicles remained the primary demand driver, reinforcing their position as the largest application area within the small-scale LNG market.

Regional Analysis

In 2024, Asia-Pacific dominated the Small-Scale LNG Market with a 43.90% share, reaching a value of USD 8.6 Bn. This strong position was supported by rising energy consumption, expanding industrial activity, and growing LNG use in transportation and remote power generation. The region benefited from the wider deployment of small liquefaction units and flexible supply systems designed to serve diverse users across developing economies.

North America followed with stable growth, driven by higher adoption of cleaner fuels and increased use of truck-based LNG distribution for industrial sites located far from pipelines. Europe recorded steady progress as countries accelerated the shift toward lower-emission fuels for heavy-duty transport and small-scale marine applications.

The Middle East & Africa showed growing potential, with LNG increasingly used in remote industrial facilities and isolated power networks. Latin America continued expanding small-scale LNG infrastructure to support transport corridors and localised energy demand, slowly strengthening its market presence.

Top Use Cases

- Remote / Off-grid Power Generation: Small-scale LNG plants can supply natural gas to power generators in locations not connected to pipelines. This allows remote communities, islands or isolated industrial sites to get clean electricity or heat without needing large infrastructure networks.

- Industrial Heating, Steam & Process Energy: Industries located far from city gas or pipeline networks can use SSLNG for their heating, steam generation or other thermal needs. This is often more economical and cleaner than oil or coal-fired boilers, especially in off-grid or under-served regions.

- Fuel for Heavy-Duty Trucks & Road Transport Fleets: SSLNG enables LNG to be used as a transport fuel for long-haul trucks and commercial road fleets — offering a lower-emission alternative to diesel, especially where pipeline gas or CNG is unavailable.

- Marine Fuel / Ship Bunkering: Small-scale LNG provides bunkering (fuel supply) for ships, especially coastal vessels, ferries, or short-sea carriers. This helps maritime operators meet stricter environmental and sulphur-emission regulations.

- Virtual Pipelines” to Supply Gas to Low-Demand Regions: Instead of building expensive physical pipelines, SSLNG uses modular liquefaction, storage, trucking or small carriers to deliver LNG. This “virtual pipeline” concept makes gas supply feasible for remote, low-demand or sparsely populated regions.

- Transitional Cleaner-Fuel Alternative to Coal or Oil: For power or heat generation in places dependent on coal or heavy fuel oil, SSLNG offers a cleaner alternative — creating lower CO₂, sulfur and particulate emissions, thus helping reduce environmental pollution and support energy transition.

Recent Developments

- In February 2025, Linde announced that during 2024 it had secured 59 new long-term “small on-site” agreements, resulting in plans to build, own and operate 64 small plants at customer locations worldwide.

- In December 2024, Wärtsilä Gas Solutions won a contract to supply the cargo-handling and fuel-gas supply systems for a new 12,500 cbm LNG bunkering vessel being built for the global energy firm Vitol at the Nantong CIMC Sinopacific Offshore & Engineering yard in China. This deal was officially booked in Q4 2024.

- In July 2024, Honeywell agreed to acquire Air Products’ LNG process-technology and equipment business for US$1.81 billion.

Conclusion

The small-scale LNG market is becoming an important part of the global energy transition. It offers a practical way to deliver cleaner fuel to areas that lack pipeline access, supporting industries, transport fleets, marine users, and remote power generation.

Its flexibility, faster deployment, and lower infrastructure needs make it suitable for emerging regions and localised energy demand. As more countries and companies focus on reducing emissions and replacing diesel or heavy fuel oil, small-scale LNG provides a reliable bridge solution.

Continuous investments in liquefaction units, storage, and distribution networks are strengthening supply chains. Overall, small-scale LNG is well positioned to support energy security, cleaner operations, and gradual decarbonization across multiple end-use sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)