Table of Contents

Overview

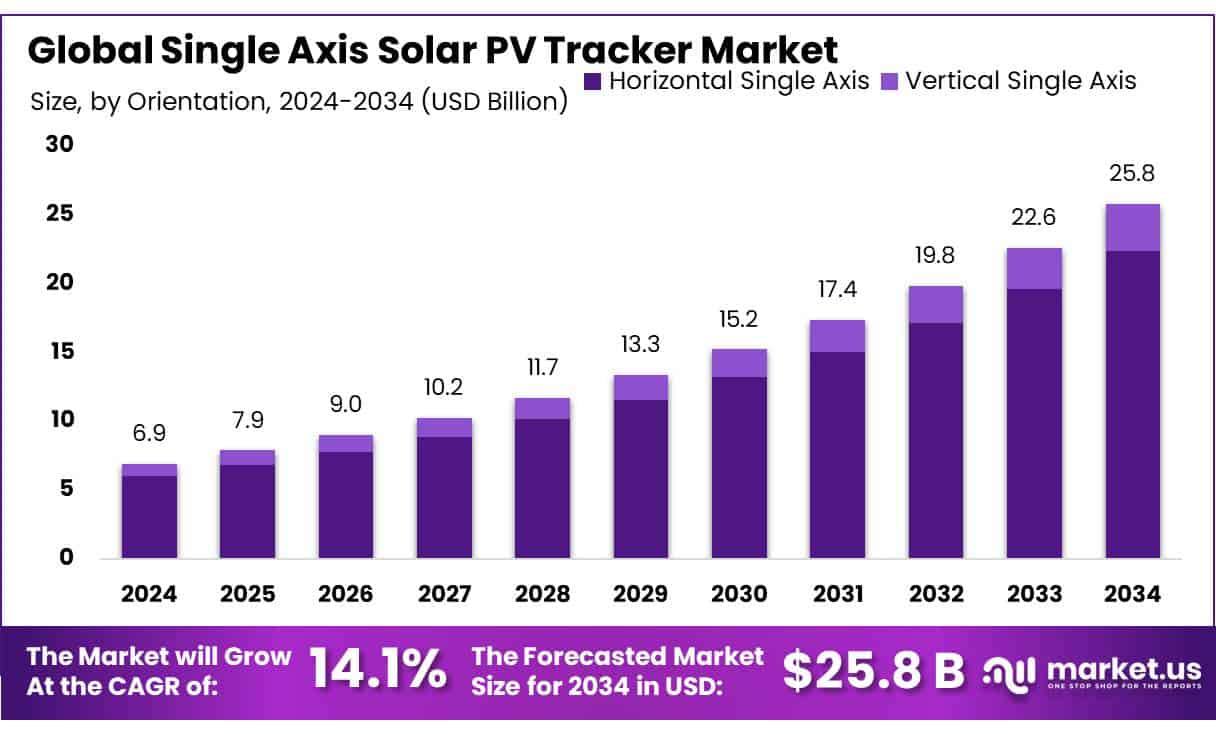

New York, NY – May 16, 2025 – The global Single Axis Solar PV Tracker Market is experiencing rapid growth, driven by increasing demand for clean energy solutions and the need for higher solar efficiency. In 2024, the market was valued at USD 6.9 billion and is projected to reach USD 25.8 billion by 2034, growing at a strong CAGR of 14.1%.

Horizontal Single Axis trackers led with an 86.7% market share in 2024, fueled by their widespread use in utility-scale solar projects. Monocrystalline Panels held a 53.8% share in 2024, driven by superior efficiency, durability, and space optimization in large-scale solar projects.

Hybrid Trackers captured a 54.1% share in 2024, favored for combining active and passive tracking benefits. Utility-scale projects led with a 72.6% share in 2024, driven by extensive use in large solar farms. Single-axis trackers maximize energy generation by tracking the sun, ideal for operators managing expansive sites.

US Tariff Impact on Market

President Trump’s new tariffs, ranging from 10% to 49% on electrical components, battery storage, and equipment from China, Southeast Asia, and Europe, threaten the US renewable energy sector. These tariffs could raise costs, disrupt supply chains, and hinder industry growth, undermining US clean energy goals.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/single-axis-solar-pv-tracker-market/request-sample/

Industry leaders warn that higher costs may increase electricity bills. Battery storage, essential for renewable energy, faces significant risks, with over 90% of US lithium-ion storage cells imported from China in 2024. Despite efforts to expand domestic production, US capacity remains inadequate. Chinese storage cell imports now face an additional 34% tariff, on top of the previous 20% from Trump’s earlier policies.

Key Takeaways

- Single Axis Solar PV Tracker Market size is expected to be worth around USD 25.8 billion by 2034, from USD 6.9 billion in 2024, growing at a CAGR of 14.1%.

- Horizontal Single Axis held a dominant market position, capturing more than an 86.7% share.

- Monocrystalline Panels held a dominant market position, capturing more than a 53.8% share.

- Hybrid Trackers held a dominant market position, capturing more than a 54.1% share.

- Electric Drive held a dominant market position, capturing more than a 67.3% share.

- Utility-Scale held a dominant market position, capturing more than a 72.6% share.

- Asia Pacific (APAC) region stands as the dominant player in the global single-axis solar photovoltaic (PV) tracker market, commanding a substantial share of approximately 46.1%, equating to an estimated market value of USD 3.1 billion in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147378

Report Scope

| Market Value (2024) | USD 6.9 Billion |

| Forecast Revenue (2034) | USD 25.8 Billion |

| CAGR (2025-2034) | 14.1% |

| Segments Covered | By Orientation (Horizontal Single Axis, Vertical Single Axis), By Panel Type (Monocrystalline Panels, Polycrystalline Panels, Thin-Film Panels), By Tracker Type (Fixed-tilt Trackers, Tilt-only Trackers, Hybrid Trackers), By Mechanism (Mechanical Drive, Electric Drive, Hydraulic Drive), By Application (Utility-Scale, Commercial and Industrial, Residential) |

| Competitive Landscape | Arctech Solar, Array Technologies, Canadian Solar, Valmont Industries, Inc., DEGERenergie, First Solar, Fronius International, Hanwha Group, JA Solar, JinkoSolar, Kyocera Corporation, Nextracker, PV Hardware, Soltec Power Holdings, SunPower Corporation, Trina Solar |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147378

Key Market Segments

By Orientation

- Horizontal Single Axis trackers led with an 86.7% market share in 2024, fueled by their widespread use in utility-scale solar projects. Their dominance stems from suitability for large-scale installations and the ability to boost energy yield with low mechanical complexity. Ideal for sun-rich regions like India, the U.S., and Australia, these systems enhance power generation through east-to-west tracking.

By Panel Type

- Monocrystalline Panels held a 53.8% share in 2024, driven by superior efficiency, durability, and space optimization in large-scale solar projects. Their compatibility with single-axis trackers maximizes energy output per area, making them a top choice for developers seeking higher returns on land and infrastructure.

By Tracker Type

- Hybrid Trackers captured a 54.1% share in 2024, favored for combining active and passive tracking benefits. Offering flexibility, efficiency, and responsiveness, they optimize panel orientation in varying weather, ensuring reliable power output. Particularly effective in regions with inconsistent sunlight, hybrid trackers balance cost and performance, supporting smarter grid integration.

By Mechanism

- Electric Drive systems dominated with a 67.3% share in 2024, valued for precision, reliability, and low maintenance. Using motors and controllers, they align panels accurately with the sun’s path, boosting energy yield in utility-scale farms. Their versatility across terrains and climates makes them a developer favorite.

By Application

- Utility-scale projects led with a 72.6% share in 2024, driven by extensive use in large solar farms. Single-axis trackers maximize energy generation by tracking the sun, ideal for operators managing expansive sites. Supported by global policy incentives and tenders, utility-scale applications benefit from high-efficiency systems to optimize returns.

Regional Analysis

- The Asia Pacific (APAC) region dominates the global single-axis solar photovoltaic (PV) tracker market, holding a 46.1% share, valued at approximately USD 3.1 billion in 2024. This leadership is driven by supportive government policies, technological innovation, and growing investments in renewable energy infrastructure.

- A key trend in APAC is the adoption of bifacial solar modules paired with single-axis trackers, which boost energy yield by capturing sunlight on both panel sides. Advances in materials and tracking algorithms further enhance system efficiency and cost-effectiveness.

Top Use Cases

- Utility-Scale Solar Farms: Single-axis trackers are widely used in large solar farms to boost energy output. They follow the sun’s east-to-west path, optimizing sunlight capture. Ideal for flat terrains, they maximize land use and improve returns, making them a top choice for utility-scale projects globally.

- Commercial Solar Installations: Businesses use single-axis trackers to enhance solar panel efficiency on commercial rooftops or ground mounts. The trackers increase energy yield, reducing electricity costs. Their simple design lowers maintenance needs, offering cost-effective solutions for industries aiming for sustainability and lower operational expenses.

- Agri-Photovoltaic Projects: Single-axis trackers support dual land use by combining solar energy with farming. They adjust panel angles to allow sunlight for crops below, boosting farm productivity. This setup is gaining traction in regions like Europe, where land scarcity drives innovative solar-agriculture integration.

- Solar-Plus-Storage Integration: Single-axis trackers pair with battery storage to store excess energy generated during peak sunlight hours. This setup ensures a consistent power supply, especially for utilities or businesses, enhancing grid reliability and supporting the growing demand for renewable energy storage solutions.

- Residential Solar Enhancements: Homeowners in sun-rich regions use single-axis trackers to increase rooftop or ground-mounted solar panel output. Though less common due to higher costs, they appeal to eco-conscious households seeking maximum energy savings and faster payback periods in high-irradiance areas.

Recent Developments

1. Arctech Solar

- Arctech Solar, a leading solar tracking solutions provider, recently launched its SkyLine II single-axis tracker, designed for rugged terrains and high wind resistance. The company expanded its global footprint with new projects in Latin America and the Middle East, enhancing energy output compared to fixed-tilt systems.

2. Array Technologies

- Array Technologies introduced its DuraTrack HZ v3 single-axis tracker, featuring advanced machine learning for real-time sun positioning. The company secured a supply deal in the U.S. and expanded production capacity to meet rising demand. Array also emphasized sustainability, reducing steel usage in new tracker models.

3. Canadian Solar

- Canadian Solar enhanced its Horizon L1 single-axis tracker, optimizing it for bifacial solar panels to increase energy yield. The company announced multiple utility-scale projects in Brazil and India. Canadian Solar also integrated IoT-enabled monitoring for better performance tracking. Their focus on cost reduction and durability strengthens competitiveness in emerging markets.

4. Valmont Industries, Inc.

- Valmont Industries launched its Vega single-axis tracker, featuring a low-maintenance design and high corrosion resistance for harsh environments. The company expanded into Australia and Africa. Valmont also introduced automated installation tools, reducing deployment time. Their focus on durability and scalability supports long-term solar farm efficiency.

5. DEGERenergie

- DEGERenergie, known for its MLD (Maximum Light Detection) technology, upgraded its DEGERtracker 9000 single-axis system for higher precision tracking. The company expanded in Europe and South America, emphasizing off-grid and agrivoltaic applications. Their patented dynamic tracking algorithm improves energy generation, making it ideal for hybrid solar projects.

Conclusion

The Single-Axis Solar PV Tracker market is poised for strong growth, driven by rising demand for efficient solar energy solutions. Commercial and emerging market projects. With supportive policies, technological advancements, and increasing renewable energy investments, single-axis trackers will play a key role in meeting global clean energy needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)