Table of Contents

Overview

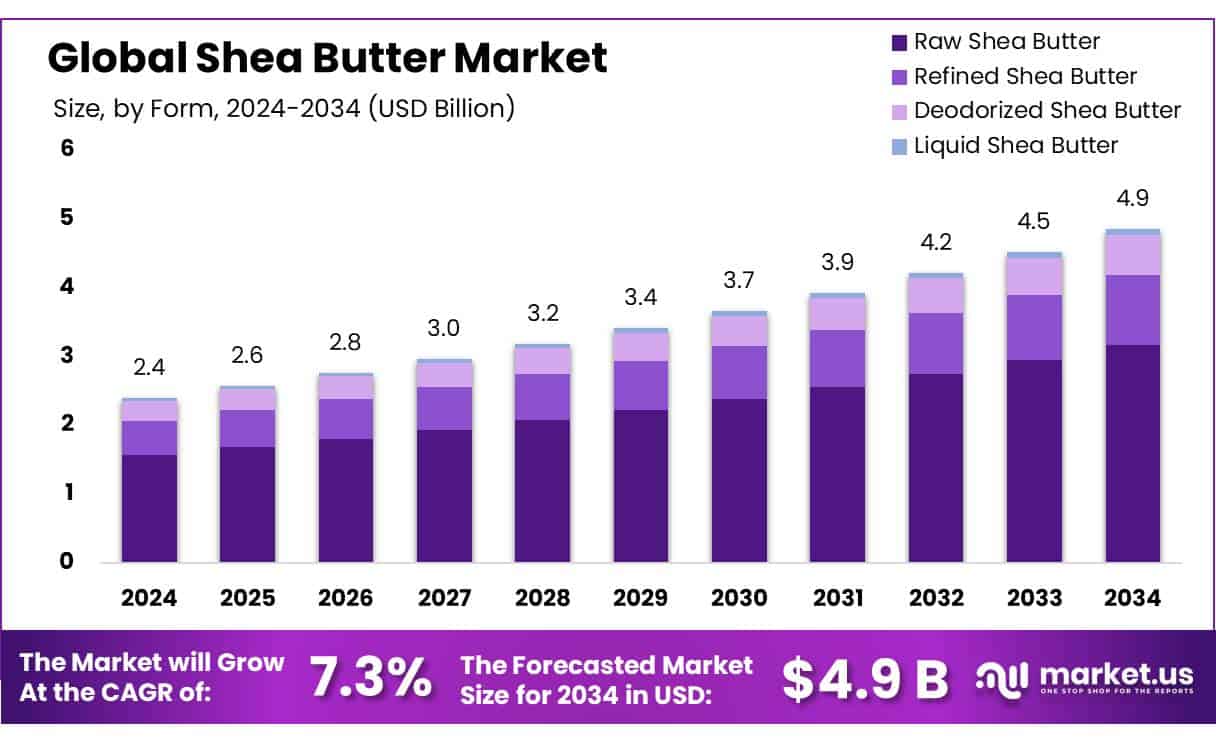

New York, NY – May 15, 2025 – The global Shea Butter Market is experiencing strong growth, driven by increasing demand in cosmetics, pharmaceuticals, and food industries. Valued at USD 2.4 billion in 2024, the market is projected to reach USD 4.9 billion by 2034, expanding at a steady CAGR of 7.3% from 2025 to 2034.

Raw Shea Butter commands a 65.1% share in 2024, driven by its unrefined, organic appeal. Its natural vitamins, fatty acids, and healing properties make it a top choice for skincare, haircare, and body care products. Cosmetics & Personal Care dominates with a 63.4% share in 2024, propelled by the shift to organic, plant-based beauty products. Indirect Sales holds a 71.2% share in 2024, supported by robust retail networks, supermarkets, specialty stores, and booming e-commerce platforms.

US Tariff Impact on Shea Butter Market

The recent introduction of sweeping new tariffs has disrupted global markets. A 10% tariff now applies to all goods entering the US, with certain countries facing steeper rates of 20-25% on top of existing duties, significantly altering global dairy trade dynamics. The unpredictable nature of these tariffs creates uncertainty for the industry.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-shea-butter-market/request-sample/

US cheese production has expanded, boosting exports by nearly 20% year-to-date compared to 2023. As Jasper noted, “In 2024, the US exported over 500,000 metric tons of cheese, compared to under 450,000 in 2023. That’s an increase of 80,000 tons, nearly 20% more, which is substantial.”

Key Takeaways

- Shea Butter Market size is expected to be worth around USD 4.9 billion by 2034, from USD 2.4 billion in 2024, growing at a CAGR of 7.3%.

- Raw Shea Butter held a dominant market position, capturing more than a 65.1% share.

- Cosmetics & Personal Care held a dominant market position, capturing more than a 63.4% share.

- Indirect Sales held a dominant market position, capturing more than a 71.2% share.

- North America emerged as a leading region in the global shea butter market, holding a substantial 31.2% share, equivalent to approximately USD 700 million.

Report Scope

| Market Value (2024) | USD 2.4 Billion |

| Forecast Revenue (2034) | USD 4.9 Billion |

| CAGR (2025-2034) | 7.3% |

| Segments Covered | By Form (Raw Shea Butter, Refined Shea Butter, Deodorized Shea Butter, Liquid Shea Butter), By Application (Cosmetics and Personal Care, Food Beverages, Pharmaceuticals, Nutraceuticals, Others), By Distribution Channel (Direct Sales, Indirect Sales) |

| Competitive Landscape | Sankofa Shea, AAK AB, AOS Products, BASF SE, Cargill, Inc., Clariant AG, Croda International Plc, Dukaan, Ghana Nuts Company Ltd., Olvea Group, Owen Owen, Shea Radiance, Sophim S.A., Suru Chemicals, The Jojoba Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147608

Key Market Segments

By Form

- Raw Shea Butter commands a 65.1% share in 2024, driven by its unrefined, organic appeal. Its natural vitamins, fatty acids, and healing properties make it a top choice for skincare, haircare, and body care products. Consumers and cosmetic manufacturers favor its minimal processing, viewing it as purer and more sustainable. With rising demand for clean, chemical-free products, raw shea butter sees strong growth in African and European markets, where traditional use and skin health awareness fuel its popularity.

By Application

- Cosmetics & Personal Care dominates with a 63.4% share in 2024, propelled by the shift to organic, plant-based beauty products. Shea butter’s moisturizing, anti-inflammatory, and healing properties make it a key ingredient in lotions, lip balms, shampoos, and creams. Its natural origin aligns with the clean beauty movement, driving demand in Europe and North America, where ethical sourcing gains traction. As concerns over chemical-based alternatives grow, shea-based cosmetics are set to maintain their lead in 2025, with brands increasingly using raw shea butter to meet consumer expectations.

By Distribution Channel

- Indirect Sales holds a 71.2% share in 2024, supported by robust retail networks, supermarkets, specialty stores, and booming e-commerce platforms. These channels ensure wide accessibility for consumers and businesses, with online platforms boosting visibility for natural shea butter, particularly in North America and Europe. Indirect sales enable both bulk and small-scale purchases, catering to diverse needs. As convenience and online shopping preferences grow, indirect channels are poised to expand further in 2025, leveraging omnichannel strategies to maintain their dominance.

Regional Analysis

- North America led the global shea butter market in 2024, capturing a 31.2% share, valued at roughly USD 700 million. This leadership stems from strong demand for natural and organic personal care products, with shea butter prized for its moisturizing and healing qualities.

- Prominent brands like The Body Shop and L’Occitane have broadened their shea butter-based product ranges to meet consumer demand for clean-label cosmetics. The region’s advanced e-commerce infrastructure further boosts product accessibility, while a focus on sustainable, ethically sourced ingredients aligns with the industry’s support for women-led shea nut harvesting and processing in West Africa.

Top Use Cases

- Skincare Moisturizer: Shea butter is a top choice for hydrating dry skin due to its rich fatty acids and vitamins. It’s used in creams, lotions, and balms to soothe irritation, reduce flakiness, and improve skin elasticity. Its natural properties appeal to consumers seeking organic, chemical-free products, driving demand in the personal care market.

- Hair Care Nourishment: Shea butter is widely used in shampoos, conditioners, and hair masks to moisturize and strengthen hair. It helps reduce scalp irritation, tame frizz, and add shine, making it popular for curly and dry hair types. Its natural appeal boosts its use in premium haircare products, especially in multicultural beauty markets.

- Anti-Aging Cosmetics: Shea butter’s anti-inflammatory and antioxidant properties make it a key ingredient in anti-aging creams and serums. It reduces fine lines, wrinkles, and age spots, appealing to aging demographics. Its ability to hydrate and rejuvenate skin drives its inclusion in luxury skincare, fueling market growth in clean beauty segments.

- Food Industry Substitute: Shea butter serves as a cocoa butter alternative in chocolates, bakery goods, and confectioneries. Its similar fat composition and lower cost make it ideal for manufacturers. Used in spreads, dips, and cooking oils, its nutritional profile attracts health-conscious consumers, expanding its role in the food processing sector.

- Pharmaceutical Applications: Shea butter is used in medicinal ointments for its healing and anti-inflammatory properties. It treats skin conditions like eczema, psoriasis, and burns, and soothes rashes and insect bites. Its natural composition makes it a preferred choice for pharmaceutical companies developing therapeutic skincare solutions, supporting market growth.

Recent Developments

1. Sankofa Shea

- Sankofa Shea, a Ghana-based producer, has expanded its sustainable shea butter sourcing by partnering with women-led cooperatives. The company focuses on ethical production, improving livelihoods for rural women. Recently, it launched a new line of unrefined, organic shea butter for global cosmetic brands. Their efforts in fair trade and eco-friendly processing have strengthened their market presence.

2. AAK AB

- AAK AB, a leader in plant-based oils, has introduced innovative shea butter solutions for cosmetics and food. Their “Shea Excellence Program” supports sustainable sourcing in West Africa. Recently, they developed a new shea-based emulsifier for skincare, enhancing product performance. AAK continues to invest in R&D to expand shea butter applications.

3. AOS Products

- AOS Products, a key supplier of specialty chemicals, has enhanced its shea butter refining process to meet pharmaceutical-grade standards. The company recently secured a new contract with a major European skincare brand, supplying high-purity shea butter for anti-aging creams. Their focus on quality control ensures premium-grade output.

4. BASF SE

- BASF SE has integrated shea butter into its natural cosmetic ingredients portfolio. Their latest innovation includes a bio-based shea butter derivative for sustainable moisturizers. BASF is also collaborating with African suppliers to improve traceability and ethical sourcing in the shea supply chain.

5. Cargill, Inc.

- Cargill has expanded its shea butter processing facilities in West Africa to meet rising global demand. The company recently launched a new deodorized shea butter variant for food and cosmetic applications. Their sustainability initiatives focus on empowering female shea collectors through training programs.

Conclusion

The Shea Butter Market is thriving, driven by rising demand for natural, organic, and sustainable products in cosmetics, personal care, and food industries. Its versatile applications, from skincare to pharmaceuticals, and strong consumer preference for clean-label solutions ensure steady growth. With robust distribution channels and ethical sourcing, shea butter is set to maintain its global market prominence.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)