Table of Contents

Overview

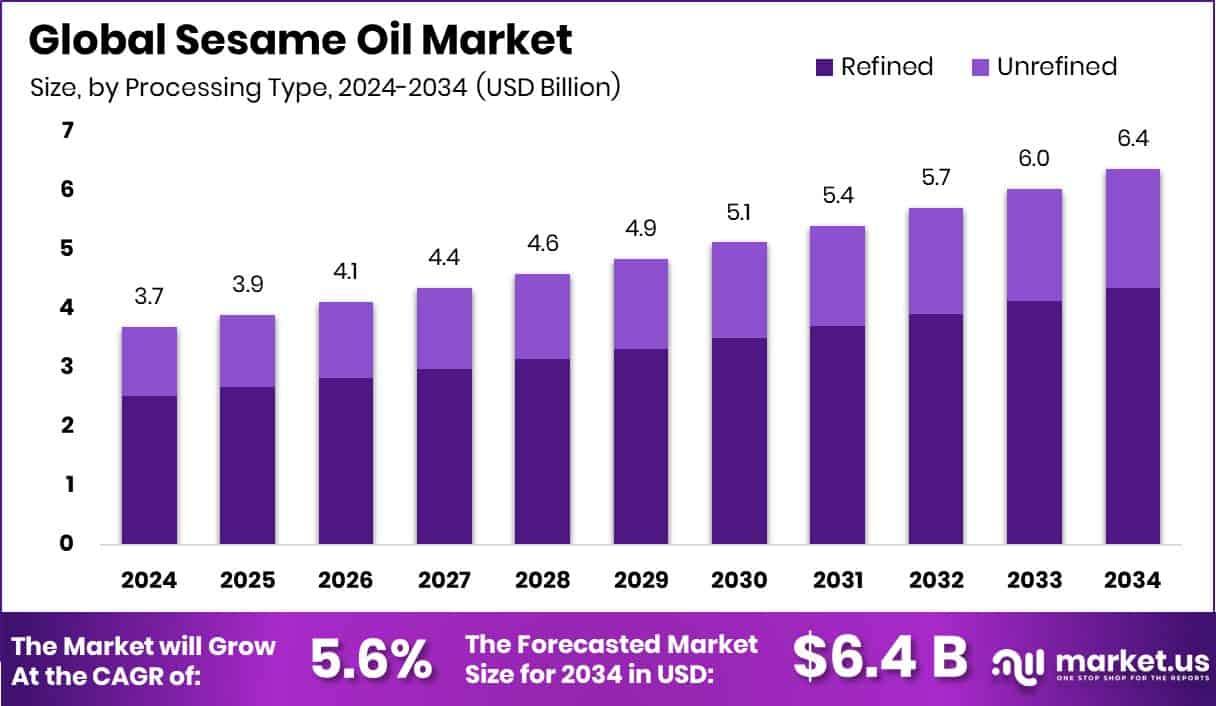

New York, NY – Aug 01, 2025 – The global sesame oil market is projected to reach approximately USD 6.4 billion by 2034, rising from USD 3.7 billion in 2024, with a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2025 to 2034. North America accounted for a significant 33.9% market share in 2024, valued at around USD 1.2 billion.

Sesame oil, extracted from sesame seeds, is widely used in cooking, cosmetics, pharmaceuticals, and traditional medicine. Known for its rich nutty flavor and nutritional profile, it contains antioxidants, healthy fats, and essential nutrients. Depending on how it is processed, sesame oil can be light (refined) or dark (toasted), each suited for different culinary and non-culinary applications.

The sesame oil market encompasses global trade and consumption across sectors such as food and beverage, personal care, and industry. Its growth is fueled by rising consumer preference for natural, plant-based oils and increased awareness of health benefits. Factors like sesame seed supply, regional taste preferences, and the oil’s nutritional value influence demand.

Health-conscious consumers are driving market expansion, favoring clean-label and functional foods. Sesame oil’s antioxidant and anti-inflammatory properties make it popular in urban diets. Additionally, the growing appeal of Asian cuisine in Western markets is boosting usage in both households and restaurants.

Beyond food, sesame oil sees rising demand in cosmetics and pharmaceuticals due to its moisturizing, healing, and carrier oil properties. As people turn to natural alternatives in skincare and wellness, sesame oil’s presence is growing in Ayurvedic and traditional medicine-based products.

Key Takeaways

- The global sesame oil market is projected to grow from USD 3.7 billion in 2024 to approximately USD 6.4 billion by 2034, registering a CAGR of 5.6% between 2025 and 2034.

- Refined processing dominates the market, accounting for around 68.4% of the total global share.

- Processed sesame oil products lead the product category, contributing 73.9% to the overall market.

- By type, refined sesame oil holds a significant 49.5% share globally.

- The food and beverage industry remains the key application area, driving 68.2% of total market demand.

- In terms of retail distribution, hypermarkets and supermarkets account for 45.7% of global sesame oil sales.

- North America stands out with a market valuation of USD 1.2 billion, capturing a 33.9% share in 2024.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-sesame-oil-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.7 Billion |

| Forecast Revenue (2034) | USD 6.4 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Processing Type (Refined, Unrefined), By Product (Processed, Virgin), By Type (Cold-Pressed Sesame Oil, Refined Sesame Oil, Blended Sesame Oil), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | Adams Group Inc., Archer Daniels Midland Company, Bunge Limited, Cargill Inc., Dipasa Group, Fuji Oil Holdings Inc., Kadoya Sesame Mills Inc., Kevala International LLC, La Tourangelle, Inc., Pansari Group, TAKEMOTO OIL & FAT CO., LTD., The Adani Wilmar Ltd, V.V. Vanniyom Oil Industries, Wilmar International Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153132

Key Market Segments

By Processing Type Analysis

Refined Sesame Oil Leads with 68.4% Global Market Share

In 2024, the refined sesame oil segment held a commanding 68.4% share in the global market. This dominance is driven by its broad usability in food, cosmetics, and industrial sectors. With its neutral taste, extended shelf life, and high smoke point, refined sesame oil is ideal for mass food production and foodservice environments requiring consistency and heat stability.

Its clear appearance and minimal scent make it a preferred ingredient in skincare and pharmaceutical formulations. The refined segment also benefits from cost-effectiveness, wide availability, and strong retail presence, particularly in urban and developing regions. Additionally, rising health awareness is steering consumers toward oils with better oxidative stability and lower saturated fat qualities that refined sesame oil delivers while maintaining nutritional value.

By Product Analysis

Processed Products Dominate with 73.9% Market Share

Processed sesame oil led the product segment in 2024, accounting for 73.9% of the global market. This category includes oils treated through filtration, deodorization, and bleaching to improve usability, shelf life, and consistency. These enhancements make processed oils highly suitable for packaged foods, cosmetics, pharmaceuticals, and everyday cooking.

Their neutral flavor, extended shelf stability, and appealing appearance meet the standards required by commercial manufacturers and consumers alike. High-temperature cooking compatibility and versatile culinary applications also contribute to this segment’s strong market presence. The affordability, accessibility, and widespread retail availability of processed variants further solidify their dominant role in global demand.

By Type Analysis

Refined Sesame Oil Accounts for 49.5% of Global Market Share

Refined sesame oil secured a leading position in the type segment with a 49.5% share in 2024. Its popularity stems from consistent quality, clean flavor, and superior heat resistance making it suitable for diverse food and non-food uses. The refining process removes odors and impurities, producing an oil that fits seamlessly into everyday cooking and industrial applications.

This variant is especially favored by food processors, cosmetic brands, and households seeking shelf-stable, neutral oils. In urban and health-focused markets, refined sesame oil is viewed as a safer, cleaner choice for regular consumption. Its growing retail availability and role in clean-label product formulations continue to drive its market strength.

By Application Analysis

Food and Beverage Segment Drives 68.2% of Market Demand

The food and beverage sector led sesame oil applications in 2024, accounting for 68.2% of global demand. This dominance is tied to sesame oil’s widespread use in traditional and modern culinary practices, from home cooking to commercial food production. Its unique flavor, health benefits, and stability under heat make it ideal for regional dishes and packaged foods alike.

As consumer interest grows in functional and clean-label ingredients, sesame oil rich in antioxidants and healthy fats is gaining popularity, especially among health-conscious individuals. Its role in enhancing taste and nutrition has solidified its position in food-based applications globally.

By Distribution Channel Analysis

Hypermarkets and Supermarkets Hold 45.7% Market Share

In 2024, hypermarkets and supermarkets represented 45.7% of sesame oil sales by distribution channel. These retail giants are favored for their convenience, offering a broad range of sesame oil products, brands, sizes, and price options in a single location. Their ability to showcase both domestic and imported variants enhances consumer choice and encourages brand experimentation.

Strong supply chains and geographic reach ensure product availability across cities and towns. These outlets also appeal to consumers through promotional offers, bulk buying options, and perceived quality assurance. Their organized format plays a significant role in shaping consumer trust and driving purchase decisions.

Regional Analysis

In 2024, North America led the global sesame oil market, capturing a substantial 33.9% share, valued at approximately USD 1.2 billion. This strong market presence is fueled by growing awareness of plant-based diets, rising demand for functional and health-oriented foods, and a strong preference for nutritious cooking oils. The region also benefits from a mature food processing industry and an increasing appetite for international cuisines that commonly use sesame oil.

Europe is witnessing steady growth, driven by a rising trend toward clean-label products and natural health supplements. In Asia Pacific, sesame oil remains deeply embedded in culinary traditions, supporting consistent demand across households and restaurants.

Meanwhile, Latin America and the Middle East & Africa are emerging markets for sesame oil, with adoption gradually increasing due to urbanization and evolving consumer diets. However, these regions still face challenges such as limited market access and economic constraints. Overall, North America’s leading position is supported by its advanced retail network, diverse applications, and strong focus on quality edible oils.

Top Use Cases

Culinary Cooking Oil for Health‑Conscious Consumers: Sesame oil is widely used in stir-frying, sautéing, marinades, and salad dressings due to its high smoke point, clean flavor, and rich antioxidant profile. With growing consumer focus on heart health and plant-based nutrition, demand is rising especially for refined and light sesame oil forms that suit everyday cooking and meal preparation.

Flavor Enhancer in Ethnic & Packaged Foods: Toasted sesame oil is added at the end of cooking for rich nutty aroma and distinctive taste, making it popular in Asian and Middle Eastern food categories. Its use in sauces, dressings, ramen, and packaged convenience foods has expanded globally as consumers explore ethnic flavors and ready-to-eat options.

Ingredient in Cosmetics and Skincare Products: Known for emollient and antioxidant properties, sesame oil is a key ingredient in lotions, massage oils, hair treatments, and sunscreens. Brands seek it for clean-label formulations. Cold-pressed and organic variants are especially favored for natural skincare lines, boosting market growth in personal care applications.

Carrier and Nutraceutical Component in Pharma & Supplements: In pharmaceutical and nutraceutical formulations, sesame oil serves as a safe carrier for active compounds and vitamin-rich supplements. Its anti-inflammatory and antimicrobial properties also support traditional wellness products in Ayurvedic and herbal medicine systems, making it a trusted ingredient in therapeutic and dietary use cases.

Base for Blended and Value-Added Functional Oils: Manufacturers are increasingly blending sesame oil with other oils or fortifying it with ingredients like omega-3s and herbal extracts to deliver functional health benefits. These value-added product variants cater to clean-label, functional food trends and help differentiate brands in competitive retail and direct-to-consumer channels.

Recent Developments

Archer Daniels Midland Company: ADM’s subsidiary SIO (Société Industrielle des Oléagineux) continues to expand its presence in pharmaceutical-grade oils. Its refined Sesame Oil IV-1 meets USP/NF and European Pharmacopoeia standards, enabling formulators to use it in injectable lipid emulsions. ADM is also active via its Edible Oils Limited joint venture in bottled seed oils, including sesame, supplying branded and private-label edible oils across UK and Europe through advanced packaging operations.

Dipasa Group: Dipasa (Dipasa International, Inc.) has seen strong growth in the North American organic sesame oil market by leveraging its fully integrated supply chain for purity and traceability. The company’s focus on organic and high-protein sesame seed varieties aims to support functional and health‑oriented food products. Its traceable sourcing empowers claims around sustainability and transparency in premium packaged oils.

Wilmar International Limited: Wilmar launched Sania Royale Sesame Oil in Indonesia in November 2024, reinforcing its consumer pack edible oil portfolio. In addition, Wilmar’s Richards Bay (South Africa) edible oils refinery commenced phase 1 operations in mid‑2024 and processes sesame seeds among other crops. The refinery is expected to complete phase 2 by December 2025, boosting Wilmar’s regional sesame oil processing capacity.

Kadoya Sesame Mills Inc.: Kadoya widely recognized as a leading Japanese sesame oil brand recently introduced a new line of organic sesame oil, catering to health-conscious and sustainability-seeking consumers. This move aligns with global trends favoring natural, cold-pressed oils, enhancing Kadoya’s premium positioning and responding to rising demand for clean-label edible oils.

Conclusion

Asia-Pacific follows closely, anchored by traditional culinary practices and growing packaged food industries. Europe’s market is expanding steadily, with clean-label and organic preferences shaping purchase patterns.

Leading companies such as Wilmar International, ADM, Kadoya Sesame Mills, and Dipasa Group are actively investing in product development, sustainable sourcing, and regional expansion to cater to evolving consumer trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)