Table of Contents

Market Overview

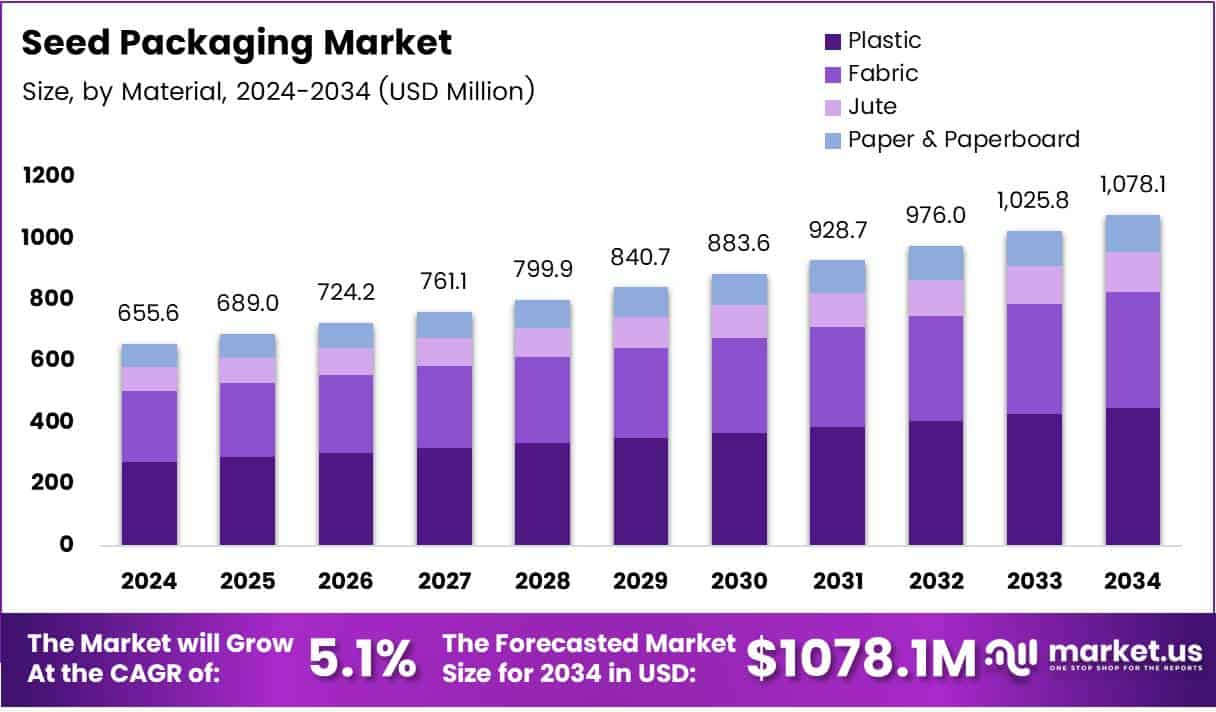

The global seed packaging market is experiencing significant growth, with projections indicating an increase from USD 655.6 million in 2024 to USD 1,078.1 million by 2034, reflecting a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2025 to 2034.

Seed packaging plays a crucial role in preserving seed quality, ensuring safe transportation, and providing essential information to consumers. The market’s expansion is driven by factors such as the increasing demand for high-quality seeds, advancements in packaging technologies, and the growing emphasis on sustainable packaging solutions.

Material Segmentation

In 2024, plastic materials dominated the seed packaging market, accounting for 46.2% of the market share. Plastic’s popularity is attributed to its cost-effectiveness, durability, and protective properties, which help in safeguarding seeds from environmental factors. Other materials used in seed packaging include fabric, jute, paper, and paperboard, each offering unique benefits in terms of sustainability and biodegradability.

Product Type Segmentation

Bags emerged as the leading product type in the seed packaging market in 2024, holding a 45.3% share. Their flexibility, ease of use, and ability to accommodate various seed quantities make them a preferred choice among consumers and manufacturers. Other product types include pouches, containers, bottles, and jars, each catering to specific packaging needs and consumer preferences.

End-Use Industry Analysis

The agriculture sector remains the dominant end-user with a 60.1% share, driven by the need for efficient seed storage and distribution. Additionally, sectors such as forestry, oil production, and gardening contribute to the demand for specialized seed packaging, each requiring tailored solutions to meet their unique requirements.

Regional Insights

The Asia Pacific region is the leader in the global seed packaging market, holding a major share of 36.4% and valued at USD 238.6 million. This dominance is mainly due to the growing agricultural activities, higher demand for high-yield seeds, and government efforts to support sustainable farming. Countries like India and China are key drivers of this growth, fueled by advancements in seed preservation and packaging technology.

Sustainability Trends

With the growing awareness of environmental issues, there is a notable shift towards sustainable packaging solutions in the seed packaging market. Manufacturers are exploring biodegradable materials and eco-friendly packaging options to reduce environmental impact. This trend aligns with the broader global movement towards sustainability and responsible consumption.

Recent Development

- In April 2025, Reusables.com raised $3.6M in funding to address the growing $100B+ packaging waste problem and launched a new initiative with the University of California to expand its reach in sustainable packaging solutions.

- In June 2025, Shellworks secured $6.2 million in seed funding to further develop its innovative biodegradable packaging made from sustainable materials, aiming to revolutionize the packaging industry.

- In December 2024, Bpacks raised €1M in pre-seed funding to create the world’s first bark-based, 100% compostable packaging, offering an eco-friendly alternative to conventional plastic.

- In November 2024, Ukhi secured $1.2 million in seed funding, led by 100Unicorns, to disrupt the sustainable packaging industry with its innovative approach to reducing packaging waste and improving environmental impact.

- In November 2024, B’ZEOS raised seed funding to accelerate the development of its seaweed-based compostable packaging, a sustainable alternative to plastic designed to reduce ocean pollution.

- In October 2024, Earthodic, a Queensland-based bio-packaging startup, raised $6 million in a seed round to drive its expansion into the U.S. market, focusing on biodegradable packaging solutions for the food and beverage industry.

Competitive Landscape

The seed packaging market is characterized by the presence of both established players and emerging companies. Key manufacturers are focusing on innovation, product diversification, and strategic partnerships to strengthen their market position. Additionally, advancements in packaging technologies, such as smart packaging and tamper-evident features, are being integrated to enhance product appeal and consumer trust.

Conclusion

The seed packaging market is poised for substantial growth, driven by factors such as increasing demand for high-quality seeds, advancements in packaging technologies, and a shift towards sustainable packaging solutions. As the market evolves, stakeholders must adapt to changing consumer preferences and environmental considerations to capitalize on emerging opportunities.