Table of Contents

Overview

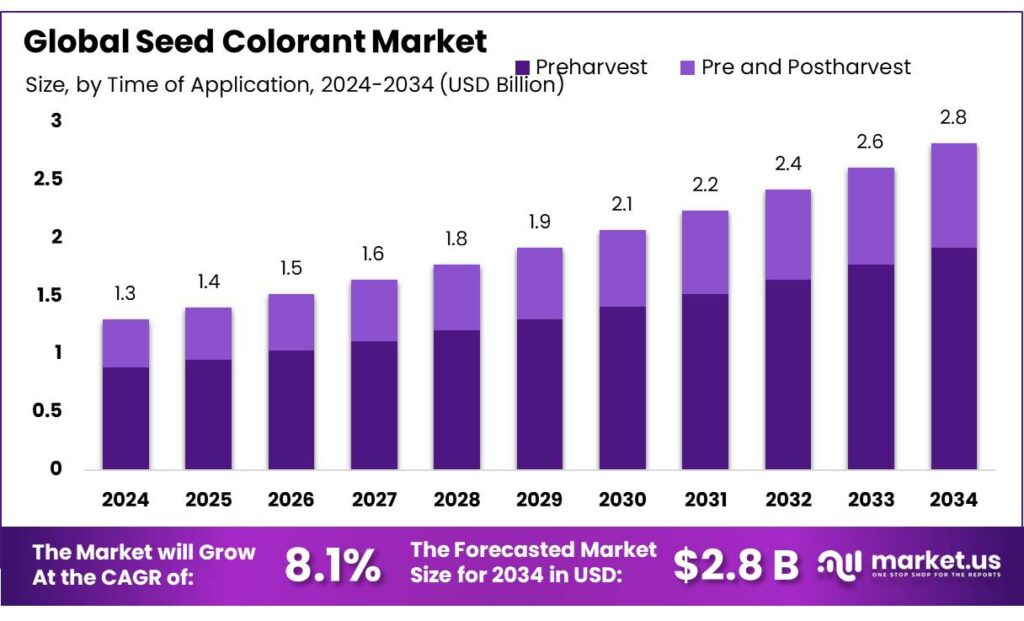

New York, NY – October 10, 2025 – The Global Seed Colorant Market is projected to reach USD 2.8 billion by 2034, up from USD 1.3 billion in 2024, expanding at a CAGR of 8.1% (2025–2034). In 2024, North America dominated the market with a 43.9% share, accounting for about USD 0.5 billion in revenue.

Seed colorants are specialized additives used in seed coatings and treatments for identification, safety, and handling purposes. They help differentiate seed varieties and brands, prevent unintentional mixing, and enhance visibility for mechanical planting systems. In some formulations, colorants also improve the adhesion of coatings or reduce dust-off during application. These ingredients are inert and must comply with EPA, REACH, and other regulatory safety standards for agricultural chemicals.

Market expansion is supported by the vast global sowing area, which sustains steady demand for treated seeds. According to the FAO (2023), around 1,600 million hectares of cropland exist globally, out of 4,800 million hectares of agricultural land, highlighting the large-scale use of seed treatments. In the U.S., mature adoption of treated seeds aligns with high planting areas, 95.2 million acres of corn and 83.4 million acres of soybeans projected, translating into major coating campaigns each season.

Key growth drivers include regulatory stewardship, dust-off reduction mandates, and traceability standards. Frameworks such as Euroseeds’ ESTA encourage the use of polymeric binders and low-abrasion pigments to meet dust emission benchmarks. Similarly, EPA-listed inert pigments and REACH-registered colorants enable safer, standardized formulations across multiple regions, enhancing product approval and accelerating market growth.

Key Takeaways

- Seed Colorant Market size is expected to be worth around USD 2.8 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 8.1%.

- Preharvest held a dominant market position, capturing more than a 67.9% share in the Seed Colorant Market.

- Liquid held a dominant market position, capturing more than a 63.2% share in the Seed Colorant Market.

- Grains and Cereals held a dominant market position, capturing more than a 41.4% share in the Seed Colorant Market.

- North America captured around 43.9% of the global Seed Colorant Market, amounting to approximately USD 0.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-seed-colorant-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.8 Billion |

| CAGR (2025-2034) | 8.1% |

| Segments Covered | By Time of Application (Preharvest, Pre and Postharvest), By Formulation (Powder, Liquid), By Сгор Туре (Grains and Cereals, Oil Seeds, Fruits and Vegetables, Turf and Ornamentals, Others) |

| Competitive Landscape | BASF SE, Sensient Technologies Corporation, Milliken & Company, Bayer CropScience AG, Chromatech Incorporated, Lanxess AG, Heubach GmbH, Sun Chemical Corporation, Dystar Group, Germains Seed Technology |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158170

Key Market Segments

By Time of Application Analysis

Preharvest Seed Colorant commands a 67.9% market share in 2024, driven by regulatory requirements and the need for clear seed safety identification. Preharvest colorants are widely used to mark treated seeds, ensuring they are distinguishable from food or feed. This practice is standard for crops like corn, wheat, and soybeans, where seed treatment is common. Stricter global regulations on treated seed handling are expected to sustain this trend into 2025, reinforcing preharvest colorants as the most widely adopted segment in commercial agriculture.

By Formulation Analysis

Liquid Seed Colorant holds a 63.2% market share in 2024, favored for its ease of application and uniform seed coating. Liquid formulations integrate seamlessly with other seed treatment chemicals, offering precise dosing, vibrant color, and compatibility with modern machinery. Unlike powders, they minimize dust and enhance handling safety, making them ideal for large-scale seed treatment of crops like maize, canola, and pulses. With tightening seed treatment standards and increasing mechanization, liquid colorant demand is projected to grow in 2025.

By Crop Type Analysis

Grains and Cereals dominate with a 41.4% market share in 2024, fueled by extensive seed treatment in staple crops such as wheat, corn, and rice. Colorants are critical for safety, regulatory compliance, and identification of treated seeds in these crops. As seed quality awareness rises and farming protocols become stricter, this segment is expected to maintain its lead in 2025, particularly in high-yield agricultural regions.

Regional Analysis

North America leads the global Seed Colorant Market in 2024 with a 43.9% share, valued at approximately USD 0.5 billion. This dominance stems from advanced agricultural infrastructure, rigorous regulations mandating treated seed coloring, and widespread seed treatment adoption in the U.S. and Canada. In the U.S., colorants are standard for treated corn and soybean seeds, while in Canada, they are extensively used for wheat, canola, and pulses to meet certification and traceability standards. This trend is expected to continue into 2025.

Top Use Cases

- Safety Marking for Treated Seeds: Seed colorants add a bright layer to seeds coated with pesticides or fungicides, making them stand out from untreated ones. This simple step helps farmers avoid mixing them with food or animal feed, cutting down on accidental harm. It’s a must in busy fields, ensuring everyone handles seeds safely and follows rules without confusion during planting time.

- Branding and Visual Appeal: Companies use unique colors on seeds to create eye-catching looks that match their brand, like a signature red for premium corn varieties. This makes products pop on shelves and builds trust with buyers who see quality right away. It turns ordinary seeds into standout items, boosting sales and loyalty among farmers who value that extra touch.

- Identifying Crop Varieties and Traits: Different shades help sort seeds by type, like blue for drought-resistant wheat or green for high-yield soy. In large operations, this clear coding speeds up planting and reduces mix-ups, letting teams pick the right batch fast. It supports smart farming by matching seeds to soil or weather needs effortlessly.

- Regulatory Compliance in Seed Treatment: Rules around the world require treated seeds to show color, proving they’ve been protected against bugs or diseases. Colorants make this easy, helping growers meet legal checks without hassle. This keeps farms running smoothly, avoids fines, and ensures safe, high-quality crops reach markets on time every season.

- Improving Seed Flow and Handling: Colorants coat seeds evenly, making them less sticky and easier to flow through machines during planting. This cuts dust, speeds up the process, and protects workers from irritation. Farmers get uniform coverage that boosts germination, turning a routine task into a reliable step for better harvests ahead.

Recent Developments

1. BASF SE

BASF continues to innovate in seed treatment formulations, enhancing the functionality of its colorants. Recent developments focus on improving the dust-off control and flowability of treated seeds, ensuring better plantability and environmental safety. Their integrated solutions, like the Vibrance seed treatment family, often include advanced colorants that provide uniform coverage and clear identification, supporting seed stewardship and traceability throughout the supply chain.

2. Sensient Technologies Corporation

Sensient has been expanding its bio-based and sustainable colorant offerings for seeds. Their recent developments include high-visibility, non-fugitive pigments that ensure color remains on the seed without leaching into the soil. They also focus on creating custom color solutions that are compliant with global regulatory standards, helping seed companies with brand differentiation and safe, reliable product performance from the bag to the field.

3. Milliken & Company

Through its AgriPlastics division, Milliken is advancing seed colorant technology with its Reactint products. These liquid colorants are designed for vibrant, uniform coloration and are compatible with modern polymer-based seed coating systems. Recent work emphasizes reducing dust and enhancing the durability of the color coat, which improves seed handling and planting efficiency for farmers while supporting seed company branding.

4. Bayer CropScience AG

Bayer integrates advanced seed colorants into its comprehensive seed treatment systems, such as those used for its DEKALB and Channel seeds. Recent developments are part of their “SeedGrowth” platform, focusing on colorants that improve planter visibility and seed singulation. The colorants are also engineered to be environmentally considerate, with low dust characteristics and formulations that support the performance of accompanying biological and chemical treatments.

5. Chromatech Incorporated

Chromatech has recently introduced new, vibrant color formulations to meet evolving market needs for seed differentiation and treatment identification. Their developments include specialized dispersions and dyes that offer excellent adherence and visibility. A key focus is on providing reliable, consistent color matching for seed companies and ensuring their products perform well in various application equipment, contributing to overall seed treatment efficacy and brand recognition.

Conclusion

Seed Colorants as a quiet powerhouse in modern farming, blending safety, style, and smarts to lift crop success. They turn basic seeds into protected, easy-to-spot gems that fit right into eco-friendly trends like greener coatings and precise planting. With farmers chasing higher yields and cleaner methods, these simple dyes open doors for innovation, from custom shades to tech-linked tracking. Overall, seed colorants promise a brighter path for sustainable agriculture, helping feed the world while keeping fields safe and vibrant.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)