Table of Contents

Overview

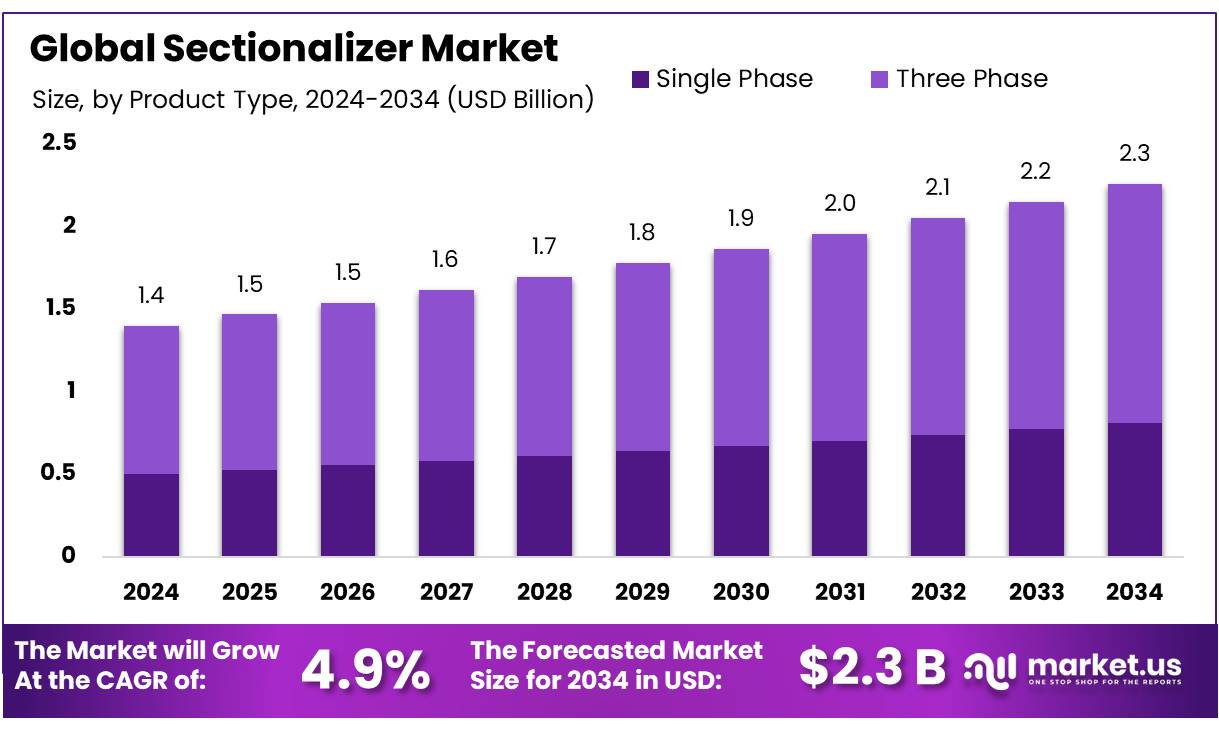

New York, NY – August 08, 2025 – The Global Sectionalizer Market is projected to grow from USD 1.4 billion in 2024 to USD 2.3 billion by 2034, achieving a CAGR of 4.9% during the 2025–2034 forecast period. In 2024, North America led the market, securing a 45.9% share with USD 0.6 billion in revenue.

Sectionalizers, often termed “concentrates” in system procurement contexts, are vital automatic protective devices used in overhead and underground distribution feeders. They isolate faulty sections during disruptions, preventing widespread outages and bolstering grid reliability. In smart grid systems, sectionalizers integrate with reclosers and remote monitoring technologies to ensure seamless coordination and uninterrupted power supply.

Key growth drivers include rapid urbanization, aging grid infrastructure, and the global shift toward smart distribution automation. Sectionalizers are increasingly adopted for their ability to automate fault isolation, minimizing service disruptions and enhancing grid resilience. In emerging markets like India and China, grid modernization and rural electrification are significant catalysts.

India’s Ministry of Power reports a rise in per capita electricity consumption to 1,395 kWh in 2023–2024, a 45.8% increase (438 kWh) from 957 kWh a decade ago, highlighting surging demand and the need for robust distribution networks. In India, government policies, including up to 100% FDI in chemical and electrical manufacturing sectors (with minor exceptions for hazardous chemicals), have spurred the adoption of automated distribution devices like sectionalizers.

In FY 2023–24, India attracted INR 73.9 billion in FDI in the chemical sector. NITI Aayog notes that 95% of India’s propylene is converted into polypropylene (PP), significantly higher than the global 70% average, reflecting a mature local supply chain that supports technologies like sectionalizers, which rely on polypropylene and related materials.

Key Takeaways

- The Sectionalizer Market size is expected to be worth around USD 2.3 billion by 2034, from USD 1.4 billion in 2024, growing at a CAGR of 4.9%.

- Three Phase held a dominant market position, capturing more than a 64.8% share in the global sectionalizer market.

- Up to 15 kV held a dominant market position, capturing more than a 51.7% share in the sectionalizer market.

- Resettable Electronic held a dominant market position, capturing more than 76.2% share in the sectionalizer market.

- Pole-mounted held a dominant market position, capturing more than a 67.9% share in the sectionalizer market.

- Industrial held a dominant market position, capturing more than a 34.2% share in the sectionalizer market.

- North America held a dominant position in the global sectionalizer market, accounting for 45.9% of the total market share, which equates to a valuation of approximately USD 0.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-sectionalizer-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.4 Billion |

| Forecast Revenue (2034) | USD 2.3 Billion |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Phase Type (Single Phase, Three Phase), By Voltage Rating (Up to 15 kV, 16-27 kV, 28-38kV), By Control Type (Resettable Electronic, Programmable Resettable), By Mounting Type (Pole Mounted, Pad Mounted), By End-Use (Industrial, Residential, Commercial, Utilities) |

| Competitive Landscape | ABB Ltd, Bevins Co., Eaton Corporation plc, Elektrolites (Power) Pvt. Ltd, Entec Electric & Electronic Co., Ltd., G&W Electric Company, Hubbell Incorporated, Hughes Power System AB, NOJA Power Switchgear Pty Ltd., S&C Electric Company, Schneider Electric SE, Siemens AG, Tavrida Electric |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153741

Key Market Segments

By Phase Type Analysis

In 2024, three-phase sectionalizers commanded a 64.8% share of the global sectionalizer market by phase type, driven by their extensive use in industrial, commercial, and large-scale utility applications. These devices excel in managing higher loads, supporting extended feeder lines, and ensuring voltage stability across diverse electrical systems.

Their robust fault isolation capabilities enhance power reliability, particularly in regions prone to frequent outages or with high energy demands. The push for grid modernization and renewable energy integration continues to drive demand for three-phase sectionalizers, as utilities prioritize operational efficiency and reduced downtime. In emerging economies, rural and semi-urban electrification projects further boost their adoption.

By Voltage Rating Analysis

In 2024, sectionalizers rated up to 15 kV captured a 51.7% share of the market by voltage rating, owing to their widespread use in urban and rural power distribution systems. These devices are ideal for secondary distribution networks serving residential, commercial, and small industrial facilities, offering compatibility with low- to medium-voltage grids and easy integration into existing setups. Their cost-effectiveness, low maintenance, and reliable fault isolation make them a top choice for utilities. Growing urbanization and rural electrification initiatives, particularly in developing regions, drive the demand for up to 15 kV sectionalizers.

By Control Type Analysis

In 2024, resettable electronic sectionalizers held a commanding 76.2% share of the market by control type, driven by the demand for automated power distribution and rapid fault restoration. These devices automatically reset after operation, reducing manual intervention and improving grid reliability.

Their real-time fault detection, remote programmability, and integration with smart grid systems make them highly desirable for utilities aiming to optimize performance and minimize outages. As smart grid adoption grows, particularly in regions with aging infrastructure, resettable electronic sectionalizers are expected to maintain their dominance.

By Mounting Type Analysis

In 2024, pole-mounted sectionalizers secured a 67.9% share of the market by mounting type, driven by their widespread use in overhead distribution systems across urban and rural areas. These units are favored for their easy installation, minimal space requirements, and accessibility for maintenance.

Their compatibility with medium-voltage networks and smart grid technologies enhances their appeal for utilities seeking efficient fault management. The ongoing modernization of aging power lines and rural electrification efforts continue to fuel demand for pole-mounted sectionalizers.

By End-Use Analysis

In 2024, the industrial sector accounted for a 34.2% share of the sectionalizer market by end-use, driven by the critical need for uninterrupted power and robust fault isolation in facilities like manufacturing plants, refineries, and heavy industries. Sectionalizers ensure operational stability and safety by quickly isolating faults, preventing costly downtime and equipment damage. The growth of industrial zones, particularly in developing economies, and the increasing adoption of automation and digitization amplify the demand for reliable power distribution systems.

Regional Analysis

In 2024, North America dominated the global sectionalizer market with a 45.9% share, valued at USD 0.6 billion. This leadership stems from the region’s advanced power distribution infrastructure, robust utility networks, and early adoption of grid automation technologies. The U.S. and Canada have prioritized upgrading aging electrical systems to enhance fault detection, reduce downtime, and improve service reliability, aligning with sectionalizer capabilities.

The integration of renewable energy sources, such as wind and solar, into the grid has increased demand for sectionalizers suited for dynamic, two-way current environments. U.S. initiatives like the Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) Program provide significant funding for grid modernization, supporting technologies like sectionalizers and automated reclosers.

Top Use Cases

- Fault Isolation in Power Grids: Sectionalizers automatically isolate faulty sections in power distribution networks, preventing widespread outages. They work with reclosers to detect and disconnect only the affected area, ensuring minimal disruption. This is critical in urban and rural grids, enhancing reliability and reducing downtime for homes, businesses, and industries.

- Smart Grid Integration: Sectionalizers enhance smart grids by integrating with remote monitoring systems. They provide real-time fault detection and isolation, improving grid efficiency. Their programmability allows utilities to manage dynamic power flows, especially with renewable energy sources, ensuring stable and resilient electricity distribution.

- Rural Electrification Support: In rural areas, sectionalizers ensure reliable power by isolating faults in long distribution lines. They reduce outage times and maintenance costs, supporting electrification projects. Their easy installation and low maintenance make them ideal for expanding access to electricity in developing regions.

- Industrial Power Reliability: Sectionalizers protect industrial facilities like factories and refineries by isolating faults quickly. This prevents costly downtime and equipment damage, ensuring continuous operations. Their ability to handle high loads makes them essential for industries with heavy power demands, enhancing safety and efficiency.

- Renewable Energy Management: Sectionalizers manage fluctuating power inputs from solar and wind sources in modern grids. They isolate faults without disrupting the entire network, supporting stable integration of renewables. This ensures a consistent power supply as utilities transition to cleaner energy sources, meeting sustainability goals.

Recent Developments

1. ABB Ltd.

ABB has introduced the Recloser-Sectionalizer Hybrid Device, combining fault isolation and automatic circuit restoration in a single unit. Their latest SACE Tmax XT series now integrates IoT for real-time monitoring via ABB Ability. The company is also focusing on grid resiliency with AI-driven predictive maintenance for sectionalizers in smart grids.

2. Bevins Co.

Bevins Co. has enhanced its BS Series Sectionalizers with advanced arc-interruption technology for faster fault detection in rural distribution networks. They recently partnered with utilities in North America to deploy auto-reclosing sectionalizers with remote control capabilities. Their focus remains on rugged designs for harsh environments.

3. Eaton Corporation plc

Eaton has launched the Cooper Power Series VFI Sectionalizer, featuring voltage and frequency intelligence for adaptive grid protection. Their Smart Grid-Ready Sectionalizers now support distributed energy resource (DER) integration. Recent deployments include microgrid applications in Europe and North America.

4. Elektrolites (Power) Pvt. Ltd

Elektrolites has developed Pole-Mounted Sectionalizers with GSM-based remote operation for Indian power distribution networks. Their ELK-SEC Series now includes fault current indicators and surge protection. The company is expanding into Southeast Asia with cost-effective sectionalizing solutions.

5. Entec Electric & Electronic Co., Ltd.

Entec has introduced Solid-State Sectionalizers with silicon carbide (SiC) technology for higher efficiency and longer lifespan. Their ENT-SEC20 Series supports LoRaWAN communication for smart grid integration. Recent projects include solar farm grid protection in the Middle East.

Conclusion

Sectionalizers are critical for modern power distribution, offering reliable fault isolation and grid resilience. Their applications in smart grids, rural electrification, industrial reliability, renewable energy, healthcare, food and beverage, and transportation highlight their versatility. As urbanization, renewable integration, and automation grow, sectionalizers will remain essential for ensuring stable, efficient, and cost-effective power delivery worldwide.