Table of Contents

Introduction

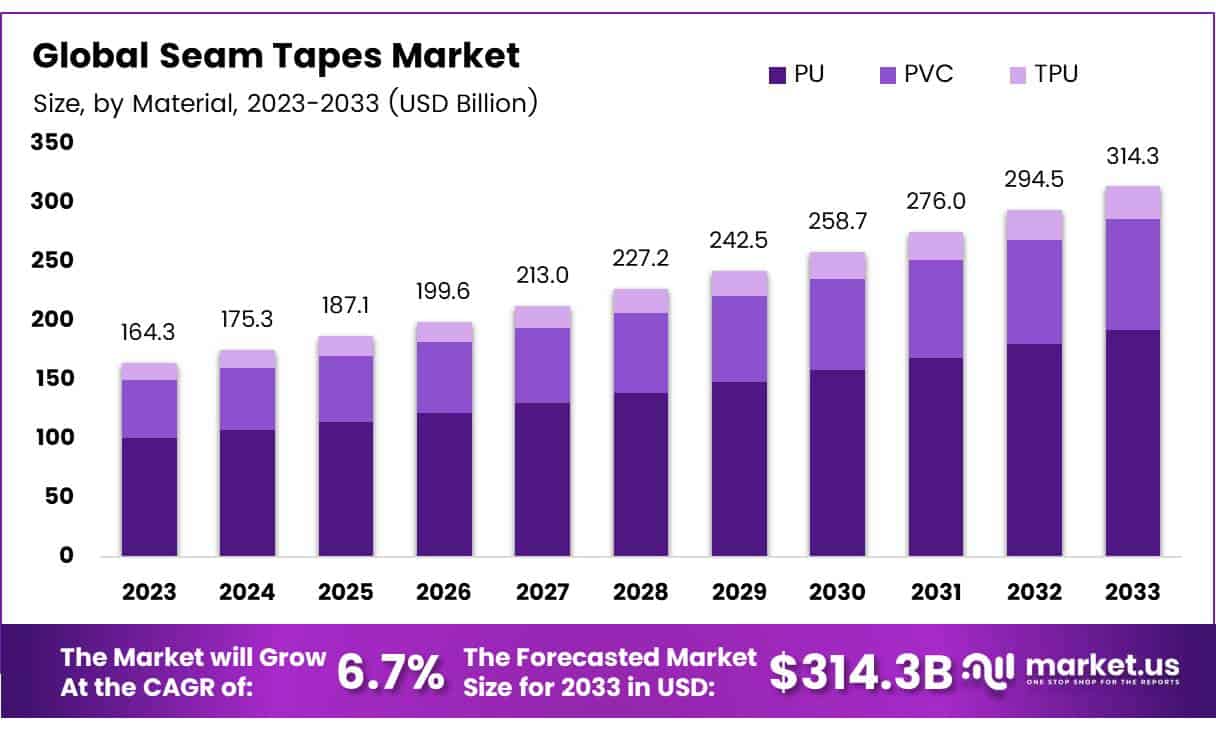

Impact of U.S. Tariffs on The Global Seam Tapes Market is projected to reach approximately USD 314.3 billion by 2033, rising from an estimated value of USD 164.3 billion in 2023. This growth is expected to occur at a compound annual growth rate (CAGR) of 6.7% during the forecast period from 2024 to 2033.

Seam tapes are specialized adhesive materials used primarily to seal the seams of fabric-based products, ensuring waterproofing, windproofing, and enhanced durability. These tapes are extensively employed across industries such as sportswear, outdoor apparel, protective gear, tents, footwear, and industrial workwear to prevent water and air penetration through stitched seams. The Seam Tapes Market refers to the global trade and application of these sealing solutions, which are critical in manufacturing high-performance textiles.

This market is witnessing steady growth, driven by the increasing demand for functional and technical textiles across sectors including outdoor sportswear, defense, medical PPE, and automotive upholstery. Rising awareness regarding worker safety, coupled with stricter regulations for personal protective equipment (PPE), is further augmenting the uptake of seam tapes. Additionally, the growth of the global outdoor and sportswear industry, fueled by rising disposable incomes and shifting consumer preferences towards high-performance, all-weather clothing, is contributing significantly to market expansion.

The market is also being shaped by advancements in seam tape materials such as polyurethane (PU) and polyvinyl chloride (PVC), which offer improved adhesion, flexibility, and environmental compliance. Asia-Pacific, particularly China and India, remains a high-potential region owing to expanding manufacturing bases and increased exports of functional garments.

Moreover, the rise in demand for lightweight, durable, and waterproof materials across diverse applications presents a robust opportunity for innovation and market penetration. As sustainability gains traction, manufacturers are also exploring eco-friendly seam tape variants, unlocking further avenues for growth. Thus, the Seam Tapes Market is positioned for sustained expansion, backed by functional demand and technological innovation.

Key Takeaways

- The global Seam Tapes Market is anticipated to reach a valuation of USD 314.3 billion by 2033, expanding at a compound annual growth rate (CAGR) of 6.7% during the forecast period.

- Polyurethane (PU) emerged as the leading material segment in 2023, capturing 64.3% of the market share, primarily due to its superior adhesive strength, flexibility, and enhanced performance in waterproof sealing applications.

- Waterproofing was the dominant application in 2023, accounting for 50.3% of the total market, supported by growing requirements across sectors such as outdoor apparel, technical textiles, and protective gear.

- The Apparel & Footwear segment held the largest end-use market share in 2023, contributing 36.5%, driven by rising demand for durable, water-resistant clothing and performance-oriented footwear.

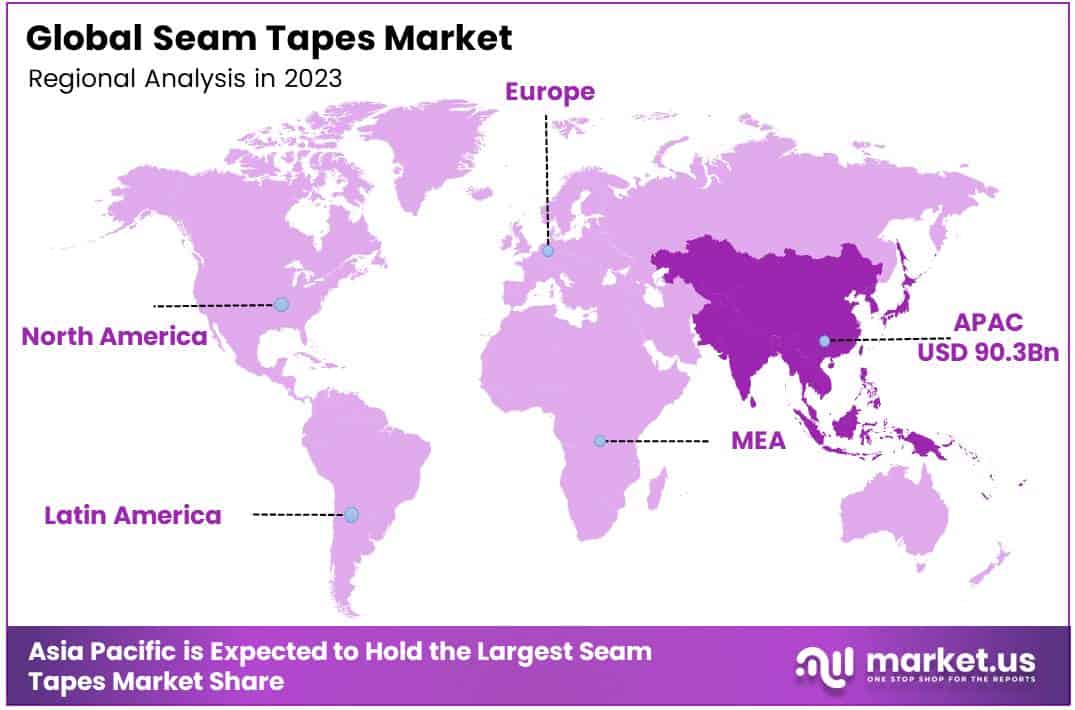

- Asia Pacific led the global market with a 55.4% share, representing USD 90.3 billion in 2023, fueled by robust manufacturing hubs, increasing export of garments, and expanding infrastructure in countries such as China, India, and Vietnam.

Request A Sample Copy Of This Report at https://market.us/report/seam-tapes-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 164.3 Billion |

| Forecast Revenue (2033) | USD 314.3 Billion |

| CAGR (2024-2033) | 6.7% |

| Segments Covered | By Material (PU, PVC, TPU), By Application (Waterproofing, Woven Fabrics, Non-Woven Fabrics, Others), By End Use (Apparel & Footwear, Healthcare, Automotive, Packaging, Others) |

| Competitive Landscape | 3M Company, Bemis Associates Inc., GCP Applied Technologies Inc., Framis Italia S.P.A., Koch Industries, Inc., Toray Industries Inc., San Chemicals, Ltd., Essentra PLC, Himel Corp., Sealon Co., Ltd., Loxy AS, Gerlinger Industries GmbH, Adhesive Films, Inc., DingZing Advanced Materials Inc., E. Textint Corp. |

Emerging Trends

- Sustainability Initiatives: There is a noticeable shift towards the adoption of eco-friendly and recyclable seam tapes, driven by increasing environmental awareness and regulatory pressures.

- Integration with Smart Textiles: Advancements in nanotechnology are facilitating the incorporation of seam tapes in smart textiles, enabling functionalities such as conductivity and sensor integration.

- Customization for Specific Applications: Manufacturers are focusing on developing seam tapes tailored to meet the unique requirements of various industries, enhancing product performance and user satisfaction.

- Growth in Emerging Economies: Countries in the Asia Pacific region, particularly India and China, are experiencing significant growth in the seam tapes market due to expanding manufacturing sectors and increasing demand for high-quality apparel.

- Technological Advancements in Adhesives: Continuous innovations in adhesive technologies are improving the bonding strength and durability of seam tapes, thereby broadening their application scope.

Top Use Cases

- Outdoor Apparel: Seam tapes are extensively used in outdoor clothing to provide waterproofing and enhance durability, catering to the growing demand for high-performance gear.

- Automotive Interiors: In the automotive industry, seam tapes are utilized for sealing and waterproofing components, contributing to vehicle durability and safety.

- Medical Protective Gear: The healthcare sector employs seam tapes in the production of medical protective equipment, ensuring waterproofing and structural integrity.

- Sports Footwear: Seam tapes are applied in sports footwear to enhance water resistance and comfort, meeting the demands of active consumers.

- Packaging Materials: In packaging, seam tapes are used to seal products, providing tamper evidence and ensuring product integrity during transit.

Major Challenges

- Environmental Regulations: Compliance with stringent environmental regulations necessitates the development of eco-friendly seam tapes, posing challenges in material selection and production processes.

- High Production Costs: The manufacturing of advanced seam tapes involves specialized materials and techniques, leading to higher production costs that may limit their adoption in cost-sensitive markets.

- Competition from Alternative Technologies: The emergence of alternative seamless technologies, such as seam welding, presents competition to traditional seam tapes, potentially affecting market share.

- Supply Chain Disruptions: Global supply chain challenges, including raw material shortages and logistical issues, can impact the availability and cost of seam tapes.

- Quality Control Issues: Ensuring consistent quality and adhesive performance across different batches of seam tapes remains a challenge, affecting product reliability and customer satisfaction.

Top Opportunities

- Expansion in Emerging Markets: There is a significant opportunity to tap into emerging markets, particularly in Asia Pacific, where urbanization and rising disposable incomes are driving demand for high-quality apparel and automotive products.

- Development of Sustainable Products: Investing in the development of biodegradable and recyclable seam tapes aligns with global sustainability trends and can cater to environmentally conscious consumers.

- Integration with Wearable Technologies: The growing trend of wearable electronics presents opportunities for seam tapes to be integrated into smart textiles, offering functionalities such as health monitoring and connectivity.

- Customization for Niche Applications: Developing seam tapes tailored for specific industries, such as aerospace and healthcare, can meet unique requirements and open new revenue streams.

- E-Commerce Growth: The expansion of e-commerce platforms provides a channel for small and medium enterprises to reach global markets, offering specialized seam tapes to a broader customer base

Key Player Analysis

The competitive landscape of the Global Seam Tapes Market in 2024 is marked by a strong presence of key players driving innovation and product development. 3M Company, a leading player, continues to leverage its vast R&D capabilities, offering high-performance seam tapes for various applications, including automotive and construction industries. Bemis Associates Inc. and GCP Applied Technologies Inc. are recognized for their advanced adhesive solutions, catering to the growing demand for eco-friendly and sustainable products.

Framis Italia S.P.A. and Koch Industries, Inc. have also established a solid foothold by delivering durable and flexible seam tape products suitable for demanding applications such as outdoor and medical markets. Companies like Toray Industries Inc. and San Chemicals Ltd. are pushing boundaries with innovative products focused on high-strength, high-adhesion tapes. Meanwhile, emerging players like Essentra PLC and Himel Corp. are rapidly expanding their presence by providing cost-effective and versatile solutions for various industries.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=136530

Top Key Players in the Market

- 3M Company

- Bemis Associates Inc.

- GCP Applied Technologies Inc.

- Framis Italia S.P.A.

- Koch Industries, Inc.

- Toray Industries Inc.

- San Chemicals, Ltd.

- Essentra PLC

- Himel Corp.

- Sealon Co., Ltd.

- Loxy AS

- Gerlinger Industries GmbH

- Adhesive Films, Inc.

- DingZing Advanced Materials Inc.

- E. Textint Corp.

Regional Analysis

Asia Pacific Dominating Region with Largest Market Share in Seam Tapes Market, 55.4% in 2024

The Asia Pacific region is expected to dominate the global Seam Tapes Market, holding a significant market share of 55.4% in 2024, with a market value of USD 90.3 billion. This strong presence is primarily driven by the growing demand for seam tapes in industries such as automotive, apparel, and construction, where the need for enhanced waterproofing and sealing solutions is rapidly increasing.

The region’s dominance can also be attributed to the thriving manufacturing sector, particularly in countries like China, India, and Japan, which are leading the production of high-performance tapes for both domestic use and export.

The rapid industrialization and urbanization in these countries have spurred a substantial demand for seam tapes, particularly in waterproof clothing, automotive, and building applications, where high-performance adhesives are essential. Additionally, the Asia Pacific region benefits from its cost-effective production capabilities and abundant raw materials, which contribute to the affordability and accessibility of seam tapes.

This has allowed the region to maintain its lead position in the global market. Furthermore, the increasing adoption of eco-friendly products in the region, coupled with advancements in tape technology, is expected to drive the demand for more sustainable and durable seam tapes.

In terms of economic factors, the impact of U.S. tariffs on imports, particularly from China, could affect the pricing and distribution of seam tapes in the Asia Pacific region. However, the region’s robust manufacturing base and strong domestic consumption are likely to mitigate these challenges, ensuring continued market growth. The competitive landscape in Asia Pacific is also marked by the presence of key global players and regional manufacturers, making it a dynamic and high-growth market segment. As such, Asia Pacific remains the most lucrative and dominant region in the seam tapes market, with a substantial contribution to the global market share in 2024.

Recent Developments

- In 2024, six fire departments in Maine received federal funding totaling over $1 million. U.S. Senator Susan Collins, serving as the Vice Chair of the Senate Appropriations Committee, revealed that these departments would use the funds to improve their protective gear and essential equipment. This financial support comes from the Fiscal Year 2023 Assistance to Firefighters (AFG) grant program, ensuring that local first responders have access to modern, upgraded tools to enhance their service capabilities.

- In November 2024, Honeywell (NASDAQ: HON) announced the sale of its Personal Protective Equipment (PPE) business to Protective Industrial Products, Inc. (PIP), a portfolio company backed by Odyssey Investment Partners. The deal, valued at $1.325 billion in cash, marks a strategic step for Honeywell in streamlining its portfolio. The company aims to focus on critical growth areas, including automation, aviation, and energy transition, aligning its investments with key global trends.

- In March 2024, Stellar Industrial Supply expanded its reach by acquiring USA Safety Supply, a Minnesota-based PPE distributor. This acquisition, which will finalize in July 2024, adds another regional hub to Stellar’s growing national network, now totaling 20 hubs. USA Safety Supply, known for its low back-order rates and strong relationships with over 250 manufacturers, strengthens Stellar’s position in the safety product market, allowing for broader distribution of its diverse range of industrial tools and products.

- In March 2024, Grünenthal, a prominent pharmaceutical leader in pain management, reported impressive financial growth for 2023. The company saw a 10% increase in net revenues, reaching €1.8 billion, despite a slight decline in adjusted EBITDA due to increased investments in future growth. Grünenthal has prioritized research and development, spending nearly €1 billion since 2017, and continues to expand its presence, particularly in the U.S. market.

Conclusion

The Seam Tapes Market is poised for sustained growth, propelled by the escalating demand for high-performance, waterproof, and durable textiles across various industries. Advancements in adhesive technologies and the increasing adoption of sustainable materials are further enhancing the functionality and environmental compatibility of seam tapes. The Asia Pacific region continues to lead the market, driven by robust manufacturing capabilities and expanding consumer markets in countries such as China and India. As industries continue to prioritize product performance and environmental responsibility, the seam tapes market is well-positioned to capitalize on these evolving trends, offering significant opportunities for innovation and expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)