Table of Contents

Overview

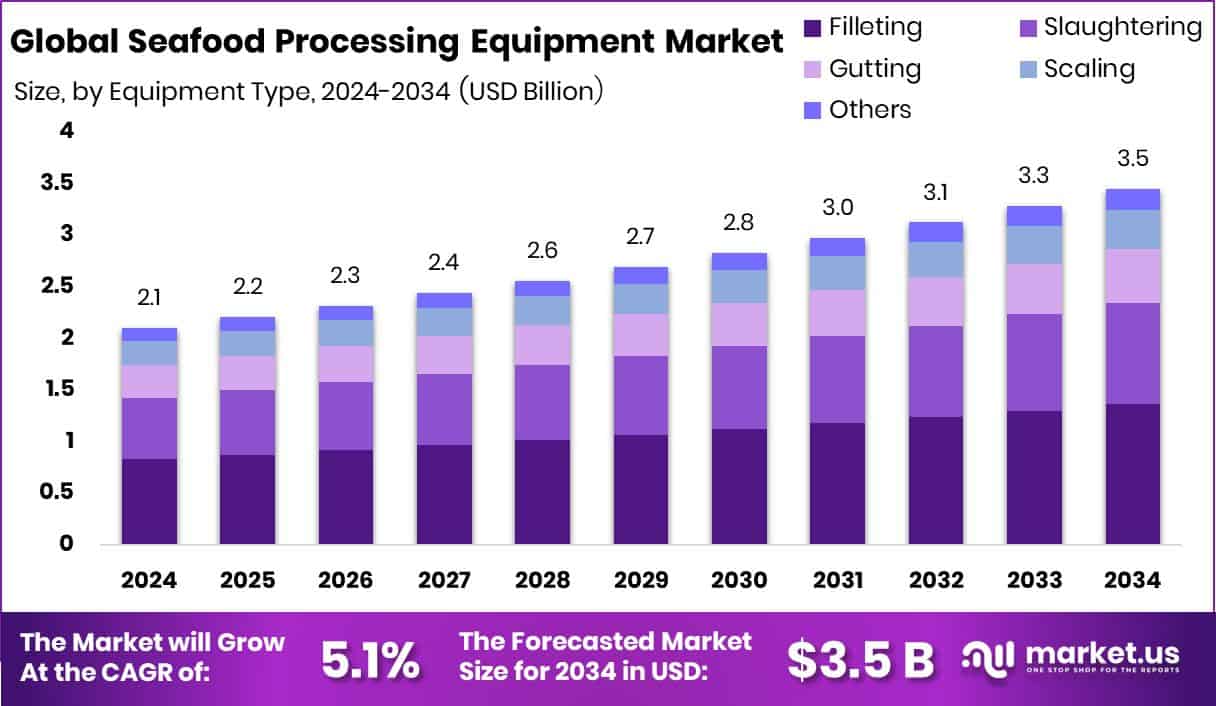

New York, NY – August 18, 2025 – The seafood processing equipment industry is set to reach USD 3.5 billion by 2034, up from USD 2.1 billion in 2024, reflecting a steady 5.1% CAGR from 2025 to 2034. In 2024, Asia Pacific dominated with a 44.7% share valued at USD 0.9 billion, largely due to the strong use of advanced technology in processing plants.

Equipment such as filleting machines, deboning units, graders, shell removal systems, freezing units, and packaging lines play a crucial role in improving hygiene, efficiency, and consistency. Investor confidence is visible, with Scout Canning raising USD 4 million to expand its canned seafood operations, while $50,000 innovation programs are supporting seafood-focused startups. Additionally, Gathered Foods secured USD 26.35 million to strengthen related food production capabilities.

Rising demand for seafood, valued for its protein and omega-3 content, continues to drive capacity expansion. Urban consumer preference for packaged and ready-to-eat seafood adds to equipment demand, supported by the growth of cold chain infrastructure in developing regions. At the same time, advances in automation, energy-saving freezing systems, and precision cutting are cutting operational costs while boosting output, positioning this sector for long-term expansion.

Key Takeaways

- The Global Seafood Processing Equipment Market is expected to be worth around USD 3.5 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- In 2024, filleting held 39.6% of the Seafood Processing Equipment Market.

- Fully Automatic systems captured a 67.9% share in the Seafood Processing Equipment Market.

- The Frozen Seafood segment accounted for 37.4% of the Seafood Processing Equipment Market.

- Seafood Processing Plants contributed 58.1% to the Seafood Processing Equipment Market share.

- Strong seafood consumption and aquaculture growth supported the Asia Pacific’s 44.7% share, reaching USD 0.9 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/seafood-processing-equipment-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.1 Billion |

| Forecast Revenue (2034) | USD 3.5 Billion |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Equipment Type (Filleting, Slaughtering, Gutting, Scaling, Others), By Automation Level (Manual, Fully Automatic), By Application (Frozen Seafood, Smoked Seafood, Canned Seafood, Dried Seafood, Surimi Seafood, Others), By End Use (Seafood Processing Plants, Restaurants and Foodservice, Retail) |

| Competitive Landscape | Arenco AB, Baader Group, Cabinplant A/S, Cretel NV, GEA Group AG, JBT Corporation, John Bean Technologies (JBT), Marel, Optimar AS, Raytec Vision S.p.A. |

➤ Directly purchase a copy of the report— https://market.us/purchase-report/?report_id=154627

Market Segments Analysis

By Equipment Type Analysis

In 2024, the filleting segment led the seafood processing equipment market by equipment type, holding a 39.6% share. This dominance highlights the importance of filleting machines in ensuring precision, reducing waste, and maintaining consistent product quality. As one of the most labor-intensive stages, automation in filleting has greatly improved efficiency while safeguarding product integrity.

Growing demand for boneless, ready-to-cook, and value-added seafood has accelerated the use of advanced systems, particularly in large-scale facilities. Modern equipment featuring sensors, vision technology, and programmable controls enhances hygiene, safety, and adaptability across different fish types.

The push to maximize yield per catch has made efficient filleting a major profitability driver. With rising aquaculture production and consistent consumer preference for uniform fillets, this segment is expected to sustain its strong position. Energy-efficient and compact models are gaining appeal, especially in export-driven regions where speed and accuracy are critical.

By Automation Level Analysis

In 2024, the fully automatic segment led the seafood processing equipment market by automation level, capturing a 67.9% share. This leadership stems from the industry’s move toward automation to meet higher production needs while ensuring consistent quality and strict food safety compliance.

Fully automatic systems cover key steps like cleaning, filleting, grading, freezing, and packaging with minimal human input, lowering labor costs and improving hygiene. Advancements such as AI-driven sorting, precision cutting, and integrated monitoring have boosted yields and reduced waste.

Large-scale exporters favor these systems for speed and uniformity, crucial for global trade, while rising demand for packaged and ready-to-cook seafood in urban markets has further driven adoption. With innovations in energy-efficient machinery and smart process controls, this segment is expected to retain its dominance as the top choice for modern seafood processors.

By Application Analysis

In 2024, the frozen seafood segment led the seafood processing equipment market by application, accounting for a 37.4% share. This dominance is fueled by rising demand for long shelf-life seafood that preserves freshness, flavor, and nutrients. Freezing remains vital for transporting and storing seafood across long distances, serving both domestic and export markets. Advanced systems like tunnel and plate freezers ensure rapid cooling, reducing ice crystal formation and maintaining texture.

The segment is further supported by increasing consumption in areas with limited fresh supply, as frozen products provide year-round access despite seasonal variations. Expanding cold chain infrastructure in emerging regions has boosted output and distribution, creating higher demand for efficient, high-capacity freezing equipment.

With consumers increasingly choosing convenience and ready-to-cook frozen meals, processors are adopting integrated freezing technologies that enhance efficiency and product consistency, solidifying frozen seafood’s leading position in the market.

By End Use Analysis

In 2024, seafood processing plants dominated the market by end use, holding a 58.1% share. Their leadership stems from large-scale operations that require advanced, high-capacity systems to meet domestic and international demand. These plants process significant volumes of raw seafood daily, making efficiency, consistency, and strict food safety compliance essential.

Integrated equipment lines covering cleaning, filleting, deboning, freezing, and packaging ensure smooth production with minimal interruptions. Growth is further fueled by rising aquaculture output, increasing seafood exports, and global demand for processed products. Automation adoption remains strong, reducing labor needs while enhancing yield and quality.

Investments in energy-efficient and water-saving solutions are also aligning operations with sustainability goals. With the capability to produce large, uniform, and high-quality volumes, seafood processing plants are central to equipment demand. Supported by technology upgrades and export-driven growth, this segment is set to retain its dominant role in the seafood value chain.

Key Market Segments

By Equipment Type

- Filleting

- Slaughtering

- Gutting

- Scaling

- Others

By Automation Level

- Manual

- Fully Automatic

By Application

- Frozen Seafood

- Smoked Seafood

- Canned Seafood

- Dried Seafood

- Surimi Seafood

- Others

By End Use

- Seafood Processing Plants

- Restaurants and Foodservice

- Retail

Regional Analysis

In 2024, the Asia Pacific led the seafood processing equipment market with a 44.7% share, valued at USD 0.9 billion. This dominance comes from its role as the largest global producer and exporter of seafood, supported by strong aquaculture sectors in China, India, Vietnam, and Indonesia. High domestic consumption, coupled with export demand to North America and Europe, has driven major investments in advanced processing systems.

Urbanization and shifting diets are boosting demand for packaged and ready-to-cook seafood, pushing the adoption of modern filleting, freezing, and packaging technologies. Government programs to modernize fisheries and strengthen cold chain logistics are also driving equipment upgrades.

Large processing hubs and favorable trade agreements have further advanced automation and energy-efficient solutions. With the ability to process high volumes while meeting strict quality standards, and with sustainability gaining focus, the Asia Pacific is expected to retain its lead in shaping global seafood processing equipment growth.

Top Use Cases

Spiral Freezer Boosting Throughput & Hygiene: A seafood company in Norway installed a Starfrost spiral freezer that processes up to 2,500 kg of fillets per hour. The automated system increases production capacity by ~35%, controls freezing temperatures precisely, reduces water usage dramatically, and maintains top-tier hygiene via an automated clean-in-place design.

Cobots for Sorting & Safety: Collaborative robots (cobots) work alongside humans to perform tasks like picking, packing, and quality sorting. These machines lower labor risks, offer flexibility (they’re easy to reprogram), and can adapt to changing production needs—helping processors maintain efficiency and safety even as market demand shifts.

Industry 4.0: AI, Vision, IoT for Smarter Processing: Seafood plants are increasingly using Industry 4.0 solutions like robotics, computer vision, AI, and IoT to automate sorting, cleaning, packing, and quality checks. These systems enhance efficiency, improve traceability, reduce waste, and support sustainable practices—transforming seafood production into intelligent, eco‑responsible operations.

On-Board Processing on Fishing Vessels: Modern fishing boats often act as floating factories. Right after catch, crews can gut, clean, freeze, and even fillet fish onboard, then vacuum-seal them. This approach preserves freshness, greatly reduces spoilage, and allows long-haul vessels to process sizable catches before returning to shore.

Top Key Players in the Market

- Arenco AB

- Baader Group

- Cabinplant A/S

- Cretel NV

- GEA Group AG

- JBT Corporation

- John Bean Technologies (JBT)

- Marel

- Optimar AS

- Raytec Vision S.p.A.

Recent Developments

- In November 2024, Baader secured a significant contract with Laxey, a land-based salmon farming company in Iceland, to deliver processing equipment for its new slaughterhouse project, strengthening Baader’s presence in high-volume aquaculture markets.

- In April 2024, Cabinplant A/S launched two notable innovations: a camera-operated vision system designed to improve fish sorting when integrated with filleting machines such as Baader or VMK, and a brown crab processing line offering adjustable speed and belt configurations. Both solutions attracted strong attention from industry visitors.

Conclusion

The seafood processing equipment market is set for steady growth, supported by rising global seafood consumption, expanding aquaculture production, and growing demand for ready-to-cook and packaged products. Advances in automation, precision cutting, and energy-efficient freezing systems are improving efficiency, reducing waste, and ensuring compliance with strict food safety standards.

Asia Pacific leads with strong aquaculture and export capabilities, while expanding cold chain infrastructure in emerging economies fuels further adoption. With sustainability and technology driving investments, the market is positioned for long-term expansion and competitiveness worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)