Table of Contents

Overview

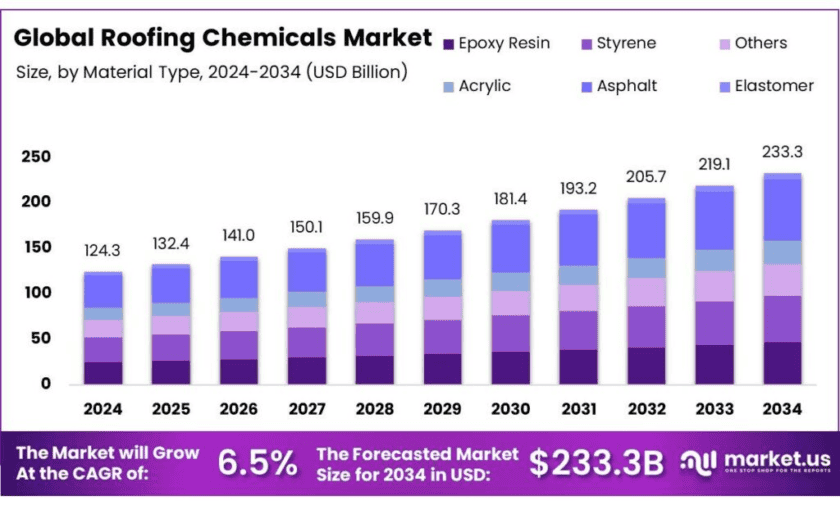

New York, NY – Nov 11, 2025 – In the global roofing chemicals market, the size is projected to expand from USD 124.3 billion in 2024 to USD 233.3 billion by 2034, reflecting a CAGR of approximately 6.5% over 2025-2034. In 2024, the Asia‑Pacific (APAC) region led with over a 42.8% share, equating to around USD 53.2 billion in revenue. Roofing chemicals—including bituminous compounds, elastomeric coatings, acrylics, polyurethanes, silicones, adhesives and primers—play a vital role in waterproofing, sealing, UV-protection, adhesion and enhancing durability of roofing systems.

Growth is driven by rapid urbanisation, infrastructure development and government housing programmes—e.g., India’s Pradhan Mantri Awas Yojana sanctioning 10 million houses in August 2023. Moreover, regulations such as the US Environmental Protection Agency (EPA) “Effluent Guidelines for Paving & Roofing Materials” and the Chemical Data Reporting (CDR) requirement heighten manufacturing oversight and raise barriers for chemical producers.

At the corporate level, for instance, BASF SE’s Coatings division achieved global sales of about €4.3 billion in 2024, highlighting how major chemical firms are exposed to related speciality façade & roofing chemical segments.

Key Takeaways

- Roofing Chemicals Market size is expected to be worth around USD 233.3 Billion by 2034, from USD 124.3 Billion in 2024, growing at a CAGR of 6.5%.

- Asphalt held a dominant market position, capturing more than a 28.9% share in the roofing chemicals market.

- Membrane Roofing held a dominant market position, capturing more than a 29.1% share in the roofing chemicals market.

- New Construction held a dominant market position, capturing more than a 59.6% share in the roofing chemicals market.

- Non-Residential held a dominant market position, capturing more than a 52.8% share in the roofing chemicals market.

- Asia Pacific region held a dominant position in the global roofing chemicals market, capturing more than a 42.8% share, translating to an estimated market value of USD 53.2 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-roofing-chemicals-market/free-sample/

Report Scope

| Market Value (2024) | USD 124.3 Bn |

| Forecast Revenue (2034) | USD 233.3 Bn |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Material Type (Epoxy Resin, Styrene, Others, Acrylic, Asphalt, Elastomer), By Roofing Type (Membrane Roofing, Elastomeric Roofing, Bituminous Roofing, Metal Roofing, Plastic (PVC) Roofing, Others), By Construction Type (New Construction, Re-Roofing), By End-Use (Residential, Non-Residential) |

| Competitive Landscape | Sika AG, BASF SE, The Dow Chemical Company, GAF Materials Corporation, Pidilite Industries, Akzo Nobel N.V., Owens Corning, Johns Manville, KARNAK Corporation, Asian Paints Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159869

Key Market Segments

By Material Type Analysis – Asphalt Leads with 28.9% Share in 2024

In 2024, asphalt dominated the global roofing chemicals market, securing a 28.9% share. Its strong market presence stems from exceptional durability, cost efficiency, and superior waterproofing performance, making it the preferred material across residential, commercial, and industrial roofing applications. The expansion of urban infrastructure and government-supported housing projects fueled its adoption, as builders prioritized long-lasting and low-maintenance roofing systems.

By Roofing Type Analysis – Membrane Roofing Holds 29.1% Share in 2024

Membrane roofing emerged as the top roofing type in 2024, accounting for a 29.1% share of the global roofing chemicals market. Its dominance is driven by high flexibility, waterproofing efficiency, and ease of installation, making it particularly suitable for flat roofs in both commercial and residential buildings. The segment gained significant traction as infrastructure projects increasingly favored solutions offering long-term leak protection and weather resistance.

By Construction Type Analysis – New Construction Dominates with 59.6% Share in 2024

In 2024, new construction projects represented the largest segment, accounting for 59.6% of the global roofing chemicals market. This dominance was driven by rapid urbanization, large-scale infrastructure investments, and government housing initiatives, all of which spurred demand for advanced roofing materials. Roofing chemicals used in new construction offer superior waterproofing, structural protection, and energy efficiency, making them essential for modern residential and commercial buildings.

By End-Use Analysis – Non-Residential Segment Leads with 52.8% Share in 2024

The non-residential sector held the leading position in 2024, capturing a 52.8% share of the roofing chemicals market. This growth was propelled by robust demand from commercial buildings, industrial facilities, and institutional structures requiring durable and weather-resistant roofing systems. Non-residential applications rely on roofing chemicals for enhanced waterproofing, UV stability, and load-bearing performance, ensuring protection against environmental and operational stresses.

List of Segments

By Material Type

- Epoxy Resin

- Styrene

- Others

- Acrylic

- Asphalt

- Elastomer

By Roofing Type

- Membrane Roofing

- Elastomeric Roofing

- Bituminous Roofing

- Metal Roofing

- Plastic (PVC) Roofing

- Others

By Construction Type

- New Construction

- Re-Roofing

By End-Use

- Residential

- Non-Residential

Regional Analysis

In 2024, the Asia-Pacific (APAC) region dominated the global roofing chemicals market, accounting for a 42.8% share, valued at approximately USD 53.2 billion. This strong regional leadership is largely driven by rapid urbanization, extensive infrastructure expansion, and proactive government housing initiatives aimed at improving urban development. Major economies such as China and India play pivotal roles in this growth through extensive construction activity and industrial modernization. Notably, China alone contributed nearly 66% of the regional market value in 2024, supported by significant public investments in infrastructure renewal, smart cities, and construction chemicals. This robust construction pipeline continues to reinforce Asia-Pacific’s position as the primary hub for roofing chemical demand and innovation.

Top Use Cases

Waterproofing And Leak Prevention: Roofing chemicals such as bituminous membranes, sealants and elastomeric coatings are widely used to prevent water ingress and roof damage. For example, bituminous roofing chemicals held about 39% share of the global roofing chemicals market in 2024. Buildings that experience frequent rain, ponding water on flat roofs or freeze-thaw cycles benefit from these additives, which extend roof life by reducing cracks, blisters or membrane detachment. From a market-analyst view: specifying high-performance waterproofing chemicals reduces whole-life maintenance cost for owners and helps them avoid mid-life re-roofing.

Energy Efficiency And Cool Roofs: Reflective coatings and other roofing chemical formulations are increasingly used to improve energy efficiency. Studies show that retrofitting a dark roof with a high-reflectance surface delivered an 11% reduction in aggregate air-conditioning energy consumption in one U.S. case. In the broader market, the roofing chemicals market was valued at ≈ USD 98.6 billion in 2024 and expected to reach USD 138.1 billion by 2030 (CAGR ~5.8%).

Retrofit And Roof-Life Extension: Many existing roofs are entering end-of-service-life, driving demand for chemical upgrades rather than full replacement. In mature markets, re-roofing with advanced polymer-modified membranes and coatings is becoming standard. This use-case matters because it means chemical companies can address existing building stock— not just new builds—giving steady demand and enabling longer warranties and performance guarantees.

Industrial And Harsh-Environment Roofs: Roofing chemicals also play a crucial role in industrial or infrastructure settings where roofs face chemical exposure, extreme weather or heavy foot-traffic. Additives like anti-fungal agents, fire-retardants, and UV stabilizers are included in coatings for such use-cases. For instance, the product-type segmentation shows “Other Additives (Fire Retardants, Anti-Fungal Agents, Cool Roof Additives)” gaining traction globally. companies supplying specialized chemicals for industrial roofs can command higher margins and face less commoditization than standard residential coatings.

Sustainable And Low-VOC Formulations: Environmental regulations and green-building standards are increasingly shaping the choice of roofing chemicals. For example, in Europe and North America, building codes and certification schemes (such as LEED or BREEAM) favour low-VOC, recyclable and energy-efficient roof coatings. The Asia-Pacific region captured around 44.54% of revenue share in 2024 within the roofing chemicals market. The opportunity here is for chemical firms and roofing system suppliers to develop “green” formulations that meet sustainability metrics, helping builders achieve carbon-reduction goals while delaying roof replacements.

Recent Developments

Sika AG, headquartered in Switzerland, produces a broad range of construction-chemicals including adhesives, sealants and roof-waterproofing systems used in roofing applications. In 2024 the company reported net sales of CHF 11,763.1 million, an increase from CHF 11,238.6 million in 2023. Their roofing-chemicals segment benefits from growing demand in infrastructure and renovation, and the firm has succeeded in improving its material margin to 54.5% in 2024.

BASF SE, the German chemical giant, develops specialized polymers and coatings for roofing systems—such as liquid elastomeric roof coatings and reflective additives—under its construction-solutions arm. While roofing-specific revenue isn’t broken out publicly, BASF’s “Surface Technologies” segment posted sales of €16,204 million in 2023. BASF’s solutions for flexible roof coatings (e.g., Acronal® PLUS 7544) underline its focus on durable, climate-adaptive roofing materials in both new build and retrofit markets.

Dow reported full-year net sales of US $44.6 billion in 2023, down from US $56.9 billion in 2022, with GAAP net income of US $660 million. The company supplies key chemical components for roofing-chemicals applications—such as polymer emulsions, adhesives and sealants—which supports roofing membrane and coating markets globally. As a market analyst, Dow’s broad chemical-portfolio, combined with global manufacturing presence across 160 + countries, gives it a strong base to serve construction-quality and regulatory-driven roofing chemistry demands.

GAF, North America’s largest roofing-materials manufacturer, offers roofing membranes, coatings and accessories including roofing-chemicals systems that support waterproofing and durability. While specific chemical-segment revenue is not publicly broken out, GAF’s parent asserts its leadership in roofing manufacturing and product innovation at over 30 U.S. locations with more than 5,000 employees. GAF’s strength lies in its integrated offering—from substrate to coating—and its ability to influence specification choices in the roofing chemicals chain, positioning it as a key channel partner for chemical suppliers targeting the roofing construction sector.

Pidilite Industries has steadily grown its presence in the roofing-chemicals segment through its “Dr. Fixit” waterproofing range and polymer-modified coatings tailored for Indian construction. In fiscal year 2023-24 it reported revenue of ₹125,226 million (versus ₹118,487 million in FY 2022-23), growing by ~5.7%. The company’s focus on construction chemistry and sealing solutions aligns with growing demand for durability and retrofit in booming infrastructure markets, positioning it well among roofing-chemical peers.

Akzo Nobel, a global coatings and chemicals leader, supports roofing-chemicals market through specialty coatings and weather-resistant systems used in roof membranes and protective surfaces. For full-year 2023 the company reported revenue of €10,668 million, up ~5% in constant currencies, with operating income rising to €1,029 million. As a market-research analyst while roofing-specific data isn’t isolated, Akzo Nobel’s broad construction-chemicals platform gives it scale and innovation strength, enabling it to meet evolving roofing material needs in many geographies.

Owens Corning, a U.S.-based building‐materials firm, reported full-year net sales of US$9.677 billion in 2023 and noted that its Roofing segment accounted for about 40% of total revenues. The Roofing net sales rose 10% to approximately US$4.0 billion in 2023 versus the prior year, driven by strong storm-activity, favourable mix and pricing. As a market research analyst, Corning’s roofing-chemicals and membrane lines are benefitting from heightened repair/maintenance demand and resilient building-material budgets, positioning the company well in the roofing chemicals space.

Johns Manville, a subsidiary of Berkshire Hathaway and a player in commercial roofing systems and waterproofing chemicals, recorded annual revenues of around US$4.0 billion in 2023. The company emphasizes premium-quality membranes, coatings and insulation solutions for roofing and construction markets. From an analyst viewpoint, Johns Manville’s focus on roofing chemicals tied to building protection and its strong backing by a large parent firm give it a stable base to expand in retrofit and specification-driven markets.

Conclusion

In conclusion, the market for roofing chemicals is clearly at a strong turning point. Builders and facility managers face larger challenges—such as heavier storms, stricter regulations and rising energy costs—so high-performance sealants, coatings and additives aren’t just optional—they’re essential. Asia-Pacific’s strong urbanisation and refurbishment demand further accelerate adoption. While raw-material volatility and installation costs remain constraints, roofing-chemical suppliers that offer low-VOC, reflective, waterproofing solutions capable of extending roof life are well-positioned.

In short, roofing chemicals have moved beyond being a small niche item to a strategic enabler of building longevity and sustainability—and companies that can deliver performance, regulatory compliance and cost-effectiveness will capture the growth ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)