Table of Contents

Overview

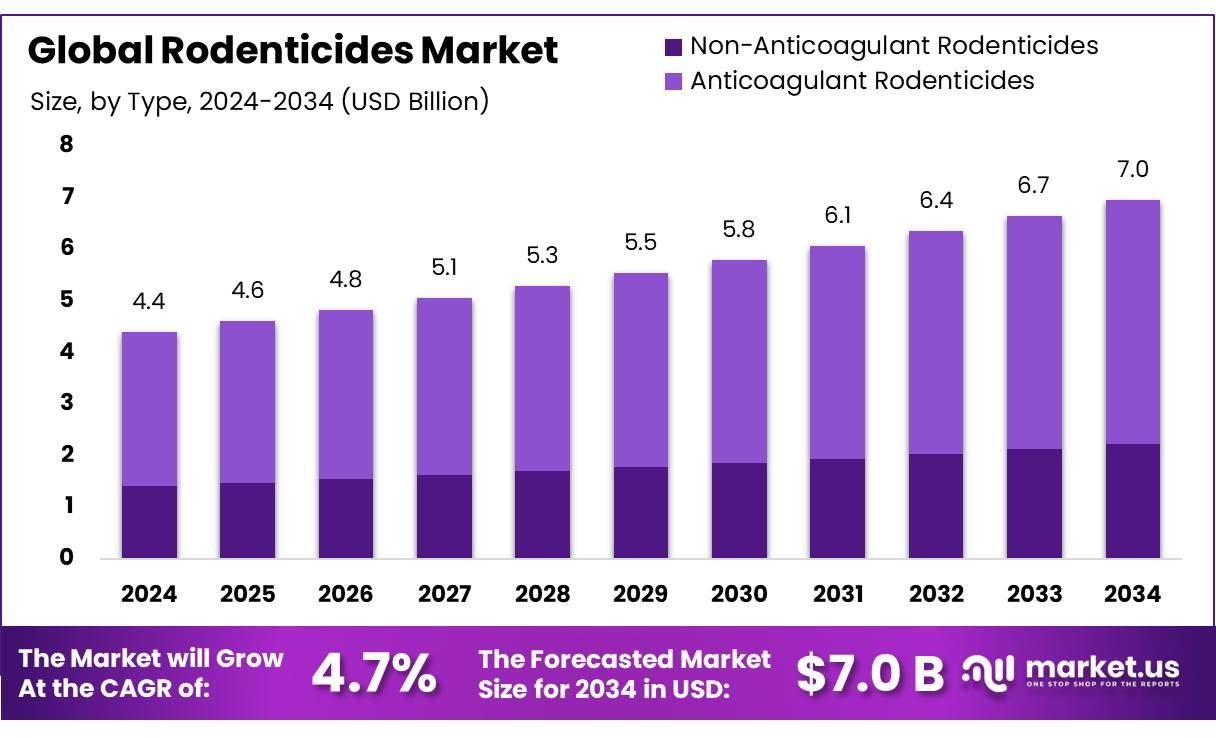

New York, NY – September 15, 2025 – The Global Rodenticides Market is projected to grow from USD 4.4 billion in 2024 to approximately USD 7.0 billion by 2034, achieving a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024, North America led the market, securing a 47.8% share with USD 2.1 billion in revenue.

The rodenticides sector is a vital component of the global pest control industry, offering chemical, mechanical, and biological solutions to manage rodent populations that threaten agriculture, public health, and infrastructure. Rodenticides are primarily divided into anticoagulants, which impair blood clotting, and non-anticoagulants, which provide rapid rodent elimination.

Rising urban sanitation needs and public health concerns drive demand. The CDC reports approximately 1 million annual human leptospirosis cases globally, with around 60,000 fatalities. In New York City, 24 cases were recorded in 2023, with additional cases in early 2024, prompting intensified local rodent control efforts.

Institutional buyers, including municipalities and pest control professionals, are consistent purchasers of professional-grade rodenticide concentrates. However, environmental concerns, such as anticoagulants found in 86% of sampled turkey vultures in Oregon, are pushing the industry toward integrated pest management (IPM), safer bait stations, and non-anticoagulant alternatives.

The U.S. Environmental Protection Agency (EPA) significantly shapes the market through the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), ensuring rodenticides meet safety standards for humans, pets, and wildlife. In November 2024, the EPA issued a final biological evaluation for 11 rodenticide active ingredients, introducing mitigation measures to minimize risks. These regulations are expected to spur innovation in safer, more effective rodenticide formulations.

Key Takeaways

- Rodenticides Market size is expected to be worth around USD 7.0 billion by 2034, from USD 4.4 billion in 2024, growing at a CAGR of 4.7%.

- Anticoagulant Rodenticides held a dominant market position, capturing more than a 67.9% share of the rodenticides market.

- Pellets held a dominant market position, capturing more than a 48.1% share of the global rodenticides market.

- Agricultural Fields held a dominant market position, capturing more than a 39.3% share of the global rodenticides market.

- North America emerged as the leading region in the global rodenticides market, holding a substantial 47.8% share, valued at around USD 2.1 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-rodenticides-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.4 Billion |

| Forecast Revenue (2034) | USD 7.0 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Type (Non-Anticoagulant Rodenticides, Bromethalin, Cholecalciferol, Zinc Phosphide, Strychnine, Anticoagulant Rodenticides), By Form (Pellets, Powders, Sprays, Others), By Application (Agricultural Fields, Warehouse, Pest Control Companies, Others) |

| Competitive Landscape | BASF SE, UPL, Ecolab, Rollins, Inc., PelGar International, Bayer AG, Neogen Corporation, Rentokil Initial plc, Liphatech, Inc., Bell Laboratories Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155442

Key Market Segments

By Type

In 2024, anticoagulant rodenticides commanded a leading 67.9% share of the global rodenticides market, driven by their proven efficacy in controlling rodent populations across agricultural, urban, and industrial environments. Second-generation anticoagulants like brodifacoum, bromadiolone, and difenacoum are favored by pest control professionals for their high potency and effectiveness against resistant rodent strains.

The U.S. Environmental Protection Agency (EPA) regulates these active ingredients with strict guidelines, including updated 2024 label restrictions under its nationwide rodenticide mitigation strategy to reduce risks to non-target species. Similarly, the European Chemicals Agency (ECHA) emphasized its critical role in high-reinvasion areas, such as food storage and processing facilities, through its 2024 comparative assessment.

By Form

Pellets dominated the rodenticides market in 2024 with a 48.1% share, valued for their ease of use, long shelf life, and high appeal to rodents. Their design supports consistent dosing and versatile application in bait stations or targeted areas, minimizing waste. In agriculture, pellets protect stored grains and field crops, addressing up to 20% of post-harvest losses in some regions, as reported by the FAO. In urban settings, their weather-resistant stability ensures effective year-round pest control.

By Application

Agricultural fields accounted for a 39.3% share of the global rodenticides market in 2024, driven by the need to protect crops and stored produce from rodent damage. Rodents threaten seeds, irrigation systems, and harvested grains, contributing to up to 20% post-harvest losses in certain regions, according to the FAO. Farmers depend on rodenticides to safeguard high-value crops like cereals, vegetables, and pulses, ensuring both yield quality and marketability.

Regional Analysis

North America led the global rodenticides market in 2024, capturing a 47.8% share valued at approximately USD 2.1 billion. This leadership stems from the region’s urbanized population, advanced agriculture, and robust public health initiatives targeting rodent-borne diseases. The EPA’s 2024 rodenticide mitigation strategy balances efficacy and environmental safety, ensuring access for professional users in agriculture, food processing, and urban pest control.

Major U.S. cities, including New York, Chicago, and Los Angeles, allocate significant budgets for rodent eradication programs. In agriculture, rodents pose challenges to grain storage and livestock operations in states like Iowa, Nebraska, and Kansas, with the USDA noting their impact on domestic and export markets. In Canada, agricultural regions like Saskatchewan and Alberta rely on rodenticides to protect grain silos and rangelands from burrowing rodents.

Top Use Cases

- Agricultural Crop Protection: Farmers use rodenticides to safeguard crops from rodents like rats and mice that chew through plants and stored grains, leading to major yield losses. By placing baits in fields and silos, these products help maintain food supplies and boost farm profits, ensuring steady harvests even in high-infestation areas.

- Residential Home Defense: Homeowners apply rodenticides in garages, attics, and basements to stop rats and mice from nesting and spreading diseases. These easy-to-use baits reduce property damage from gnawing on wires and walls, creating safer living spaces and cutting down on costly repairs for families in urban suburbs.

- Commercial Food Storage Security: Warehouses and food processing plants deploy rodenticides to protect inventory from rodent contamination, which can spoil goods and violate health codes. Targeted bait stations keep rodents away from pallets and conveyor belts, helping businesses avoid fines and recalls while upholding hygiene standards in busy operations.

- Urban Infrastructure Maintenance: City managers use rodenticides along sewers, parks, and alleys to control rat populations that carry illnesses and damage public utilities. This prevents outbreaks and structural wear, supporting cleaner streets and healthier communities without disrupting daily life in densely packed neighborhoods.

- Wildlife Habitat Management: In natural reserves and farms near woods, rodenticides target invasive rodents like squirrels and gophers that harm native plants and burrow into soil. Applied carefully in burrows, they preserve ecosystems and protect endangered species, balancing pest control with environmental care for long-term biodiversity.

Recent Developments

1. BASF SE

BASF is advancing integrated pest management with its Selontra rodenticide, containing the fast-acting active ingredient cholecalciferol (Vitamin D3). Recent developments focus on its high efficacy against resistant rodents and favourable environmental profile, breaking down quickly upon exposure to sunlight. BASF emphasises its use in professional baiting programs for effective resistance management.

2. UPL

UPL has strengthened its rodenticide portfolio through the acquisition of the Zodiac range from BASF’s professional pest control portfolio. This strategic move integrates well-known brands like Storm and Terralax into their offerings. Recent efforts are focused on expanding market access and promoting these solutions, which include second-generation anticoagulants and non-anticoagulant options, to a broader global professional customer base.

3. Ecolab

Ecolab focuses on digital innovation and service. Their recent developments include integrating rodenticide use with advanced monitoring technology like the Ecolab Pest Elimination Portal. This provides data-driven insights, allowing for more targeted and reduced rodenticide application. Their approach emphasises prevention and precision, aligning with sustainable pest management goals and reducing overall chemical reliance.

4. Rollins, Inc. (Orkin)

Rollins, operating through Orkin, leverages technology to enhance rodent control. Their recent A.I.-powered Radar service uses smart traps and remote monitoring to detect rodent activity early. This allows for precise, minimal use of rodenticides only when and where necessary, moving towards a more responsive and environmentally conscious approach to population management as part of a broader Integrated Pest Management strategy.

5. PelGar International

PelGar continues to develop and market a wide range of rodenticides, including blocks, grains, and pastes. A key recent focus is on their non-anticoagulant product lines, such as those containing Vitamin D3 and calcium carbonate, which are crucial for managing rodenticide resistance. They emphasise providing effective, versatile solutions for both professional and agricultural markets globally.

Conclusion

The Rodenticides Market is steadily expanding, driven by rising urban growth and agricultural demands that amplify rodent threats worldwide. Innovations like eco-friendly baits and biological alternatives are gaining traction to meet stricter safety rules. As a market research analyst, I see strong opportunities in sustainable solutions that align with consumer preferences for greener pest control, promising reliable returns for stakeholders focused on effective, low-risk products.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)