Table of Contents

Introduction

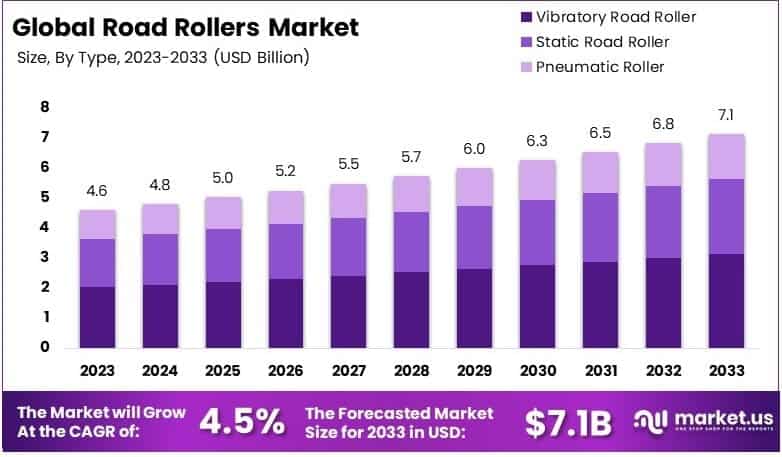

The global road rollers market is projected to reach a value of approximately USD 7.1 billion by 2033, up from USD 4.6 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 4.5% over the forecast period from 2024 to 2033.

oad rollers, also known as compaction rollers, are heavy construction equipment used to compact soil, asphalt, concrete, or other materials during construction and road-building projects. These machines are typically employed in the construction of highways, airports, dams, and other infrastructure projects, ensuring the ground is solid and stable. The road rollers market refers to the global industry involved in the manufacturing, distribution, and sales of these heavy machines.

This market is influenced by various factors, including advancements in construction technologies, increased demand for infrastructure development, and growing urbanization worldwide. The market’s growth is driven by several key factors, such as the rapid expansion of road networks, particularly in emerging economies, the rising demand for sustainable and efficient construction equipment, and the need for road maintenance due to aging infrastructure. Additionally, the market benefits from an increase in public and private investments in large-scale infrastructure projects, as governments and organizations prioritize transportation networks.

The demand for road rollers is also supported by the growing adoption of automated and advanced roller models, designed to improve operational efficiency and reduce environmental impact. Opportunities in the road rollers market lie in the continued shift towards energy-efficient and eco-friendly machines, which meet stricter environmental regulations. Furthermore, the growing focus on smart construction technologies and the rise in private sector investments in road and infrastructure projects open new avenues for manufacturers, allowing them to expand their product offerings and reach untapped regional markets.

Key Takeaways

- The Road Rollers Market was valued at USD 4.6 billion in 2023 and is projected to reach USD 7.1 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.5%.

- In 2023, the Vibratory Road Roller segment led the market, owing to its superior efficiency in compacting uneven surfaces, which enhances operational outcomes.

- The 8–15 Ton capacity segment dominated the market in 2023, driven by its versatility in medium-scale construction projects.

- The Construction application segment represented 38.2% of the market share in 2023, largely attributed to the increasing infrastructure development across various regions.

- North America held the largest market share in 2023, accounting for 36.3% of the total market, valued at USD 1.67 billion, driven by robust construction activities in the region.

Delve into Sector-Wise Impact Assessments of US Trade Tariffs https://market.us/report/road-rollers-market/request-sample/

Road Rollers Statistics

The imposition of U.S. tariffs on imported construction equipment and materials has had a significant impact on the road roller market, affecting both manufacturers and end-users.

Cost Increases and Supply Chain Disruptions

The reinstatement and expansion of tariffs, including a 25% levy on steel and aluminum imports, have led to increased production costs for road rollers, which rely heavily on these materials. Manufacturers like Caterpillar have reported additional costs ranging from $250 million to $350 million in a single quarter due to tariffs, prompting measures such as reduced discretionary spending and delayed shipments of tariff-affected imports .

These tariffs have also disrupted supply chains, causing delays and shortages in key components necessary for road roller production. The increased demand for domestically sourced materials, as companies attempt to mitigate tariff impacts, has further strained supply chains, leading to longer lead times and higher prices .

Market Adjustments and Strategic Responses

In response to these challenges, companies are exploring strategies such as reshoring manufacturing operations to the U.S. and diversifying their supplier base to reduce reliance on countries affected by tariffs. This shift aims to enhance supply chain resilience and mitigate the financial impact of tariffs .

However, these adjustments come with their own set of challenges, including the need for significant capital investment and potential increases in operational costs. The uncertainty surrounding future tariff policies continues to pose risks for long-term planning and investment in the road roller market.

Impact on End-Users and Construction Projects

The increased costs associated with tariffs are often passed down to end-users, leading to higher prices for road rollers and construction projects. This has the potential to slow down infrastructure development, as budget constraints may delay or scale back projects. Additionally, the financial burden may shift preferences toward renting equipment or purchasing used machinery, impacting new equipment sales .

Emerging Trends

- Integration of Smart Technologies: Modern road rollers are increasingly equipped with GPS, telematics, and automated control systems, enhancing operational efficiency and precision in compaction processes.

- Adoption of Electric and Hybrid Models: To meet environmental standards, there is a growing preference for electric and hybrid road rollers, which offer reduced emissions and lower operational costs.

- Focus on Operator Safety and Comfort: Manufacturers are incorporating advanced safety features and ergonomic designs to improve operator comfort and reduce fatigue, thereby enhancing productivity.

- Rise of Autonomous and AI-Driven Rollers: The development of autonomous road rollers, utilizing AI and machine learning, is streamlining operations and reducing human error in compaction tasks.

- Shift Towards Rental Services: An increasing number of construction firms are opting for road roller rentals, driven by cost-effectiveness and the flexibility to access advanced machinery without substantial capital investment.

Top Use Cases

- Urban Infrastructure Development: Road rollers are essential in the construction of roads, highways, and bridges, ensuring the durability and stability of urban infrastructure projects.

- Airport Runway Construction: The aviation sector utilizes road rollers for the construction and maintenance of runways, requiring precise compaction to withstand heavy aircraft loads.

- Industrial Facility Construction: In the establishment of industrial complexes, road rollers are employed to prepare stable foundations, facilitating the construction of factories and warehouses.

- Mining and Quarry Operations: Road rollers are utilized in mining and quarrying activities to compact haul roads, ensuring safe and efficient transportation of materials.

- Maintenance of Existing Road Networks: Regular maintenance of roads involves the use of road rollers to repair and resurface existing pavements, extending their lifespan and improving safety.

Major Challenges

- High Initial Investment Costs: The substantial capital required to purchase road rollers can be a barrier for small and medium-sized enterprises, limiting their access to advanced machinery.

- Fuel Price Volatility: Fluctuating fuel prices impact the operational costs of road rollers, affecting the overall budget of construction projects.

- Shortage of Skilled Operators: The demand for trained personnel to operate advanced road rollers exceeds supply, leading to potential delays and increased training costs.

- Stringent Environmental Regulations: Compliance with evolving environmental standards necessitates continuous innovation and investment in cleaner technologies.

- Competition from Alternative Technologies: Emerging compaction methods and materials present competition to traditional road rollers, requiring adaptation and innovation within the market.

Top Opportunities

- Expansion in Emerging Markets: Rapid urbanization in regions like Asia-Pacific presents significant opportunities for road roller manufacturers to tap into new markets.

- Development of Eco-Friendly Models: Investing in the creation of low-emission and electric road rollers aligns with global sustainability goals and attracts environmentally conscious consumers.

- Integration of Telematics and IoT: Incorporating telematics and IoT technologies enables real-time monitoring and predictive maintenance, enhancing operational efficiency.

- Collaboration and Strategic Partnerships: Forming alliances with regional distributors and technology providers can facilitate market entry and innovation, expanding product offerings.

- Focus on Rental and Leasing Models: Developing flexible rental and leasing options caters to the growing demand for cost-effective access to advanced road rollers.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=131532

Key Player Analysis

Caterpillar Inc., a key player in the global road rollers market, maintains a dominant presence through its extensive portfolio of heavy equipment designed for high efficiency and durability. The company is leveraging advanced technology in its machines, ensuring a blend of productivity and sustainability. JC Bamford Excavators Ltd. (JCB) is another significant player, offering a wide range of road rollers known for their versatility and user-friendly features, catering to various construction applications. BOMAG GmbH and Wirtgen Group, part of the same parent company, are renowned for their innovative compaction solutions, with a focus on enhancing performance and fuel efficiency.

Additionally, companies like Dynapac and Sakai Heavy Industries are pushing the envelope on technological advancements in vibration and compaction control systems. XCMG, Volvo, and KOMATSU stand out for their global reach and comprehensive product offerings. Their strategic focus on expanding manufacturing capabilities and improving product quality positions them to capitalize on growing infrastructure development globally

Key Players in the Market

- Caterpillar Inc.

- JC Bamford Excavators Ltd. (JCB)

- BOMAG GmbH

- Wirtgen Group

- Speedcrafts Limited

- XCMG Construction Machinery Co., Ltd.

- Xiamen XGMA Machinery Co., Ltd.

- Sakai Heavy Industries, Ltd.

- Dynapac

- Volvo Construction Equipment

- Shantui Construction Machinery Co., Ltd.

- Hamm AG

- KOMATSU Ltd.

- LiuGong Machinery Co., Ltd.

- Doosan Infracore

Regional Analysis

North America Dominating Region in Road Rollers Market with Largest Market Share of 36.3%

The North American road rollers market is projected to dominate the global landscape, capturing a market share of 36.3% in 2024, valued at USD 1.67 billion. The region’s growth is primarily driven by robust infrastructure development, government investments in road construction, and increasing demand for modernized heavy machinery. North America’s road rollers market is supported by the expansion of transportation networks and significant road rehabilitation projects, particularly in the United States and Canada. The increasing need for efficient compaction solutions in construction and road maintenance is further boosting market demand.

The U.S. stands out as a major contributor to the region’s growth, with its advanced construction industry and widespread use of road rollers in large-scale infrastructure projects. As one of the largest markets globally, the U.S. market faces an added complexity due to the ongoing impact of tariffs. U.S. tariffs on steel and other raw materials have resulted in higher equipment costs, which could potentially slow the adoption of road rollers in certain construction sectors. However, this challenge is mitigated by a steady demand for machinery in public infrastructure projects, which continue to drive growth in the region. Despite tariff-induced price hikes, the North American road rollers market remains resilient, further reinforced by technological advancements, such as the integration of intelligent compaction systems that improve operational efficiency.

Recent Developments

- In 2024, Construction Partners, Inc. announced its plan to acquire Lone Star Paving, a Texas-based company known for its asphalt production and road construction services. The deal strengthens CPI’s presence in central Texas, expanding its operations through Lone Star’s 10 asphalt plants, 4 aggregate sites, and 1 liquid asphalt terminal. This strategic move supports CPI’s growth strategy across southeastern U.S. markets and is expected to boost its annual revenue and earnings from fiscal 2025.

- In 2024, SANY India participated in Bauma Conexpo 2024 with a powerful message titled “Chariots of Development.” The company highlighted its advanced machinery and commitment to supporting India’s infrastructure goals under the Viksit Bharat 2047 vision. The equipment on display showcased SANY’s focus on productivity, innovation, and sustainable development in the construction sector.

- In 2024, Caterpillar continued its investment in artificial intelligence by building on decades of internal development. The company reflected on its early use of autonomous mining trucks in Texas more than 30 years ago. Today, Caterpillar is leveraging that foundation to enhance safety and efficiency in modern construction and mining through smart systems powered by AI.

- In 2024, Volvo CE introduced a range of new products and technologies during the Volvo Days event in Eskilstuna, Sweden. As part of its shift toward a more sustainable and digital future, the company showcased electric and conventional equipment, new digital solutions, and emphasized its global sustainability goals. This event marked the first major product launch since naming Eskilstuna as its corporate headquarters.

Conclusion

The global road rollers market is experiencing significant growth, driven by escalating infrastructure development, technological advancements, and a shift towards sustainable construction practices. Governments and private sectors are increasingly investing in road construction and maintenance projects, particularly in emerging economies, thereby boosting demand for efficient compaction equipment. Technological innovations, such as the integration of GPS, telematics, and automation, are enhancing operational efficiency and reducing environmental impact. Furthermore, the adoption of electric and hybrid road rollers aligns with global sustainability goals and attracts environmentally conscious consumers. Despite challenges like high initial investment costs and fluctuating fuel prices, the market’s positive trajectory is supported by strategic partnerships, product innovations, and a growing preference for rental services. As the industry continues to evolve, manufacturers are focusing on developing advanced, eco-friendly, and cost-effective solutions to meet the dynamic demands of the construction sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)