Table of Contents

Overview

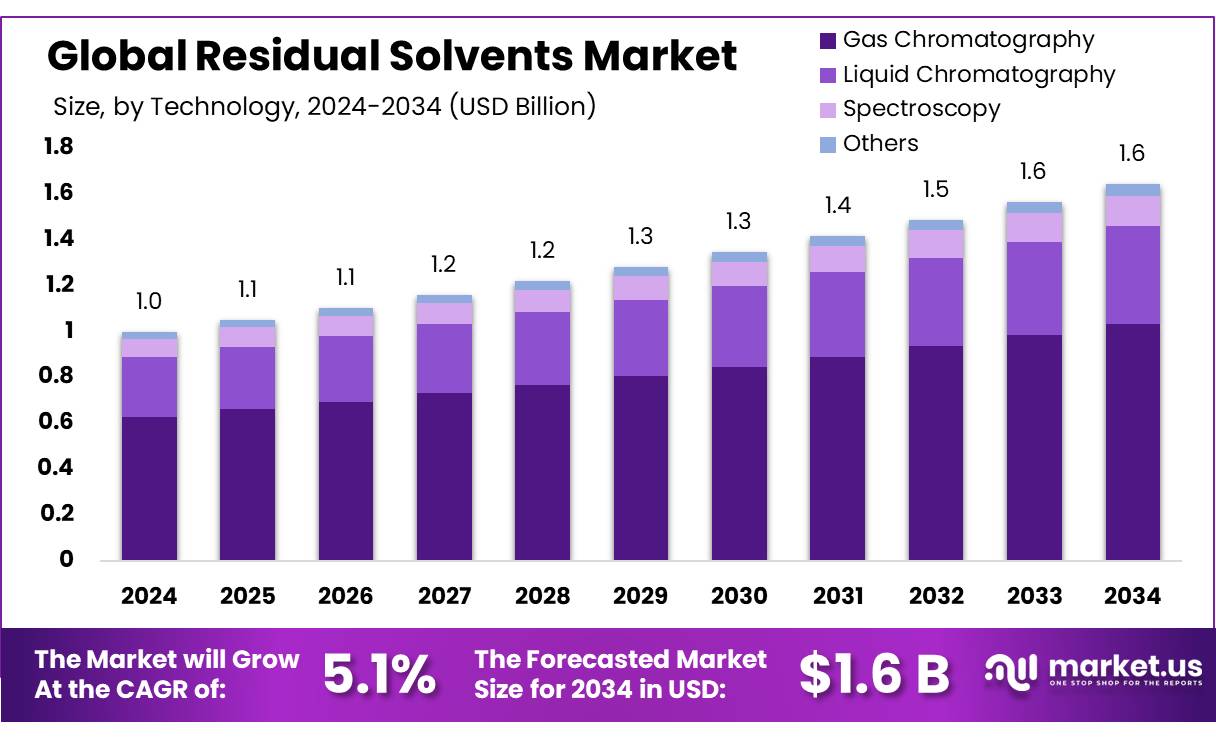

New York, NY – August 11, 2025 – The Global Residual Solvents Market is projected to reach USD 1.6 billion by 2034, up from USD 1.0 billion in 2024, with a CAGR of 5.1% during the forecast period (2025–2034). In 2024, North America led the market, holding a 46.9% share and generating USD 0.4 billion in revenue.

Residual solvents are trace chemicals left in active pharmaceutical ingredients (APIs), excipients, or drug products after manufacturing. While typically removed during production, their residual presence can impact product stability and patient safety. The International Conference on Harmonisation (ICH) classifies residual solvents into three toxicity-based categories, requiring strict testing and control to meet regulatory standards.

In India, the chemical industry plays a vital role, producing over 80,000 chemical products and contributing approximately 7% to GDP as of 2022, while employing around five million people. The sector spans bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilizers, with residual solvents critical for ensuring product purity and safety across these applications.

The Central Pollution Control Board (CPCB) in India mandates that pharmaceutical solvent losses not exceed 5% of annual storage inventory to minimize environmental impact and promote sustainability. Additionally, government initiatives like the Production Linked Incentive (PLI) Scheme for Active Pharmaceutical Ingredients (APIs), with INR 6,940 crores allocated (including INR 4,600 crores for agri and products like pharmaceuticals), and the Scheme for Promotion of Bulk Drug Parks aim to strengthen domestic manufacturing and enhance quality control, including residual solvent management.

Key Takeaways

- Residual Solvents Market size is expected to be worth around USD 1.6 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 5.1%.

- Gas Chromatography held a dominant market position in the residual solvents market by technology, capturing more than a 62.9% share.

- Class 3 held a dominant market position in the residual solvents market by type, capturing more than a 58.2% share.

- Pharmaceuticals held a dominant market position in the residual solvents market by application, capturing more than a 61.3% share.

- North America secured a commanding position in the residual solvents market by region, accounting for approximately 46.9% of the total market value, equivalent to around USD 0.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/residual-solvents-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.0 Billion |

| Forecast Revenue (2034) | USD 1.6 Billion |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Technology (Gas Chromatography, Liquid Chromatography, Spectroscopy, Others), By Type (Class 1, Class 2, Class 3), By Application (Pharmaceuticals, Food and Beverage, Cosmetics, Others) |

| Competitive Landscape | Agilent Technology, Beifenruili, Bruker, Fuli Instruments, LECO, PerkinElmer, Shimadzu, Techcomp, Thermo Fisher Scientific |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153862

Key Market Segments

By Technology Analysis

Gas Chromatography commands a 62.9% market share in 2024, driven by its superior accuracy and reliability. Widely used in pharmaceuticals, food, and chemical industries, this technology excels at detecting and quantifying trace volatile organic solvents in complex mixtures. Its precision, speed, and alignment with global testing standards solidify its dominance. In 2025, demand for gas chromatography is expected to stay strong, fueled by regulatory requirements and the need for quality assurance in drug and food production. Compatibility with various detectors and automation systems further cements its role as a key tool for residual solvent analysis.

By Type Analysis

Class 3 Solvents hold a 58.2% market share in 2024, owing to their low toxicity and broad application. These solvents, with minimal health risks, are widely used in pharmaceuticals and food processing, where higher acceptable daily intake levels offer formulation flexibility. In 2025, Class 3 solvents are projected to maintain their lead, particularly in regions with lenient regulatory frameworks. Their widespread use, lower regulatory hurdles, and ease of removal during processing continue to drive their market dominance.

By Application Analysis

Pharmaceuticals account for a 61.3% market share in 2024, propelled by stringent quality control and solvent testing requirements. Global regulations from agencies like the FDA and EMA mandate rigorous monitoring of solvent residues in active pharmaceutical ingredients (APIs) and finished drugs. In 2025, the pharmaceutical sector is expected to retain its dominance, driven by increasing drug production, robust quality assurance practices, and growing demand for analytical testing to ensure patient safety and product stability.

Regional Analysis

North America leads with a 46.9% share, valued at USD 0.4 billion in 2024, driven by its robust pharmaceutical and biotechnology sectors and stringent regulatory framework. The U.S. Food and Drug Administration (FDA), United States Pharmacopeia (USP), and International Council for Harmonisation (ICH) enforce rigorous guidelines, requiring thorough residual solvent testing to ensure patient safety.

High consumer awareness of product safety and purity fuels demand for transparent testing protocols and validated analytical methods. The region’s early adoption of automated and AI-enhanced solvent analysis systems boosts laboratory efficiency, reducing turnaround times and improving detection sensitivity.

Government-led quality assurance initiatives and pharmacopoeial updates emphasize residual solvent control in manufacturing. These factors drive consistent analytical spending, solidifying North America’s position as the leading contributor to the global residual solvents market in 2024.

Top Use Cases

- Pharmaceutical Quality Control: Residual solvents are tested in drugs to ensure safety and compliance with regulations like ICH Q3C. Gas chromatography detects trace solvents in APIs, ensuring they meet strict limits, protecting patient health, and maintaining product stability, which is critical for pharmaceutical companies to avoid recalls and meet global standards.

- Food Safety Testing: In food processing, residual solvents like ethanol or hexane used in extraction must be monitored. Testing ensures these solvents stay below safe limits, preventing health risks and ensuring product quality. This is vital for consumer safety and compliance with food safety regulations in industries like beverages and oils.

- Cosmetics Product Safety: Residual solvents in cosmetics, used during formulation, are tested to ensure they don’t harm users. Class 3 solvents, with low toxicity, are commonly used, but strict limits are enforced. Testing helps manufacturers meet safety standards, build consumer trust, and comply with regulations like those set by the FDA.

- Environmental Compliance: Industries test residual solvents to meet environmental regulations, like India’s CPCB guidelines, limiting solvent losses. This ensures minimal environmental impact from volatile organic compounds, promoting sustainable manufacturing practices in pharmaceuticals, chemicals, and other sectors while avoiding regulatory penalties.

- Biotechnology Purity Assurance: Biotech products, like biologics, require high-purity solvents to avoid contamination. Residual solvent testing ensures these products meet strict quality standards, supporting safe production of vaccines and therapies. Advanced techniques like gas chromatography ensure precision, driving demand in the growing biotech sector.

Recent Developments

1. Agilent Technologies

Agilent has enhanced its 7890B GC System with advanced residual solvents testing capabilities, integrating Headspace (HS) and GC/MSD for improved accuracy. Their SmartHS software automates sample prep, reducing errors. Agilent also released updated USP compliance solutions, streamlining pharmaceutical testing.

2. Beifenruili

Beifenruili introduced the GC-2060 gas chromatograph with FID and HS for residual solvents, targeting Chinese pharmacopeia standards. Their system features high sensitivity and low detection limits, aligning with ChP 2020 guidelines.

3. Bruker

Bruker’s SCION GC-MS systems now support residual solvents analysis with Compass CDS software for automated workflows. Their EVOQ GC-TQ enhances sensitivity for trace solvents, meeting USP/EP standards.

4. Fuli Instruments

Fuli’s GC-9720 series incorporates dual detectors (FID/ECD) for residual solvents, improving pharmaceutical QC. Their HS-20 headspace sampler reduces matrix effects, ensuring compliance with GMP/GLP.

5. LECO

LECO’s Pegasus BT 4D GC×GC-TOFMS enables high-resolution residual solvents profiling, detecting ultra-trace levels. Their ChromaTOF software simplifies data analysis for USP compliance.

Conclusion

The Residual Solvents Market is growing due to rising demand for safe, high-quality products in pharmaceuticals, food, cosmetics, and biotechnology. Strict regulations, like ICH Q3C and FDA guidelines, drive the need for advanced testing methods such as gas chromatography. With increasing consumer awareness and environmental concerns, the market is expected to expand steadily, with North America leading due to its robust regulatory and industry framework.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)