Table of Contents

Introduction

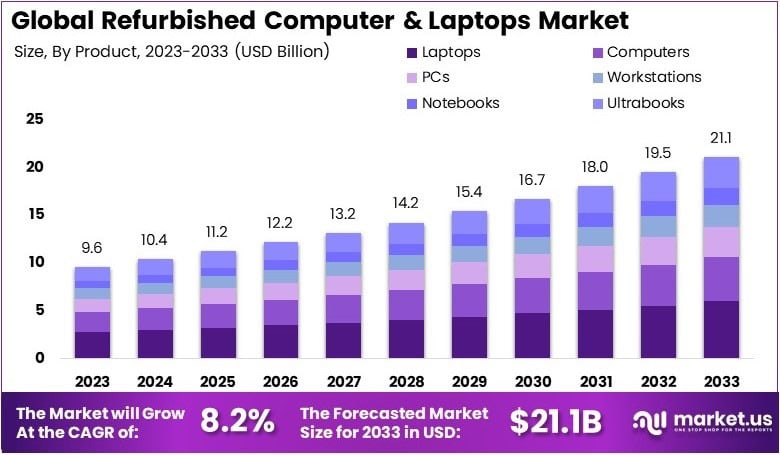

The Global Refurbished Computer And Laptops Market is projected to reach approximately USD 21.1 billion by 2033, up from USD 9.6 billion in 2023, reflecting a compound annual growth rate (CAGR) of 8.2% during the forecast period from 2024 to 2033.

The refurbished computers and laptops market represents a rapidly expanding segment within the broader IT hardware industry, driven by increasing consumer awareness of cost-effective and sustainable computing solutions. Refurbished computers and laptops refer to pre-owned devices that undergo rigorous testing, repair, and quality assurance processes to restore them to a fully functional state, often with upgraded components and renewed warranties.

The market for these devices has experienced significant growth, fueled by multiple factors, including cost advantages, rising e-waste concerns, and government initiatives promoting circular economies. The affordability of refurbished products compared to new models has attracted budget-conscious consumers, small and medium enterprises (SMEs), and educational institutions, further accelerating demand.

Additionally, the rising trend of remote work and online education has increased the need for reliable yet economical computing solutions, contributing to sustained market expansion. The market is also benefiting from the growing penetration of e-commerce platforms that enhance accessibility and offer certified refurbished products with warranty-backed reliability.

Key opportunities lie in emerging economies where price sensitivity is high, as well as in corporate sustainability programs that encourage businesses to adopt eco-friendly IT procurement policies. Technological advancements in component-level refurbishment and the increasing acceptance of certified refurbished devices by enterprises further enhance market potential.

However, challenges such as consumer perception regarding product quality and the availability of low-cost new alternatives may hinder growth. Overall, with sustainability and affordability driving purchasing decisions, the refurbished computers and laptops market is poised for steady growth, offering opportunities for manufacturers, retailers, and third-party refurbishers to capitalize on shifting consumer preferences and regulatory support for a circular economy.

Key Takeaways

- The global refurbished computers and laptops market is anticipated to reach USD 21.1 billion by 2033, up from USD 9.6 billion in 2023. The market is expected to grow at a CAGR of 8.2% during the forecast period (2024–2033).

- Laptops dominated with a 28.4% share in 2023, reflecting strong consumer preference for portability.

- Windows OS led with a 65.6% market share, driven by its broad compatibility across devices.

- Online/eCommerce platforms accounted for 58.5% of sales, fueled by convenience and product availability.

- Grade A refurbished devices held a 45.5% share, offering high-quality, near-new performance.

- APAC led the market with 41.7% share, benefiting from increasing adoption in cost-sensitive regions.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 9.6 Billion |

| Forecast Revenue (2033) | USD 21.1 Billion |

| CAGR (2024-2033) | 8.2% |

| Segments Covered | By Product (Computers, PCs, Workstations, Laptops, Notebooks, Ultrabooks), By Operating System (Windows OS, Mac OS, Linux OS), By Sales Channel (Online/eCommerce, Offline/Brick & Mortar Stores), By Grade (Grade A, Grade B, Grade C, Grade D), By Screen Size (11-13 inches, 14-16 inches, 17 inches and above), By End User (Enterprises (Small and Medium, Large), Educational Institutes, Government, Personal), By Distribution Channel (OEMs, Distributors, Online) |

| Competitive Landscape | Amazon Renewed, Apple Certified Refurbished Inc., Arrow Direct, Asustek Computer Inc., Dell Refurbished, Fujitsu Limited, HP Renew, International Business Machines (IBM), Lenovo Group Limited, LG Electronics Inc., Microsoft Corporation, Micro-Star International (MSI) Co., Ltd., Panasonic Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Toshiba Corporation |

Emerging Trends

- Increased Demand for Cost-Effective Computing Solutions: Individuals and businesses are increasingly seeking affordable alternatives to new devices, leading to a rise in the popularity of refurbished computers and laptops.

- Environmental Sustainability Initiatives: Growing awareness of electronic waste has prompted consumers to opt for refurbished electronics, which help reduce environmental impact by extending product lifespans.

- Technological Advancements in Refurbishment Processes: Improvements in refurbishment techniques have enhanced the quality and reliability of refurbished devices, making them more appealing to consumers.

- Expansion of Online Sales Channels: The growth of e-commerce platforms has made it easier for consumers to access refurbished electronics, broadening the market reach.

- Adoption of Circular Economy Principles: Businesses and consumers are embracing practices that prioritize reusing and refurbishing products, aligning with sustainable consumption models.

Top Use Cases

- Educational Institutions: Schools and universities are acquiring refurbished computers to provide students with necessary technology while managing budget constraints.

- Small and Medium-Sized Enterprises (SMEs): SMEs are utilizing refurbished laptops to equip their workforce cost-effectively, allowing for technological capability without significant capital expenditure.

- Non-Profit Organizations: Charitable organizations are adopting refurbished devices to support their operations and outreach programs economically.

- Government Agencies: Public sector entities are incorporating refurbished computers to meet sustainability goals and reduce procurement costs.

- Individual Consumers: Budget-conscious individuals are purchasing refurbished laptops for personal use, benefiting from reduced prices without compromising functionality.

Major Challenges

- Perception of Quality and Reliability: Some consumers remain skeptical about the performance and lifespan of refurbished devices, affecting market acceptance.

- Supply Chain Constraints: The availability of high-quality used devices for refurbishment can be inconsistent, impacting supply.

- Lack of Standardization: Variations in refurbishment processes and quality standards can lead to inconsistent product quality.

- Data Security Concerns: Ensuring complete data sanitization on refurbished devices is critical to prevent potential data breaches.

- Limited Warranty and Support: Refurbished products often come with shorter warranty periods, which may deter potential buyers concerned about post-purchase support.

Top Opportunities

- Market Expansion in Emerging Economies: Growing digital adoption in developing regions presents a significant opportunity for refurbished device markets.

- Corporate Sustainability Initiatives: Companies aiming to reduce their environmental footprint may increasingly turn to refurbished electronics as part of their sustainability strategies.

- Government Policies Promoting E-Waste Reduction: Legislative support for recycling and reuse of electronics can bolster the refurbished market.

- Development of Certification Standards: Establishing industry-wide refurbishment standards can enhance consumer trust and product reliability.

- Integration of Trade-In Programs: Encouraging consumers to trade in old devices can ensure a steady supply of products for refurbishment, supporting market growth.

Key Player Analysis

The Global Refurbished Computer and Laptops Market in 2024 is driven by key players leveraging advanced refurbishment processes, quality certifications, and robust distribution networks to capture growing consumer demand. Amazon Renewed dominates with its vast e-commerce reach, offering certified refurbished products across multiple brands. Apple Certified Refurbished Inc. maintains a competitive edge through strict quality assurance and warranty-backed offerings.

Dell Refurbished, HP Renew, and Lenovo Group Limited capitalize on direct-to-consumer sales, ensuring brand reliability and post-sale support. IBM and Arrow Direct focus on enterprise-grade refurbished systems, catering to businesses seeking cost-effective IT solutions. Microsoft Corporation plays a critical role by supplying certified pre-owned Surface devices, while Samsung, Sony, LG, and Panasonic contribute to the segment through refurbished computing and display solutions. Asustek, MSI, Fujitsu, and Toshiba strengthen market dynamics by offering performance-oriented refurbished laptops for gaming, business, and consumer use. Together, these players drive market expansion through innovation and sustainability initiatives.

Top Key Players in the Market

- Amazon Renewed

- Apple Certified Refurbished Inc.

- Arrow Direct

- Asustek Computer Inc.

- Dell Refurbished

- Fujitsu Limited

- HP Renew

- International Business Machines (IBM)

- Lenovo Group Limited

- LG Electronics Inc.

- Microsoft Corporation

- Micro-Star International (MSI) Co., Ltd.

- Panasonic Corporation

- Samsung Electronics Co.Ltd.

- Sony Corporation

- Toshiba Corporation

Regional Analysis

Asia-Pacific Leads the Refurbished Computer and Laptops Market with the Largest Market Share of 41.7% in 2024

The Asia-Pacific region dominates the refurbished computer and laptops market, accounting for 41.7% of the global market share in 2024, with a valuation of approximately USD 4.0 billion. The region’s leadership can be attributed to the rising demand for cost-effective computing solutions, increasing digitalization, and growing adoption of refurbished IT assets by enterprises and educational institutions.

Countries such as China, India, and Japan are key contributors, driven by government initiatives promoting electronic waste management and circular economy practices. Additionally, the increasing number of small and medium-sized enterprises (SMEs) and startups opting for refurbished devices to reduce IT expenditures further supports market growth. The presence of major refurbishment service providers and expanding e-commerce platforms specializing in second-hand electronics also contribute to the strong market position of the region.

Recent Developments

- In 2023, ASUS India introduced the ‘Select Store’ concept for refurbished PCs, making high-quality, restored devices accessible at budget-friendly prices. The initiative ensures that each PC undergoes rigorous inspection and refurbishment, offering consumers a reliable and cost-effective alternative to new products.

- In 2024, Framework secured $18M in fresh funding, with a $17M Series A-1 round led by Spark Capital alongside investors like Buckley Ventures, Anzu Partners, Cooler Master, and Pathbreaker Ventures. The company, founded with a mission to transform consumer electronics, continues to push for repairable and upgradeable devices. Despite industry challenges, Framework has expanded its market share each year, proving that longevity and sustainability in tech resonate with consumers.

- In 2023, XtraCover launched the BuyBack Guarantee program to combat e-waste by extending the usability of refurbished smartphones and laptops. The program encourages responsible tech consumption, allowing users to trade in old devices hassle-free. By prioritizing sustainability, XtraCover aims to reduce environmental impact and support a circular economy in the electronics industry.

- In 2024 – The Office of Broadband Access and Expansion (OBAE) Launches Computer Donation Campaign, The Office of Broadband Access and Expansion (OBAE) has initiated a statewide campaign to provide refurbished computers to community members and organizations in need. As part of the state’s commitment to digital equity and inclusion, OBAE is partnering with Digitunity, a national nonprofit dedicated to advancing digital equity through computer ownership. Together, OBAE and Digitunity will connect individual and corporate donors with regional nonprofits to refurbish and distribute donated computers to New Mexicans.

Conclusion

The refurbished computers and laptops market is experiencing steady growth, driven by increasing demand for affordable and sustainable technology solutions. Consumers and businesses are opting for refurbished devices due to cost benefits, environmental concerns, and improved refurbishment quality. The expansion of online sales channels and corporate sustainability initiatives further support market growth. However, challenges such as consumer perception, supply chain constraints, and standardization issues persist. Leading industry players are focusing on quality assurance, certification programs, and strategic distribution networks to strengthen market presence. With rising digital adoption and government support for e-waste management, the market is set for continued expansion.