Table of Contents

Overview

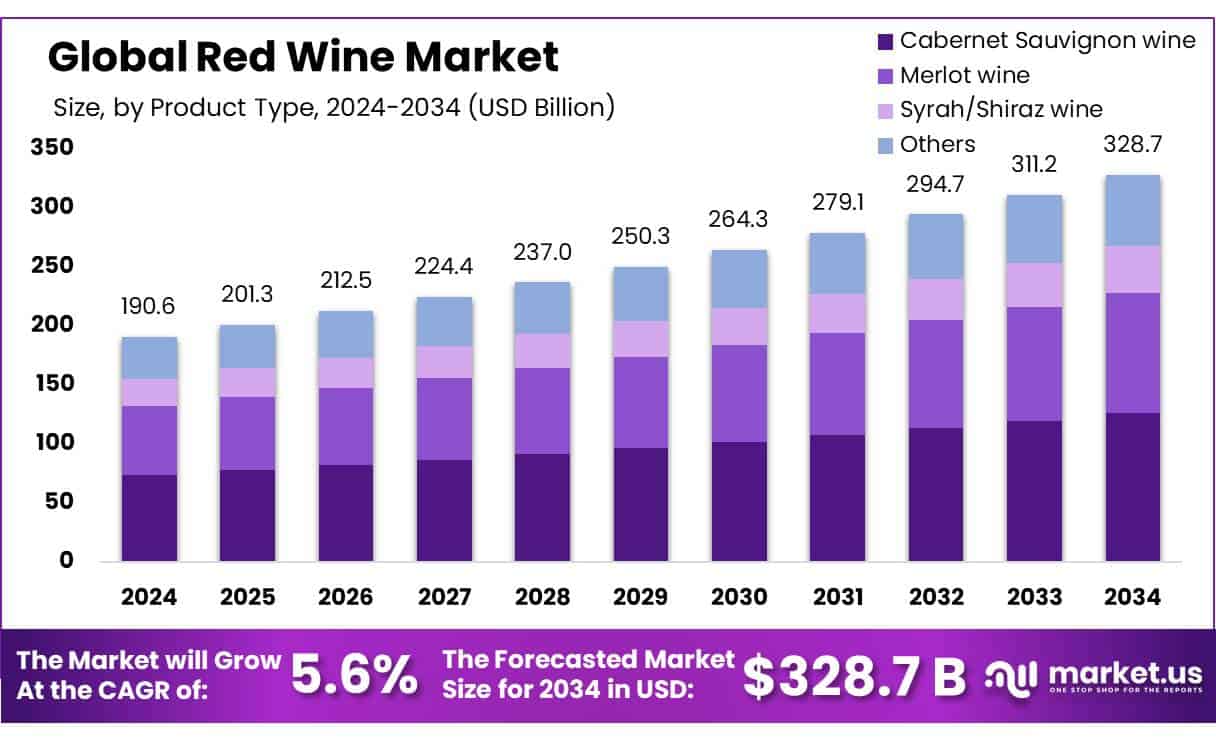

New York, NY – May 09, 2025 – The global Red Wine Market is experiencing strong growth, driven by increasing demand and shifting consumer preferences. In 2024, the market was valued at USD 190.6 billion and is projected to reach USD 328.7 billion by 2034, growing at a steady CAGR of 5.6% from 2025 to 2034.

In 2024, Semi-Sweet red wine led the global market with a 46.7% share, favored for its balanced sweetness and approachable acidity. Popular among newer wine drinkers and casual consumers, it shines at social events and pairs well with diverse cuisines, including spicy, tangy, and mildly sweet dishes. On-trade channels, encompassing restaurants, bars, hotels, and lounges, accounted for 79.4% of global red wine sales in 2024. Red wine’s prominence in dining culture, particularly in Europe and North America, fueled this dominance, with consumers enjoying curated wine lists, sommelier guidance, and tailored food pairings.

US Tariff Impact on Red Wine Market

In the latest fallout from a tit-for-tat trade war that has markets reeling, the United States wine industry is bracing for the effects of 200% tariffs on European wine and spirits imports. In short, the U.S. placed a 25% tariff on metal imported from other countries; the E.U. struck back by implementing 50% tariffs on a variety of goods from the U.S. that includes bourbon; and on March 13 President Trump posted on Truth Social that if the tariff were not removed immediately, the U.S. would place a 200% tariff on all wine, Champagne, and spirits coming from the E.U. While both sides have paused their tariffs until the middle of April, which may allow for some negotiation, the threat still looms, leaving uncertainty on both sides of the Atlantic.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/red-wine-market/request-sample/

Key Takeaways

- The Red Wine Market is expected to be worth around USD 328.7 billion by 2034, up from USD 190.6 billion in 2024, and growing at a CAGR of 5.6%.

- Cabernet Sauvignon wine held a dominant market position, capturing more than a 38.5% share in the global red wine segment.

- Semi-sweet held a dominant market position, capturing more than a 46.7% share in the global red wine market.

- On-trade held a dominant market position, capturing more than a 79.4% share in the global red wine market.

- North America emerged as the dominant region in the global red wine market, commanding a 43.8% share and reaching a market value of USD 83.4 billion.

Report Scope

| Market Value (2024) | USD 190.6 Billion |

| Forecast Revenue (2034) | USD 328.7 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Product Type (Cabernet Sauvignon wine, Merlot wine, Syrah/Shiraz wine, Others), By Sweetness Level ( Dry, Semi-sweet, Sweet), By Sales Channel (On-trade, Off-trade) |

| Competitive Landscape | E & J Gallo Winery, The Wine Group, Castel Group, Treasury Wine Estates Limited, Constellation Brands Inc., Rémy Cointreau SA, Brown-Forman, Diageo plc., Altria Group, Inc., Heineken N.V., Accolade Wines, Amvyx SA, Bacardi Limited, Campri Group, Castel Group, Caviro |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147724

Key Market Segments

By Sweetness Level

- In 2024, semi-sweet red wine led the global market with a 46.7% share, favored for its balanced sweetness and approachable acidity. Popular among newer wine drinkers and casual consumers, it shines at social events and pairs well with diverse cuisines, including spicy, tangy, and mildly sweet dishes.

- Rising consumption in Asia and Eastern Europe, where fruit-forward wines are preferred, drove significant growth. Retailers noted strong sales due to repeat purchases and the wines’ appeal as gifts during holidays. Semi-sweet wines are expected to sustain their lead as producers target millennials and occasional drinkers with expanded, lighter, and sweeter offerings.

By Sales Channel

- On-trade channels, encompassing restaurants, bars, hotels, and lounges, accounted for 79.4% of global red wine sales in 2024. Red wine’s prominence in dining culture, particularly in Europe and North America, fueled this dominance, with consumers enjoying curated wine lists, sommelier guidance, and tailored food pairings.

- Urban nightlife, upscale dining, and wine tourism further supported growth, with wineries deepening ties to the hospitality sector to promote premium labels. As travel and dining trends continue to recover post-pandemic, on-trade sales are projected to remain robust in 2025, particularly in urban hubs and tourist hotspots.

Regional Analysis

- North America led the global red wine market in 2024, capturing a 43.8% share with a market value of USD 83.4 billion. The United States, with its well-established wine industry and vibrant wine culture, primarily drives this dominance. Key to the region’s success are its renowned wine-producing areas, including California’s Napa Valley, Oregon’s Willamette Valley, and Washington’s Columbia Valley, celebrated for their high-quality red wines.

- Evolving consumer preferences also fuel growth, with increasing demand for premium, organic, and sustainably produced wines, driven by heightened health awareness and a preference for authentic, artisanal products. Canada further contributes to the region’s market strength through its expanding and diversifying wine industry. Canadian consumers are increasingly embracing both domestic and international red wines, further boosting the region’s market growth.

Top Use Cases

- Consumer Preference Analysis: Red wine market data helps identify popular varietals like Cabernet Sauvignon or semi-sweet wines, guiding producers to align with consumer tastes. It reveals preferences for organic or premium wines, enabling brands to target health-conscious or luxury buyers, especially in North America, where demand for quality wines is strong.

- Marketing Strategy Development: Data on red wine sales channels, like on-trade dominance, informs targeted campaigns for restaurants and bars. Understanding urban consumer trends helps create promotions for premium labels, boosting brand visibility and loyalty among millennials and casual drinkers in growing markets.

- Product Innovation: Market insights highlight demand for sustainable or low-alcohol red wines, encouraging brands to develop organic or canned options. Data on sweetness levels, like semi-sweet’s popularity, guides new flavor profiles to attract younger or occasional drinkers, ensuring products meet evolving tastes.

- Regional Market Expansion: Red wine data shows North America’s 43.8% market share, signaling opportunities for expansion in the U.S. and Canada. Insights into emerging markets like Asia, where fruit-forward wines are favored, help brands tailor offerings and distribution to capture growing consumer bases.

- Competitor Benchmarking: Analyzing competitors’ market share, like Cabernet Sauvignon’s 38.5% lead, helps brands identify gaps and strengths. Data on pricing and packaging trends, such as premium labels, allows companies to position products competitively, enhancing market presence against established players.

Recent Developments

1. E & J Gallo Winery

- E & J Gallo Winery, the world’s largest family-owned winery, has expanded its premium red wine portfolio with new sustainable initiatives. They introduced carbon-neutral wines under their “Barefoot” brand and invested in water conservation in California vineyards. Gallo also acquired Rombauer Vineyards, strengthening its luxury wine segment. Their focus on eco-friendly packaging and direct-to-consumer sales reflects shifting market trends.

2. The Wine Group

- The Wine Group, known for brands like “Franzia” and “Cupcake Vineyards,” has been innovating with lower-alcohol and organic red wine options. They recently launched a new line of boxed wines with extended shelf life to reduce waste. The company is also expanding in Asia, targeting younger consumers with affordable, easy-to-drink red blends.

3. Castel Group

- France’s Castel Group has been focusing on African market growth, introducing affordable red wines in countries like Nigeria and Angola. They also partnered with blockchain firms to enhance traceability in their supply chain, ensuring authenticity for premium Bordeaux wines. Their Château brands are gaining traction in China’s luxury wine market.

4. Treasury Wine Estates (TWE)

- TWE, owner of Penfolds, launched a new luxury red wine collection. They’re also expanding in the U.S. with their brand, using augmented reality labels for engagement. After China’s wine tariffs, TWE shifted focus to India and Southeast Asia for growth.

5. Constellation Brands

- Constellation Brands, known for “Robert Mondavi” and “The Prisoner,” is investing in high-end Napa Valley red wines. They acquired a minority stake in a premium Pinot Noir producer and are using AI for vineyard optimization. Their focus on premiumization and DTC sales is driving growth.

Conclusion

The global Red Wine Market is set for strong growth, driven by rising demand for premium and health-conscious wines. Key trends like sustainable winemaking, premiumization, and e-commerce expansion are shaping the industry. Companies are innovating with organic wines, lower-alcohol options, and luxury collectibles to attract younger and health-focused consumers. Emerging markets in Asia, Africa, and Latin America offer huge potential due to growing middle-class demand. While challenges like tariffs and climate change exist, the market’s adaptability ensures long-term success. For investors and brands, focusing on quality, sustainability, and digital sales will be crucial in this evolving landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)