Table of Contents

Overview

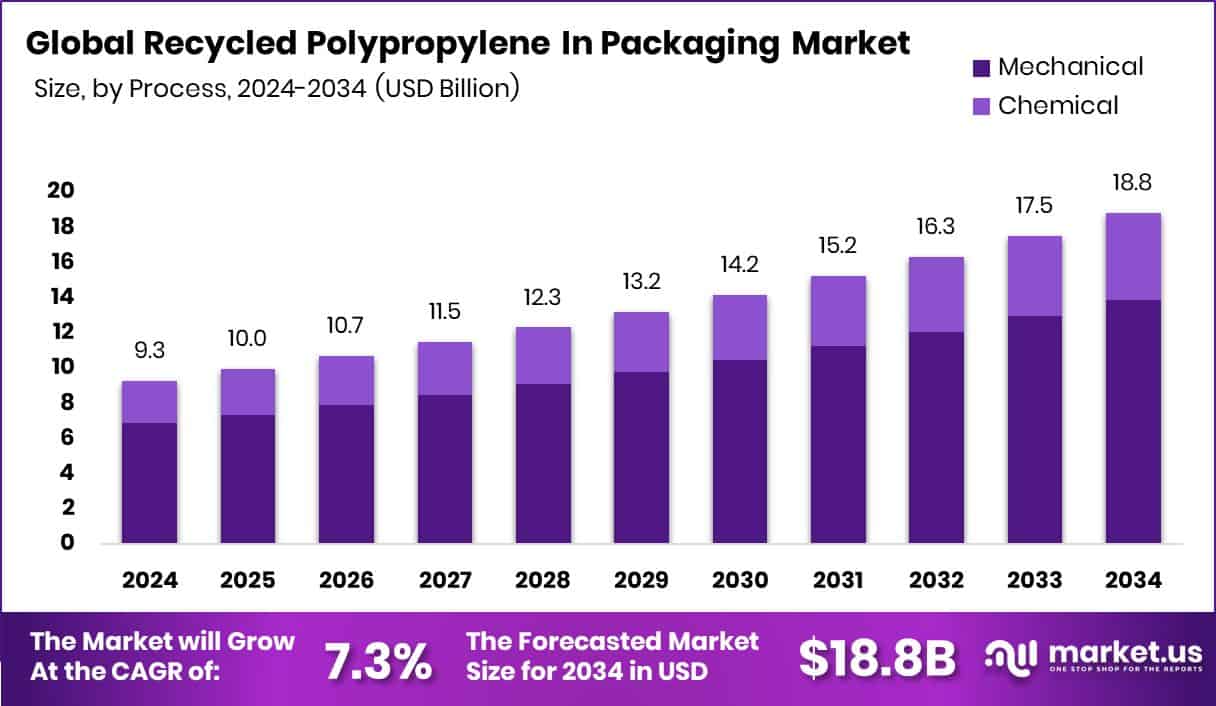

New York, NY – October 15, 2025 – The recycled polypropylene (rPP) in the packaging market is expanding rapidly, projected to reach USD 18.8 billion by 2034 from USD 9.3 billion in 2024, growing at a 7.3% CAGR. North America, valued at USD 3.6 billion, benefits from strong recycling investments and sustainability mandates.

rPP, derived from post-consumer and industrial waste, supports carbon reduction and circular economy goals across packaging types such as containers, caps, and films. Growth stems from strict recycled-content laws, corporate ESG goals, and consumer demand for sustainable packaging. Major funding is fueling recycling capacity: a US$25 million PP/PE recycling fund was launched, while a $120 million polypropylene project aims to scale recycled PP supply.

GreenMantra Technologies secured a $10 million loan from Closed Loop Infrastructure Group, and Closed Loop Partners received an additional $10 million to enhance PP/PE recycling. The U.S. Department of Energy’s $182 million loan to IRG’s plastics recycling project further boosts chemical recycling adoption.

These coordinated financial efforts and technology upgrades are building a strong recycling ecosystem that will sustain market growth, improve the supply of quality recycled resin, and help global brands meet circular packaging and emission-reduction goals.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-recycled-polypropylene-in-packaging-market/request-sample/

Key Takeaways

- The Global Recycled Polypropylene in Packaging Market is expected to be worth around USD 18.8 billion by 2034, up from USD 9.3 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- In 2024, mechanical recycling dominated the recycled polypropylene in the packaging market with a 73.9% share.

- Flexible packaging led the Recycled Polypropylene in Packaging Market, accounting for 68.3% of the total share.

- The food and beverage sector held a 37.7% share in the Recycled Polypropylene in Packaging Market.

- The North American recycled polypropylene packaging market reached a strong valuation of USD 3.6 billion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161126

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.3 Billion |

| Forecast Revenue (2034) | USD 18.8 Billion |

| CAGR (2025-2034) | 7.3% |

| Segments Covered | By Process (Mechanical, Chemical), By Packaging Type (Flexible Packaging, Rigid Packaging), By End Use (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Automotive, Others) |

| Competitive Landscape | Braskem, Borealis AG, Mitsubishi Chemical, Exxon Mobil Corporation, Nexam Chemical, Pashupati Group of Industries, Sumitomo Chemical Co., Ltd., Nexeo Plastics, LLC, Shell Chemicals, ECOPLAS (HK) LIMITED |

Key Market Segments

By Process Analysis

In 2024, the Mechanical process dominated the “By Process” segment of the Recycled Polypropylene in Packaging Market, accounting for a 73.9% share. This method remains the preferred recycling route due to its low operational costs, scalability, and ability to retain polymer strength for packaging products like films, trays, and caps. Mechanical recycling involves sorting, washing, shredding, and remelting post-consumer polypropylene waste into reusable pellets.

Its reduced chemical usage and smaller carbon footprint align with sustainability and circular economy goals. Ongoing investments in sorting and processing technologies continue to enhance efficiency, reinforcing the process’s leadership across global packaging applications.

By Packaging Type Analysis

In 2024, Flexible Packaging dominated the “By Packaging Type” segment of the Recycled Polypropylene in Packaging Market, securing a strong 68.3% share. Formats like films, pouches, and wraps remain popular for their light weight, affordability, and versatility across food, personal care, and household products. Using recycled polypropylene in these applications helps meet sustainability and circular economy goals while maintaining desirable strength, thermal stability, and barrier properties.

Enhanced mechanical recycling processes have improved clarity and consistency in rPP, expanding its use in multilayer film structures. A growing focus on plastic waste reduction and eco-friendly packaging solutions continues to drive flexible packaging’s leadership in the global market.

By End Use Analysis

In 2024, the food and beverage sector led the “By End Use” segment of the Recycled Polypropylene in Packaging Market, accounting for a 37.7% share. This dominance stems from the rising adoption of rPP in food containers, caps, films, and ready-to-eat meal packaging, valued for its lightweight, durable, and moisture-resistant qualities. Food manufacturers increasingly use recycled polypropylene to align with sustainability goals and circular packaging regulations.

Its strong sealing ability and suitability for high-temperature processing make it ideal for diverse food applications. Additionally, growing consumer demand for environmentally responsible packaging and new investments in food-grade recycled PP technologies have reinforced the segment’s prominent position within the global packaging industry.

Regional Analysis

In 2024, North America led the Recycled Polypropylene in Packaging Market with a 38.90% share, valued at about USD 3.6 billion. This dominance reflects its advanced recycling infrastructure, strong sustainability commitments, and heightened consumer awareness. Strict environmental laws in the U.S. and Canada continue to accelerate rPP adoption across food, beverage, and e-commerce packaging sectors.

Europe closely follows, supported by circular economy directives and extended producer responsibility schemes promoting recycled-content use. The Asia Pacific region is emerging rapidly, driven by industrial expansion and government actions to curb plastic waste.

Latin America is steadily growing as recycling capacity improves, particularly in flexible and rigid packaging. Meanwhile, the Middle East & Africa are gradually strengthening their recycling ecosystems through new policy frameworks and private investments aimed at tackling plastic waste management challenges.

Top Use Cases

- Ice-cream tubs made from food-grade rPP: Magnum, the ice cream brand, collaborated with SABIC to launch tubs made from post-consumer recycled polypropylene that meet food-grade safety standards. These tubs were rolled out across Europe, replacing virgin plastic versions and using over 160,000 kg of recycled plastic.

- Purified recycled PP for consumer goods packaging: Procter & Gamble developed a Circular Polymer Purification method (called Verso Vita™) to take used polypropylene, purify it to nearly virgin quality, then remold it into new packaging.

- Rigid containers and caps for household use: rPP is used to make rigid containers, jars, tubs, and caps for household products like detergents, creams, and food storage. Its durability, moisture resistance, and cost advantages make it a good fit.

- Flexible packaging films and pouches: Because rPP can be remelted and extruded, it’s used in flexible packaging like films, pouches, or wraps (for example, in food or personal care). Its strength and heat resistance help in multi-layer film structures.

- Combining rPP and virgin PP for hybrid packaging: In some applications, rPP is blended with virgin PP to balance cost, mechanical strength, and performance. This hybrid approach lets brands include recycled content while ensuring critical performance.

- Packaging shift in regulated markets (food-contact rPP): In the U.S. and Canada, to comply with environmental and extended producer responsibility (EPR) laws, many packaging firms are pushing food-safe rPP adoption. However, one challenge is gaining regulatory approval and technical confidence in recycled food-grade PP.

Recent Developments

- In September 2025, Borealis inaugurated a new compounding line in Beringen, Belgium, to produce polyolefins that already contain recyclate content.

- In July 2025, Mitsubishi Chemical and partner ENEOS held a ceremony marking the completion of their chemical recycling/plastic-to-oil conversion facility at the Ibaraki Plant (Kamisu City).

- In November 2024, ExxonMobil announced it would invest over US$200 million to expand its chemical recycling operations at its Baytown and Beaumont (Texas) plants.

- In October 2024, Nexam Chemical announced that the European Patent Office issued a “Decision to Grant” their patent covering technology for recycled polypropylene (rPP).

Conclusion

The recycled polypropylene in the packaging market is gaining momentum as industries shift toward circular and sustainable material use. Increasing government regulations, brand commitments, and consumer demand for eco-friendly packaging are driving adoption across the food, beverage, and personal care sectors. Technological advancements in mechanical and chemical recycling are improving material quality, allowing broader applications.

Collaborations and investments from resin producers and recyclers continue to enhance supply chain efficiency. With growing awareness about plastic waste reduction, recycled polypropylene is emerging as a vital solution for sustainable packaging, balancing performance, cost, and environmental responsibility in global markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)