Table of Contents

Overview

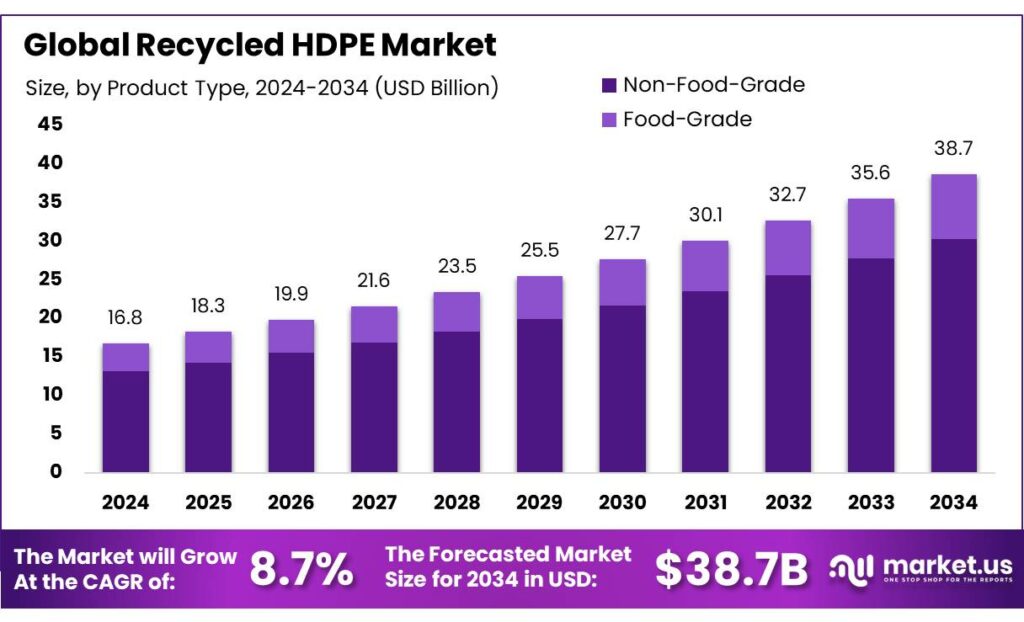

New York, NY – September 18, 2025 – The Global Recycled HDPE Market is projected to reach USD 38.7 billion by 2034, growing from USD 16.8 billion in 2024, with a steady CAGR of 8.7% between 2025 and 2034. In 2024, the Asia Pacific region led the market, contributing over 53.9% share with USD 9 billion in revenue, reflecting the region’s strong recycling infrastructure and rising demand for sustainable materials.

High-density polyethylene (HDPE), classified as a type 2 thermoplastic polymer, is widely recognized for its durability, chemical resistance, and moisture barrier properties. Recycled HDPE is created by collecting, sorting, cleaning, and remelting used HDPE products into pellets or granules, which are then utilized in producing outdoor furniture, containers, plastic lumber, and construction materials.

While food-grade applications remain limited due to contamination risks during recycling, the non-food sector drives consistent demand. One of the biggest growth drivers is the stringent environmental regulations encouraging plastic recycling, alongside increasing consumer preference for eco-conscious products. However, effective recycling remains a challenge, creating opportunities for technological innovations and advanced product development.

Globally, PET, HDPE, and PP plastics make up about 80% of rigid plastic packaging, yet recycling rates remain modest. In the U.S. alone, only around 20% of PET, HDPE, and PP plastics were recycled in 2024, highlighting both the challenge and the significant growth potential of the recycled HDPE sector.

Key Takeaways

- The Global Recycled HDPE Market was valued at USD 16.8 billion in 2024, at a CAGR of 8.7% and is estimated to reach USD 38.7 billion by 2034.

- Based on product type, non-food-grade recycled HDPE encompassed the largest market globally, valued at around 78.2%

- Among the end-use industries, the recycled HDPE market was led by the consumer goods industry in 2024, with a 31.1% share of the total global market.

- Asia Pacific became the largest market for recycled HDPE and saw the fastest growth in 2024, valuing around USD 9 billion, which is approximately 53.9% of the total market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/recycled-hdpe-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 16.8 Billion |

| Forecast Revenue (2034) | USD 38.6 Billion |

| CAGR (2025-2034) | 8.7% |

| Segments Covered | By Product Type (Non-Food-Grade, Food-Grade), By End-Use Industry (Packaging, Construction, Consumer Goods, Other Industries) |

| Competitive Landscape | Veolia Environnement SA, Biffa Group, KW Plastics, Plastipak Holdings, Inc., Altium Packaging (Envision Plastics), ALPLA Werke Alwin Lehner GmbH & Co KG, Cirplus GmbH, KAMAL POLYPLAST, Reprocessed Plastics, Inc., Reclaim Plastics, Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156680

Key Market Segments

Product Type Analysis

Non-Food-Grade Recycled HDPE Leads with 78.2% Market Share

The recycled HDPE market is segmented into non-food-grade and food-grade categories. In 2024, non-food-grade recycled HDPE commanded a significant 78.2% share of the global market. Although HDPE is inherently food-safe, recycled HDPE is primarily used for non-food applications due to potential contamination risks during the recycling process. The presence of various substances from prior use and collection makes it challenging to ensure compliance with food safety standards.

Per the U.S. Food and Drug Administration, materials intended for direct or indirect food contact must not contain intentionally added carcinogenic substances or other chemicals exceeding 0.5 parts per billion. The variability in recycled HDPE often fails to meet these stringent requirements, making it more suitable for non-food applications where safety regulations are less restrictive.

End-Use Industry Analysis

Consumer Goods Sector Leads with 31.1% Market Share

The recycled HDPE market is divided into packaging, construction, consumer goods, and other industries. In 2024, the consumer goods sector led with a 31.1% market share, valued at approximately USD 5.2 billion. Recycled HDPE’s durability and eco-friendly properties make it a preferred material for consumer products such as toys, pens, ropes, bike racks, furniture, picnic tables, benches, recycling bins, and trash cans. Additionally, it is widely used in the construction industry for plastic lumber, piping, decking, and fencing, as well as in packaging for products like antifreeze and chemical bottles.

Regional Analysis

Asia Pacific Holds 53.9% of the Global Recycled HDPE Market

In 2024, the Asia Pacific region dominated the global recycled HDPE market with a 53.9% share, valued at approximately USD 9 billion. As the largest producer and consumer of HDPE, the region led by China benefits from rapid urbanization, industrialization, and growing environmental awareness in high-GDP countries like China, India, Japan, South Korea, and Southeast Asian nations.

Regulatory measures, such as China’s 2018 and 2019 import bans on 24 and 16 materials, respectively, have bolstered local plastic recycling efforts. Similarly, South Korea’s bans on single-use plastic bags, straws, stirrers, and upcoming restrictions on cutlery and takeout containers by late 2025 have driven demand for recycled HDPE. Japan’s robust recycling systems further support the region’s leadership in promoting a circular economy for HDPE waste.

Top Use Cases

- Packaging for Household Chemicals: Recycled HDPE shines in making sturdy bottles for cleaners, oils, and detergents, thanks to its tough build that resists leaks and chemicals. This keeps everyday items safe while cutting down on new plastic use, making it a smart pick for brands aiming to go green without losing quality.

- Outdoor Furniture and Benches: Turning old plastic into benches, picnic tables, and chairs gives parks and yards long-lasting spots that shrug off weather, bugs, and rot. It’s low-care and eco-smart, letting communities enjoy durable seating that looks good and lasts for years in busy spots.

- Construction Piping and Lumber: Recycled HDPE forms strong pipes for water lines and fake wood boards for decks or fences, handling moisture and wear like a champ. Builders love it for easy setup and no upkeep, turning waste into reliable parts that boost green building projects everywhere.

- Recycling Bins and Trash Cans: These bins, made from recycled HDP, are tough against cracks and easy to clean, perfect for homes or streets to sort waste right. They encourage more recycling by being simple and strong, helping close the loop on plastics in daily life.

- Toys and Playground Gear: Safe and colorful recycled HDPE builds kids’ toys, slides, and racks that stand up to rough play and sun without fading. Parents pick it for being non-toxic and earth-friendly, sparking fun while teaching little ones about reusing stuff from the start.

Recent Developments

1. Veolia Environnement SA

Veolia is expanding its recycled HDPE production capacity to meet rising demand, particularly for food-grade applications. A key project is the modernization of its plastic recycling facility in Germany, enhancing its ability to produce high-quality recycled polymers. This supports Veolia’s goal of transforming plastic waste into a valuable resource for a circular economy.

2. Biffa Group

Biffa is investing significantly in UK plastic recycling infrastructure. County Durham will process bottles annually, producing rHDPE pellets. This development strengthens the domestic supply of recycled content for UK manufacturers and supports the country’s plastic packaging tax goals.

3. KW Plastics

As one of the world’s largest HDPE recyclers, KW Plastics continues to innovate in processing hard-to-recycle colored HDPE containers, like those for laundry detergent. Their proprietary technology allows them to produce high-quality, post-consumer recycled (PCR) HDPE from this stream, diverting significant material from landfills and providing a consistent supply of recycled resin to major brands.

4. Plastipak Holdings, Inc.

Through its Clean Tech division, Plastipak is a leader in producing food-grade rHDPE. A major recent development is the expansion of its recycling facilities across Europe and the US, increasing the output of certified recycled content. This directly supports brand owners’ sustainability commitments by providing high-quality rHDPE suitable for direct food contact and personal care product packaging.

5. Altium Packaging

Altium focuses on producing custom sustainable packaging with high recycled content. A key development is their growing portfolio of rHDPE containers, including bottles and jugs made with up to 100% post-consumer resin (PCR). They are actively partnering with major brands in the food, beverage, and household chemicals sectors to help them meet ambitious recycled content targets and circularity goals.

Conclusion

Recycled HDPE is a rising star in sustainable materials, blending toughness with eco-friendliness to meet growing calls for greener choices. It transforms everyday waste into reliable products across packaging, building, and play areas, easing pressure on resources while fitting strict rules on plastics. With buyers leaning toward planet-positive options, this versatile stuff promises steady gains, urging firms to weave it into plans for lasting wins in a watchful world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)