Table of Contents

Overview

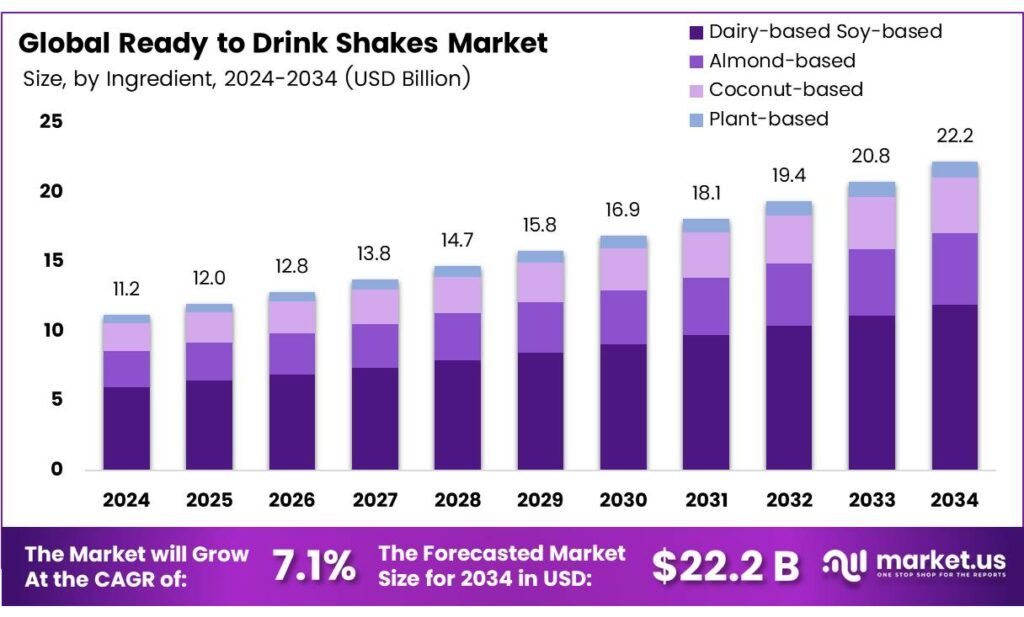

New York, NY – September 19, 2025 – The Global Ready-to-Drink (RTD) Shakes Market is projected to reach USD 22.2 billion by 2034, up from USD 11.2 billion in 2024, expanding at a CAGR of 7.1% between 2025 and 2034.

RTD shakes, often formulated with animal, dairy, or plant-based proteins, are widely consumed by athletes, bodybuilders, active individuals, and patients requiring nutritional support. They also play a growing role in weight management and addressing protein-deficient diets. However, concerns have emerged regarding herbal and dietary supplements (HDS), including protein-based products enhanced with botanical extracts, vitamins, minerals, amino acids, and synthetic compounds.

Studies have linked these to hepatotoxicity, raising risks of liver injury, failure, and in severe cases, death. A study reviewing 36 protein supplement products revealed widespread mislabeling. Of these, 20 were produced in India and 16 by multinational brands. Nearly 69.4% contained less protein than claimed, with actual protein levels per 100 g falling short of advertised values, ranging from minor deficits under 10% to over 50%. This underscores growing scrutiny over product quality and transparency within the sector.

From a regulatory and product development perspective, shelf-stable high-protein dairy beverages are classified based on acidity. Beverages with water activity (aw) >0.85 and pH >4.6 fall under low-acid foods, while those with aw >0.85 and pH ≤4.6 are treated as acidified foods. Such categorizations influence safety standards, formulation processes, and compliance with food regulations. Industry efforts toward reformulation are also reshaping the market.

According to the Food and Drink Federation, sugar levels in soft drinks have been cut by 46% over the past five years, while pre-packed milk-based beverages have seen a 30% sugar reduction. These improvements highlight the sector’s response to health-conscious consumers and regulatory pressures. The RTD shakes industry is set for strong growth, supported by rising health awareness, demand for convenient nutrition, product innovation, and sustainability initiatives.

Key Takeaways

- The Global Ready-to-Drink Shakes Market is projected to grow from USD 11.2 billion in 2024 to USD 22.2 billion by 2034, at a CAGR of 7.1%.

- Dairy-based and Soy-based shakes dominated in 2024, holding a 53.7% market share due to consumer preference for dairy and plant-based proteins.

- Chocolate flavor led the market in 2024 with a 44.3% share, driven by its universal appeal and nutritional value.

- The High-Protein shakes captured a 41.7% market share in 2024, fueled by demand for fitness and weight management solutions.

- Supermarkets and Hypermarkets accounted for a 37.8% share in 2024, favored for their product variety and competitive pricing.

- North America held a 43.7% share of the global market in 2024, valued at USD 4.8 billion, driven by fitness trends and strong retail infrastructure.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-ready-to-drink-shakes-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 11.2 Billion |

| Forecast Revenue (2034) | USD 22.2 Billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Ingredient (Dairy-based, Soy-based, Almond-based, Coconut-based, Plant-based), By Flavor (Chocolate, Vanilla, Strawberry, Mixed Berry, Tropical), By Functional Benefits (High Protein, Low Fat, No Sugar Added, Gluten-Free, Lactose-Free, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Health Food Stores, Specialty Stores, Others) |

| Competitive Landscape | Kellogg’s, Kraft Heinz, Danone, General Mills, Unilever, Abbott Laboratories, Campbell Soup Company, Mead Johnson Nutrition, FrieslandCampina, Nestle, PepsiCo |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156773

Key Market Segments

By Ingredient

Dairy- and Soy-Based Segment Commands 53.7% Share

In 2024, the dairy- and soy-based segment led the RTD shakes market, holding a 53.7% share. Dairy proteins like whey and casein remain popular for their complete amino acid profiles, rapid absorption, and muscle recovery benefits, attracting athletes and health-conscious consumers. Soy-based shakes, cholesterol-free and heart-healthy, appeal to lactose-intolerant and vegan/vegetarian consumers, broadening the segment’s reach. The combination of dairy’s digestibility and taste with soy’s plant-based appeal drives sustained growth across diverse demographics.

By Flavor

Chocolate Holds 44.3% Share

Chocolate dominated the RTD shakes market in 2024 with a 44.3% share, favored for its rich, indulgent taste and universal appeal across age groups. Its versatility in pairing with both dairy- and plant-based formulations enhances its popularity. Manufacturers are capitalizing on this demand by innovating with low-sugar, high-protein, and nutrient-fortified chocolate variants, ensuring the flavor’s continued dominance in the market.

By Functional Benefits

High Protein Leads with 41.7% Share

The high protein segment captured a 41.7% share in 2024, driven by growing consumer focus on fitness, muscle recovery, and weight management. Popular among athletes, gym-goers, and busy professionals, high-protein shakes meet the demand for convenient, nutrient-dense options. With rising awareness of protein’s role in satiety and metabolism, this segment is poised for further growth in 2025, fueled by clean-label trends and added benefits like low sugar and vitamin fortification.

By Distribution Channel

Supermarkets and Hypermarkets Hold 37.8% Share

Supermarkets and hypermarkets led distribution in 2024 with a 37.8% share, driven by their extensive product variety, competitive pricing, and promotional offers. These outlets enable consumers to compare brands and access both premium and mass-market RTD shakes, with discounts and bundled deals encouraging bulk purchases. Their dominance is expected to continue, supported by the trend toward one-stop shopping and the expansion of organized retail in emerging markets.

Regional Analysis

North America Leads with 43.7% Share, USD 4.8 Billion

North America held a commanding 43.7% share of the global RTD shakes market in 2024, valued at USD 4.8 billion, driven by demand for convenient, nutrition-focused meal replacements and robust retail infrastructure. Europe followed as a strong second, with growth fueled by health awareness and innovative flavors in markets like the UK.

The Asia-Pacific (APAC) region is the fastest-growing, propelled by urbanization, rising incomes, and demand for on-the-go nutrition, particularly in India and Japan. Other regions show emerging potential, though affordability and awareness pose challenges to broader adoption.

Top Use Cases

- Post-Workout Recovery: Busy athletes grab these shakes right after gym sessions to quickly rebuild muscles and ease soreness. Packed with easy-to-digest proteins, they help restore energy without needing a full meal, fitting perfectly into tight schedules for better performance and faster gains.

- Quick Breakfast Boost: Morning rush-hour folks sip these as a speedy start to the day, delivering balanced nutrition in one bottle. They curb hunger until lunch while providing steady fuel for work or school, making healthy mornings simple even on the go.

- Midday Snack for Weight Control: Office workers facing afternoon slumps turn to these low-calorie options to stay full and focused. They replace junk food temptations, supporting steady weight management by keeping metabolism active without extra effort or prep time.

- Senior Daily Nutrition Aid: Older adults use these shakes to easily meet protein needs for stronger bones and muscles. With added vitamins, they help maintain energy and mobility, offering a gentle way to combat age-related fatigue and support overall wellness.

- On-the-Go Meal Replacement: Travelers or parents juggling kids opt for these portable drinks during commutes or errands. They provide complete, satisfying nutrition in seconds, ensuring no skipped meals and keeping everyone energized amid hectic daily adventures.

Recent Developments

1. Kellogg’s (Kellanova)

Kellogg’s, now operating as Kellanova, is expanding its iconic Special K brand into the RTD protein shake segment. The new Special K High Protein Shakes target health-conscious consumers. This launch represents a strategic move to leverage a trusted brand name to capture market share in the competitive nutrition shake space.

2. Kraft Heinz

Kraft Heinz focuses its RTD shake strategy on the nutritional health segment through its partnership with Orgain, a leader in plant-based nutrition. Recent developments include expanding Orgain’s distribution and launching new flavors for its Organic Protein plant-based shakes. This allows Kraft Heinz to tap into the growing consumer demand for clean, plant-based protein options without directly extending its traditional brands into this category.

3. Danone

Danone continues to lead with innovation in medical and health nutrition through its Ensure brand. A key recent development is the launch of Ensure Complete, a new plant-based RTD shake. Containing 30g of complete protein from a fava bean and pea blend, it is designed to support muscle health for aging adults, addressing a critical need in the senior nutrition market with a sustainable, dairy-free option.

4. General Mills

General Mills leverages its powerful yogurt portfolio to compete in the RTD shake market. A significant innovation is the launch of Light & Fit High Protein Shakes. They are positioned as a gym-friendly, post-workout option, directly extending the equity of the popular Light & Fit brand beyond spoonable yogurt into the beverage aisle to meet consumer demand for convenient protein.

5. Unilever

Unilever focuses its RTD efforts on its sustainable nutrition brand, OWYN. Key developments include new flavor launches and a major retail expansion into stores like Walmart and Target. OWYN’s shakes are entirely plant-based, free from major allergens, and use a clean ingredient profile, aligning with Unilever’s broader goal of making plant-based nutrition more accessible to the mainstream market.

Conclusion

Ready-to-Drink shakes are evolving into everyday heroes for health on the move. With lifestyles speeding up and wellness taking center stage, these convenient sips are blending into routines seamlessly, from gym bags to office desks. Brands keep innovating with fresh plant-based twists and fun flavors to match diverse tastes, while eco-friendly packaging wins over mindful shoppers. Expect even more tailored options that make nutrition feel effortless, driving steady demand as people prioritize quick, feel-good fuel in a balanced life.