Table of Contents

Overview

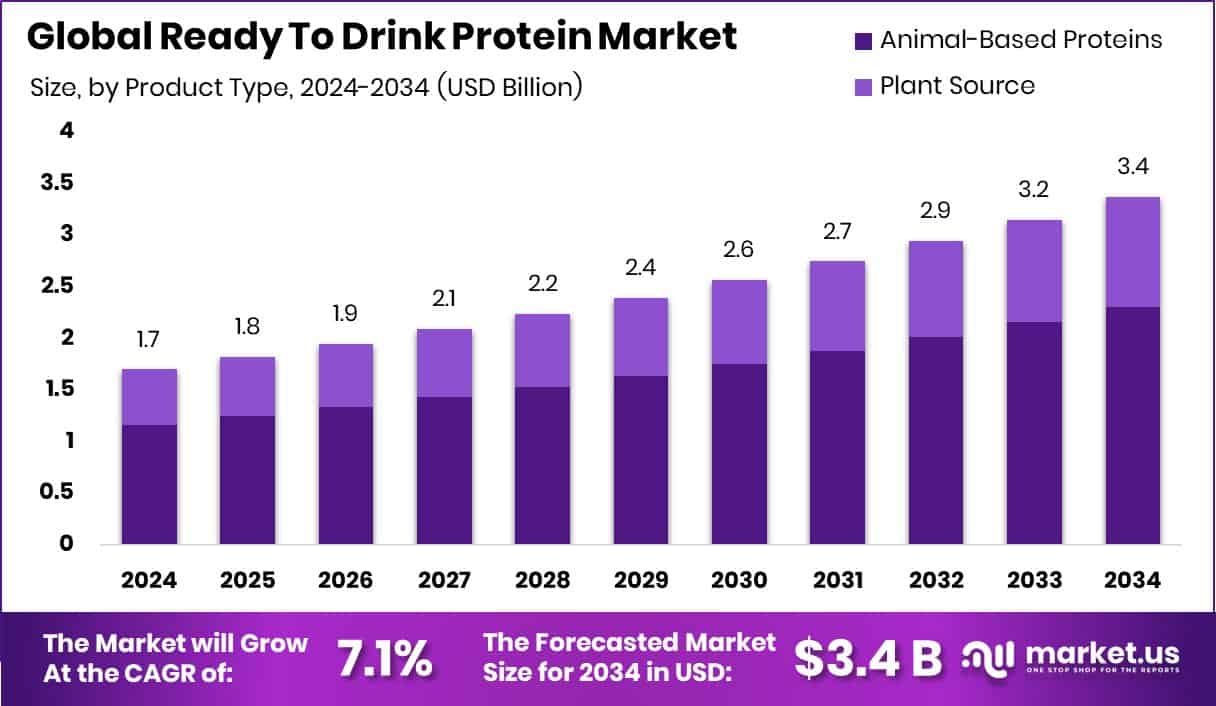

New York, NY – August 21, 2025 – The global Ready To Drink Protein Market is projected to reach approximately USD 3.4 billion by 2034, doubling from its 2024 valuation of USD 1.7 billion. This growth represents a steady compound annual growth rate (CAGR) of 7.1% from 2025 to 2034. North America remains a key contributor to this expansion, holding a notable market value of USD 0.8 billion. RTD protein beverages are pre-made, convenient drinks designed to deliver a quick protein boost, making them highly popular among fitness enthusiasts, athletes, and individuals managing active lifestyles or looking for a fast, nutritious meal alternative.

The RTD protein market encompasses the production and commercial sale of ready-to-consume protein beverages. These products cater to a broad consumer base that includes those engaged in sports, weight management, or simply those seeking functional food options. Rising health awareness and the adoption of wellness-driven lifestyles are major drivers of market growth. In response to shifting dietary preferences, there has been a surge in the development of plant-based and lactose-free formulations, attracting vegan and lactose-intolerant consumers. For instance, Nobell Foods recently raised USD 150 million to support the development of plant-based dairy alternatives, showcasing growing investor confidence in this evolving segment.

Busy modern lifestyles continue to fuel demand for convenient nutritional solutions like RTD protein drinks. Their portability, diverse flavor offerings, and role in quick energy delivery make them a go-to option for on-the-go consumption. The global emphasis on high-protein diets further reinforces their popularity, as more people seek accessible sources of essential nutrients. Innovations are also reshaping the market landscape, with companies like Kynda securing €3 million to develop fungal-based protein using fermentation, signaling a move toward sustainable and novel protein sources.

Key Takeaways

- The global Ready To Drink (RTD) Protein Market is projected to grow from USD 1.7 billion in 2024 to approximately USD 3.4 billion by 2034, registering a CAGR of 7.1% between 2025 and 2034.

- Animal-based protein products hold a dominant position in the market, accounting for 68.40% of total RTD protein sales.

- Bottled RTD protein drinks are the most preferred packaging format, capturing 58.30% of the market share.

- Supermarkets and hypermarkets are the leading distribution channels, representing 43.20% of the total market.

- North America leads the global market with a 48.10% share, contributing around USD 0.8 billion to the overall RTD protein market

➤ For a deeper understanding, click on the sample report link: https://market.us/report/ready-to-drink-protein-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.7 Billion |

| Forecast Revenue (2034) | USD 3.4 billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Product Type (Animal-Based Proteins (Milk, Whey, Others), Plant Source (Pea Protein, Soy Protein, Quinoa Protein, Rice Protei, Hemp Protein, Others)), By Packaging Type (Bottles, Cans, Cartons, Pouches, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) |

| Competitive Landscape | Abbott Laboratories, Amway Corporation, Ascent Protein, Danone S.A., Glanbia plc, ICONIC Protein, Kellogg Company, Koia, Labrada Nutrition, Nestlé S.A., Orgain, Inc., PepsiCo, Inc., Post Holdings Inc., Premier Nutrition Corporation, Pure Protein, The Coca-Cola Company, The Simply Good Foods Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144813

Key Market Segments

1. By Product Type Analysis

- In 2024, animal-based proteins dominated the Ready To Drink (RTD) Protein Market, accounting for 68.40% of the total market share. This dominance is primarily due to the perception that animal-based proteins, such as whey and collagen, offer complete essential amino acid profiles, making them ideal for muscle repair and recovery. These protein types have long been trusted by athletes and fitness-conscious consumers, further reinforcing their strong market position. The continued preference for animal-based RTD protein drinks is also supported by their wide availability and variety. Brands have successfully launched multiple flavors and formulations that appeal to both performance-focused users and general health-conscious consumers. This variety has helped animal-based proteins maintain their lead, despite growing interest in plant-based alternatives. While plant-based RTD options are gaining momentum, the deep-rooted consumer habits and consistent performance of animal-based products continue to secure their market lead. Moving forward, innovation in flavor development and improved nutritional profiles is expected to drive further growth within this segment.

2. By Packaging Type Analysis

- In terms of packaging, bottled RTD protein drinks led the market in 2024 with a 58.30% share. Bottles are favored for their durability, convenience, and portability, making them ideal for busy lifestyles. Whether made from plastic or glass, bottled formats protect the drink’s freshness and allow for easy consumption on the go. Bottled packaging also benefits from its widespread availability across retail channels, which enhances product visibility and consumer access. Furthermore, bottles offer excellent branding opportunities through visually appealing labels and designs, helping companies attract attention and build brand loyalty in a competitive marketplace. Given these advantages, bottled RTD protein drinks are expected to maintain their dominance. As demand for convenient and nutritious beverages grows, bottles will likely remain the preferred packaging format due to their practicality and consumer familiarity.

3. By Distribution Channel Analysis

- Supermarkets and hypermarkets emerged as the leading distribution channel for RTD protein drinks in 2024, capturing 43.20% of the market. Consumers favor these outlets for the convenience of one-stop shopping, the ability to compare products in person, and immediate access to a wide selection of RTD options. The large footprint and strategic placement of supermarkets and hypermarkets allow them to reach diverse consumer groups efficiently. These retail environments offer both well-known brands and new entrants, providing ample choices and driving impulse purchases. Regular promotions and competitive pricing also contribute to their popularity, especially among value-conscious shoppers. As these retailers continue expanding their health and wellness sections, they are well-positioned to retain their dominance in RTD protein distribution. Their role in shaping consumer purchasing behavior and providing trusted shopping experiences reinforces their importance in the growth of the RTD protein market.

Regional Analysis

- The global Ready To Drink (RTD) Protein Market is geographically segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, with each region displaying distinct growth trends and opportunities.

- North America leads the market with a commanding 48.10% share, equivalent to a market value of USD 0.8 billion. This leadership is largely fueled by a well established fitness culture, widespread awareness of nutritional supplements, and a strong consumer focus on health and wellness.

- Europe ranks next, supported by a mature market of health conscious consumers and a strong network of retail channels that make RTD protein drinks easily accessible. In contrast, the Asia Pacific region is witnessing significant growth, driven by urbanization, rising disposable incomes, and the growing adoption of Western dietary preferences positioning it as a critical growth hub in the coming years.

- Although currently smaller in scale, the Middle East & Africa and Latin America are emerging markets with promising potential. Increasing health awareness, combined with improvements in retail infrastructure, is expected to drive the uptake of RTD protein beverages across these regions.

Top Use Cases

- Post‑Workout Recovery: Athletes and fitness‑enthusiasts often use RTD protein beverages after exercise to promote muscle repair and accelerate recovery. These convenient pre‑mixed drinks deliver precise protein doses often in portable form, making them ideal for post‑gym or post‑training replenishment without the need for mixing powders or preparing shakes.

- On‑the‑Go Nutrition: Busy professionals, commuters and students turn to RTD protein drinks for quick and balanced nutrition. These shelf‑stable, ready to consume products provide a protein‑rich snack between meals, supporting sustained energy and satiety while fitting into fast‑paced lifestyles without requiring refrigeration or preparation.

- Meal Replacement Aid: Consumers seeking calorie control or time‑saving meals often rely on RTD protein drinks as meal substitutes. With balanced macro‑nutrient profiles protein, carbs, fat they support weight management or dieting goals. They offer a convenient option when time or appetite limits eating a full meal but nutritional needs still demand attention.

- Weight Management Support: RTD protein beverages help control appetite and support weight loss regimens by increasing feelings of fullness. Protein is known to reduce hunger hormones and preserve lean mass during calorie restriction. These drinks serve as controlled‑portion snacks or mini‑meals that align with structured diets and help curb unhealthy food cravings.

- Plant‑Based Lifestyle Integration: As plant‑protein demand rises, RTD protein drinks are increasingly formulated from soy, pea, or other plant sources. This caters to vegans, flexitarians, and those avoiding dairy, allowing them to receive on‑the‑go protein in clean‑label formulations. These plant‑based RTDs appeal through allergen‑free claims and growing consumer preference for sustainable ingredients.

- Aging & Clinical Nutrition: Older adults and clinical or hospitalized patients use RTD protein beverages to maintain muscle mass, support recovery, and supplement nutrition when appetite is low. These fortified, easy to consume beverages help prevent under‑nutrition and muscle loss in elderly populations or in clinical situations where regular meals are insufficient or impractical.

Recent Developments

1. Abbott Laboratories:

- Abbott launched its new PROTALITY™ brand at the beginning of 2024, featuring a high‑protein RTD shake aligned with its successful Ensure Max Protein formula. The shake delivers 30 g of combined fast and slow‑digesting protein, 1 g sugar, 150 calories, and 25 vitamins and minerals. Abbott also entered into a sponsorship as the exclusive protein shake partner of the Professional Pickleball Association tour. Ensure achieved over $3 billion in global sales in 2024, with growth driven by aging populations valuing muscle‑support nutrition.

2. Amway Corporation:

- Amway’s Nutrilite™ brand recently expanded its ready‑to‑drink protein portfolio with Mixed Soy Protein Drink with Peptides & Aloe Vera, specifically designed to support mobility. Their Nutrilite Organic All in One RTD shake delivers 20 g plant‑based protein, 25 vitamins, fiber, and whole food ingredients. Their XS™ Sports Protein Shakes continue to offer 25 g whey/casein protein per 11 oz bottle with just 1 g sugar an athlete‑focused RTD option.

3. Ascent Protein:

- Ascent has recently expanded its Whole Foods footprint with three new products, including its Clear Whey Protein Isolate in Pineapple Coconut and Orange Mango flavors, plus the Mint Chocolate Chip whey powder debut. Although primarily powders, their clear whey drink aligns with the hydration‑style RTD segment. These launches began nationwide in spring 2025 at Whole Foods stores.

4. Danone S.A.:

- Danone North America has entered the RTD protein shake market under its Oikos brand. In mid‑May 2025, it launched shelf‑stable Oikos Protein Shakes (12 fl oz), delivering 30 g protein, 5 g prebiotic fiber, only 1 g sugar, and no artificial sweeteners. Rolling out across Amazon and major retailers including CVS, Kroger, HyVee, with expansion to Walmart, Target.

5. Glanbia plc:

- Glanbia subsidiary Optimum Nutrition continues investment in RTD nutrition. Most recently, they introduced OptiATP, a heat‑stable ATP ingredient suited for acidic RTD formulations via partnership with TSI Group. They also broadened their ISOPURE portfolio by launching Collagen Peptides supporting joints, skin and immunity. Functional and performance RTD products remain a core growth area for Glanbia.

Conclusion

The Ready To Drink (RTD) Protein Market is growing steadily as more people choose healthy and convenient options in their daily lives. Consumers are becoming more aware of the importance of protein for fitness, energy, and overall health. This has led to increased demand for RTD shakes that can be consumed on the go. The market is expanding beyond gyms and athletes, now attracting working professionals, older adults, and even plant-based lifestyle followers. Companies are focusing on better ingredients, cleaner labels, and a wider variety of flavors to meet different consumer needs. With strong interest across regions, the future of this market looks bright and full of opportunity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)