Table of Contents

Overview

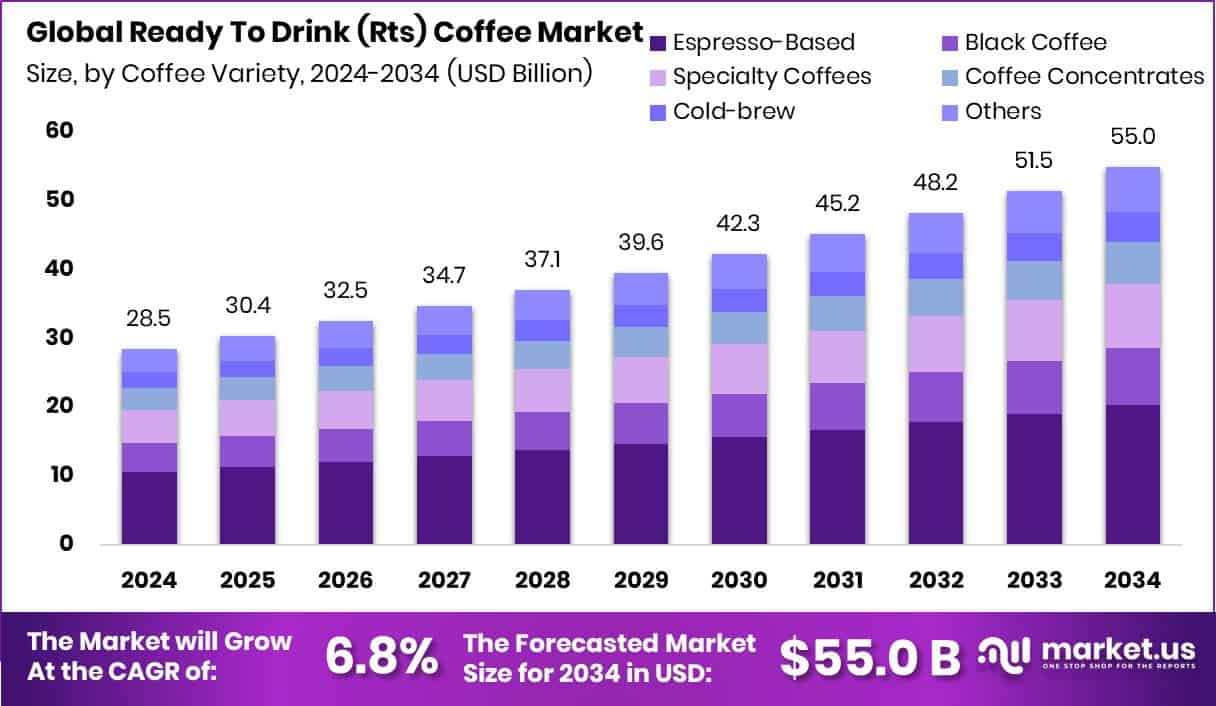

New York, NY – August 7, 2025 – The global Ready To Drink (RTD) Coffee Market is projected to grow significantly, reaching approximately USD 55.0 billion by 2034 from USD 28.5 billion in 2024, at a CAGR of 6.8% between 2025 and 2034. The Asia-Pacific region currently leads the market, holding a 42.10% share, with revenue estimated at USD 11.9 billion. RTD coffee, commonly available in bottles or cans, offers consumers a quick and convenient way to enjoy coffee without the need for brewing. These ready-to-consume beverages are available in a variety of styles, from plain black coffee to those enhanced with milk, sugar, and unique flavors, making them attractive to a wide range of consumers.

The demand for RTD coffee continues to rise as busy lifestyles fuel the need for on the go beverage solutions. This market appeals to various consumer segments, including students, working professionals, and fitness enthusiasts, who seek both the flavor and energy boost of coffee with minimal preparation time. The rising trend of premiumization and customization in coffee offerings is also enhancing the popularity of RTD coffee, with brands focusing on new flavors, healthier ingredients, and sustainable packaging to attract health-conscious and environmentally aware consumers.

Recent funding activities further highlight the growing investor interest in this sector. Fast Coffee, a coffee startup, secured $1 million in seed funding, including $400,000 from a previous pre-seed round. Specialty coffee brand Blue Tokai raised $35 million in a funding round led by Belgium-based Verlinvest, pushing its valuation to around $180 million. First Coffee also gained momentum with $1.2 million in seed funding led by BEENEXT, while Philippines-based Pickup Coffee raised $40 million at a valuation of $130 million. These developments reflect the strong growth potential and increasing global appetite for innovation in the RTD coffee space.

Key Takeaways

- The global Ready To Drink (RTD) Coffee Market is projected to reach approximately USD 55.0 billion by 2034, rising from USD 28.5 billion in 2024, with an expected CAGR of 6.8% from 2025 to 2034.

- Espresso-based RTD coffee products lead by coffee type, accounting for a notable 37.30% share of the market.

- The original flavor remains the top choice among consumers, representing 67.30% of the flavor segment.

- Packaging-wise, glass and PET bottles dominate, making up 61.2% of total market share.

- Supermarkets and hypermarkets are the most preferred sales channels, contributing 41.20% to the market.

- Asia-Pacific leads regional sales, generating USD 11.9 billion in 2024 and holding a 42.10% share of the global market

➤ For a deeper understanding, click on the sample report link: https://market.us/report/ready-to-drink-rts-coffee-market/free-sample/

Report Scope

| Market Value (2024) | USD 28.5 Billion |

| Forecast Revenue (2034) | USD 55.0 Billion |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Coffee Variety (Espresso-Based, Black Coffee, Specialty Coffees, Coffee Concentrates, Cold-brew, Others), By Flavour (Original, Flavoured (Vanilla, Hazelnut, Caramel, Chocolate, Others)), By Packaging Material (Glass and PET Bottles, Cartons, Cups, Cans, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others) |

| Competitive Landscape | Asahi Group Holdings, Ltd., Danone S.A., The Coca‑Cola Company., JAB Holding Company, Lotte Chilsung Beverage Co Ltd, McDonald’s Corporation, Nestle S.A., PepsiCo, Suntory Beverage & Food, Dr. Pepper Snappel Group., Starbucks, Unilever, Ajinomoto General Foods Inc., Suntory Beverage & Food |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144920

Key Market Segments

1. By Coffee Variety Analysis

- Espresso-based RTD coffee leads the market with a strong 37.30% share, primarily due to its bold flavor and high caffeine content that resonates with consumers seeking a quick, energizing beverage. In 2024, this segment held a dominant 49.2% market share, highlighting its strong foothold. The popularity of espresso drinks once limited to cafés has successfully transitioned into the ready-to-drink format. Espresso-based RTD products appeal to traditional coffee drinkers who enjoy the intensity of espresso but prefer the convenience of a pre-packaged option, combining quality and ease of use in one offering.

2. By Flavour Analysis

- The Original flavor remains the top choice among consumers, accounting for 67.30% of the RTD coffee market. In 2024, it captured a leading 49.2% share in the flavor segment, largely due to its widespread appeal and resemblance to the classic black coffee experience. This flavor satisfies those who enjoy the authentic taste of coffee without any added sweeteners or enhancements. Its simplicity and traditional profile resonate across age groups, reinforcing its place as the preferred choice for consumers seeking a no-frills, rich coffee taste in a ready-to-drink format.

3. By Packaging Material Analysis

- Glass and PET bottles dominate RTD coffee packaging, holding a 61.2% market share due to their practicality and consumer appeal. In 2024, this packaging category led with a 49.2% share, reflecting its popularity across various consumer segments. Glass bottles are appreciated for maintaining the quality and flavor of the beverage while offering a premium appearance. Meanwhile, PET bottles are lightweight, durable, and convenient for on-the-go consumption. The combination of both materials meets a broad spectrum of preferences, balancing aesthetics, functionality, and recyclability.

4. By Distribution Channel Analysis

- Supermarkets and hypermarkets are the leading distribution channels for RTD coffee, accounting for 41.20% of the market in 2024. With a dominant 49.2% share, this segment benefits from high consumer footfall and the convenience of offering multiple brands and product options under one roof. These retail outlets are favored for their accessibility and affordability, providing shoppers with the ability to explore and purchase RTD coffee as part of their regular grocery runs. The wide reach and comprehensive product visibility in these venues make them crucial to the market’s overall growth and accessibility.

Regional Analysis

- Asia-Pacific accounts for 42.10% of the global Ready To Drink (RTD) Coffee Market, with a market value of USD 11.9 billion.

- The RTD coffee market is experiencing varied growth trends across regions, including Asia-Pacific, North America, Europe, the Middle East & Africa, and Latin America, each shaped by distinct consumer behaviors and market conditions.

- Asia-Pacific leads the global RTD coffee market, driven by a strong coffee culture in countries like Japan and South Korea, along with a growing demand for convenient beverage choices. The region’s dominance reflects changing lifestyles and increasing consumer interest in ready-made options.

- North America follows with a strong inclination toward premium and health-focused RTD coffee products, showcasing the region’s emphasis on wellness and high-quality ingredients. Europe, too, is seeing a shift from traditional brewed coffee to more convenient RTD formats, in line with evolving consumer habits.

- In the Middle East & Africa, demand is rising due to rapid urbanization and improved retail access, making RTD coffee more readily available. Latin America, while still developing in this segment, benefits from its deep-rooted coffee culture and a growing younger population that is increasingly embracing modern consumption trends.

Top Use Cases

- On the go convenience: Busy individuals such as students and professionals choose RTD coffee because it offers instant caffeine without the need for brewing. It fits seamlessly into fast-paced routines, whether during commutes, office breaks, or errands, providing a practical and efficient way to enjoy quality coffee wherever they may be.

- Health‑oriented product options: Consumers increasingly seek RTD coffee varieties that align with healthy lifestyles those that are low in sugar, dairy-free, or infused with functional ingredients like vitamins or adaptogens. This interest in wellness-driven formats positions RTD coffee as more than just a caffeine fix it’s being embraced as a nourishing and conscious choice.

- E‑commerce and digital retail expansion: RTD coffee brands are leveraging online retail platforms to reach customers directly, offering home delivery and subscription models. This digital shift enhances accessibility and allows brands to showcase niche or premium products to targeted consumer segments who prefer browsing and buying online at their convenience.

- Retail channel versatility: RTD coffee is distributed through a wide range of outlets—from supermarkets and convenience stores to kiosks and self-service machines making it accessible at various touch points. This flexibility ensures consumers can easily grab a ready-made beverage whether during grocery shopping, commuting, or post-work caffeine breaks.

- Product innovation and flavor experimentation: Novelty in the RTD coffee segment is thriving, with brands introducing flavors like cold brew, nitro, caramel, vanilla, or even plant-based and seasonal specialties. These unique offerings cater to adventurous consumers and encourage repeat engagement by continually refreshing the product experience.

Recent Developments

1. Asahi Group Holdings, Ltd.

- Asahi Group continues strengthening its non alcohol RTD beverage innovation, notably in coffee and tea. Its R&D site explicitly highlights activities in “coffee” within the non‑alcohol beverage category, as part of its efforts to explore new raw materials and production technologies to meet consumer trends. Additionally, Asahi achieved a milestone in sustainability by securing SBTi certification for both short‑ and long‑term net‑zero emissions targets, underscoring its commitment to environmentally responsible growth across all beverage segments—including RTD coffee.

2. Danone S.A.

- Danone’s Coffee Creations platform (including brands like International Delight and StōK) drove strong volume‑and‑mix growth in North America throughout 2024, contributing to overall category. Full‑year 2024 results report that Coffee Creations, along with High Protein and Waters, significantly bolstered performance in North America, supporting a +4.3 % like‑for‑like sales increase. However, in Q1 2025, the Coffee Creations category faced a slower start due to competitive pressures and some service‑level disruptions that led to temporary out‑of‑stock events.

3. The Coca‑Cola Company

- Coca‑Cola reorganized its structure so that Costa Coffee’s RTD business outside Europe will now report through local operating units, as Costa and Innocent brands are shifted under the Europe Operating Unit effective January 1, 2025. Additionally, Costa Coffee expanded its U.S. RTD lineup in summer 2024, launching three canned Iced Coffee Latte flavors (Mocha, Caramel, Signature Blend) marketed toward active lifestyles, with retail placements in outlets like Amazon Fresh, Walgreens, 7‑Eleven, and more

4. JAB Holding Company

- JAB, through its subsidiary Keurig Dr Pepper (KDP), remains a major RTD coffee player. In May 2025, JAB’s subsidiary initiated a secondary offering of 75 million shares in KDP, adjusting its ownership stake to around 4.4 %, reaffirming capital activity in the ready‑to‑drink coffee/dairy category. Additionally, JAB restructured leadership of its restaurant and coffee brands by appointing José Cil (former Restaurant Brands International CEO) as chairman across Panera Brands, including Caribou Coffee, Pret A Manger, and Einstein Bros., seeking brand revitalization even though these are broader coffee‑adjacent ventures rather than RTD beverage lines.

5. Lotte Chilsung Beverage Co., Ltd.

- Lotte Chilsung showcases its RTD coffee innovation via its Let’s Be and Cantata brands. “Let’s Be” is promoted as a signature canned‑coffee brand from Korea, aiming for global recognition with emotionally resonant branding. “Cantata” emphasizes quality, using high‑grade beans and double‑drip extraction to deliver balanced flavor and aroma in its RTD coffee products. These highlights underscore the company’s continued focus on brand identity and product quality in the RTD coffee market.

Conclusion

the Ready To Drink (RTD) coffee market is growing steadily due to changing lifestyles and increasing demand for convenient beverage options. Consumers are looking for products that are easy to carry, tasty, and offer a quick energy boost. This has encouraged companies to launch new flavors, healthier ingredients, and eco-friendly packaging. Major players like Coca‑Cola, Danone, Asahi, JAB, and Lotte are actively expanding their product lines to meet evolving consumer preferences. With rising coffee culture and interest in premium and functional drinks, the RTD coffee market is expected to keep expanding in both developed and emerging regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)