Table of Contents

Overview

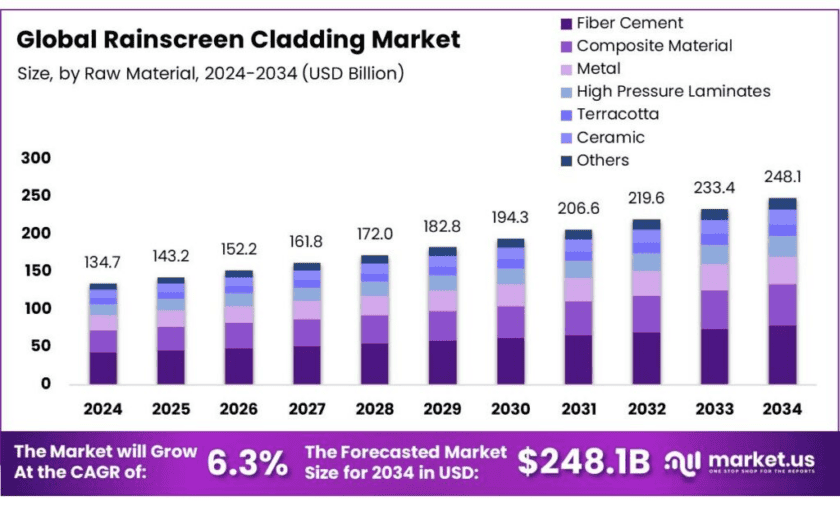

New York, NY – Nov 07, 2025 – The Global Rainscreen Cladding Market is projected to reach USD 248.1 billion by 2034, up from USD 134.7 billion in 2024, registering a CAGR of 6.3% between 2025 and 2034. In 2024, Europe dominated the market with a 45.9% share, accounting for approximately USD 61.8 billion in revenue. Rainscreen cladding—also referred to as ventilated façade cladding—is a multilayer façade system consisting of an outer weather-resistant skin, an air cavity, and an inner support wall.

It enhances building performance by controlling moisture, minimizing thermal bridging, and enabling ventilation behind the façade, thereby improving durability, insulation, and aesthetics. The system’s rising adoption is driven by growing emphasis on energy-efficient and sustainable building designs.

In India, government initiatives are encouraging the uptake of green building materials such as rainscreen cladding. Incentives include tax benefits, low-interest loans, and fast-track approvals for LEED and IGBC-certified projects. The Gujarat government, for example, reimburses up to INR 3 lakh or 50% of the IGBC certification fee, whichever is lower, for certified projects. The Indian Green Building Council (IGBC) has also set an ambitious goal of achieving 10 billion sq ft of certified green buildings by 2035.

Globally, government standards and energy regulations indirectly support market growth. In the United States, under EISA Section 433, all new or majorly renovated federal buildings must cut fossil fuel energy use by 55% from the 2003 baseline and comply with energy efficiency standards such as ASHRAE and IECC. Additionally, federal funding for new construction is permitted only when buildings meet or exceed these federal energy performance criteria, further promoting advanced façade technologies like rainscreen cladding.

Key Takeaways

- Rainscreen Cladding Market size is expected to be worth around USD 248.1 Billion by 2034, from USD 134.7 Billion in 2024, growing at a CAGR of 6.3%.

- Fiber cement held a dominant position in the rainscreen cladding market, capturing more than a 31.8% share.

- Residential applications held a dominant market position in the rainscreen cladding industry, capturing more than a 31.6% share.

- New construction held a dominant market position in the rainscreen cladding industry, capturing more than a 67.9% share.

- Europe emerged as the leading regional market for rainscreen cladding, capturing a significant 45.9% share, equivalent to USD 61.8 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-rainscreen-cladding-market/free-sample/

Report Scope

| Market Value (2024) | USD 134.7 Bn |

| Forecast Revenue (2034) | USD 248.1 Bn |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Raw Material (Fiber Cement, Composite Material, Metal, High Pressure Laminates, Terracotta, Ceramic, Others), By Application (Residential, Commercial, Official, Institutional, Industrial), By Construction Type (New Construction, Renovation) |

| Competitive Landscape | Kingspan Insulation plc, Carea Ltd., M.F. Murray Companies, Inc., Celotex Ltd., CGL Facades Co., Rockwool International A/S, FunderMax, Everest Industries Ltd., Trespa International B.V., Euro Panels Overseas N.V. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159845

Key Market Segments

By Raw Material Analysis – Fiber Cement Leads with 31.8% Share in 2024

In 2024, fiber cement dominated the global rainscreen cladding market, capturing a 31.8% share. Its leadership stems from outstanding durability, low maintenance costs, and affordability compared to metal or composite alternatives. Composed of cement, cellulose fibers, and mineral fillers, fiber cement panels demonstrate high resistance to moisture, fire, and pest damage, making them ideal for both residential and commercial projects. The segment’s future strength lies in technological innovations improving surface textures, finishes, and colors, which enhance both performance and architectural aesthetics.

By Application Analysis – Residential Sector Leads with 31.6% Share in 2024

The residential segment held the largest market share in 2024, accounting for 31.6% of global rainscreen cladding demand. This growth is propelled by rising consumer preference for energy-efficient, visually appealing, and low-maintenance homes. Homeowners and developers are adopting rainscreen systems for their ability to provide thermal insulation, weather resistance, and long-term façade durability. Additionally, government incentives promoting sustainable housing—such as tax rebates and energy-efficiency certifications—are accelerating the use of eco-friendly cladding materials in residential construction.

By Construction Type Analysis – New Construction Dominates with 67.9% Share in 2024

In 2024, new construction projects accounted for a commanding 67.9% share of the global rainscreen cladding market. This dominance is primarily due to the rapid expansion of urban infrastructure, commercial complexes, and residential buildings worldwide. Developers increasingly favor rainscreen cladding for its aesthetic versatility, moisture protection, and thermal performance, which extend building lifespan and reduce energy costs. Moreover, strict building codes and sustainability regulations in regions such as Europe and North America mandate energy-efficient façade solutions for new structures.

List of Segments

By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

By Construction Type

- New Construction

- Renovation

Regional Analysis

In 2024, Europe held a commanding position in the global rainscreen cladding market, accounting for a 45.9% share, valued at approximately USD 61.8 billion. This leadership is largely fueled by strict building codes, rapid urban development, and the region’s strong focus on energy-efficient and sustainable construction.

The region’s dominance is further reinforced by proactive government initiatives and EU-wide sustainability programs. Under the European Green Deal and the Renovation Wave strategy, substantial investments are directed toward improving the energy performance of residential and commercial buildings.

Top Use Cases

EU deep-retrofit programs targeting energy savings: Rainscreen cladding is widely used in Europe to upgrade façades during energy renovations, helping cut heat loss, manage moisture, and improve U-values. The EU’s Renovation Wave aims to renovate 35 million buildings by 2030, and buildings account for ~40% of EU energy use—a scale that positions ventilated façades as a high-volume retrofit solution for walls and curtain façades. Public and social buildings retrofitted with high-performance envelopes can unlock significant energy bill reductions and carbon savings across the stock.

U.S. federal projects complying with fossil-fuel reduction rules: New and major-renovation federal buildings in the U.S. must reduce fossil-fuel-generated energy consumption under EISA Section 433 (final rule issued May 1, 2024). Project teams respond by tightening the envelope—using rainscreen systems to raise effective R-values, limit thermal bridging, and control bulk rain and vapor—so facilities meet progressively stricter energy targets during design.

UK new builds hitting Part L 2021 performance uplifts: For non-domestic buildings in England, the Part L 2021 uplift targets a 27% CO₂ reduction versus 2013 baselines; notional values also tighten fabric limits (e.g., walls from 0.35 to 0.26 W/m²·K; glazing to ~1.4–1.6 W/m²·K). Developers use ventilated rainscreen façades with continuous insulation and thermally broken sub-framing to meet these targets while preserving design flexibility.

Hot-climate cooling-load reduction through ventilated facades: In warm seasons, a ventilated air-cavity behind the outer panel can limit solar heat gains and lower cooling loads. Computational and experimental studies on ventilated façades (including rainscreen assemblies) report that properly designed ventilation gaps and opening strategies significantly reduce heat transfer from the sun-exposed skin to the wall, improving indoor comfort and HVAC efficiency—especially in hot, sunny climates.

Fire-performance compliance and façade upgrades: Where local codes require large-scale fire testing, rainscreen systems are engineered and selected to pass BS 8414 full-scale façade fire tests (Part 1 for masonry substrates; Part 2 for steel frames). Upgrading legacy façades to BS 8414-assessed systems enables owners to maintain a drained/ventilated cavity while meeting stringent fire-safety requirements on high-rise and complex buildings.

Recent Developments

Kingspan Insulation plc: In 2023, Kingspan reported Group turnover of €8,608 million and trading profit of €573.8 million for its insulated-panels business (down 9 % on 2022) as it developed high-performance façade and rainscreen systems including its K-Roc® Rainscreen Slab and AlphaCore Pad (thermal conductivity 0.020 W/mK).

Carea Ltd.: Carea has built a robust niche in rainscreen cladding: with over 10 million m² of façade panels installed, three industrial sites in France, and nearly 40 years’ experience designing mineral composite rainscreen systems for both new build and refurbishment.

M.F. Murray Companies, Inc.: Although specific revenue figures for 2023 are not publicly broken out, market reports estimate that this company commands about 10 %–14 % of the global rainscreen cladding market in that year. M.F. Murray specialises in metal and composite panel systems, focusing on weather-resistance, corrosion protection and modular façade integration — features highly relevant to the rainscreen segment. Their work thus aligns with the drives in the market for durable, high-performance cladding solutions.

Celotex Ltd.: In December 2023, Saint‑Gobain announced the sale of a majority stake in the PIR (polyisocyanurate) insulation business under the Celotex brand, which is widely used in rainscreen cladding applications. Market-research sources estimate Celotex’s share of the global rainscreen cladding market at around 8 %–12 % in 2023.

CGL Facades Co.: CGL Facades, founded in 1946 and headquartered in Scotland, operates a 50,000 sq ft factory and has manufactured rainscreen cladding systems for over 30 years. Their product range—such as CS3 support-grid ventilated façades—is CWCT and BS EN 13501-1 certified to resist water, wind and fire penetration.

ROCKWOOL International A/S: In 2023 the ROCKWOOL Group reported sales of EUR 3.6 billion, down 4 % in local currencies compared with 2022, with an EBIT margin of 14.3 %. Their façade insulation and façade cladding product lines (including ventilated façade systems) are seeing an increased shift in demand, especially for flat roofs and façade insulation in 2024.

FunderMax: FunderMax delivers high-pressure laminate (HPL) panels designed for rainscreen façade use—its “Max Compact Exterior” and “m.look Exterior” ranges provide scratch-resistant, weather-stable finishes and feature non-combustible EN 13501-1 class A2-s1-d0 options. While public financials specific to its rainscreen cladding segment for 2023-24 are not disclosed, the company emphasises sustainability, long-life performance and architectural flexibility globally.

Everest Industries Ltd.: In FY 2024 (ended March 2024), Everest Industries reported total revenues of approximately INR 1,575 crore, down around 4 % from INR 1,648 crore in FY 2023. The company’s cladding business—via its wall-cladding panels and exterior façade boards—focuses on fibre-cement and high-performance boards branded “SuperHD” and “ColourClad” for exterior rainscreen-type applications.

Trespa International B.V.: In 2023, Trespa reported revenue of approximately €179.7 million within its parent cluster. As a key player in the rainscreen cladding sector, Trespa specialises in high-pressure laminate panels for exterior façades (e.g., its Meteon® series) and emphasises sustainability by integrating up to 70 % wood-fibres in panel cores and offering transparent CO₂-footprint data. The company leverages decades of material innovation and architectural partnerships to address modern demands for durability, aesthetics and envelope performance.

Euro Panels Overseas N.V.: According to recent Belgian filings, Euro Panels Overseas recorded a turnover of €17.39 million in its latest results (filed June 2024) and employed about 10.6 FTEs. The firm manufactures external façade panels, cladding boards and roofing products, positioning itself in the rainscreen market as a smaller niche supplier. Its scale is modest compared to global leaders, but its relevance lies in targeted regional supply and specialised cladding solutions.

Conclusion

In conclusion, the global market for rainscreen cladding is firmly on an upward trajectory. The driving forces behind this growth are clear: increasing demand for façade systems that deliver superior moisture control, thermal performance, and durability, especially as sustainability and building-performance standards tighten globally.