Table of Contents

Overview

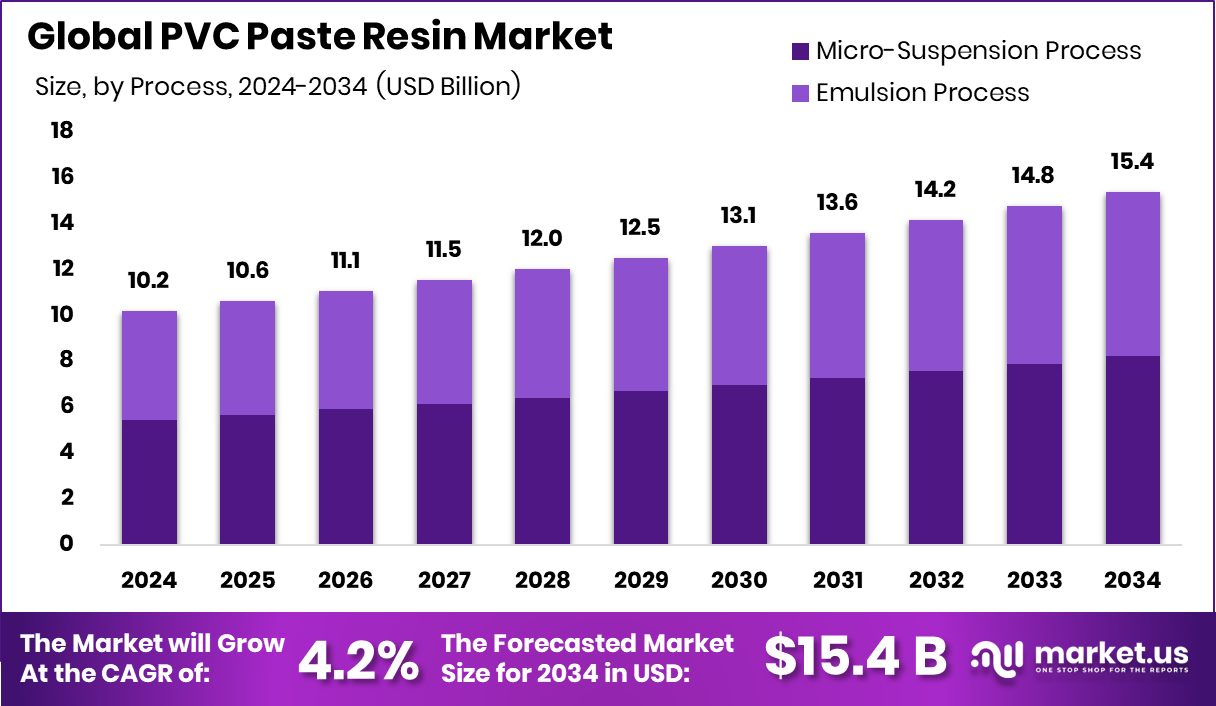

New York, NY – September 29, 2025 – The Global PVC Paste Resin Market was valued at USD 10.2 billion in 2024 and is projected to grow at a CAGR of 4.2% between 2025 and 2034, reaching approximately USD 15.4 billion by 2034.

PVC paste resin is a fine particle-sized polyvinyl chloride powder that, when blended with plasticizers, produces a stable plastisol paste. This material is widely valued for its chemical stability, durability, and electrical insulation properties, which remain effective even after the addition of various modifiers. The paste is utilized in multiple processing techniques, such as coating, dipping, and spraying, enabling the production of flexible PVC goods, including artificial leather, gloves, flooring, and wallpapers.

Its versatility makes it a key input across several industries. Market growth is largely driven by demand from the construction and automotive sectors, both of which require durable, lightweight, and cost-effective materials. In line with global sustainability trends, the industry is also shifting towards phthalate-free plasticizers and bio-based PVC alternatives, reflecting a growing environmental and health consciousness.

However, challenges persist due to concerns around the environmental impact of PVC production and disposal, particularly linked to its high chlorine content. These issues may pose regulatory and reputational risks for manufacturers. Despite these hurdles, polyvinyl chloride remains one of the most widely used plastics globally, with annual resin consumption exceeding 40 million tons, underscoring its indispensable role in modern manufacturing and infrastructure.

Key Takeaways

- The Global PVC Paste Resin Market was valued at USD 10.2 billion in 2024, at a CAGR of 4.2% and is estimated to reach USD 15.4 billion by 2034.

- Based on the process, PVC paste resin that is produced through the micro-suspension process dominated the market in 2024, comprising about 53.4% share of the total global market.

- Based on the grade of PVC paste resins, high K-value grade resins led the market with approximately 42.9% of the market share.

- Among the end-use industries, PVC paste resins are used in the construction sector, and hence, they dominated the market in 2024, accounting for around 35.7% of the market share.

- Asia Pacific was the largest market for PVC paste resin in 2024 due to its rapidly expanding construction industry, comprising around 42.5% of the total global market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-pvc-paste-resin-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.2 Billion |

| Forecast Revenue (2034) | USD 15.4 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Process (Micro-Suspension Process, Emulsion Process), By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Others), By End-Use Industry (Construction, Automotive, Electronics, Packaging, Others) |

| Competitive Landscape | INEOS Group Limited, LG Chem, Westlake Corporation, Hanwha Solutions Corporation, Orbia, Tosoh Corporation, Formosa Plastics Corporation, SCG Chemicals Public Company Limited, Kaneka Corporation, Chemplast Sanmar, and Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157677

Key Market Segments

Process Analysis

The PVC paste resin market is divided by production process into micro-suspension and emulsion methods. In 2024, the micro-suspension process held the largest share at 53.4%. This dominance stems from its ability to produce resins with superior flow, lower viscosity, and enhanced thermal and water resistance compared to the emulsion process. The micro-suspension method also allows precise control over particle size (approximately 1 μm), ensuring consistent and high-quality resin properties. Additionally, it uses fewer emulsifiers, resulting in higher purity and better overall performance.

Grade Analysis

Based on grade, the PVC paste resin market is segmented into high K-value, mid K-value, low K-value, and other grades. In 2024, high K-value resins led with a 42.9% market share. Their higher molecular weight enhances tensile strength, modulus, and impact resistance, making them ideal for applications requiring durability under stress and strain.

High K-value resins offer superior resistance to creep, deformation, and flex fatigue, ensuring long-lasting performance in products like rigid pipes, window frames, and building profiles. While low K-value resins suit flexible applications like films and packaging, high K-value resins excel in demanding uses such as high-performance cable insulation and tough coatings.

End-Use Industry Analysis

By end-use, the market is segmented into construction, automotive, electronics, packaging, and others. In 2024, the construction industry dominated with a 35.7% market share. PVC’s durability, affordability, versatility, and resistance to water, corrosion, and weather make it a preferred material over wood and metal. Its flame-retardant properties, ease of installation, lightweight design, and long lifespan further enhance its appeal for applications like pipes, electrical wiring, flooring, and window profiles in construction.

Regional Analysis

In 2024, Asia Pacific accounted for 42.5% of the global PVC paste resin market, valued at approximately US$4.4 billion. The region’s dominance is fueled by rapid industrialization, urbanization, and robust manufacturing in countries like China, India, South Korea, and Southeast Asia. China alone consumes 38% of global PVC, driven by extensive infrastructure projects and production of consumer goods, automotive parts, and construction materials.

In India, demand for affordable housing and government initiatives like smart cities has increased the need for PVC-based products such as wall coverings, flooring, and pipes. The region’s role as a global automotive hub, with major producers like Japan, China, and South Korea, further boosts demand for PVC paste resins in car interiors and wiring.

Top Use Cases

- Floor Coverings and Wall Papers: PVC paste resin is widely used to create durable vinyl flooring and wallpapers for homes and offices. It mixes easily into a paste for smooth spreading, offering resistance to wear, stains, and moisture. This makes it a go-to choice for easy-to-clean surfaces that last long without fading, helping builders save on upkeep costs while providing a stylish, affordable finish for everyday spaces.

- Artificial Leather Products: In making faux leather for bags, shoes, and upholstery, PVC paste resin shines by dipping or coating fabrics for a soft, flexible feel. It withstands daily use, water, and scratches better than real leather at a lower price. This use case boosts the fashion and furniture industries with eco-friendlier options that mimic luxury without the high maintenance.

- Protective Gloves and Gear: For industrial and medical gloves, PVC paste resin forms a tough yet pliable layer through dipping processes. It guards against chemicals, cuts, and germs while staying comfortable for long wear. This application supports safety in factories, hospitals, and labs, delivering reliable protection that bends with movements and cleans up easily for repeated use.

- Cable Coatings and Insulation: PVC paste resin coats wires and cables for electrical systems, providing a flame-resistant shield against shocks and harsh weather. Applied via spraying or molding, it ensures safe, flexible wiring in buildings and vehicles. This keeps connections reliable in tough spots, cutting risks and costs for electricians and manufacturers aiming for secure setups.

- Medical Tubing and Bags: In healthcare, PVC paste resin crafts flexible tubes, blood bags, and IV lines that are sterile and kink-free. Its smooth paste form allows precise shaping for safe fluid flow without leaks. This use supports patient care by offering biocompatible materials that endure sterilization and handling, making treatments smoother and safer overall.

Recent Developments

1. INEOS Group Limited

INEOS Inovyn continues to invest in its PVC paste resin capabilities, focusing on high-value, specialty grades for coatings, printing inks, and synthetic leather. Recent developments highlight the launch of new low-VOC (Volatile Organic Compound) and phthalate-free grades to meet stringent environmental regulations and customer demand for safer, more sustainable products. Their strategy emphasizes circularity, including projects to incorporate bio-attributed and recycled feedstocks into their vinyl chain.

2. LG Chem

LG Chem is advancing its PVC paste resin portfolio with a strong focus on the Asian market, particularly for flooring and automotive applications. Recent developments include the introduction of eco-friendly grades that support green building standards. The company is also integrating its vertical integration from caustic soda and ethylene to enhance supply stability and competitive positioning, while investing in R&D for higher-performance, specialized paste resins.

3. Westlake Corporation

Westlake has been actively managing its PVC paste resin product mix to serve high-demand applications like medical gloves and automotive underbody coatings. A key recent development is their focus on operational excellence and supply chain reliability to meet robust global demand. They are also progressing in sustainability initiatives, exploring ways to reduce the carbon footprint of their vinyl products, including paste resins, through process innovations.

4. Hanwha Solutions Corporation

Hanwha Solutions is aggressively expanding its global footprint for PVC paste resin, particularly through its subsidiary Hanwha Solutions Chemical Division. A major recent development is the operational focus on its large-scale capacity to supply key markets. The company is targeting growth in segments such as artificial leather and floorings, while also developing more environmentally compliant products to align with global sustainability trends.

5. Orbia

Operating through its Polymer Solutions business (Vestolit), Orbia is strengthening its position in PVC paste resin with a focus on specialty applications. Recent developments include the launch of new Vestolit E-PVC grades designed for superior performance in coatings and rotomolding. The company emphasizes its Mobility segment, developing paste resins for automotive sealants and underbody coatings that offer excellent adhesion and stone-chip resistance.

Conclusion

PVC paste resin is a powerhouse material driving innovation across industries. Its versatility in creating flexible, tough products like coatings and leathers meets rising needs for affordable, long-lasting solutions in construction, autos, and health. With trends leaning toward greener practices, this resin promises steady growth by adapting to eco-friendly tweaks while keeping costs low and performance high, ensuring it remains a staple for builders and makers worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)