Table of Contents

Overview

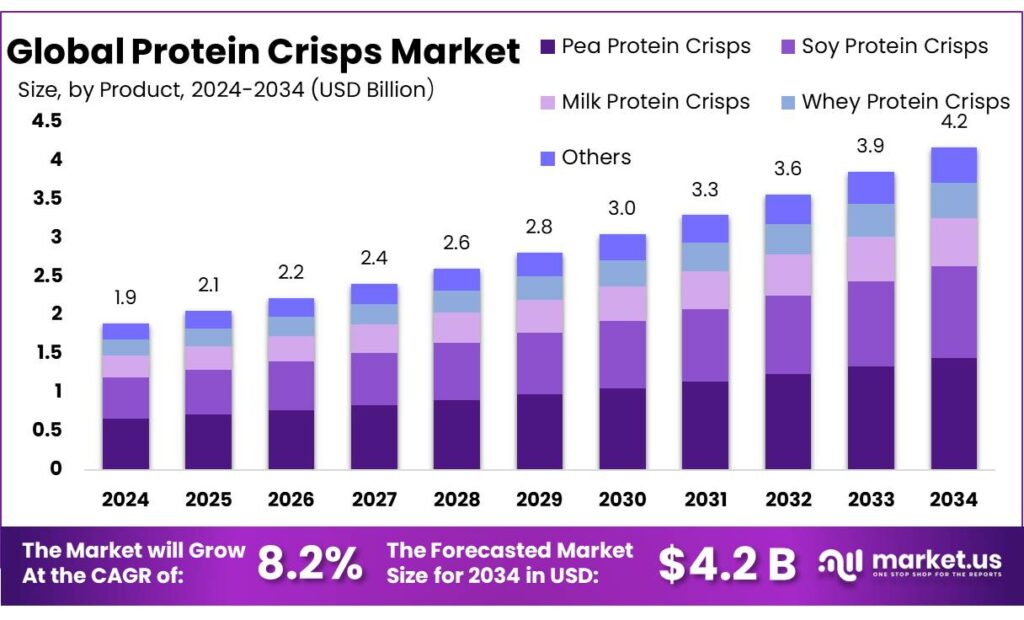

New York, NY – October 01, 2025 – The Global Protein Crisps Market is projected to reach USD 4.2 billion by 2034, up from USD 1.9 billion in 2024, growing at a CAGR of 8.2% between 2025 and 2034. In 2024, North America led the market, holding over 34.8% share, valued at USD 0.6 billion.

A key driver of this growth is the increasing awareness of how vital protein is in daily nutrition. In India, about 73% of the population is believed to be protein-deficient, with rural communities most affected. To address this gap, both private brands and government collaborations are pushing for protein-enriched foods. One notable example is McDonald’s India, which teamed up with government food scientists to launch a vegetarian protein slice.

The product sold 32,000 units within 24 hours in South India, proving consumers are eager for such innovations. This shift is also fueled by startups that blend health with taste. For instance, SuperYou, a brand backed by Bollywood actor Ranveer Singh, has already sold over 10 million protein wafers since November 2024. These products cater especially to urban buyers seeking modern, nutritious snack options.

The government is playing an active role too. The Central Food Technological Research Institute (CFTRI), under the Ministry of Food Processing Industries, is working with companies to create affordable, protein-rich foods tailored to Indian eating habits. Such efforts not only target urban markets but also aim to improve nutrition in rural areas, bridging the country’s protein gap.

Key Takeaways

- Protein Crisps Market size is expected to be worth around USD 4.2 billion by 2034, from USD 1.9 billion in 2024, growing at a CAGR of 8.2%.

- Pea Protein Crisps held a dominant market position, capturing more than a 34.7% share of the Indian protein crisps market.

- Chocolate-flavored protein crisps held a dominant market position, capturing more than a 36.4% share of the Indian protein crisps market.

- Sports nutrition application led the Indian protein crisps market, capturing more than a 58.3% share.

- Hypermarkets and supermarkets emerged as the leading distribution channels for protein crisps in India, capturing a substantial 41.5% share of the market.

- North America emerged as the dominant region in the global protein crisps market, capturing a substantial 34.8% share, equivalent to approximately USD 0.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/protein-crisps-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.2 Billion |

| Forecast Revenue (2034) | USD 1.9 Billion |

| CAGR (2025-2034) | 8.2% |

| Segments Covered | By Product (Pea Protein Crisps, Soy Protein Crisps, Milk Protein Crisps, Whey Protein Crisps, Others), By Flavour (Vanilla, Chocolate, Peanut Butter, Mocha, Others), By Application (Sports Nutrition, Weight Management, Others), By Distribution Channel (Hypermarkets/Supermarkets, Grocery Stores, Convenience Stores, Specialty Stores, Online Stores, Others) |

| Competitive Landscape | General Mills Inc., W.K. Kellogg Co., PepsiCo, Post Holdings, Inc., Quest Nutrition & WorldPantry.com LLC, Premier Nutrition Company, LLC, Power Crunch, MYPROTEIN (The Hut Group), Nestle |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157447

Key Market Segments

Pea Protein Crisps Analysis

In 2024, pea protein crisps commanded a leading 34.7% share of the Indian protein crisps market, reflecting strong consumer demand for plant-based, allergen-friendly, and sustainable snacks. Their neutral flavor, complete amino acid profile, and compatibility with vegan and gluten-free diets drive this popularity. Rising health awareness, a shift toward plant-based diets, and the demand for functional snacks further fuel growth. Ongoing innovations in flavor, texture, and packaging are expected to sustain this upward trend, catering to diverse Indian consumer preferences.

Flavor Analysis

Chocolate-flavored protein crisps led the Indian market in 2024 with a 36.4% share, driven by their indulgent taste paired with high protein content. This appeals to fitness enthusiasts, health-conscious consumers, and those seeking convenient snacks. Manufacturers are innovating to balance rich chocolate flavor with nutritional benefits, attracting consumers transitioning from traditional snacks to healthier alternatives without compromising taste.

Application Analysis

The sports nutrition segment dominated the Indian protein crisps market in 2024, holding a 58.3% share. This reflects strong demand from athletes and fitness enthusiasts for high-protein snacks that support muscle recovery and performance. The rise of fitness culture and growing awareness of protein’s dietary importance have propelled this trend. Protein crisps are increasingly available in gyms, health stores, and online platforms, with brands tailoring products to meet the nutritional needs of active consumers.

Distribution Channel Analysis

Hypermarkets and supermarkets led protein crisps in India in 2024, capturing a 41.5% market share. Major retailers like Reliance Retail, D-Mart, and MORE offer diverse product ranges, competitive pricing, and convenient shopping experiences. Strategic in-store placements, such as endcaps and checkout aisles, boost visibility and impulse purchases. Single-serving and multi-pack options cater to varied consumer needs, solidifying these channels as the top choice for protein crisp purchases.

Regional Analysis

North America led the global protein crisps market in 2024 with a 34.8% share, valued at approximately USD 0.6 billion. This dominance stems from strong health and wellness trends, widespread adoption of high-protein diets, and a robust fitness culture, particularly in the United States. Major food manufacturers drive growth through diverse product offerings, including gluten-free, vegan, and keto-friendly options. Expanded distribution through supermarkets, health food stores, and online platforms further enhances product accessibility across the region.

Top Use Cases

- Post-Workout Recovery Snack: Fitness lovers grab protein crisps right after gym sessions to quickly rebuild muscles and regain energy. These crunchy bites deliver essential nutrients without heavy meals, fitting busy routines. With rising gym culture, they help people recover faster and stay active longer, making them a go-to for anyone chasing strength and endurance goals.

- On-the-Go Healthy Nibble: Busy workers and travelers pick protein crisps for quick bites during commutes or meetings. Portable and mess-free, they curb hunger without junk food guilt. As lifestyles speed up, these snacks support steady energy, helping folks avoid crashes and focus better on their day.

- Weight Management Aid: People watching their figure choose protein crisps to feel full longer, cutting down on extra calories from sugary treats. Their satisfying crunch tricks the brain into thinking it’s indulging, while boosting metabolism gently. This makes them ideal for steady progress in slimming down without strict diets.

- Plant-Based Diet Boost: Vegans and vegetarians turn to pea or soy protein crisps for easy protein hits without animal products. These options match eco-friendly eating habits, adding variety to meals. With more folks going green, they fill the gap for tasty, guilt-free snacks that align with kinder food choices.

- Meal Companion Topper: Home cooks sprinkle protein crisps on salads, yogurts, or cereals for an extra protein punch and fun texture. This simple add-on turns ordinary dishes into balanced bites, appealing to families seeking healthier twists. It encourages creative eating that keeps nutrition fun and effortless.

Recent Developments

1. General Mills Inc.

General Mills is expanding its protein portfolio under the powerful Fiber One and Nature Valley brands. Recent innovation includes the launch of Fiber One Protein Crisp Bars. These products leverage a crispy texture to target health-conscious consumers seeking high-protein, high-fiber snacks, directly competing in the growing protein crisp category. This move diversifies their snack bar offerings beyond traditional granola.

2. WK Kellogg Co

WK Kellogg Co. is focusing on core brands like Special K to capture the protein snack trend. A key development is the introduction of Special K Protein Snack Crisps. These light, crispy pieces are designed as a satisfying, high-protein snack, aligning with the company’s strategy to revitalize its portfolio with modern, nutrition-focused products that meet demand for convenient, better-for-you options.

3. PepsiCo

As the owner of Quaker, PepsiCo is aggressively innovating in the protein space. A significant recent launch is the Quaker Protein Crisps line. These crunchy, chip-like snacks offer a substantial protein content, marking a strategic move to bridge the gap between its traditional grain-based products and the booming better-for-you snacking category, leveraging Quaker’s strong brand equity in nutrition.

4. Post Holdings, Inc.

Through its PowerBar brand, Post Holdings is reinforcing its position in performance nutrition with new Protein Crisp Bars. These bars feature a layered crisp texture and are marketed as a high-protein snack for active lifestyles. This innovation is part of Post’s broader strategy to modernize its nutritional brands and compete directly with other crisp-style protein bars on the market.

5. Quest Nutrition

A pioneer in the category, Quest Nutrition continues to lead with its high-profile Quest Protein Crisp Bar. The company’s primary recent development is the constant flavor innovation and line extensions for this product. By regularly launching new limited-edition and permanent flavors, they maintain strong consumer engagement and dominate the shelf space for protein crisps, reinforcing their identity as a key innovator in high-protein, low-carb snacks.

Conclusion

Protein crisps as a bright spot in the snacking world, blending crunch with real health perks to meet today’s demands for smart, simple eats. They’re riding waves of fitness buzz, plant-powered shifts, and grab-and-go needs, drawing in everyone from gym buffs to eco-minded families. Brands that nail flavors, clean ingredients, and easy access will lead this fun, feel-good trend, turning everyday munching into a step toward better living. The future looks tasty and promising for these versatile gems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)