Table of Contents

Overview

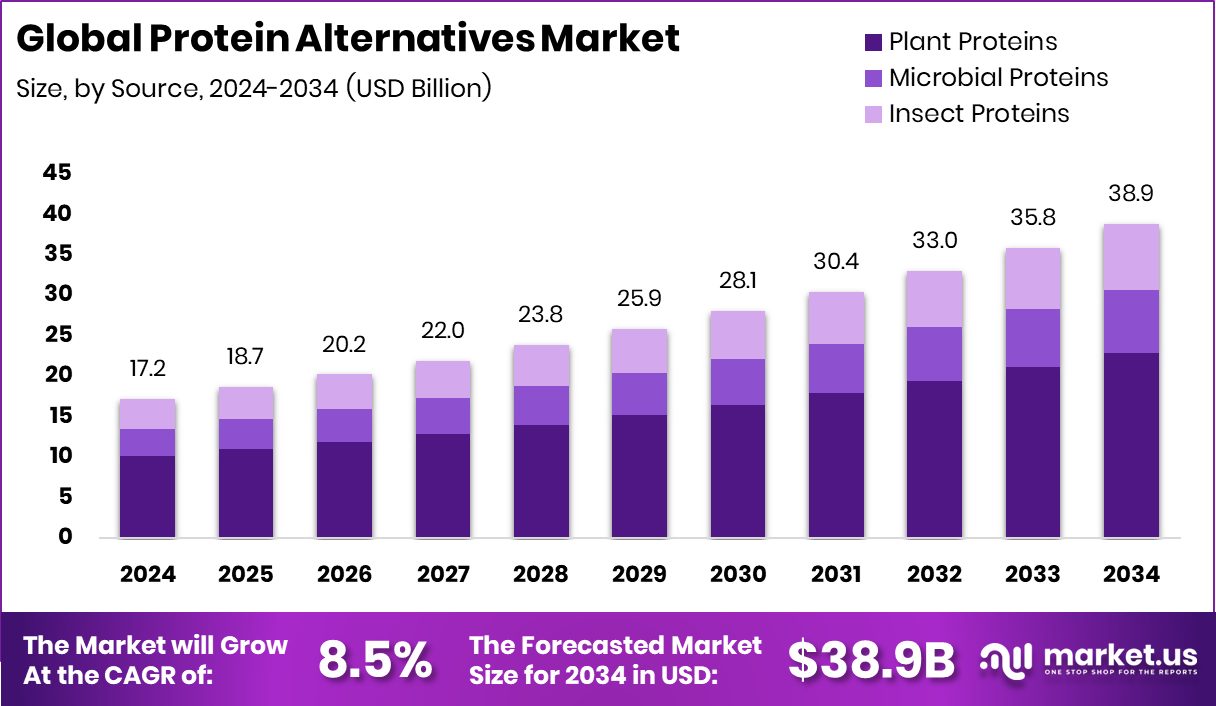

New York, NY – Nov 06, 2025 – The global protein-alternatives market is projected to climb from about USD 17.2 billion in 2024 to approximately USD 38.9 billion by 2034, with a compound annual growth rate of around 8.5% between 2025 and 2034. The Asia-Pacific region stands out with a roughly 38.9% share, driven by growing demand for sustainable nutrition.

“Protein alternatives” describe non-dairy and non-animal-derived protein sources that substitute traditional animal-based proteins in foods and beverages. These include plant-based proteins (from legumes, jackfruit, microalgae), fermentation-derived proteins, and up-cycled proteins recovered from waste or co‐streams. As consumer awareness about greenhouse gas emissions, land use, and animal welfare in conventional protein production rises, food manufacturers are increasingly embracing these novel ingredients.

Innovation in this space is well-funded. For example, a microalgae-protein start-up secured USD 25 million, while a fermentation-based protein company (Farmless) raised €4.8 million to build a pilot plant and develop new products. A Swiss firm obtained USD 10 million to repurpose a dairy factory for beer-waste protein. Meanwhile, up-cycled Rubisco-protein start-up Day 8 landed USD 750k in pre-seed funding.

Algae-protein business Brevel gathered USD 18.5 million to scale a neutral-tasting ingredient at cost parity with soy/pea. Jackfruit-meat-alternative company Karana secured USD 1.7 million in seed financing. Meanwhile, large-scale supply-chain plays include Bunge’s USD 550 million investment in a U.S. soy-protein concentrate facility and Benson Hill’s USD 102 million acquisition to expand soy-protein capabilities.

With ongoing technological advances, scaling efficiencies, and evolving regulations, these protein alternatives are rapidly moving from niche to mainstream—offering manufacturers and consumers a promising path to more sustainable, diverse, and resilient protein systems.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-protein-alternatives-market/request-sample/

Key Takeaways

- The Global Protein Alternatives Market is expected to be worth around USD 38.9 billion by 2034, up from USD 17.2 billion in 2024, and is projected to grow at a CAGR of 8.5% from 2025 to 2034.

- In the protein alternatives market, plant proteins dominate with a 58.9% share, driven by sustainability and nutritional advantages.

- The protein alternatives market sees protein isolates at 38.5%, valued for purity, solubility, and formulation flexibility.

- Within the protein alternatives market, dry and wet fractionation technologies capture a 45.4% share, ensuring efficiency and high-quality extraction.

- The Protein Alternatives Market reports food and beverage applications at 49.2%, reflecting rising adoption in snacks, dairy, and beverages.

- The Asia-Pacific market value reached approximately USD 6.6 billion, driven by rising protein consumption.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=163289

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 17.2 Billion |

| Forecast Revenue (2034) | USD 38.9 Billion |

| CAGR (2025-2034) | 8.5% |

| Segments Covered | By Source (Plant Proteins (Soy Protein, Wheat, Pea, Rice, Hemp, Others), Microbial Proteins (Mycoprotein, Algea Protein), Insect Proteins (Cricket, Black Soldier Fly Larvae (BSFL), Others)), By Form (Protein Isolates, Protein Concentrates, Textured Proteins and TVP, Hydrolysates and Peptides), By Production Technology (Dry and Wet Fractionation, Extrusion and Texturization, Precision Fermentation, Cellular Agriculture), By Application (Food and Beverage (Plant-Based Meat Analogues), Dairy and Dairy Alternative Alternatives (Bakery and Confectionery, Beverages, Others), Dietary Supplements and Sports Nutrition, Animal Feed and Pet Food, Personal Care and Cosmetics, Others) |

| Competitive Landscape | ADM, Cargill Inc., International Flavors & Fragrances Inc., Kerry Group plc, Ingredion Inc., The Scoular Company, Avebe, Roquette Frères, Mycotechnology Inc., Bühler Group |

Key Market Segments

By Source Analysis

In 2024, Plant Proteins dominated the By Source segment of the global Protein Alternatives Market, capturing a 58.9% share. This leadership stems from their broad availability, affordability, and strong nutritional equivalence to animal-derived proteins.

Consumers increasingly favor plant-based options such as soy, pea, and grain proteins for their sustainability and health benefits. The segment’s strength also lies in its adaptability across applications, including beverages, meat substitutes, and bakery products.

Moreover, the rise of vegan lifestyles and supportive government policies promoting plant-based nutrition continue to accelerate adoption. As a result, plant proteins have become the cornerstone of the protein alternatives industry, offering a scalable, eco-friendly, and nutritionally balanced foundation for global food innovation and sustainable dietary transitions.

By Form Analysis

In 2024, Protein Isolates led the By Form segment of the global Protein Alternatives Market, commanding a 38.5% share. Their dominance stems from exceptional purity, superior digestibility, and versatile functionality in food and beverage formulations.

Widely incorporated into nutrition bars, beverages, and dietary supplements, protein isolates deliver concentrated protein with minimal fat and carbohydrate content. Their smooth blending ability enhances texture and flavor without compromising nutritional quality, making them ideal for health-focused products.

Rising consumer demand for clean-label, fortified, and high-protein foods continues to fuel their adoption. Supported by advancements in extraction technologies and growing interest in functional nutrition, protein isolates remain a cornerstone ingredient—reinforcing their leadership in the global protein alternatives landscape throughout 2024.

By Production Technology Analysis

In 2024, Dry and Wet Fractionation dominated the By Production Technology segment of the global Protein Alternatives Market, accounting for a 45.4% share. This leadership reflects the methods’ high efficiency and scalability in refining plant-based and microbial proteins. Both technologies enable superior protein extraction while maintaining nutritional integrity and minimizing process waste.

Their adaptability across diverse raw materials ensures consistent quality and functional performance in food, beverage, and nutritional applications. Furthermore, their cost-effectiveness and capability to produce clean-label, minimally processed ingredients have made them highly preferred by manufacturers worldwide.

As sustainability and functionality drive innovation in protein processing, dry and wet fractionation continue to set the industry benchmark—solidifying their dominance in the global protein alternatives production landscape in 2024.

By Application Analysis

In 2024, the Food and Beverage segment led the By Application category of the global Protein Alternatives Market, securing a 49.2% share. This dominance stems from the increasing integration of alternative proteins into everyday foods, including snacks, bakery products, and beverages. As consumers embrace protein-rich, sustainable, and wellness-oriented diets, demand for such fortified applications continues to surge.

Manufacturers are leveraging protein alternatives to improve texture, flavor, and nutritional balance, while aligning with clean-label and plant-forward trends. The segment’s expansion also mirrors the broader shift toward functional and fortified foods, meeting evolving dietary preferences across global markets.

Consequently, food and beverage applications remain the principal growth engine of protein alternative consumption, reinforcing their pivotal role in shaping the industry’s direction in 2024.

Regional Analysis

In 2024, Asia-Pacific led the global Protein Alternatives Market, holding a 38.9% share valued at USD 6.6 billion. This dominance is driven by the rising demand for plant-based nutrition, rapid urbanization, and supportive government policies that promote sustainable food systems.

Major countries such as China, Japan, and India are experiencing surging interest in protein-enriched and health-focused foods, supported by expanding fitness and wellness awareness. North America follows closely, fueled by strong consumption of protein snacks and adoption of clean-label ingredients, while Europe maintains steady growth due to sustainability commitments, vegan diets, and favorable regulatory backing.

Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets, increasingly integrating plant and microbial proteins to meet evolving dietary preferences. Collectively, these regional shifts underline the global expansion of protein alternatives, with Asia-Pacific’s production strength and lifestyle transitions cementing its leadership in 2024.

Top Use Cases

- Meat analogues: Alternative proteins such as legumes, fungi, or microbes are used to create meat-like products (burgers, mince, sausages) that mimic animal meat’s texture and flavour, offering a lower-impact and more sustainable option.

- High-protein bakery & snack items: Plant-based proteins (for example, pea or wheat protein) are incorporated into bakery goods, snack,s and bars to boost protein content, improve texture and support clean-label demands.

- Dairy and egg substitutes: Proteins derived via fermentation or from plants can replace dairy proteins (like casein or whey) or egg proteins, enabling yoghurt, ice-cream or baked goods without animal sources.

- Up-cycled waste-stream proteins: By-products or waste from agricultural or food-processing operations are converted into protein ingredients, reducing waste and creating new sustainable raw materials.

- Nutrition-fortified beverages and shakes: Alternative protein isolates or concentrates are used in ready-to-drink beverages or nutrition shakes, offering high protein, low fat/carbs, digestibility and functional benefits.

- Plant-forward diets for sustainable agriculture: Using alternative proteins shifts demand away from livestock, supporting more resilient agricultural systems, lower greenhouse emissions, and offering farmers new opportunities

Recent Developments

- In October 2025, Kerry introduced Smart Taste™, a proprietary flavour-science platform designed to help customers address cost pressures, supply-chain/ingredient volatility, nutrition demands, and sustainability, while maintaining taste.

- In September 2024, Avebe partnered with IQI Pet Food to launch ProtaSTAR®, a premium potato-based protein aimed at vegan and grain-free pet-food applications.

- In July 2024, Ingredion launched VITESSENCE® Pea 100 HD, a new pea protein engineered for cold-pressed bars. It features roughly 84% protein dry basis, better texture (softer, less grit), and a cleaner label to help snack makers deliver better taste and nutrition.

- In February 2024, Cargill expanded its partnership with ENOUGH (a mycoprotein producer) by investing in its Series C funding round and signing a commercial agreement to use ENOUGH’s ABUNDA® mycoprotein.

Conclusion

The protein alternatives market is evolving rapidly as consumers, industries, and governments prioritize sustainable and ethical food choices. Advancements in plant-based, fermentation-derived, and upcycled protein technologies are reshaping the global food landscape. Companies are investing in innovation to improve taste, texture, and nutritional quality while reducing environmental impact.

Growing awareness of health, climate, and animal welfare concerns continues to drive demand. With expanding applications across food, beverages, and nutrition, protein alternatives are transitioning from niche offerings to mainstream staples, symbolizing a global shift toward a more resilient, sustainable, and inclusive food system for future generations.