Table of Contents

Overview

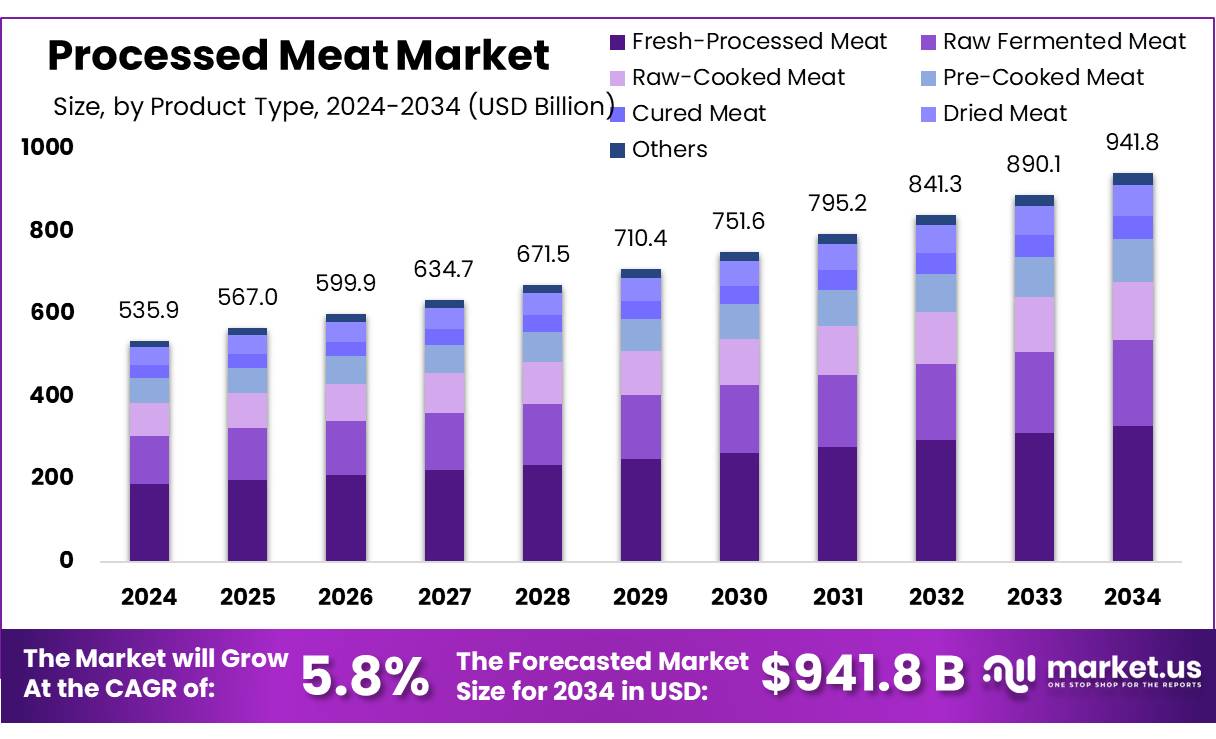

New York, NY – August 04, 2025 – The Global Processed Meat Market is projected to grow from USD 535.9 billion in 2024 to approximately USD 941.8 billion by 2034, achieving a CAGR of 5.8% during the 2025–2034 forecast period. In 2024, North America led the market, accounting for a 37.8% share and generating revenues of USD 202.5 billion.

The processed meat concentrates sector includes products like bacon, sausages, cured meats, and meat-based sauces, which undergo processes such as curing, fermentation, smoking, or preservative addition to enhance flavor and extend shelf life. These products differ from simple ground or cut meats due to their advanced processing techniques and improved shelf stability. The processed meat industry exhibits significant consolidation, particularly in major global markets.

In the U.S., the top four firms accounted for roughly 85% of steer and heifer purchases and 67% of hog purchases in recent years, indicating strong buyer-side concentration. Globally, Tyson and JBS control approximately 46% of beef packing and hold significant shares in pork and poultry packing. This oligopolistic structure supports economies of scale but raises concerns about regulatory scrutiny and competitive pressures. National regulations ensure safety and quality in processed meat production.

In India, the Food Safety and Standards Authority of India (FSSAI), established under the 2006 Food Safety and Standards Act and operational since 2008, regulates meat product manufacturing, packaging, distribution, and imports.

FSSAI oversees compliance through 22 referral laboratories, 72 government labs, and 112 NABL-accredited private labs. Governments promote sustainability and innovation in meat processing. In 2023, the U.S. Department of Agriculture’s Sustainable Agriculture Research and Education (SARE) program allocated over USD 30 million to support sustainable meat processing, including concentrates production.

Additionally, USDA and Food Safety Inspection Service (FSIS) data highlight that the four largest U.S. packers controlled 85% of steer and heifer purchases in 2023, prompting antitrust and food safety oversight. Initiatives like President Biden’s 2021 Executive Order on competition, combined with updated merger guidelines from the Federal Trade Commission and Department of Justice, aim to address market power imbalances and ensure product quality across the supply chain.

Key Takeaways

- Processed Meat Market size is expected to be worth around USD 941.8 billion by 2034, from USD 535.9 billion in 2024, growing at a CAGR of 5.8%.

- Fresh-Processed Meat held a dominant market position, capturing more than a 32.1% share of the global processed meat market.

- Sausages held a dominant market position, capturing more than a 38.6% share of the global processed meat market.

- Chilled held a dominant market position, capturing more than a 48.2% share in the global processed meat market.

- Poultry held a dominant market position, capturing more than a 44.7% share in the global processed meat market.

- Supermarket/Hypermarket held a dominant market position, capturing more than a 49.1% share of the global processed meat market.

- North America remains the dominant region in the global processed meat market, holding approximately 37.8% share, equivalent to around USD 202.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-processed-meat-market/request-sample/

Report Scope

| Market Value (2024) | USD 535.9 Billion |

| Forecast Revenue (2034) | USD 941.8 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Product Type (Fresh-Processed Meat, Raw Fermented Meat, Raw-Cooked Meat, Pre-Cooked Meat, Cured Meat, Dried Meat, Others), By Type (Sausages, Bacon, Ham, Salami, Deli Meats, Others), By Category (Frozen, Canned, Chilled), By Animal Type (Poultry, Beef, Pig, Others), By Distribution Channel ( Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail, Others) |

| Competitive Landscape | BRF S A, Cargill Incorporated, Conagra Brands Inc., Danish Crown Group, Foster Farms, Hormel Foods Corporation, JBS S.A., Maple Leaf Foods Inc., Nippon Meat Packers Inc., Pilgrim’s Pride Corporation, Smithfield Foods, Inc., The Kraft Heinz Company, Tyson Foods Inc., WH Group (Smithfield Foods) |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152740

Key Market Segments

By Product Type: Fresh-Processed Meat Leads

In 2024, Fresh-Processed Meat captured a 32.1% share of the global processed meat market, driven by consumer demand for convenience and freshness. Products like marinated chicken, pre-seasoned pork chops, and pre-cooked sausages appeal to urban and semi-urban households, particularly dual-income families with fast-paced lifestyles. These products blend the quality of raw cuts with the ease of processed items, offering extended shelf life while maintaining taste and texture.

By Type: Sausages Dominate

Sausages held a 38.6% market share in 2024, fueled by their versatility, convenience, and global appeal. From breakfast patties to smoked or spicy variants, sausages cater to diverse cuisines and are popular in fast food, quick-service restaurants, and ready-to-eat meals. Innovations like low-fat, organic, and plant-blended options have broadened their consumer base, supporting strong demand across developed and developing regions.

By Category: Chilled Segment Prevails

The Chilled category led with a 48.2% share in 2024, favored for its perceived freshness, superior taste, and minimal processing compared to frozen or shelf-stable alternatives. Products like sliced ham, deli turkey, and marinated cuts dominate supermarket refrigerated sections, appealing to health-conscious and quality-focused consumers. Demand for clean-label and short-ingredient-list products further boosts this segment, particularly in urban retail and foodservice channels.

By Animal Type: Poultry Takes the Lead

Poultry commanded a 44.7% share in 2024, driven by its affordability, lean protein profile, and versatility. Chicken and turkey products, including nuggets, sausages, patties, and deli slices, are staples in ready-to-eat meals, fast food, and school lunches. Poultry’s lower fat content, quick cooking time, and cost-effectiveness compared to red meats make it a preferred choice, especially in regions with growing youth populations.

By Distribution Channel: Supermarkets and Hypermarkets Excel

Supermarkets and Hypermarkets accounted for a 49.1% share in 2024, benefiting from wide product availability, competitive pricing, and consumer trust. These retail formats offer a diverse range of processed meats, from sausages to cold cuts, under one roof, often with promotional discounts and loyalty programs. The expansion of organized retail in emerging markets and rising urban populations has significantly increased its dominance.

Regional Analysis

North America held a 37.8% market share in 2024, generating USD 202.5 billion in revenue, driven by robust consumption, advanced infrastructure, and product innovation. Canada contributes significantly, supported by urbanization and foodservice growth, while Mexico exhibits the fastest regional growth with a mid-single-digit CAGR, fueled by rising disposable incomes and demand for convenient foods. Regulatory support, such as the USDA’s investments and Canada’s CAD 13 million through the Sustainable Canadian Agricultural Partnership, strengthens the region’s processed meat infrastructure.

Top Use Cases

- Convenience for Busy Lifestyles: Processed meat, like sausages and deli meats, is popular among working professionals and families. Ready-to-eat or quick-cook options save time, fitting fast-paced schedules. Supermarkets and online stores make these products easily accessible, driving demand for convenient meal solutions.

- High-Protein Diet Appeal: Processed meats, such as bacon and jerky, attract fitness enthusiasts and health-conscious consumers. They offer a high-protein, filling option for snacks or meals. Low-carb and keto diets boost their popularity as a tasty, protein-rich choice.

- Flavor Variety for Diverse Tastes: Manufacturers add herbs, spices, and global flavors to processed meats like salami and hot dogs. This variety appeals to adventurous eaters and millennials seeking unique tastes. New flavor innovations keep consumers engaged and expand market reach.

- Extended Shelf Life for Storage: Processed meats, including canned and frozen products, last longer due to preservation techniques like curing and smoking. This makes them ideal for households and foodservice industries, reducing waste and ensuring availability, especially in remote areas.

- Affordable Protein Source: Compared to fresh meat, processed meats like burgers and sausages are often cheaper. This affordability appeals to budget-conscious consumers in developing regions, supporting higher consumption in countries with growing economies and urban populations.

- Restaurant and Fast-Food Integration: Processed meats are widely used in fast-food chains and restaurants for burgers, sandwiches, and pizzas. Their consistent quality and quick preparation make them a staple in foodservice, catering to the growing trend of eating out.

Recent Developments

1. BRF S.A.

- BRF, a Brazilian meat processor, has expanded its plant-based and healthier meat alternatives, launching new products under the Sadia and Perdigão brands. The company is also investing in sustainability, aiming for carbon neutrality. BRF recently partnered with The Nature Conservancy to promote regenerative agriculture in its supply chain.

2. Cargill Incorporated

- Cargill is investing in cultivated meat, partnering with Aleph Farms to develop lab-grown beef. The company is also enhancing transparency in its supply chain through blockchain technology. Additionally, Cargill expanded its plant-based protein offerings to meet rising demand for sustainable alternatives.

3. Conagra Brands Inc.

- Conagra, known for brands like Hebrew National and Duke’s, has been innovating with clean-label processed meats, removing artificial ingredients. The company also launched new pre-marinated and ready-to-cook meat products for convenience. Conagra is focusing on reducing sodium and preservatives in its offerings.

4. Danish Crown Group

- Danish Crown is shifting toward climate-neutral pork production, aiming for net-zero emissions. The company introduced low-carbon pork products under its “Climate-Controlled Pork” initiative. It also invested in biogas plants to reduce waste from meat processing.

5. Foster Farms

- Foster Farms has been focusing on antibiotic-free poultry and expanding its organic chicken line. The company faced recent scrutiny over food safety, but has since enhanced its sanitation protocols. Foster Farms also introduced new pre-marinated and air-fried chicken products.

Conclusion

The Processed Meat Market is thriving due to its convenience, affordability, and versatility, catering to busy lifestyles and diverse tastes. Growing demand for high-protein and organic options, alongside innovations in flavors and preservation, fuels expansion. Despite health concerns, the market adapts with healthier alternatives, ensuring steady growth in urban and emerging economies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)