Table of Contents

Overview

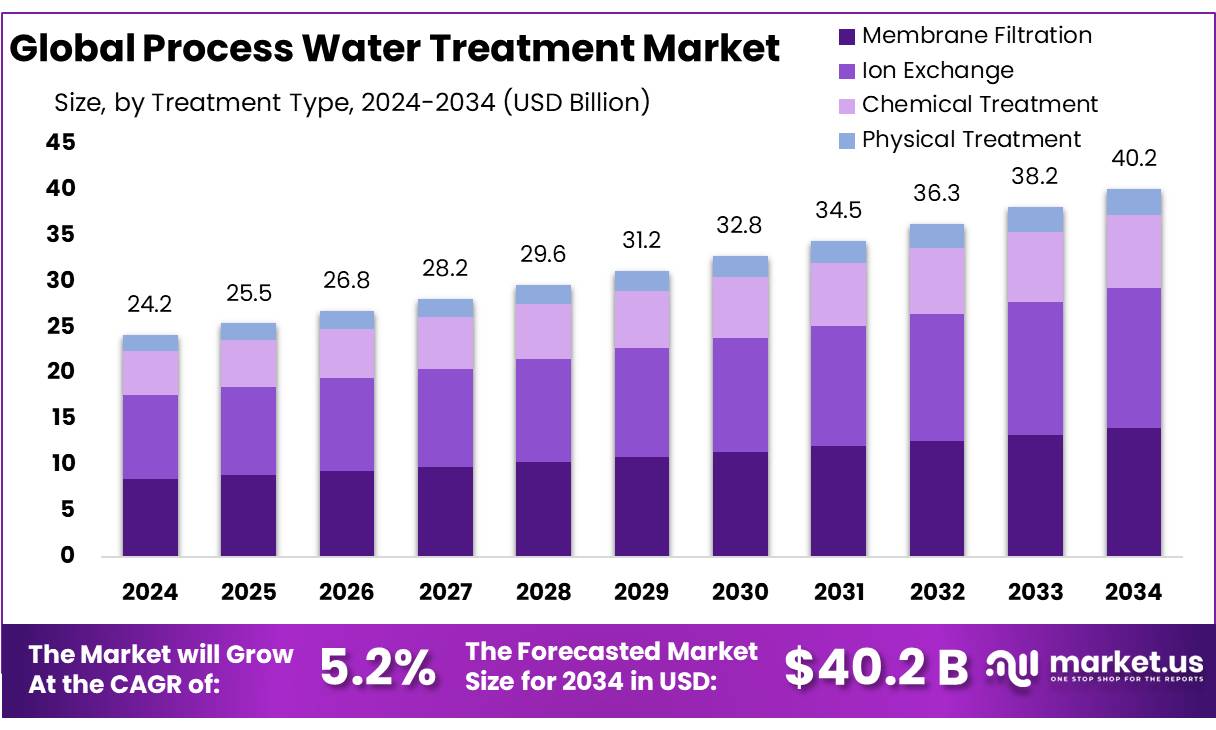

New York, NY – August 06, 2025 – The Global Process Water Treatment Market is projected to reach approximately USD 40.2 billion by 2034, rising from USD 24.2 billion in 2024, with a steady compound annual growth rate (CAGR) of 5.2% between 2025 and 2034. In 2024, North America emerged as the leading region, accounting for over 47.2% of the global market share, equivalent to USD 11.4 billion in revenue.

Process water treatment concentrates, such as antiscalants, biocides, and coagulants, are essential chemical additives used to treat and condition industrial water streams. These chemicals are vital for maintaining compliance with environmental discharge regulations and for protecting key equipment, including boilers, cooling towers, and membrane systems. Their application is particularly important in industries such as power generation, oil and gas, and heavy manufacturing, where water quality has a direct impact on performance and regulatory compliance.

Key contributing sectors to the usage of these treatment concentrates include textiles, pharmaceuticals, and food processing. A notable initiative in India by the South Gujarat Textile Processors Association involves the development of a 600 million litres per day (MLD) deep-sea discharge pipeline, intended to support industrial growth in Surat and nearby regions. This project reflects the industry’s proactive response to treatment-related challenges.

Several drivers are influencing the adoption of process water treatment solutions, including stricter environmental regulations, cost benefits of water reuse, and improvements in treatment technologies. Under India’s AMRUT 2.0 program, cities with populations over 100,000 are mandated to recycle at least 20% of their wastewater, further emphasizing the need for effective treatment solutions.

Government initiatives continue to shape the market, particularly in India, where programs like the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and the National Mission for Clean Ganga (NMCG) focus on enhancing urban water and wastewater systems. For example, in Chandigarh, a ₹77 crore AMRUT-2 project aims to lay 175 kilometers of pipelines for tertiary treated water, thereby expanding reuse infrastructure.

In the U.S., the Department of Energy (DOE) has committed USD 27.8 million to decarbonization projects within water resource recovery facilities, supporting the broader Energy-Water Nexus framework. Additionally, the EPA’s Clean Watersheds Needs Survey has mapped over 27,000 wastewater treatment facilities to aid in infrastructure planning. Over the next two decades, the country’s total investment requirement for wastewater infrastructure is estimated at USD 600 billion, with USD 298 billion earmarked for capital improvements.

Key Takeaways

- The Global Process Water Treatment Market is projected to grow from USD 24.2 billion in 2024 to approximately USD 40.2 billion by 2034, expanding at a CAGR of 5.2%.

- Membrane Filtration led the market with a 34.9% share, making it the most widely adopted process water treatment technology globally.

- Industrial Discharge emerged as the dominant application segment, accounting for more than 36.1% of the global market share.

- Secondary Treatment captured a significant position, holding over 28.2% share in the overall process water treatment market.

- The Chemical and Petrochemical sector was the leading end-user, contributing more than 31.7% share to the global market.

- North America held the largest regional market share at 47.2%, which translates to a market value of approximately USD 11.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/process-water-treatment-market/request-sample/

Report Scope

| Market Value (2024) | USD 24.2 Billion |

| Forecast Revenue (2034) | USD 40.2 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Treatment Type (Membrane Filtration, Ion Exchange, Chemical Treatment, Physical Treatment), By Source (Industrial Discharge, Surface Water, Ground Water, Wastewater), By Process Unit (Pretreatment, Primary Treatment, Secondary Treatment, Tertiary Treatment, Ultrafiltration), By End-Use (Chemical and Petrochemical, Automotive, Pharmaceuticals, Food and Beverage, Oil and Gas, Others) |

| Competitive Landscape | Ion Exchange (India) Limited, WABAG Ltd., Xylem Inc., GE Water Process Technologies, Evoqua Water Technologies LLC, Ecolab, Culligan International Company, SUEZ Water Technologies Solutions, Siemens Water Technologies, Pentair plc, Veolia Water Technologies, Aquatech, Lenntech B.V. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153414

Key Market Segments

By Treatment Type: Membrane Filtration

Membrane Filtration led the global process water treatment market in 2024, securing a 34.9% share due to its high efficiency and widespread industrial adoption. Its ability to remove suspended solids, bacteria, and dissolved contaminants makes it ideal for industries like pharmaceuticals, food and beverage, and power generation.

The technology’s precision and minimal chemical use align with stringent water discharge regulations. The shift toward zero-liquid discharge (ZLD) systems has boosted demand for membrane-based processes, such as ultrafiltration and reverse osmosis. By 2025, this segment is expected to sustain strong growth, driven by the need for high-purity water in critical manufacturing and increasing water recycling adoption in both developed and emerging markets.

By Source: Industrial Discharge

Industrial Discharge dominated the market in 2024 with a 36.1% share, fueled by rising effluent volumes and stricter treatment regulations. Sectors like chemicals, pharmaceuticals, textiles, and metal processing generate significant wastewater, necessitating advanced treatment to meet regulatory standards, particularly in developing economies with expanding industrial activity.

By 2025, this segment is projected to maintain its lead, supported by growing enforcement of ZLD systems and a focus on sustainability. The increasing pressure on freshwater resources is also driving industries to recycle treated water, further increasing demand for tailored treatment solutions for industrial discharge.

By Process Unit: Secondary Treatment

Secondary Treatment held a 28.2% share in 2024, leading due to its critical role in biological purification. Processes like activated sludge, trickling filters, and bio-towers effectively remove organic contaminants, addressing biochemical oxygen demand (BOD) and suspended solids to meet discharge standards.

Its widespread adoption stems from proven effectiveness in treating high-strength effluents from industries like chemicals and food processing. By 2025, the segment is expected to remain dominant, supported by stricter wastewater regulations and advancements in energy-efficient aeration systems and bio-reactors, particularly in both established and emerging markets.

By End-Use: Chemical and Petrochemical

The Chemical and Petrochemical sector led in 2024 with a 31.7% share, driven by high water consumption and complex contaminants from chemical processing and refining. Treatment is essential for regulatory compliance and to prevent equipment issues like corrosion, scaling, and fouling.

With a focus on water reuse and efficiency, advanced treatment technologies are increasingly adopted. By 2025, this segment is expected to maintain its dominance, propelled by expanding refining capacities in Asia-Pacific and the Middle East, alongside stricter effluent discharge regulations to minimize environmental impact.

Regional Analysis

North America dominated the global market in 2024, holding a 47.2% share valued at USD 11.4 billion. This leadership is driven by advanced infrastructure, stringent regulations like the U.S. Clean Water Act, and high adoption of treatment technologies across manufacturing, chemical processing, power generation, and petrochemical sectors.

The region’s focus on water reuse, ZLD, and pollutant removal supports compliance and cost efficiencies. By 2025, North America is expected to maintain its lead, bolstered by public-private infrastructure investments, clean-water technology incentives, and advancements in digital monitoring and energy-efficient systems, solidifying its position as a global benchmark for process water treatment.

Top Use Cases

- Cooling Tower Maintenance: Process water treatment ensures cooling towers in industries like power generation and manufacturing operate efficiently. It removes scale, corrosion, and bacteria, preventing equipment damage and maintaining heat transfer efficiency. Technologies like biocides and antiscalants are used to meet strict water quality standards, reducing downtime and extending equipment lifespan.

- Boiler Feedwater Treatment: Treating water for boilers in industries such as chemical processing prevents scaling and corrosion. This ensures efficient steam production and protects costly equipment. Processes like reverse osmosis and ion exchange remove minerals and impurities, meeting regulatory standards and improving operational reliability while minimizing energy costs.

- Pharmaceutical Manufacturing: In pharmaceuticals, high-purity water is critical for drug production. Process water treatment uses membrane filtration and UV disinfection to remove contaminants and microbes. This ensures compliance with strict health regulations, maintains product quality, and prevents contamination, supporting safe and consistent manufacturing processes.

- Textile Industry Wastewater Treatment: Textile plants treat wastewater to remove dyes and chemicals before discharge. Processes like coagulation and filtration ensure compliance with environmental regulations. Treatment enables water reuse, reducing costs and environmental impact while supporting sustainable operations in regions with strict discharge norms.

- Food and Beverage Processing: Water treatment in food processing ensures safe, clean water for production and cleaning. Technologies like ultrafiltration remove bacteria and particles, meeting food safety standards. Treated water maintains product quality, prevents contamination, and supports efficient operations in beverage and dairy manufacturing.

Recent Developments

1. Ion Exchange (India) Limited

Ion Exchange has recently introduced advanced Zero Liquid Discharge (ZLD) solutions for industrial wastewater treatment, focusing on sustainability and water reuse. They have also expanded their membrane-based treatment systems for high-efficiency desalination and heavy metal removal. Their INDION range of resins and technologies is being used in power plants, refineries, and chemical industries.

2. WABAG Ltd.

WABAG has secured multiple contracts for industrial and municipal water treatment projects, including a 50 MLD sewage treatment plant in Ethiopia. They are also implementing AI-driven water management systems for real-time monitoring and optimization. Their advanced oxidation and biological treatment technologies are gaining traction in the pharmaceutical and textile sectors.

3. Xylem Inc.

Xylem has launched next-generation digital water solutions, including Xylem Vue powered by GoAigua, for smart water treatment process optimization. They are also focusing on energy-efficient aeration systems and UV disinfection technologies for industrial applications. Their Leopold filters and Wedeco oxidation systems are widely adopted in the food & beverage and semiconductor industries.

4. GE Water & Process Technologies (Now Part of SUEZ)

GE’s water division (now under SUEZ) has introduced ZeeWeed 500D ultrafiltration membranes for high-flow industrial water treatment. They are also advancing electrodeionization (EDI) and reverse osmosis (RO) technologies for power plants and microelectronics. Their Alliance Partner Program supports customized water treatment solutions.

5. Evoqua Water Technologies LLC

Evoqua has enhanced its MEMCOR membrane systems for superior filtration in process water applications. They are also expanding electrochemical treatment solutions for heavy metal removal and chlorine-free disinfection. Their Siemens-branded analytics and automation tools improve operational efficiency.

Conclusion

The Process Water Treatment Market is growing due to rising industrial demand, stricter environmental regulations, and water scarcity concerns. Technologies like membrane filtration and zero-liquid discharge systems are key to ensuring compliance, improving efficiency, and promoting sustainability across industries like pharmaceuticals, textiles, and power generation. As urbanization and industrialization expand, the need for advanced water treatment solutions will drive market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)