Table of Contents

Overview

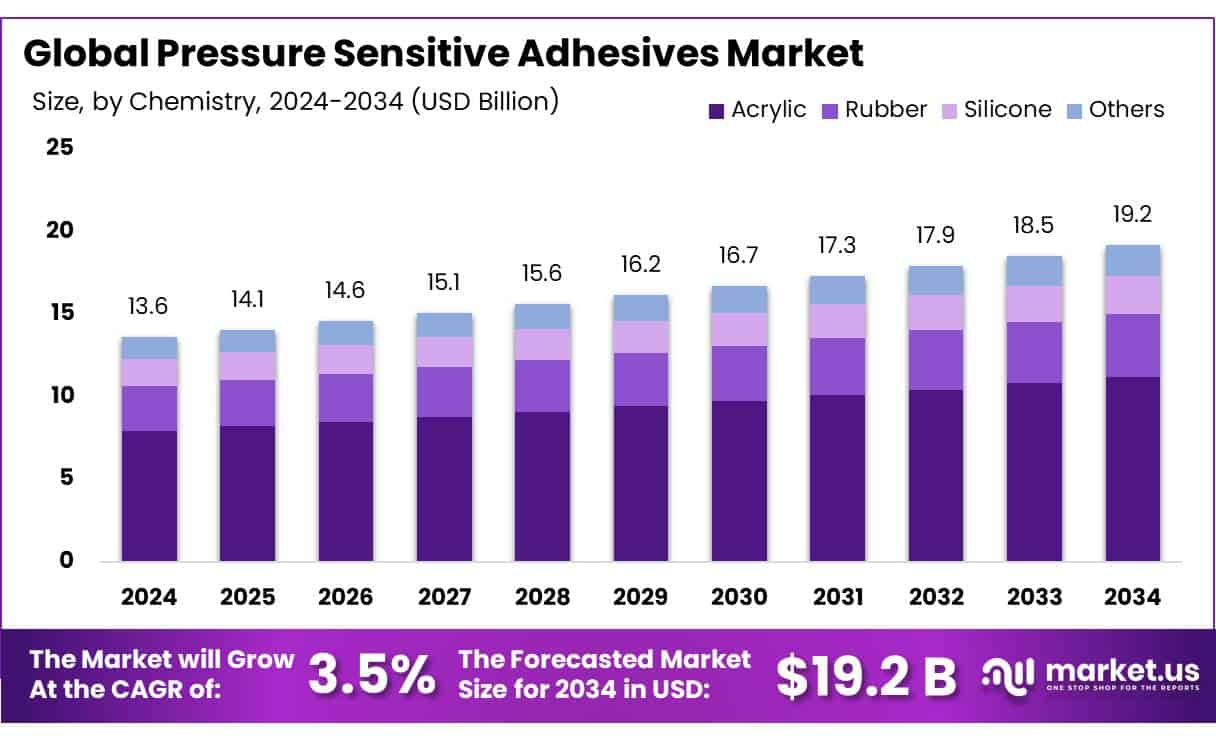

New York, NY – May 08, 2025 – The global Pressure Sensitive Adhesives (PSA) Market is growing steadily, driven by high demand across industries like packaging, automotive, healthcare, and electronics. In 2024, the market was valued at USD 13.6 billion and is expected to reach USD 19.2 billion by 2034, growing at a 3.5% CAGR from 2025 to 2034.

Acrylic-Based PSAs led the market, capturing over 58.3% of the share. Their dominance stems from versatility, excellent bonding strength, and resilience against UV light and temperature fluctuations. Water-Based PSAs dominated in 2024 with a 46.8% market share, favored for their eco-friendly profile, low VOC emissions, and versatility in packaging, labels, and consumer goods.

Plastic substrates held a 35.6% share in 2024, leading due to their flexibility, durability, and lightweight properties in packaging, automotive, electronics, and consumer goods. The Automotive and Transportation sector led with a 42.7% share in 2024, driven by demand for lightweight, durable bonding in vehicle assembly, interior trim, and noise reduction.

Key Takeaways

- The global Pressure Sensitive Adhesives Market is projected to reach USD 19.2 billion by 2034, growing at a CAGR of 3.5% from 2025 to 2034.

- Acrylic-based PSAs dominated with 58.3% market share in 2024 due to their durability, UV resistance, and versatility across industries.

- Water-based PSAs led with a 46.8% share in 2024, favored for being eco-friendly, low-VOC, and compliant with strict environmental regulations.

- Plastic substrates held the largest share, 35.6% in 2024, due to their widespread use in packaging, automotive, and electronics.

- Labels were the top PSA application, capturing 45.9% market share in 2024, driven by demand in food & beverage, pharmaceuticals, and logistics.

- The automotive sector was the leading end-user, holding 42.7% share in 2024, due to demand for lightweight and durable bonding solutions.

- APAC is the dominant region, accounting for 46.3% of the global PSA market USD 6.2 billion, led by China, Japan, India, and South Korea.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-pressure-sensitive-adhesives-market/request-sample/

Analyst Viewpoint

The pressure-sensitive adhesives (PSA) market offers compelling investment opportunities due to its versatility in industries like packaging, automotive, electronics, and healthcare. Global demand is surging, driven by PSAs’ ease of use, requiring no heat or solvents, just pressure to bond. The push for lightweight vehicles and compact electronics boosts demand for PSAs, which provide strong bonding without added weight.

Sustainability trends are creating opportunities for eco-friendly options, such as bio-based or recyclable adhesives, aligning with consumer preferences. Investors should target companies innovating in green adhesives or expanding in high-growth regions like Asia-Pacific, where industrialization drives demand.

Technological advancements, like UV-curable or smart adhesives, show promise but demand significant R&D. Regulatory pressures in Europe and North America, with strict VOC limits and recycling rules, increase compliance costs but spur innovation. Firms with robust R&D and sustainable solutions are best positioned for success in this dynamic, high-potential market.

Report Scope

| Market Value (2024) | USD 13.6 Billion |

| Forecast Revenue (2034) | USD 19.2 Billion |

| CAGR (2025-2034) | 3.5% |

| Segments Covered | By Chemistry (Acrylic, Rubber, Silicone, Others), By Technology (Water-based, Solvent-based, Hot Melt, Radiation-Cured), By Substrate (Plastic, Paper, Metal, Glass, Wood, Others), By Application (Labels, Tapes, Graphics, Others), By End-Use (Automotive and Transportation, Electronics, Consumer Goods, Packaging, Building and Construction, Medical and Healthcare, Others) |

| Competitive Landscape | Henkel AG and Co. KGaA, H.B. Fuller Company, Arkema, 3M, Sika AG, Ashland, Inc., Pidilite Industries Ltd., Momentive Performance Materials, Inc., Franklin International, Inc., DuPont de Nemours, Inc., Helmitin Adhesives, DIC Corporation, Avery Dennison Corporation, Wacker Chemie AG, Tesa SE, Illinois Tool Works Inc., Scapa, Jowat SE, Exxon Mobil Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146444

Key Market Segments

By Chemistry

- In 2024, Acrylic-Based PSAs led the market, capturing over 58.3% of the share. Their dominance stems from versatility, excellent bonding strength, and resilience against UV light and temperature fluctuations. Widely used in packaging, automotive, electronics, and healthcare, acrylic PSAs excel in applications like labels, tapes, and medical adhesives due to their durability and ease of use. Their non-toxic nature and ability to bond to diverse surfaces solidify their preference over other chemistries.

By Technology

- Water-Based PSAs dominated in 2024 with a 46.8% market share, favored for their eco-friendly profile, low VOC emissions, and versatility in packaging, labels, and consumer goods. They align with stringent environmental regulations in North America and Europe, making them a manufacturer favorite. Demand is expected to remain robust, fueled by sustainability trends and innovations improving drying times and bond strength.

By Substrate

- Plastic substrates held a 35.6% share in 2024, leading due to their flexibility, durability, and lightweight properties in packaging, automotive, electronics, and consumer goods. PSAs bond effectively to plastics like polyethylene, polypropylene, and PVC, supporting applications in labels, tapes, and protective films. Demand is driven by rising packaging needs and flexible electronics, with plastic expected to maintain its lead. Innovations enhancing adhesion to challenging plastic surfaces and sustainability trends toward recyclable plastics further bolster its dominance, despite competition from paper and metal substrates.

By Application

- Labels commanded a 45.9% share of the PSA market in 2024, driven by demand from food & beverage, pharmaceuticals, retail, and logistics for branding, information, and tracking. Pressure-sensitive labels, requiring no water, heat, or solvents, are ideal for high-speed production. Growth is fueled by e-commerce, stricter labeling regulations, and smart label technologies like RFID. While tapes and specialty films also utilize PSAs, labels remain the largest application, supported by innovations in eco-friendly and linerless labels that reduce waste.

By End-Use

- The Automotive and Transportation sector led with a 42.7% share in 2024, driven by demand for lightweight, durable bonding in vehicle assembly, interior trim, and noise reduction. PSAs, preferred over mechanical fasteners, reduce weight, enhance fuel efficiency, and improve vibration resistance, aligning with the rise of electric vehicles (EVs) and stricter emissions standards. Growth is expected to continue with increasing EV production. While packaging and healthcare are significant, automotive applications like wire harnessing tapes, interior panels, and exterior decals ensure this sector’s dominance, boosted by high-temperature-resistant and recyclable PSAs.

Regional Analysis

- The Asia-Pacific (APAC) region dominates the global pressure-sensitive adhesives (PSA) market, holding a 46.3% share valued at USD 6.2 billion in 2024. This leadership is fueled by rapid industrialization, a booming packaging sector, and rising demand from the automotive and electronics industries. Key contributors include China, Japan, India, and South Korea.

- Surging e-commerce activities drive demand for PSA applications in labels, tapes, and specialty films. The electronics sector, particularly in South Korea and Taiwan, heavily utilizes PSAs for display bonding and smartphone assembly. In Japan and India, the automotive industry boosts PSA use in lightweight vehicle production. APAC’s cost-competitive manufacturing and robust export markets solidify its position. The region’s dynamic industrial growth and advancements in adhesive formulations ensure its continued dominance in the global PSA market.

Top Use Cases

- Packaging Labels: PSAs are widely used for labels on food, beverage, and retail products. They stick instantly with light pressure, ensuring secure branding and tracking. Their versatility supports high-speed production, meeting e-commerce and logistics demands for durable, cost-effective labeling solutions.

- Automotive Assembly: PSAs bond lightweight materials in vehicles, reducing weight for better fuel efficiency. Used in interior trims, wire harnessing, and exterior decals, they offer vibration resistance and durability, supporting the rise of electric vehicles and eco-friendly manufacturing.

- Electronics Bonding: PSAs are critical in smartphones and displays, bonding tiny components without adding bulk. They ensure precision in compact devices, supporting miniaturization trends. Their reliability in high-tech applications like wireless charging and screen assembly drives demand.

- Medical Adhesives: PSAs are used in bandages, wound dressings, and diagnostic devices. Their non-toxic, skin-friendly properties ensure safe, secure adhesion. They meet strict hygiene standards, supporting growth in healthcare for reliable, easy-to-use medical products.

- Construction Applications: PSAs are applied in flooring, insulation, and roofing. They provide strong bonding for interior and exterior surfaces, offering durability and ease of use. Their role in mega-construction projects supports infrastructure growth, especially in urbanizing regions.

Recent Developments

1. Henkel AG & Co. KGaA

- Henkel has expanded its Loctite PSA portfolio with sustainable solutions, including bio-based and recyclable adhesives. The company introduced Loctite Liofol LA 6910, a UV-curable PSA for flexible electronics, enhancing durability and performance. Henkel also focuses on reducing its carbon footprint by incorporating renewable raw materials.

2. H.B. Fuller Company

- H.B. Fuller launched Swifttak 5500, a high-performance PSA for automotive and industrial applications, offering superior adhesion in extreme conditions. H.B. Fuller emphasizes circular economy initiatives, including recyclable adhesive solutions.

3. Arkema

- Arkema’s Bostik division developed Novacool, a next-generation PSA for refrigeration labels, ensuring adhesion at ultra-low temperatures. The company also introduced Sartomer 9545, a UV-curable PSA resin for electronics. Arkema is advancing bio-sourced acrylic PSAs under its Sustainable Bostik initiative.

4. 3M

- 3M introduced 3M VHB Tape 5952, an optically clear PSA for automotive and display bonding. The company also expanded its Sustainable Adhesives line, reducing VOC emissions. 3M’s Flexible Circuits PSA enhances wearables and IoT device performance.

5. Sika AG

- Sika launched SikaTack-Panel, a high-strength PSA for construction panels, improving installation efficiency. The company also developed Sika Bond-Tape, a double-sided adhesive for automotive assembly. Sika emphasizes eco-friendly formulations with low environmental impact.

Conclusion

The Pressure-Sensitive Adhesives (Psa) Market is thriving, driven by their versatility across packaging, automotive, electronics, and healthcare. With strong demand in Asia-Pacific, eco-friendly innovations, and applications like smart labels and lightweight vehicle bonding, PSAs offer significant growth potential. Despite regulatory challenges, their ease of use and adaptability ensure a sticky future, making them a compelling focus for investors and industry players.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)