Table of Contents

Overview

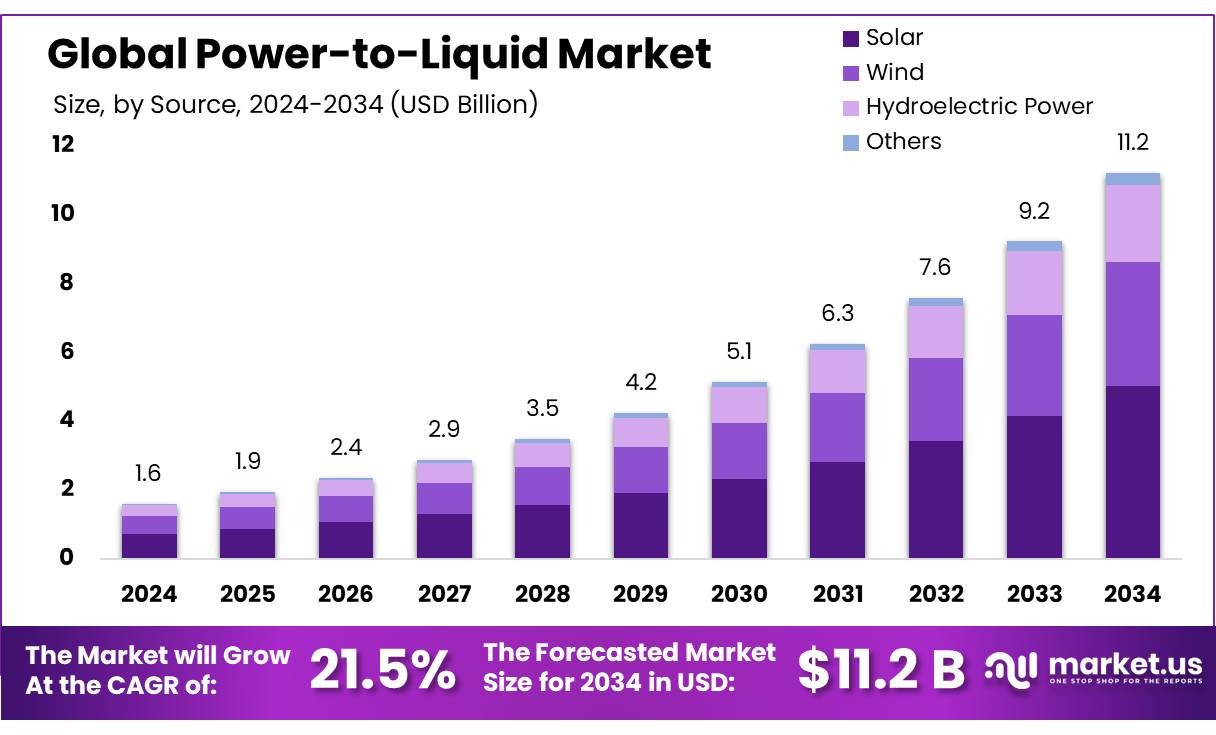

New York, NY – August 05, 2025 – The Global Power-to-Liquid (PtL) Market is projected to reach USD 11.2 billion by 2034, up from USD 1.6 billion in 2024, with a CAGR of 21.5% during the 2025–2034 forecast period. In 2024, Europe led the market, holding a 47.8% share with USD 0.7 billion in revenue.

Power-to-Liquid technology converts renewable electricity, water, and carbon dioxide into sustainable liquid fuels, such as synthetic hydrocarbons and methanol, through green hydrogen and Fischer-Tropsch processes. This approach is vital for decarbonizing hard-to-electrify sectors like aviation, maritime transport, and heavy industry, aligning with global net-zero emissions goals.

The PtL sector is advancing rapidly, driven by pilot projects and technological innovations. Carbon Recycling International’s Iceland plant, launched, produces 1.3 million liters of methanol annually using CO2 from a geothermal source, with capacity expanded to over 5 million liters. In a PtL facility in Werlte, Germany, synthetic jet fuel via the Fischer-Tropsch method highlights growing investment in PtL.

Key drivers of PtL growth include the rise of renewable energy sources like wind and solar, which power PtL processes, and advancements in electrolysis and CO2 capture technologies, improving efficiency and scalability. The aviation sector is a major catalyst, with the U.S. Department of Energy’s SAF Grand Challenge targeting 3 billion gallons of Sustainable Aviation Fuel (SAF) annually and 35 billion.

Innovations from companies like Lydian Labs and INERATEC are further advancing PtL. Their modular systems adapt to variable renewable energy inputs, lowering costs and boosting scalability. INERATEC’s €70 million project, backed by the European Investment Bank, will launch Europe’s largest e-fuel plant.

The PTL market outlook is strong, with the International Energy Agency (IEA) forecasting a 20%+ rise in transportation energy demand. Advances in PtL efficiency and cost reductions, such as achieving €1.83 per kilogram production costs at 61.3% efficiency in a 1 MW plant, are expected to enhance economic viability, positioning PtL as a cornerstone of sustainable energy transitions.

Key Takeaways

- The Global Power-to-Liquid (PtL) Market is projected to grow from USD 1.6 billion in 2024 to approximately USD 11.2 billion by 2034, registering a strong CAGR of 21.5% over the forecast period.

- In 2024, solar energy emerged as the leading source in the PtL market, accounting for more than 44.9% of the total market share, owing to its widespread availability and scalability.

- Electrolysis-based PtL technology held the top position in 2024, securing over 55.1% of the market share due to its effectiveness in generating green hydrogen from renewable electricity.

- Synthetic hydrocarbons dominated the fuel type segment in 2024, representing more than 58.2% of the market, primarily due to their compatibility with existing fuel infrastructure.

- Transportation stood out as the major application segment, contributing over 68.3% of the market share in 2024, driven by growing demand for low-carbon fuels in aviation, shipping, and heavy-duty road transport.

- Europe led the regional landscape in 2024, capturing a dominant 47.8% share of the global PtL market, with a total market value of around USD 0.7 billion, supported by strong policy frameworks and industrial activity.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/power-to-liquid-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.6 Billion |

| Forecast Revenue (2034) | USD 11.2 Billion |

| CAGR (2025-2034) | 21.5% |

| Segments Covered | By Source (Solar, Wind, Hydroelectric Power, Others), By Technology (Electrolysis-based PtL, Fischer-Tropsch Synthesis, Biological Conversion, Methanol Conversion), By Fuel Type (Synthetic Hydrocarbons, Hydrogen, Methanol), By Application (Transportation, Industrial) |

| Competitive Landscape | Sasol, Ineratech, Nordic Electrofuel AS, Topsoe, Blue World Technologies, Neste, BP PLC, Ludwig-Bölkow-Systemtechnik GmbH, Sunfire GmbH, Lanza Tech, Lufthansa, Neste, SkyNRG, Total Energies, United Airlines |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153329

Key Market Segments

By Source Analysis

In 2024, solar energy dominated the global Power-to-Liquid (PtL) market, securing a 44.9% share. This leadership is fueled by the global surge in solar photovoltaic (PV) installations, particularly in sun-rich regions like the Middle East, North Africa, and Asia-Pacific. Solar’s reliability and accessibility provide consistent electricity for PtL electrolyzers.

With solar power costs now rivaling fossil fuels, its role in PtL is expanding. In 2025, solar’s prominence is expected to persist as new PtL facilities, often co-located with solar farms, enhance efficiency and grid stability. Solar’s compatibility with decentralized systems further strengthens its position in driving synthetic fuel production.

By Technology Analysis

Electrolysis-based Power-to-Liquid (PtL) led the market in 2024, capturing a 55.1% share, propelled by the global push for green hydrogen as a clean energy carrier. Electrolysis splits water into hydrogen and oxygen using renewable electricity, providing carbon-free hydrogen for synthetic fuel production.

Supported by net-zero goals, countries in Europe, North America, and Asia are investing heavily in electrolyzer infrastructure. In 2025, electrolysis-based PtL is set to maintain its lead, driven by expanding solar and wind energy capacity. Its low lifecycle emissions and scalability make it a cornerstone for sustainable fuel production.

By Fuel Type Analysis

In 2024, synthetic hydrocarbons commanded a 58.2% share of the Power-to-Liquid market due to their seamless integration with existing fuel infrastructure, including pipelines, engines, and refueling systems. This makes them ideal for aviation, shipping, and heavy transport, where alternative fuels often require costly upgrades.

Produced from captured CO2 and green hydrogen, synthetic hydrocarbons support carbon-neutral goals while maintaining performance and stability. In 2025, demand is expected to remain robust as regulations favor low-emission fuels and industries seek drop-in solutions to meet sustainability targets.

By Application Analysis

In 2024, transportation accounted for a 68.3% share of the global Power-to-Liquid market, driven by the need to decarbonize aviation, maritime, and heavy road transport, where battery-electric solutions are less viable. PtL fuels, particularly synthetic hydrocarbons, are valued for their high energy density and compatibility with existing infrastructure.

Government mandates in Europe and North America, such as those promoting sustainable aviation and maritime fuels, are boosting PtL adoption. In 2025, transportation’s dominance is expected to grow as airlines and shipping operators increase low-emission fuel use to meet climate goals.

Regional Analysis

In 2024, Europe held a 47.8% share of the global Power-to-Liquid market, valued at USD 0.7 billion, driven by strong policy support under the European Green Deal and the Fit for 55 package. Germany, the Netherlands, and Denmark lead with large-scale PtL projects, public-private partnerships, and investments in electrolyzer and synthetic fuel infrastructure.

The EU’s ReFuelEU Aviation initiative, with binding quotas for Sustainable Aviation Fuels, fuels demand for PtL-based hydrocarbons. Europe’s robust renewable energy networks, particularly wind and solar, support electrolysis-based PtL, while ports like Rotterdam and Hamburg emerge as hydrogen and PtL fuel hubs, enhancing the region’s leadership.

Top Use Cases

- Aviation Fuel Production: Power-to-Liquid (PtL) creates synthetic jet fuels from renewable energy and CO2, ideal for aviation. These fuels work with existing aircraft and infrastructure, cutting emissions significantly. With global aviation aiming for net-zero, PtL offers a scalable solution to meet rising demand for sustainable aviation fuel (SAF).

- Maritime Fuel Replacement: PtL produces carbon-neutral fuels like e-methanol for ships. These fuels integrate with current maritime engines and storage systems, reducing greenhouse gas emissions. As shipping faces stricter environmental rules, PtL fuels provide a practical way to decarbonize long-distance maritime transport without major infrastructure changes.

- Heavy Industry Decarbonization: PtL fuels power heavy industries like steel and cement, where electrification is challenging. Synthetic hydrocarbons from PtL replace fossil fuels, lowering emissions while maintaining high energy needs. This supports industries in meeting strict carbon reduction targets without disrupting existing processes or equipment.

- Long-Haul Transport Fuels: PtL delivers synthetic diesel for trucks, compatible with current engines and fuel stations. It offers high energy density for long-haul transport, reducing emissions compared to traditional diesel. As regulations push for cleaner fuels, PtL provides a drop-in solution to decarbonize road transport efficiently.

- Energy Storage Solution: PtL converts excess renewable energy into liquid fuels for storage and later use. Unlike batteries, these fuels store energy long-term without degradation, ideal for seasonal energy needs. This helps balance grid demand and supports renewable energy integration in remote or off-grid areas.

Recent Developments

1. Sasol

Sasol, in partnership with Topsoe, is advancing PtL technology to produce sustainable aviation fuel (SAF). The company is leveraging its Fischer-Tropsch expertise to develop low-carbon fuels from green hydrogen and CO₂. A key focus is scaling up PtL processes to meet global SAF demand. Sasol is also involved in South Africa’s Hydrogen Valley initiative, exploring PtL integration.

2. Ineratech

Ineratech is developing compact PtL systems for decentralized fuel production. Their technology emphasizes modular, scalable solutions to convert renewable energy and CO₂ into synthetic fuels. Recent progress includes pilot projects demonstrating efficient methanol and diesel production. The company aims to commercialize small-scale PtL units for remote and off-grid applications.

3. Nordic Electrofuel AS

Nordic Electrofuel is progressing toward commercial-scale renewable fuel production in Norway. Their PtL plant will produce SAF and other e-fuels using CO₂ capture and electrolysis. The company has secured funding and permits, targeting operations. Their technology focuses on high-efficiency, low-emission fuel synthesis.

4. Topsoe

Topsoe is scaling its eFuel technology, combining electrolysis and Fischer-Tropsch synthesis for PtL fuels. The company is constructing an electrolyzer plant to support large-scale e-fuel production. Topsoe’s solutions target aviation and shipping, with recent partnerships including Sasol and other energy firms.

5. Blue World Technologies

Blue World Technologies is advancing methanol-based PtL solutions, focusing on fuel cells and green methanol production. Their recent developments include high-temperature electrolysis and catalytic conversion systems. The company is working on maritime and heavy transport applications, with pilot projects underway.

Conclusion

The Power-to-Liquid Market is poised for rapid growth, driven by its ability to produce sustainable fuels for hard-to-decarbonize sectors like aviation, shipping, and heavy industry. With increasing renewable energy availability and supportive policies, PtL offers scalable, carbon-neutral solutions. Its compatibility with existing infrastructure and potential for cost reductions make it a key player in achieving global net-zero goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)