Table of Contents

Overview

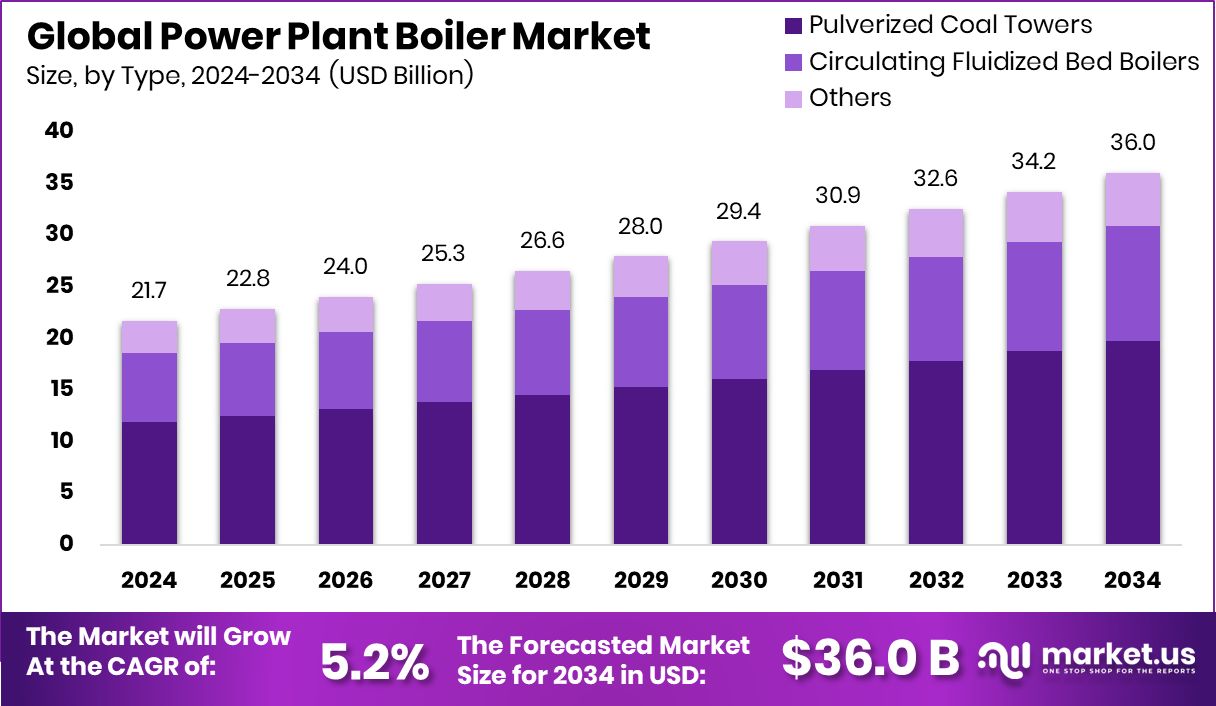

New York, NY – August 20, 2025 – The Global Power Plant Boiler Market is projected to reach USD 36.0 billion by 2034, growing from USD 21.7 billion in 2024, with a CAGR of 5.2% from 2025 to 2034. The Asia Pacific region, driven by robust industrial growth, accounted for a market value of USD 10.2 billion in 2024.

A power plant boiler is a closed vessel that generates steam by heating water, a critical component in thermal power plants. The steam produced drives turbines to generate electricity. Operating under high pressure and temperature, these boilers are designed to use various fuels, including coal, natural gas, biomass, or waste heat. The efficiency, safety, and performance of power plants heavily rely on the boiler’s design and operational capabilities.

The power plant boiler market encompasses the global demand, production, and installation of industrial-scale boilers for thermal power generation. The market is fueled by rising energy needs in both developing and developed nations, particularly in rapidly urbanizing and industrializing regions. Stricter environmental regulations are pushing the adoption of cleaner, more efficient boiler systems.

Supercritical and ultra-supercritical boilers, which offer higher efficiency, are gaining traction, especially in regions prioritizing energy transition. The growing use of renewable energy sources has spurred demand for hybrid boiler systems that combine conventional fuels with solar thermal or biomass inputs, creating opportunities for innovative designs and retrofitting.

Aging thermal power plants in developed countries are being upgraded or replaced, driving demand for advanced boiler technologies. An industry report highlighted a $1.5 million grant for the cleanup of the former Slate Belt coal facility, reflecting efforts to address environmental concerns and modernize infrastructure.

Key Takeaways

- The Global Power Plant Boiler Market is expected to be worth around USD 36.0 billion by 2034, up from USD 21.7 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Pulverized coal towers dominate the power plant boiler market, holding a significant 54.8% share globally.

- 400–800 MW capacity boilers lead the segment, capturing 49.1% share due to balanced efficiency.

- Subcritical technology remains widely used in power plant boilers, accounting for a 48.2% market share.

- Coal-based boilers continue to dominate the fuel type segment, holding a strong 69.3% market share.

- Power generation applications represent the core demand, contributing 61.3% to the total boiler market size.

- Asia Pacific held a 47.2% share of the global market during the year.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/power-plant-boiler-market/request-sample/

Report Scope

| Market Value (2024) | USD 21.7 Billion |

| Forecast Revenue (2034) | USD 36.0 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Type (Pulverized Coal Towers, Circulating Fluidized Bed Boilers, Others), By Capacity (Upto 400 MW, 400-800 MW, Above 800 MW), By Technology (Subcritical, Supercritical, Ultra-supercritical), By Fuel Type (Coal Based, Gas Based, Oil Based, Others), By Application (Power Generation, Industrial Steam, District Heating, Cogeneration, Waste-to-energy) |

| Competitive Landscape | Babcock & Wilcox Enterprise, Dongfang Electric Corporation, Doosan Heavy Industries & Construction, General Electric, Mitsubishi Hitachi Power Systems, Siemens, IHI Corporation, John Wood Group, Bharat Heavy Electrical Limited, Thermax, Andritz Group, Sumitomo Heavy Industries, Valmet, Harbin Electric |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154859

Key Market Segments

By Type Analysis

Pulverized Coal Towers led the Power Plant Boiler Market by type, commanding a 54.8% share in 2024. Their dominance stems from widespread use in large-scale thermal power plants, particularly in coal-reliant regions.

These towers excel in producing high-temperature steam for turbine-driven base-load power generation, offering reliability and continuous operation. Advancements in combustion control and emission reduction technologies have enhanced their compliance with environmental standards, while retrofitting older units with modern systems sustains their market leadership, especially in emerging economies.

By Capacity Analysis

The 400–800 MW capacity range held a 49.1% share of the market in 2024, favored for its balance of efficiency and grid compatibility. Ideal for base-load power generation, these boilers are suited for medium-to-large urban and industrial regions, offering the benefits of larger units without their complexity or high costs.

Their versatility with fuels like coal and biomass blends, along with adaptability for retrofitting aging plants, drives their prominence. This segment aligns with infrastructure investments that prioritize reliable and scalable power generation.

By Technology Analysis

Subcritical technology dominated with a 48.2% share in 2024, reflecting its widespread use in existing coal-based thermal power infrastructure. These boilers, operating at lower pressure and temperature, are cost-effective and simpler to install and maintain, making them a practical choice for developing regions.

Retrofitting with emission control technologies ensures compliance with environmental regulations, while their proven reliability and component availability sustain their market leadership despite the gradual adoption of advanced technologies.

By Fuel Type Analysis

Coal-based boilers held a commanding 69.3% share in 2024, driven by their role in base-load power generation in coal-abundant regions. Their established infrastructure and operational familiarity underpin their dominance, despite environmental pressures. These systems, often integrated with subcritical or pulverized coal technologies, remain critical for energy security and cost-effectiveness in many economies, supporting their significant market presence amid the global energy transition.

By Application Analysis

Power generation applications accounted for 61.3% of the market in 2024, reflecting boilers’ essential role in producing steam to drive turbines for electricity. These systems meet the base-load demands of industrial, commercial, and residential sectors, forming the backbone of centralized power facilities. Their adaptability across fuel types and capacities, combined with ongoing plant refurbishments and new installations, reinforces their leading position in addressing rising electricity needs.

Regional Analysis

The Asia Pacific region led the Power Plant Boiler Market in 2024, with a market value of USD 10.2 billion and a 47.2% share. Rapid industrialization, high electricity demand, and significant investments in power infrastructure in countries like China, India, and Southeast Asia drive this dominance.

While North America and Europe focus on retrofitting aging plants and shifting to renewables, the Middle East & Africa and Latin America show gradual growth, with opportunities in urban power needs and infrastructure modernization. Asia Pacific’s leadership underscores its pivotal role in global thermal power generation.

Top Use Cases

- Electricity Generation: Power plant boilers produce high-pressure steam to drive turbines, generating electricity for homes and businesses. They use fuels like coal, natural gas, or biomass, meeting the rising global energy demand. Their efficiency and reliability make them essential for a stable power supply in urban and industrial areas.

- Industrial Process Heating: Boilers provide steam or heat for industrial processes like food processing, chemical production, and oil refining. They ensure consistent high temperatures needed for manufacturing, improving efficiency, and reducing costs. Their versatility supports various industries, driving demand for advanced boiler systems.

- District Heating Systems: Power plant boilers supply steam or hot water for district heating, warming multiple buildings through underground pipes. This eliminates the need for individual boilers, boosting energy efficiency and cutting emissions. It’s widely used in urban areas for residential and commercial heating needs.

- Waste-to-Energy Conversion: Boilers in waste-to-energy plants burn municipal or industrial waste to produce steam for electricity generation. They help manage waste while generating power, supporting sustainable practices. This use case is growing due to increasing waste management needs and demand for renewable energy sources.

- Cogeneration (Combined Heat and Power): Boilers in cogeneration systems produce both electricity and usable heat from a single fuel source. This improves energy efficiency by capturing waste heat for industrial or heating purposes. It’s popular in facilities needing both power and heat, reducing costs and environmental impact.

Recent Developments

1. Babcock & Wilcox (B&W)

B&W is focusing on carbon capture technology and renewable energy integration. Their BrightLoop chemical looping technology is a key development, designed to convert fossil and waste fuels into energy while isolating carbon dioxide for sequestration or use, supporting decarbonization goals. They are also advancing oxy-combustion solutions and biomass energy projects, helping clients transition to cleaner energy sources while maintaining the use of existing boiler infrastructure through retrofits and upgrades.

2. Dongfang Electric Corporation (DEC)

DEC recently achieved a milestone with the world’s first ultra-supercritical CFB (circulating fluidized bed) boiler, designed for high efficiency and low emissions when burning low-quality coal and biomass blends. They are also at the forefront of developing advanced ultra-supercritical (A-USC) coal-fired units, pushing steam parameters for greater efficiency.

3. Doosan Enerbility

Doosan Enerbility is heavily investing in carbon-free energy solutions. A major focus is on hydrogen-fueled gas turbines and boilers, having successfully tested a gas turbine combustor on a hydrogen-natural gas mix. They are also developing ammonia co-firing technology for coal-fired boilers as a decarbonization pathway.

4. General Electric (GE)

GE’s recent developments center on enabling gas power plants to transition to low-carbon fuels. Their HA-class gas turbines, the world’s most efficient, are now being offered with capabilities to burn high volumes of hydrogen, with a roadmap to 100%. They are also pioneering carbon capture solutions through strategic partnerships.

5. Mitsubishi Power

Mitsubishi Power is a leader in the transition to a hydrogen economy. They have achieved commercial operation of gas turbines capable of firing on a hydrogen blend and have tested technology targeting 100%. Their T-Point 2 facility validates the reliability of these advanced systems.

Conclusion

The Power Plant Boiler Market is growing due to rising electricity demand, industrialization, and a focus on sustainable energy. Boilers are vital for generating power, heating, and waste management, with advanced technologies like supercritical boilers boosting efficiency and reducing emissions. As governments push for cleaner energy and infrastructure upgrades, the market is set to expand, offering opportunities for innovation and investment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)