Table of Contents

Overview

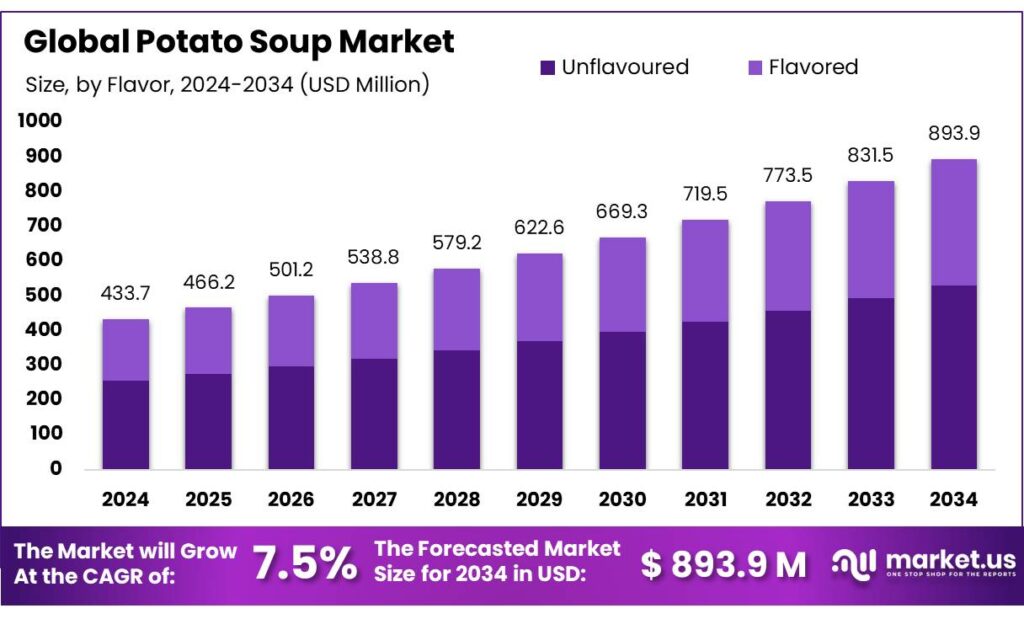

New York, NY – September 16, 2025 – The Global Potato Soup Market is projected to reach USD 893.9 million by 2034, up from USD 433.7 million in 2024, with a compound annual growth rate (CAGR) of 7.5% during the 2025–2034 forecast period. In 2024, North America led the market, accounting for a 39.7% share and generating USD 172.1 million in revenue.

The potato soup industry is expanding due to shifting consumer preferences, advancements in food processing technology, and supportive government policies. In India, potatoes are a key ingredient in various processed foods, including soups, supported by robust agricultural output and government initiatives aimed at enhancing potato-based product development.

India’s potato production is concentrated in states such as Uttar Pradesh, West Bengal, and Bihar. In the 2024–25 season, Uttar Pradesh alone produced 244 lakh metric tonnes of potatoes across 6.96 lakh hectares, with Agra contributing 76,000 hectares. This strong production base supports the rising demand for processed potato products like soups.

Key Takeaways

- Potato Soup Market size is expected to be worth around USD 893.9 Million by 2034, from USD 433.7 Million in 2024, growing at a CAGR of 7.5%.

- Unflavoured held a dominant market position, capturing more than a 59.3% share in the Potato Soup Market.

- Ready-to-Eat held a dominant market position, capturing more than a 34.8% share in the Potato Soup Market.

- Retail held a dominant market position, capturing more than a 38.9% share in the Potato Soup Market.

- North America emerged as the dominant region in the Potato Soup Market, capturing 39.7% of global sales, equating to approximately USD 172.1 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/potato-soup-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 433.7 Million |

| Forecast Revenue (2034) | USD 893.9 Million |

| CAGR (2025-2034) | 7.5% |

| Segments Covered | By Flavor (Unflavoured, Flavored), By Type (Ready-to-Eat, Powdered, Canned, Organic, Low Sodium, Cream-based, Dehydrated), By Application (Retail, Foodservice, Institutional, Convenience Stores, Restaurants, Others) |

| Competitive Landscape | ConAgra Foods, Kraft Heinz, Nestlé, Unilever, Amy’s Kitchen, Hain Celestial Group, Pacific Foods, B&G Foods, Hormel Foods, Knorr, McCain Foods |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156457

Key Market Segments

Flavor Analysis

Unflavoured Commands 59.3% Share in 2024

In 2024, unflavoured potato soup led the market, securing a 59.3% share in the Potato Soup Market. Its dominance reflects consumer preference for a versatile base that can be tailored with spices or herbs. Both foodservice outlets and households value unflavoured soup as a foundation for traditional or fusion recipes, while its neutral taste appeals to health-conscious consumers seeking low-sodium, additive-free options.

Looking to 2025, unflavoured potato soup is poised to maintain its lead, driven by the growing popularity of packaged and ready-to-cook meals. Manufacturers are emphasizing clean-label products with natural ingredients to meet demand for wholesome foods. The segment’s adaptability across cuisines ensures its continued dominance in retail and foodservice, solidifying its role as the cornerstone of the potato soup market.

Type Analysis

Ready-to-Eat Holds 34.8% Share in 2024

In 2024, ready-to-eat potato soup captured a 34.8% market share, fueled by demand for convenient meal solutions. Popular in urban areas, this segment—available in canned, packaged, and microwaveable formats—caters to fast-paced lifestyles with its long shelf life, portion control, and consistent flavor. It appeals to consumers seeking quick, wholesome options.

By 2025, ready-to-eat soup is expected to sustain its growth, supported by demand for premium, clean-label, and low-sodium varieties. Innovations like resealable pouches and single-serve bowls enhance convenience, while the rise of on-the-go eating and comfort food trends strengthens the segment’s position. Ready-to-eat remains a key driver in the potato soup market, balancing convenience and quality.

Application Analysis

Retail Secures 38.9% Share in 2024

In 2024, the retail segment dominated the Potato Soup Market with a 38.9% share, driven by the popularity of packaged soups in supermarkets, hypermarkets, and convenience stores. Retail channels offer diverse options, from ready-to-eat cans to dehydrated mixes, supported by appealing packaging, promotions, and brand variety.

By 2025, retail is expected to maintain its lead as packaged foods remain a staple for daily meals. The growth of online grocery platforms expands access, while retail’s ability to offer budget-friendly and premium products caters to diverse consumers. Retail continues to drive growth in the potato soup market through accessibility and variety.

Regional Analysis

North America Leads with 39.7% Share (USD 172.1 Million) in 2024

In 2024, North America held a 39.7% share of the global Potato Soup Market, generating USD 172.1 million in revenue. This leadership is driven by a cultural affinity for comforting dishes, a robust retail network, and demand for convenient yet flavorful options. In the U.S. and Canada, potato soup, whether classic creamy varieties or heartier blends, remains a go-to for busy families and health-conscious consumers. The availability of ready-to-eat and ready-to-heat formats, paired with clean-label and low-sodium options, fuels North America’s dominance in the market.

Top Use Cases

- Comfort Food for Chilly Evenings: Potato soup shines as a go-to warm hug on cold nights, with its creamy texture and mild flavors wrapping around simple ingredients like tender potatoes and a hint of herbs. Families gather around steaming bowls, feeling cozy and satisfied after a long day, making it a beloved choice for relaxed winter dinners that bring everyone together without much fuss.

- Quick Weeknight Family Meal: Busy parents love whipping up potato soup in one pot, tossing in everyday veggies and a splash of milk for a hearty, filling dish ready in under an hour. It keeps kids happy with its smooth, comforting taste while offering a balanced bite that stretches leftovers into lunches, turning rushed evenings into easy, stress-free family bonding time.

- Versatile Side for Hearty Dinners: Pair potato soup alongside grilled meats or fresh salads to round out a meal, its subtle earthiness complementing bolder flavors without overpowering the plate. Diners enjoy the contrast of its velvety warmth against crisp greens or juicy proteins, making it a smart pick for gatherings where variety keeps things light yet satisfying.

- Loaded Topping Party for Game Days: Transform potato soup into a fun crowd-pleaser by piling on crispy bacon bits, melted cheese, and green onions, turning it into a shareable dip-like treat for casual watch parties. Guests dig in with spoons or chips, loving the customizable bursts of flavor that make it a lively, interactive snack, fueling lively chats and cheers.

- Gentle Starter for Health-Focused Meals: As a light opener, potato soup eases into dinners with its naturally soothing blend of blended spuds and broth, providing gentle nourishment for those seeking simple, feel-good eats. It sets a calm tone for veggie-packed mains, appealing to wellness seekers who appreciate its easy digestibility and subtle warmth without heavy add-ons.

Recent Developments

1. ConAgra Brands

ConAgra has focused on brand consolidation, streamlining its potato soup offerings under its powerful Marie Callender’s frozen meals brand. Recent developments are part of a broader strategy to optimize its portfolio for efficiency and growth, rather than launching new potato soup SKUs. This ensures their classic creamy potato soup remains a key item in their frozen entree and soup lineup.

2. The Kraft Heinz Company

Kraft Heinz has leveraged innovation to drive growth in its soup segment. While not exclusively for potato soup, their recent Heinz Soups launch in the UK (including a Creamy Potato & Leek variant) marks a significant entry into a new market. This development is a key part of their global growth strategy, introducing their soup portfolio to new consumers under the iconic Heinz brand.

3. Nestlé

Nestlé has been heavily investing in reformulating its products to meet clean-label demands. For their canned soups under brands like Libby’s, this means reducing artificial additives and using simpler ingredients. While not a flashy new launch, this quiet, significant development across their portfolio aims to improve the nutritional profile and appeal of their classic creamy potato soup to modern, health-conscious shoppers.

4. Unilever

Unilever has divested its soup assets, including the potent Knorr brand. Therefore, recent developments for products like Knorr potato soup are now under the purview of the new owner, Investindustrial. Any innovation or market changes are part of the new entity’s strategy, not Unilever’s, as the company has exited the soup market entirely to focus on other core categories.

5. Amy’s Kitchen

Amy’s Kitchen continues to lead in the organic, canned soup space with a commitment to simple, non-GMO ingredients. Their recent developments are consistent: maintaining their classic Organic Cream of Potato soup as a staple while ensuring their entire line, including other potato-based varieties, meets the growing consumer demand for organic, vegetarian, and gluten-free options without compromising on taste or quality.

Conclusion

Potato Soup is emerging as a timeless yet evolving staple in today’s fast-paced kitchens, blending nostalgic comfort with fresh twists like plant-based options and bold seasonings. Its appeal lies in effortless versatility, drawing in health-conscious eaters craving wholesome warmth alongside busy families eyeing quick, customizable meals. With rising interest in cozy, no-fuss foods that foster connection, this humble dish holds strong potential to nurture loyalty across generations, quietly anchoring meal routines while adapting to modern tastes for sustainability and simplicity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)