Table of Contents

Overview

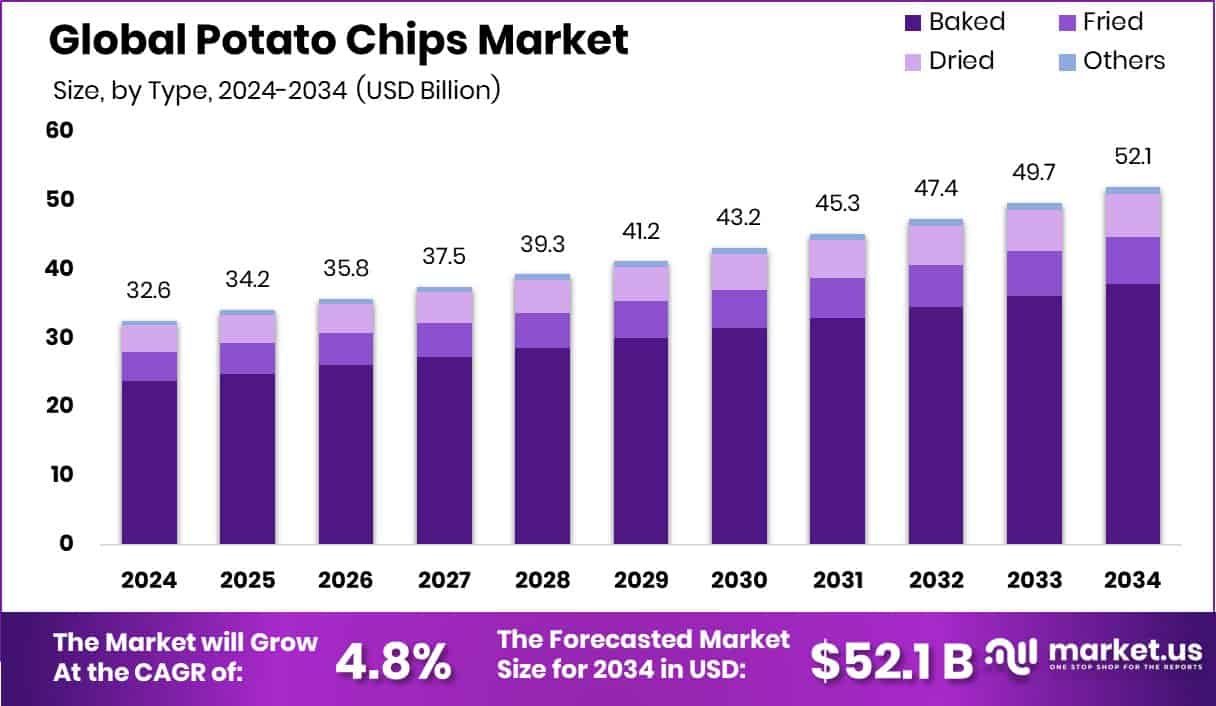

New York, NY – August 08, 2025 – The global potato chips market is projected to reach USD 52.1 billion by 2034, rising from USD 32.6 billion in 2024, with a CAGR of 4.8% during the forecast period (2025–2034). Asia-Pacific, driven by a strong snacking culture, accounted for USD 14.2 billion of the market. Potato chips, typically thinly sliced and either fried or baked before being seasoned, remain a universally popular snack, widely distributed through supermarkets, convenience stores, and vending machines.

In India, the potato chips industry has seen significant growth, fueled by changing consumer preferences, increasing urbanization, and supportive government measures. Once dominated by homemade variants, the Indian market has evolved to feature a wide range of branded and packaged products. This shift indicates a broader trend toward convenience and ready-to-eat snacks among Indian consumers, further supported by an expanding middle class and rising disposable incomes.

India is one of the largest potato producers globally, with around 48.6 million metric tonnes harvested in 2016–17 over 2.35 million hectares, according to the Ministry of Agriculture & Farmers Welfare. Uttar Pradesh contributed over 32% of this output. Yet, only about 4% of this yield is processed, highlighting a vast opportunity for value addition. The organized chips market includes both global giants and regional players, and as modern retail and e-commerce channels continue to grow, the industry stands poised for further expansion through investments in processing technology, supply chains, and innovative product offerings.

Key Takeaways

- The global potato chips market is projected to grow from USD 32.6 billion in 2024 to approximately USD 52.1 billion by 2034, registering a CAGR of 4.8% between 2025 and 2034.

- Baked potato chips dominated the product segment in 2024, holding a substantial 72.9% market share.

- Conventional potato chips remained the most popular variety, accounting for 87.2% of total market demand.

- Regular-flavored chips led in terms of flavor preference, representing 39.1% of the market due to strong consumer favor for classic options.

- Household and retail consumption represented the largest end-use segment with a 78.3% market share, reflecting the popularity of chips as an at-home snack.

- Supermarkets and hypermarkets emerged as the leading distribution channels, contributing 59.3% to overall sales.

- The Asia-Pacific region recorded a market value of USD 14.2 billion, underlining its significant role in the global potato chips industry.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-potato-chips-market/free-sample/

Report Scope

| Market Value (2024) | USD 32.6 Billion |

| Forecast Revenue (2034) | USD 52.1 Billion |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Type (Baked, Fried, Dried, Others), By Category (Organic, Conventional), By Flavour (Regular, Plain/Salted, Single Flavor, Blended Flavor), By End-use (Retail/Household, Food Service Sector), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | PepsiCo, The Campbell Soup Company, EuropeSnacks, LaSalle Capital, KP Snacks, Calbee Inc., Kellanova, Priniti Foods Pvt. Ltd., Utz Brands Inc., Bikaji Foods International Ltd., Old Dutch Foods, Kettle Brand, Frito-Lay North America, Inc, The Lorenz Bahlsen Snack-World GmbH & Co KG, Great Lakes Potato Chips |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146630

Key Market Segments

1. By Type Analysis

- In 2024, baked potato chips held a commanding 72.9% share in the market by type, reflecting the growing consumer inclination toward healthier snack options. Baked chips are widely regarded as a better alternative to fried variants due to their lower fat content, making them especially appealing to health-conscious individuals and urban consumers. The rise in demand from fitness-aware and diet-conscious buyers has spurred innovation, with manufacturers introducing baked varieties in multigrain and low-sodium formats. Many leading brands have expanded their baked chip offerings, incorporating regional flavors while maintaining a focus on health. Furthermore, government-backed health awareness campaigns and improved labeling practices have supported the rise in popularity of baked chips.

2. By Category Analysis

- Conventional potato chips dominated the category segment in 2024, capturing an impressive 87.2% market share. Their widespread appeal is rooted in familiar flavors, consistent quality, and affordability. Conventional chips continue to attract a broad consumer base across age groups and retail channels, particularly in supermarkets, convenience stores, and local outlets. Brand loyalty plays a key role in their dominance, with recognized brands offering trusted taste experiences, often supported by promotional pricing, combo packs, and value deals. Despite emerging health-focused snacking trends, traditional chips remain popular for their indulgent taste and convenience, maintaining a strong presence on store shelves.

3. By Flavour Analysis

- Regular-flavored potato chips led the flavor segment with a 39.1% market share in 2024. This classic flavor remains a consumer favorite due to its simplicity, familiarity, and broad appeal across all age groups and regions. Regular chips are often the preferred choice for households, travel, gatherings, and everyday snacking, making them top-sellers across various distribution channels including supermarkets and online platforms. Their consistent taste and affordability make them a staple snack. For new brands, launching with a regular flavor variant is often a strategic entry point to build consumer trust and recognition in the competitive market.

4. By End-Use Analysis

- The retail/household segment held a dominant 78.3% share of the market in 2024. Consumers continue to purchase potato chips for at-home consumption, driven by everyday snacking needs, family occasions, and personal enjoyment. The expansion of organized retail, increasing disposable incomes, and shifting eating habits have significantly contributed to this trend. Most purchases are made in bulk or family-sized packs from supermarkets, hypermarkets, or online platforms. The rise of hybrid work models and remote lifestyles has further increased the frequency of at-home snacking, leading to higher sales in this segment.

5. By Distribution Channel Analysis

- Supermarkets and hypermarkets led global distribution in 2024 with a 59.3% share. Their dominance is supported by the convenience of one-stop shopping, where consumers can choose from a wide variety of chip brands, flavors, and pack sizes. These stores offer regular discounts, promotional displays, and ample shelf space, encouraging impulse purchases and brand visibility. Bulk purchasing habits among households also contribute to strong sales in this channel. Additionally, the expansion of supermarket chains into smaller cities and towns has made branded potato chips more accessible, reinforcing their position as the primary distribution channel worldwide.

Regional Analysis

- In 2024, Asia-Pacific emerged as the leading region in the global potato chips market, commanding a 43.7% share and generating revenue of USD 14.2 billion. This growth was fueled by rapid urbanization, evolving dietary habits, and an expanding youth demographic with a strong preference for quick and convenient snack options. The increasing availability of packaged snacks through modern retail outlets further boosted regional demand.

- North America maintained a mature and stable market, with the U.S. and Canada showing steady consumption levels, supported by high per capita intake and a strong foothold of well established chip brands. Europe also recorded consistent performance, driven by consumer interest in organic, baked, and locally inspired flavor variants, reflecting regional preferences and health-conscious trends.

- The Middle East & Africa region witnessed moderate growth, supported by rising disposable incomes and the expansion of urban retail infrastructure. Latin America showed promising potential, especially in markets like Brazil and Mexico, where improved retail access and growing consumer awareness are slowly driving chip consumption. While North America and Europe continue to play significant roles, Asia-Pacific stood out in 2024 as the top contributor in both value and volume, reflecting the region’s dynamic retail development and expanding snack-loving population.

Top Use Cases

- Convenience snacking (on‑the‑go): Busy consumers choose potato chips for quick, ready‑to‑eat snacking while commuting, at work, or between meals. They value the portability, no‑prep convenience, and satisfying crunch, making chips a top choice to fill small hunger gaps during hectic days.

- Health‑oriented variants (better‑for‑you snacks): Brands offer baked, low‑fat, low‑sodium, multigrain or chips with added protein to appeal to health‑aware shoppers. These options target diet‑conscious consumers seeking nutrient‑lighter indulgences that still deliver taste and crunch without guilt.

- Flavor innovation & global tastes: Manufacturers launch regionally inspired, exotic flavors—like spicy, sweet‑tangy, global cuisines to capture adventurous consumers craving novelty. Limited‑edition and viral flavor drops attract younger audiences and drive impulse purchases through social media trend excitement.

- Family & bulk purchase occasions: Larger bag sizes and value‑packs cater to family snacking, home gatherings, parties, travel, and group events. Consumers often purchase in bulk for shared occasions, offering value and convenience while encouraging repeat sales for established brands.

- Retail channel dominance (supermarkets, e‑commerce): Potato chips sell heavily through supermarkets, hypermarkets, and online grocery platforms. These channels offer product variety, promotions, and easy home delivery or bulk shopping supporting strong visibility and easy access in both urban and semi‑urban markets.

Recent Developments

1. PepsiCo / Frito‑Lay North America, Inc.

- PepsiCo plans to fully rebrand Lay’s and Tostitos by eliminating all artificial colors and flavors by the end of 2025, aligning with U.S. regulator moves to phase out synthetic dyes. They will also shift to healthier oils like avocado and olive oil across these brands. Additionally, Lay’s and Tostitos relaunches will emphasize simple ingredients—potatoes, oil, and salt. This rollout is part of a broader health-conscious strategy, including protein‑enriched snacks and promotion of value brands such as Chester’s and Santitas.

2. KP Snacks (UK, EuropeSnacks/Intersnack-owned)

- KP Snacks has reformulated its entire Popchips line to be non‑HFSS (i.e. low in fat, salt, sugar) ahead of UK regulations. The move covers all classic Popchips flavors and includes a non‑HFSS stamp on packaging. Separately, KP’s brands like Tyrrells, Hula Hoops, and McCoy’s continue innovation under parent Intersnack. Note: setup and regulatory info from Companies House and public statements confirm financial filings and planned sustainability and labor compliance policies.

3. Utz Brands Inc.

- Utz introduced a limited‑edition Lemonade‑flavored potato chip in partnership with Alex’s Lemonade Stand Foundation, donating up to USD 25 k of sales to fund childhood cancer research. The brand also showcased seasonal innovations at the 2025 Sweets & Snacks Expo, including avocado‑oil kettle chips, pretzel snacks, and Zapp’s “Hot Pepper” chips for Potbelly Sandwich Works. Financially, Utz reported strong Q1 2025 results and reaffirmed full‑year guidance, citing solid organic growth and expanding retail volume.

4. Calbee Inc. / Calbee America

- Calbee America launched a new Weston’s Family Farms organic potato chip line in June 2025, certified USDA‑organic, gluten‑free, and non‑GMO, available in sea salt, sea salt & vinegar, and white truffle flavors. In January 2025, the company opened R&D Innovation Center in Madera, California, to develop Asian‑inspired and better‑for‑you snacks (including chips), leveraging Japanese technology to produce kosher, organic, and gluten‑free products. This supports Calbee’s strategy for double‑digit product growth in North America.

Conclusion

The potato chips market continues to evolve, driven by changing consumer lifestyles, growing preference for ready-to-eat snacks, and the rising popularity of innovative flavors and healthier options. Brands are focusing more on baked and low-fat varieties to align with health-conscious trends, while also experimenting with regional and bold flavors to attract younger consumers.

The expansion of organized retail and online grocery platforms has made chips more accessible to a wider audience. With strong brand loyalty, continuous product development, and increasing demand for convenience, the potato chips market is expected to maintain steady growth and offer long-term opportunities across both developed and emerging regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)