Table of Contents

Overview

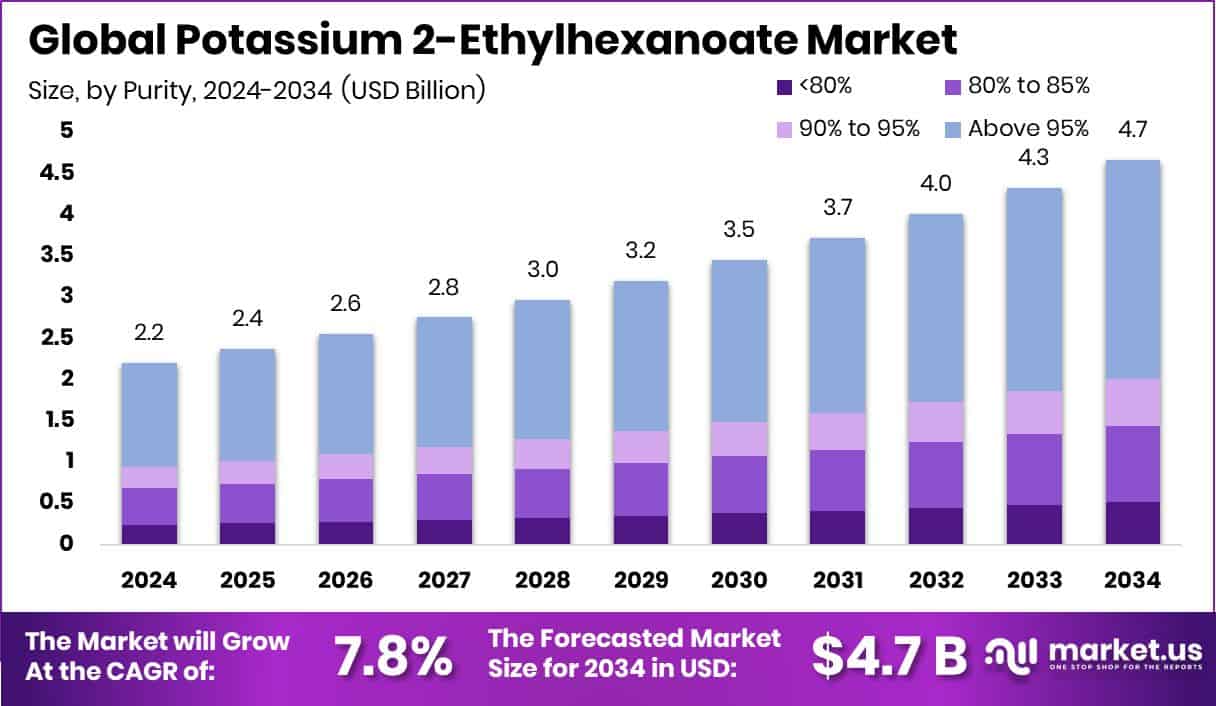

New York, NY – August 08, 2025 – The global Potassium 2-Ethylhexanoate market is projected to reach approximately USD 4.7 billion by 2034, growing from USD 2.2 billion in 2024 at a compound annual growth rate (CAGR) of 7.8% between 2025 and 2034. Asia-Pacific currently dominates the global landscape, accounting for 47.4% of the total market share with a value of USD 1.04 billion. This compound serves as a crucial catalyst and stabilizer in industrial applications, particularly in the production of synthetic rubber and plastics, where it enhances polymerization efficiency and material durability.

Market growth is fueled by increasing demand from the polymer and coatings sectors. Manufacturers are shifting toward more efficient, cost-effective catalysts, and Potassium 2-Ethylhexanoate is emerging as a preferred choice for applications that require thermal stability and resistance to chemicals. Its functional benefits in enhancing the flexibility, strength, and longevity of materials make it an integral component across various industrial segments.

In particular, the automotive industry is contributing significantly to market expansion. As the sector moves toward lightweight and fuel efficient vehicles, there is growing interest in advanced materials that offer strength without added weight. Potassium 2-Ethylhexanoate supports this trend by improving the quality of materials used in vehicle components, making it essential for modern automotive manufacturing focused on performance and sustainability.

Key Takeaways

- The global Potassium 2-Ethylhexanoate market is projected to reach USD 4.7 billion by 2034, rising from USD 2.2 billion in 2024, with a CAGR of 7.8% during 2025–2034.

- The compound with over 95% purity leads the market, accounting for 57.5% of the total share in its purity segment.

- The solution form of Potassium 2-Ethylhexanoate is most widely used, representing 67.4% of the market due to its ease of application.

- Paints and coatings are the largest application area, consuming 36.9% of the total Potassium 2-Ethylhexanoate demand.

- Asia-Pacific dominates the regional landscape, holding a 47.4% share of the global market, driven by strong industrial demand.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-potassium-2-ethylhexanoate-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.2 Billion |

| Forecast Revenue (2034) | USD 4.7 Billion |

| CAGR (2025-2034) | 7.8% |

| Segments Covered | By Purity (<80%, 80% to 85%, 90% to 95%, Above 95%), By Form (Powder, Solution), By Application (Paints and Coatings, Adhesives and Sealants, Plastics, Rubber, Metalworking Fluids, Others) |

| Competitive Landscape | Milliken & Company, Glindia Chemicals, American Elements, Haihang Industry Co.,Ltd., Shandong Lanhai Industry Co., Ltd, ADEG S.R.L., Ferguson Chemicals, Ningbo Inno Pharmchem Co.,Ltd., Mofan Polyurethane Co., Ltd., SincereChemical, Ivy Fine Chemicals, Ronak Chemicals, Actylis, Nihon Kagaku Sangyo Co., Ltd., Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146515

Key Market Segments

1. By Purity Analysis

- In 2024, the segment comprising potassium 2-ethylhexanoate with purity levels above 95% commanded a significant 57.5% share of the overall market. This dominance underscores the rising preference for high-purity variants in industrial applications due to their superior stability, compatibility, and overall performance. Sectors such as coatings, lubricants, and adhesives particularly favor this grade for its ability to meet stringent regulatory and technical standards, especially in industries like automotive, electronics, and consumer goods where consistent product quality is essential.

2. By Form Analysis

- The solution form of potassium 2-ethylhexanoate led the market in 2024, accounting for 67.4% of the total share. Its popularity is largely due to its practicality and efficiency in manufacturing processes across diverse industries. As a liquid, it offers ease of handling, uniform mixing, and better integration into formulations, making it especially suitable for use in coatings, adhesives, and pharmaceuticals. The solution form also ensures enhanced dispersion and reactivity, positioning it as a preferred choice in high precision, high volume operations.

3. By Application Analysis

- In terms of applications, paints and coatings represented the largest segment in 2024, securing a 36.9% share of the market. This trend reflects the crucial role of potassium 2-ethylhexanoate as a stabilizer that enhances the performance and durability of coatings. The compound’s compatibility with multiple resin types and its ability to boost coating longevity have made it vital in construction and automotive sectors. Furthermore, growing demand for eco-friendly formulations and compliance with VOC emission standards continue to strengthen its use in modern coating technologies.

Regional Analysis

- In 2024, Asia-Pacific emerged as the leading region in the Potassium 2-Ethylhexanoate market, capturing a dominant 47.4% share valued at USD 1.04 billion. This strong regional performance is driven by widespread industrial consumption and growing demand across major economies such as China, India, and Japan. The region’s expanding manufacturing base and large-scale applications in sectors like coatings, adhesives, and automotive continue to fuel market growth and solidify its leadership position.

- North America holds a steady position in the global market, supported by increasing adoption of eco-friendly additives and consistent growth in infrastructure projects across the U.S. and Canada. Meanwhile, Europe maintains moderate market strength, influenced by strict environmental regulations and the continued use of potassium 2-ethylhexanoate in paints, coatings, and catalytic applications. Both regions benefit from technological advancements and regulatory alignment toward sustainable practices.

- Other regions are showing gradual growth. The Middle East & Africa is witnessing rising demand, especially in the construction and chemical industries within countries like the UAE and South Africa. Latin America, led by Brazil and Mexico, is also gaining traction as industrialization picks up pace and the use of potassium 2-ethylhexanoate expands in automotive and architectural coatings. While Asia-Pacific continues to lead, the evolving industrial landscape in these emerging markets signals promising opportunities for future expansion.

Top Use Cases

- Catalysis in Polymer Production (Catalyst Use): Potassium 2‑ethylhexanoate is widely applied as a catalyst in polyurethane and polyester resin manufacturing. It accelerates reaction rates, enables better polymer structure control, and helps reduce reliance on other metals (like cobalt). This makes it essential in large volume foam, plastics, and resin industries, offering efficiency and cost benefits in core polymerization processes.

- Accelerated Drying in Coatings (Resin Drier): In paints and coating formulas, this compound serves as a resin drier that speeds up drying time and improves surface finish durability. By facilitating faster curing, it enhances final coating performance and reduces production cycle times. Its adoption is strong in industrial, architectural, and automotive coatings where efficient application and quality are priorities.

- Corrosion Inhibition in Metalworking (Metalworking Fluids): Used as an additive in metalworking fluids, Potassium 2‑ethylhexanoate helps protect cutting tools and machined metal surfaces from corrosion during operations like milling and turning. It prolongs equipment life, enhances lubricant stability, and helps maintain product quality. This use case is important for industrial machining and metal fabrication sectors looking to optimize performance and reduce downtime.

- Dispersing & Wetting Agent (Additive Use): The compound is also employed as a dispersing or wetting agent in formulations, aiding uniform mixing of ingredients in adhesives, sealants, and specialty chemicals. It improves dispersion of particles, stabilizes formulations, and supports consistent performance. This application benefits industries requiring precise, high‑quality blends such as adhesives, sealants, and specialized coatings.

- Catalyst in PIR Foam for Insulation (Trimerization Application): In advanced insulation foam production, potassium 2‑ethylhexanoate acts as a trimerization catalyst in polyisocyanurate (PIR) foam systems. It helps form highly cross linked polymer networks, resulting in rigid, thermally efficient foams. This application is critical in building insulation and refrigeration industries seeking durable, fire‑resistant, and energy‑saving materials.

Recent Developments

1. Milliken & Company:

- In January 2025, Milliken & Company (via its Borchers specialty‑chemicals arm) launched a new product called Potassium Hex‑Cem, a catalyst formulation containing potassium 2‑ethylhexanoate. It is specifically designed for rigid urethane foam production and two‑component PUR coating systems. This product accelerates trimerization and improves processing while reducing cobalt usage and discoloration in unsaturated polyester resin systems. It reinforces Milliken’s focus on high‑performance additive technology for industrial coatings and polyurethane markets.

2. Glindia Chemicals:

- Glindia Chemicals recently highlighted the release of a solid form of potassium 2‑ethylhexanoate, which offers significantly lower volatility compared to liquid solutions. This solid grade minimizes vapor emissions and enhances workplace safety, making it more suitable for users in controlled environments or where solvent exposure is a concern. This development underscores Glindia’s strategy toward safer, high‑purity product formats for specialty chemical markets such as electronics, pharmaceuticals, and coatings.

3. American Elements

- American Elements is listed among the key global producers of potassium 2‑ethylhexanoate, particularly in high‑purity grades used in coatings, catalysts, and polymer systems. While no specific product launch or press announcement was found, its regular inclusion in industry reports highlights sustained market presence and broad supply capability. The company continues to serve major industrial and laboratory customers looking for consistent quality and custom packaging options.

4. Ronak Chemicals

- Ronak Chemicals, based in Ankleshwar, India, manufactures potassium 2‑ethylhexanoate as part of its fine‑chemical portfolio. Their MSDS indicates a production capacity of approximately 50 MT per year of Potassium 2‑ethylhexanoate (CAS 3164‑85‑0), primarily used as an intermediate in pharmaceuticals (e.g., azilsartan medoxomil potassium salt) and coatings. Although no recent strategic update was published, this volume suggests active regional supply to pharmaceutical and resin additive markets.

Conclusion

The Potassium 2-Ethylhexanoate market is growing steadily due to its increasing use in industries like coatings, adhesives, and polymers. The demand is especially high in regions with strong manufacturing activity and rising focus on high-performance materials. Products with high purity are more popular because they offer better stability and efficiency. The solution form is widely used because it’s easy to handle and blends well in different applications. With industries moving toward safer and more efficient chemicals, the market for potassium 2-ethylhexanoate is expected to see continued growth across various sectors in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)