Table of Contents

Overview

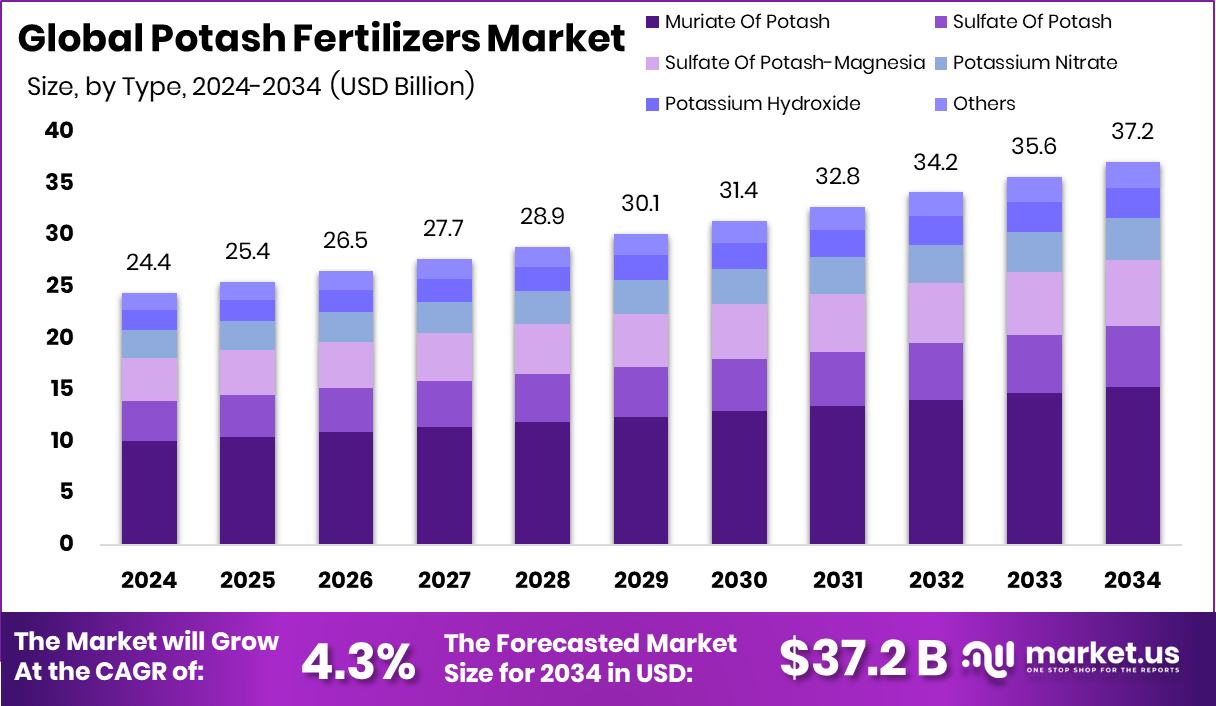

New York, NY – September 02, 2025 – The Global Potash Fertilizers Market is projected to experience significant growth, reaching an estimated value of USD 37.2 billion by 2034, up from USD 24.4 billion in 2024, with a compound annual growth rate (CAGR) of 4.3% over the forecast period from 2025 to 2034. This growth is largely driven by the increasing global population, particularly in the Asia Pacific region, which accounts for a substantial market share valued at USD 10.4 billion.

The rising demand for food production, coupled with limited arable land, is pushing the adoption of potash fertilizers to enhance agricultural productivity and ensure food security. Potash fertilizers, primarily composed of potassium, are essential mineral-based nutrients that complement nitrogen and phosphorus in supporting plant growth. Derived mainly from potassium chloride found in naturally occurring potash ores, these fertilizers play a critical role in improving water retention, root strength, disease resistance, and overall crop yield.

They also enhance crop quality by improving fruit size, color, and taste, making them indispensable for agricultural efficiency. The market encompasses the global production, trade, and consumption of potassium-based fertilizers, serving diverse sectors such as agriculture, horticulture, and commercial farming, with demand driven by crops like cereals, oilseeds, fruits, and vegetables.

Several factors contribute to the market’s expansion, including the depletion of soil nutrients and the need for sustainable soil management practices. Modern farming techniques, such as precision agriculture, are encouraging farmers to use potassium-rich fertilizers to address soil potassium deficiencies, which can weaken crop resilience against climate variability. Additionally, growing awareness of balanced nutrient application is increasing potash adoption worldwide.

Regional soil conditions and farming practices influence usage patterns, with significant investments supporting market growth. For instance, the USDA has allocated a USD 80 million grant to a planned potash facility in Osceola County, while Millennial Potash received USD 3 million in U.S. government funding for its project in Gabon, highlighting the strategic importance of potash in global agriculture.

Key Takeaways

- The Global Potash Fertilizers Market is expected to be worth around USD 37.2 billion by 2034, up from USD 24.4 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In the Potash Fertilizers Market, Muriate of Potash holds 41.2% due to its cost-effectiveness.

- Solid form dominates the Potash Fertilizers Market with an 81.7% share, favored for easy storage and application.

- Broadcasting application leads the Potash Fertilizers Market at 56.1%, offering uniform nutrient distribution across fields.

- Cereals and grains account for 46.9% of the Potash Fertilizers Market demand, driven by high potassium needs.

- Strong agricultural base drives potash fertilizer demand in the Asia Pacific by 42.7%.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-potash-fertilizers-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 24.4 Billion |

| Forecast Revenue (2034) | USD 37.2 Billion |

| CAGR (2025-2034) | 4.3% |

| Segments Covered | By Type (Muriate Of Potash, Sulfate Of Potash, Sulfate Of Potash-Magnesia, Potassium Nitrate, Potassium Hydroxide, Others), By Form (Solid, Liquid), By Application (Broadcasting, Foliar, Fertigation, Others), By Crop Type (Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others) |

| Competitive Landscape | Agrium Inc., Yara International ASA, The Mosaic Company, JSC Belaruskali, Eurochem Group AG, Borealis AG, HELM AG, Sinofert Holdings Limited, Israel Chemicals Ltd., Nutrien, K+S Aktiengesellschaft, SQM S.A |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155229

Key Market Segments

By Type Analysis – Muriate of Potash Leads with 41.2% Share

In 2024, Muriate of Potash (MOP) secured a dominant 41.2% share in the Potash Fertilizers Market by type. Known chemically as potassium chloride, MOP’s leadership stems from its high potassium concentration, affordability, and versatility in application across key crops such as cereals, oilseeds, and fruits. Farmers prefer MOP for its rapid soil absorption, which improves root development, water retention, and crop resistance against pests and diseases.

Its solubility makes it suitable for modern irrigation systems, while its compatibility with blended fertilizers adds to its market strength. Additionally, its cost-effectiveness positions it as a top choice in price-sensitive agricultural regions. With rising food demand and shrinking arable land, MOP is expected to sustain its leading role in the years ahead.

By Form Analysis – Solid Form Holds 81.7% Share

In 2024, the solid form of potash fertilizers accounted for 81.7% of the market, reflecting its dominance in large-scale farming. Solid potash fertilizers, commonly available in granule or crystalline forms, are valued for their ease of handling, storage, and transportation. They provide long shelf life and consistent nutrient release, ensuring efficient potassium delivery.

Farmers benefit from their compatibility with existing farm machinery and reduced nutrient leaching compared to liquid forms. Strong adoption in staple crop cultivation, where bulk fertilizer application is essential, further supports the segment’s leadership. Given their practicality, affordability, and efficiency, solid formulations are expected to maintain their commanding share.

By Application Analysis – Broadcasting Accounts for 56.1%

In 2024, broadcasting emerged as the leading application method, representing 56.1% of the potash fertilizers market. Broadcasting involves evenly spreading fertilizers across soil surfaces, ensuring wide nutrient distribution—particularly beneficial for cereals and oilseeds.

The method’s popularity lies in its simplicity, cost-effectiveness, and adaptability for both manual and mechanized farming. It enables bulk application, reduces labor intensity, and enhances nutrient uptake when combined with tillage. Its effectiveness in maintaining soil fertility at scale has cemented broadcasting as the most widely used application technique, a position it is set to retain.

By Crop Type Analysis – Cereals & Grains Capture 46.9%

In 2024, cereals and grains dominated the potash fertilizers market by crop type, securing 46.9% of the share. With crops like wheat, rice, maize, and barley being staple foods worldwide, the demand for potash fertilizers in this segment is consistently strong.

Potassium is essential for enhancing yield, grain quality, and resistance to stress conditions. Extensive cultivation areas in Asia-Pacific, North America, and Europe further reinforce this demand. By improving grain size, storage potential, and post-harvest value, potash fertilizers remain indispensable for meeting global food security needs.

Regional Analysis

Asia Pacific Leads with 42.7%, Valued at USD 10.4 Bn

In 2024, the Asia Pacific emerged as the largest regional market, holding a 42.7% share valued at USD 10.4 billion. The region’s leadership is fueled by its vast agricultural base and high population-driven food demand, particularly in China, India, and Southeast Asia.

Limited arable land and rapid urbanization have increased reliance on high-efficiency fertilizers to maximize yields. Government subsidies, nutrient management programs, and the adoption of precision farming further support market growth. While North America and Europe benefit from advanced farming practices, and Latin America gains from export-led agriculture, the Asia Pacific continues to lead due to its scale of production, technological adoption, and supportive policies.

Top Use Cases

- Boosting Crop Yields: Potash fertilizers provide potassium, a key nutrient that helps plants grow stronger and produce more crops. They improve fruit and vegetable size, making them vital for farmers aiming to increase output on limited land, especially for high-demand crops like corn and soybeans.

- Enhancing Disease Resistance: Potassium from potash strengthens plant immunity, helping crops fight diseases and pests. This reduces crop losses and the need for chemical pesticides, supporting healthier plants and sustainable farming, particularly for fruits, vegetables, and nuts in regions with pest challenges.

- Improving Water Retention: Potash helps plants manage water better, making them more resilient to drought. It regulates water movement in plant tissues, ensuring crops like wheat and rice thrive in dry conditions, which is crucial in water-scarce areas for consistent yields.

- Supporting Soil Fertility: Continuous farming depletes soil potassium, but potash fertilizers replenish it. They maintain soil health, ensuring long-term productivity for crops like potatoes and sugar beets, especially in intensive agriculture regions where soil nutrient loss is a concern.

- Enhancing Crop Quality: Potash improves the taste, texture, and nutritional value of crops like tomatoes and grains. It boosts protein, starch, and vitamin content, making produce more appealing and nutritious, which meets consumer demand for high-quality food.

Recent Developments

1. Agrium Inc.

Agrium operates as Nutrien, the world’s largest potash producer. Recent developments focus on maximizing its operational capability to address global supply gaps, particularly from Eastern Europe. Nutrien announced it would increase its potash production, leveraging its flexible asset base to support global food security.

2. Yara International ASA

Yara is focusing on decarbonization and supply chain transparency. A key recent development is its investment in the Herøya green ammonia project in Norway, aiming to decarbonize its production processes. Furthermore, Yara has pioneered the world’s first fully digitalized, emission-free mine-to-product potash supply chain pilot using blockchain technology to ensure traceability and reduce the carbon footprint of its Canadian potash shipments to partners like Cargill.

3. The Mosaic Company

Mosaic’s recent developments address both operational recovery and market expansion. The company is recovering from significant water inflow issues at its Esterhazy (K3) mine in Canada, with the new shaft now operational. Strategically, Mosaic is expanding its footprint by acquiring the Ma’aden Wa’ad Al Shamal phosphate production joint venture in Saudi Arabia, strengthening its global phosphate and potash portfolio, and diversifying its supply sources.

4. JSC Belaruskali

Belaruskali has been severely impacted by international sanctions and the loss of traditional export routes due to the war in Ukraine. A major recent development is its struggle to maintain exports, now heavily reliant on Russian railways and ports. The company’s future is deeply intertwined with geopolitical events, facing challenges in receiving payments and insuring shipments, which have significantly disrupted its role in the global potash market.

5. EuroChem Group AG

EuroChem, like Belaruskali, faces extreme challenges due to sanctions on its major shareholders. Recent developments involve navigating these restrictions, with its state-of-the-art Usolskiy potash mine in Russia now operational but facing logistical and financial hurdles.

Conclusion

Potash fertilizers are essential for modern agriculture, driving higher crop yields, better quality, and sustainable farming practices. With global food demand rising due to population growth, potash remains critical for addressing potassium deficiencies in soils, especially in regions like Asia and Latin America. Its role in improving plant resilience and food security ensures strong market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)