Table of Contents

Overview

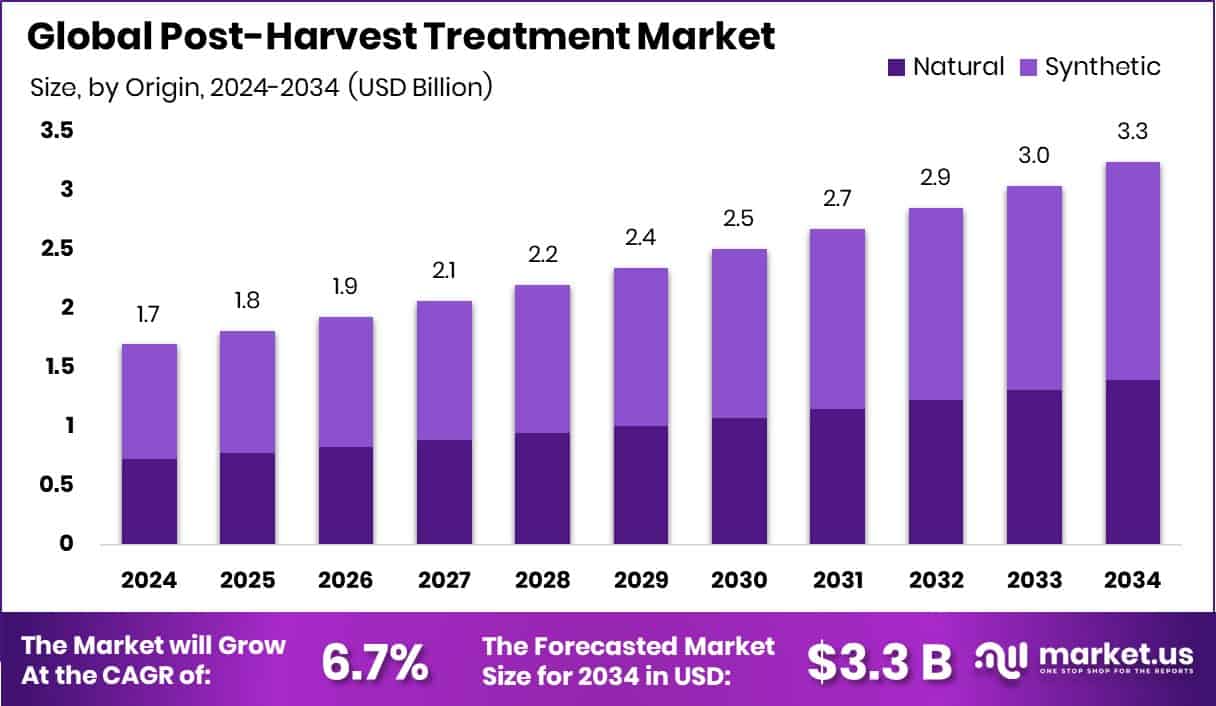

New York, NY – September 02, 2025 –The post-harvest treatment industry is set for strong growth, expected to reach USD 3.3 billion by 2034, up from USD 1.7 billion in 2024, advancing at a 6.7% annual rate from 2025 onward. The Asia Pacific region leads with a 41.7% share, valued at USD 0.7 billion.

Post-harvest treatment covers practices such as cleaning, cooling, packaging, storage, and biological or chemical applications to maintain the freshness, safety, and quality of crops while reducing spoilage and extending shelf life.

Rising demand for fresh produce and the need to reduce food loss are driving wider adoption. Governments and agricultural bodies are supporting this shift, with the Manitoba Government investing $13 million in the Downtown Agriculture Exchange and granting $150,000 for grain research. Additionally, grain grower groups pledged $13.4 million to support Cereals Canada’s GATE initiative, advancing innovation in grain treatment.

Consumer preference for safe, nutritious food with a longer shelf life is reinforcing these changes. New investments are boosting biological and sustainable solutions: BioPrime raised $6 million for bio-fungicides and bio-insecticides, while Irish start-up CropBiome secured €1.3 million to develop natural treatments. These eco-friendly approaches are creating opportunities that meet both food security and sustainability needs.

➤ Click the sample report link for complete industry insights: https://market.us/report/post-harvest-treatment-market/request-sample/

Key Takeaways

- The Global Post-Harvest Treatment Market is expected to be worth around USD 3.3 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In the Post-Harvest Treatment Market, synthetic solutions dominate, holding a strong 57.9% share globally.

- Chemical treatment leads the Post-Harvest Treatment Market, accounting for 58.3% share in preservation methods worldwide.

- Coatings represent 31.2% of the Post-Harvest Treatment Market, ensuring extended freshness and product safety.

- Cereals and grains lead applications in the Post-Harvest Treatment Market, capturing a 32.5% market share.

- Asia Pacific, holding a 41.70% share worth USD 0.7 Bn, reflects strong agricultural post-harvest adoption.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155712

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.7 Billion |

| Forecast Revenue (2034) | USD 3.3 Billion |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Origin (Natural, Synthetic), By Treatment Type (Biological Treatment (Enzyme-Based Solutions, Microbial Inoculants), Chemical Treatment (Fungicidal Treatment, Insecticidal Treatment), Physical Treatment (Cold Storage, Heat Treatment, UV Treatment)), By Product (Coatings, Cleaners, Fungicides, Insecticides, Sanitizers, Others), By Application (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Flowers and Ornamentals, Others) |

| Competitive Landscape | JBT, Syngenta Crop Protection, Nufarm, Bayer AG, BASF SE, Citrosol, Hazel Technologies Inc., Janssen PNP, Futureco Chemicals Inc, AgriCoat NatureSeal Ltd |

Key Market Segments

By Origin Analysis

In 2024, synthetic treatments dominated the Post-Harvest Treatment Market by Origin, holding 57.9% of the share. Their strong position comes from being cost-effective, consistent, and capable of delivering quick results across a wide range of crops.

These treatments are commonly used to protect fruits, vegetables, and grains from microbial spoilage, pests, and early ripening, helping extend shelf life and enabling smooth transport for both domestic and global trade. Their impact is especially important in developing regions, where weak storage and handling systems often increase crop losses.

Synthetic solutions also align well with large-scale farming operations, offering standardized methods that support mass distribution needs. Backed by established regulatory approval in many countries, they remain more readily accessible to producers than newer alternatives.

Although natural and sustainable options are gaining attention, the proven efficiency, affordability, and widespread use of synthetic treatments have secured their leading role in 2024, ensuring crop quality and minimizing post-harvest waste.

By Treatment Type Analysis

In 2024, chemical treatments led the Post-Harvest Treatment Market by Treatment Type, holding 58.3% of the share. Their dominance stems from widespread use in controlling microbial growth, delaying ripening, and safeguarding crops from pests and fungi during storage and transport.

Applied extensively to fruits, vegetables, and grains, these treatments help preserve appearance, nutritional value, and freshness, which is especially vital for export-driven supply chains. Their fast action, variety of formulations, and affordability compared to newer methods make them a preferred choice for farmers and distributors seeking to reduce losses.

Support from regulatory approvals in many regions has further boosted adoption, allowing producers to meet food safety standards while serving large-scale distribution networks. With their proven reliability and ability to support global trade volumes, chemical treatments remained the most trusted post-harvest solution in 2024.

By Product Analysis

In 2024, coatings led the Post-Harvest Treatment Market by Product with a 31.2% share. Their rise is driven by the growing use of edible and protective layers that guard against moisture loss, microbial spoilage, and oxidation, helping extend the shelf life of perishable crops.

Fruits and vegetables benefit most, as coatings preserve texture, flavor, and appearance—key factors for consumer appeal and export value. By reducing spoilage during long-distance shipping, they enable suppliers to meet global demand for fresh, high-quality produce.

Coatings also appeal to shifting consumer preferences, offering a natural alternative to synthetic preservatives while keeping costs manageable for growers and distributors. Their ability to cut post-harvest losses and enhance product presentation strengthens their adoption.

Ongoing advances in bio-based and edible technologies further support sustainability and regulatory compliance. With proven effectiveness in maintaining quality and extending market reach, coatings secured their position as the top product segment in 2024.

By Application Analysis

In 2024, cereals and grains dominated the Post-Harvest Treatment Market by Application with a 32.5% share. Their leadership reflects their critical role in global food security, as they serve as staple foods for billions worldwide.

Post-harvest practices for cereals and grains focus on protecting stored crops from pests, fungi, and moisture damage—common factors that cause large-scale losses. These treatments help preserve quality over long periods, ensuring year-round availability and supporting the trade of key staples like rice, wheat, corn, and barley.

Their dominance is also tied to dependence on bulk storage and large handling systems, where even small spoilage leads to major economic setbacks. Techniques such as fumigation, coatings, and moisture control are widely used to safeguard harvests while retaining nutritional value.

Rising global demand, not only for food but also for animal feed and biofuels, further strengthens the need for reliable protection. As a result, cereals and grains secured a leading 32.5% share of the market in 2024.

Regional Analysis

The Post-Harvest Treatment Market reflects diverse regional growth patterns influenced by agricultural production, regulatory standards, and consumer preference for fresh foods. In 2024, the Asia Pacific led with a 41.7% share, valued at USD 0.7 billion, supported by its vast farming base, strong exports of fruits, vegetables, and grains, and rising need for advanced storage and preservation methods.

China, India, and Southeast Asian countries are increasingly adopting modern solutions to curb food waste and strengthen supply chains. North America shows steady growth, driven by advanced infrastructure and stringent safety rules, while Europe focuses on sustainable and eco-friendly practices in line with its environmental agenda. The Middle East & Africa is gradually building presence through food security initiatives in challenging climates.

Meanwhile, Latin America, with its significant fruit and vegetable exports, prioritizes treatments that protect quality during long-distance shipping. Despite these regional differences, Asia Pacific’s scale, investment, and policy support secure its leadership role, underscoring its influence in global post-harvest advancements.

Top Use Cases

- Sanitizing Fresh Produce with Peracetic Acid & Hydrogen Peroxide: After harvest, fruits and vegetables are washed using peracetic acid and hydrogen peroxide to kill harmful microbes. This method keeps the produce cleaner, safer, and fresher for transport or sale—important for ready-to-eat items. It’s a cleaner alternative to chlorine-based washes.

- Using Edible Coatings to Slow Water Loss: After harvest, produce like apples or tomatoes is coated with edible waxes or moisture barriers. These coatings stop the fruits from drying out, help keep them crisp, and preserve their look, taste, and texture during transport.

- Blocking Ethylene to Delay Ripening: Some harvested fruits, like apples and mangoes, are treated with 1-MCP (an ethylene inhibitor). This slows down ripening and keeps the fruit from going soft or decaying too soon—particularly useful for shipping to distant markets.

- Combating Decay with Heat, Fungicides, and Biological Agents: To prevent rotting, harvested produce (e.g., mangoes, grapes) may be dipped in warm water, treated with fungicides, or sprayed with helpful microbes like Pseudomonas syringae. These steps help control fungus and bacteria causing spoilage.

- Value-Adding Sweet Potatoes Through Processing: Some farmers process freshly harvested sweet potatoes (cleaning, drying, packaging) and create new value-added products. This approach raises their income and helps reduce waste by making produce ready for sale or longer storage.

- DIY Retrofit Cooling Space for Berries: Small-scale growers convert old sheds into cooled packing spaces using low-cost tech like CoolBots. This cooling environment helps berries stay fresh longer after harvest, protecting them from damage and spoilage during handling.

Recent Developments

- In January 2025, JBT finalized its takeover of Marel and began operating as JBT Marel Corporation, combining their strengths in food processing and post‑harvest tech. This merger broadens their technology offerings and expands their global reach.

- In January 2025, Nufarm completed the purchase of most of Yield10 Bioscience’s assets. This brings in advanced omega‑3 camelina seed and bioenergy tech, strengthening Nufarm’s sustainable crop and post‑harvest offerings.

- In June 2024, Citrosol introduced the CATsystem®, the world’s first automatic control system for fungicide post-harvest treatments. It keeps treatment concentrations steady in real time, reducing waste, preventing resistance, and improving precision in decay control.

Conclusion

The Post-Harvest Treatment Market is evolving as a vital link between farm production and consumer demand. By reducing spoilage, extending shelf life, and improving food quality, these treatments directly address global challenges of food security and waste reduction. Innovations in coatings, bio-based solutions, and precision technologies are making processes safer, eco-friendly, and more efficient.

With rising consumer preference for fresh, safe, and sustainable food, along with strong government and industry support, post-harvest solutions are becoming indispensable worldwide. This sector’s progress reflects not only technological growth but also a shared commitment to ensuring better utilization of harvests and protecting future supplies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)