Table of Contents

Overview

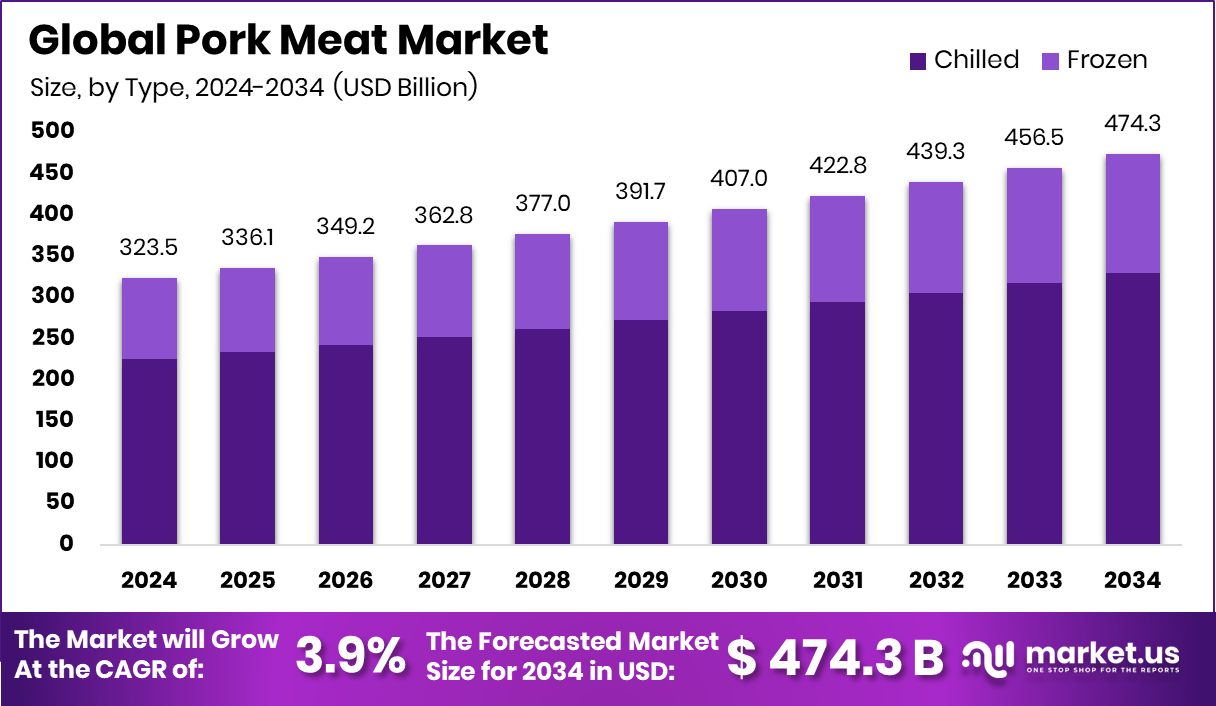

New York, NY – October 03, 2025 – The Global Pork Meat Market is projected to reach around USD 474.3 billion by 2034, rising from USD 323.5 billion in 2024, with a CAGR of 3.9% between 2025 and 2034. Asia Pacific leads the market with 46.8% share, valued at USD 151.3 billion, supported by rapid urbanization and growing demand for protein-rich diets.

Pork meat, derived from domestic pigs, is one of the most widely consumed sources of animal protein globally due to its versatility, affordability, and cultural acceptance. It is consumed in fresh, processed, and cured forms, making it a staple across both traditional cuisines and modern ready-to-eat food categories. Market growth is driven by factors such as population expansion, rising protein consumption, improved cold chain logistics, and technological advancements in processing.

Increasing consumer focus on health is also boosting demand for leaner, high-quality pork products. Additionally, investments in alternative production are shaping the future of the industry. Mewery has secured USD 3.3 million in government grants to scale cultivated pork, while Cambridge-based Uncommon raised €28 million to expand its cultured pork operations. Together, these factors highlight pork’s significant role in global diets and its evolving market landscape.

Key Takeaways

- The Global Pork Meat Market is expected to be worth around USD 474.3 billion by 2034, up from USD 323.5 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In the Pork Meat Market, chilled products dominate with 69.5%, showing strong consumer preference globally.

- Conventional pork leads the Pork Meat Market with 89.4%, reflecting affordability and widespread consumption across regions.

- Ham captures 34.7% share in the Pork Meat Market, driven by versatile use in global cuisines.

- Household application holds 68.3% in the Pork Meat Market, highlighting pork’s role as a daily protein source.

- Supermarkets and hypermarkets contribute 46.9% to the Pork Meat Market, ensuring accessibility through established retail networks.

- Strong consumer demand in the Asia Pacific supported the Pork Meat Market’s 46.8% share worth USD 151.3 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/pork-meat-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 323.5 Billion |

| Forecast Revenue (2034) | USD 474.3 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Type (Chilled, Frozen), By Nature (Conventional, Organic), By Cut Type (Ham, Ribs, Others), By Application (Household, Commercial), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Others) |

| Competitive Landscape | Danish Crown, Triumph Foods, Yurun Group, Vion Food Group Ltd., WH Group, Smithfield Foods, JBS S.A., Tönnies Zerlegebetrieb GmbH, Tyson Foods Inc., Shuanghui Development |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157909

Key Market Segments

By Type Analysis

Chilled pork led the market in 2024, commanding a 69.5% share. Its dominance stems from consumer demand for fresh, nutrient-rich products with superior taste and texture compared to frozen options. Favored in households and foodservice for its quick preparation, chilled pork benefits from expanded cold-chain infrastructure, ensuring wider retail availability. Growing urbanization, demand for minimally processed meat, and preference for premium dining experiences further solidify its strong market position.

By Nature Analysis

Conventional pork held an 89.4% share in 2024, driven by its cost-effectiveness, large-scale production, and widespread availability. Its affordability and reliable supply through established farming and distribution networks make it the top choice for consumers. High demand in households, foodservice, and processing industries, where it serves as a versatile ingredient, supports its dominance. Efficient conventional farming practices ensure stable production to meet global protein needs.

By Cut Type Analysis

Ham captured a 34.7% share in 2024, leading the cut type segment due to its versatility in fresh and processed forms. Popular for its rich flavor and ease of preparation, ham is a staple in various culinary traditions, from festive dishes to daily meals. The rise of value-added and ready-to-eat options appeals to urban consumers, while its strong presence in retail, foodservice, and export channels reinforces its market leadership.

By Application Analysis

Household consumption accounted for 68.3% of pork meat usage in 2024, driven by its role as a primary protein source in daily diets. Pork’s taste, versatility, and affordability make it a household favorite across cuisines. The availability of chilled and packaged pork in supermarkets and online platforms enhances convenience and quality, while urbanization and rising incomes boost demand for quick-to-cook options.

By Distribution Channel Analysis

Supermarkets and hypermarkets led distribution with a 46.9% share in 2024, offering a wide range of fresh, chilled, and processed pork products. These retail formats provide convenience, quality assurance, and attractive promotions, building consumer trust. Advanced cold storage and the growth of organized retail chains improve product availability, while urban demand for one-stop shopping solidifies their dominance.

Regional Analysis

In 2024, the Asia Pacific region led the global pork meat market, capturing a 46.8% share valued at USD 151.3 billion. This dominance is driven by dense urban populations, advanced cold-chain infrastructure, and robust retail penetration in major cities. North America maintains steady growth, fueled by strong household demand, mature processing capabilities, and widespread availability of convenient, chilled pork cuts through supermarkets and online channels.

Europe’s market thrives on stringent animal-health standards and a growing preference for traceable, high-quality pork, supported by efficient distribution networks and advanced packaging that extends shelf life. The Middle East & Africa region is experiencing growth from a smaller base, propelled by improved logistics, the rise of quick-service formats, and diversified import sources ensuring year-round availability for specific consumer segments.

Top Use Cases

- Ready-to-Cook Products: Pork meat is popular for ready-to-cook meals like pre-marinated chops or sausages, offering convenience for busy households. These products save time, appeal to urban consumers, and are widely available in supermarkets, driving demand for quick, flavorful meal solutions.

- Processed Meat Products: Pork is a key ingredient in processed foods like bacon, ham, and deli meats. Its versatility and rich flavor make it a favorite for sandwiches, breakfast items, and snacks, boosting sales in retail and foodservice sectors.

- Restaurant and Foodservice Menus: Pork features heavily in restaurant menus, from BBQ ribs to pork tacos, due to its taste and adaptability. Chefs prefer it for diverse cuisines, attracting diners seeking affordable yet premium dining experiences.

- Home-Cooked Meals: Pork is a staple for home cooking, used in stir-fries, roasts, and stews. Its affordability and variety of cuts make it ideal for families, supporting consistent demand across households globally.

- Export and Trade Markets: Pork is a major export commodity, with high demand in regions lacking local supply. Its popularity in global cuisines ensures strong trade, especially for chilled and frozen cuts, meeting diverse consumer needs.

Recent Developments

1. Danish Crown

Danish Crown is pivoting towards climate-neutral pork. A major strategy involves transitioning to sustainable feed sources like green protein to lower the carbon footprint of its entire supply chain. This long-term commitment responds to growing consumer demand for environmentally responsible meat production and aims to secure the future of Danish pig farming.

2. Triumph Foods

Triumph Foods is aggressively expanding its production capacity to meet sustained demand. A key recent development is the opening of a new facility in Columbia, Missouri, dedicated to further processing and case-ready products. This investment enhances their value-added offerings for retail and foodservice customers, strengthening their market position and increasing pork output significantly to capitalize on current market opportunities.

3. Yurun Group

Facing significant financial pressure, Yurun Group’s recent developments are dominated by restructuring efforts. The company has been dealing with court-supervised debt restructuring to avoid liquidation after defaulting on bonds. Its focus is on stabilizing operations and negotiating with creditors to ensure business continuity, reflecting the severe challenges within China’s pork and real estate sectors that have impacted the conglomerate.

4. Vion Food Group Ltd.

Vion is intensifying its focus on transparency and animal welfare with its “WeCare” program. A recent key initiative involves launching a barcoded traceability system for pork, allowing consumers to see the farm of origin. Concurrently, the company is navigating market volatility by strategically adjusting its geographical footprint, including the potential sale of some assets to optimize its portfolio for long-term, sustainable growth.

5. WH Group

WH Group, owner of Smithfield Foods, continues to vertically integrate and diversify its product portfolio. Recent developments highlight a strategic expansion of its packaged meats and foodservice segments to add value beyond fresh pork. The company is also investing heavily in automation and data analytics across its US and European operations to enhance supply chain efficiency and reduce costs, mitigating the impact of input price inflation.

Conclusion

The Pork Meat Market thrives due to its versatility, affordability, and global appeal. From convenient ready-to-cook options to restaurant dishes and export markets, pork meets diverse consumer needs. Growing urban lifestyles, improved cold-chain systems, and demand for high-quality, flavorful protein continue to drive its strong market presence, ensuring sustained growth across various applications and regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)