Table of Contents

Overview

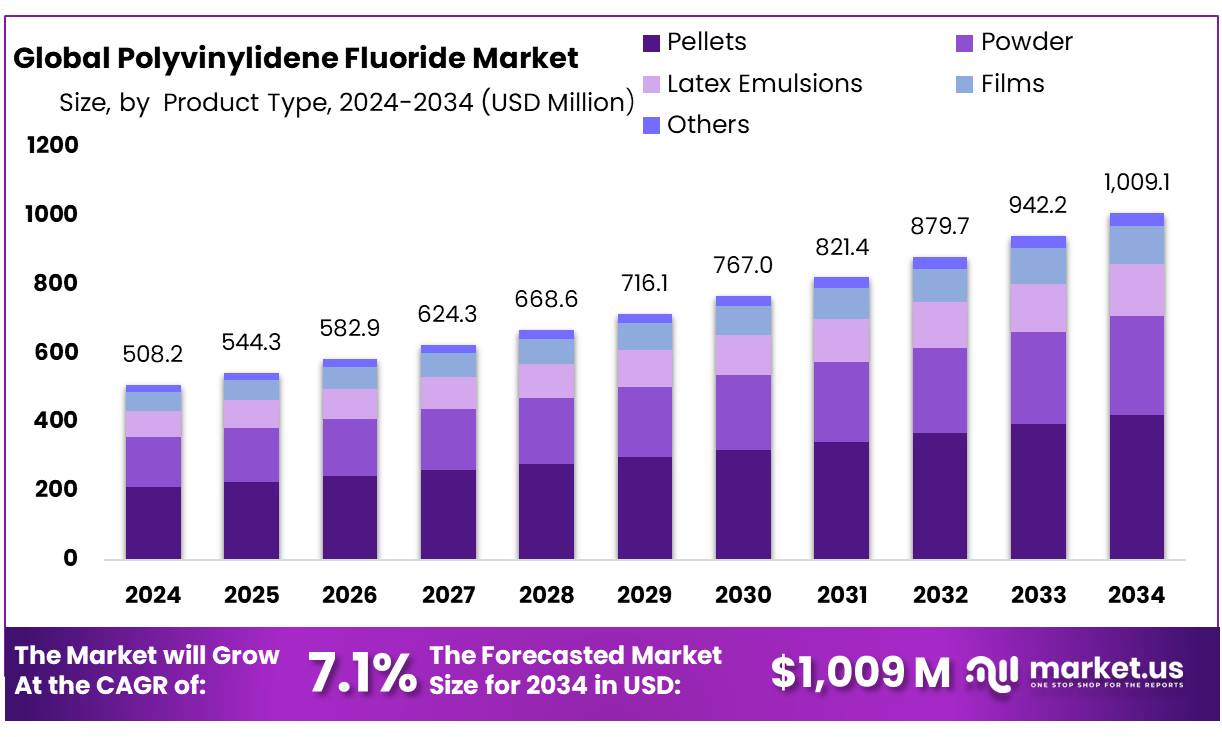

New York, NY – August 05, 2025 – The Global Polyvinylidene Fluoride (PVDF) Market is projected to grow from USD 508.2 million in 2024 to approximately USD 1009.1 million by 2034, achieving a CAGR of 7.1% over the forecast period (2025–2034). In 2024, the Asia-Pacific (APAC) region led the market, accounting for a 38.2% share, equivalent to USD 194.1 million in revenue.

PVDF, a semi-crystalline thermoplastic fluoropolymer, is valued for its chemical inertness, thermal stability (melting point ~177°C), and piezoelectric properties. These qualities drive its increasing application in lithium-ion battery binders, high-performance membranes, architectural coatings, and advanced electronic components, particularly in energy storage, coatings, and high-purity sectors.

Government support for clean energy is a major catalyst. In the U.S., the Inflation Reduction Act and CHIPS & Science Act have spurred over USD 150 billion in battery supply chain investments since 2021, boosting PVDF demand for electric vehicle (EV) battery separators and binders. The 45X Advanced Manufacturing Production Tax Credit and 48C Energy Tax Incentives further encourage domestic production of PVDF-intensive components.

In the U.S. and EU, regulations like the Safe Drinking Water Act and the EU’s Water Framework Directive are promoting PVDF-based filtration systems for enhanced water purification. At the corporate level, Arkema is expanding its PVDF production capacity by 15% in Kentucky with a USD 20 million investment, targeting completion by mid-2026 to meet growing demand in EV batteries, semiconductors, and cable insulation.

U.S. federal strategies, including the Department of Energy’s four-year review (2021–2024), emphasize PVDF’s critical role in advanced battery sectors. The DOE Loan Programs Office and U.S. International Development Finance Corporation have allocated at least USD 55 million to secure raw material supply chains for clean energy, indirectly supporting PVDF market growth.

Key Takeaways

- The Polyvinylidene Fluoride (PVDF) Market is projected to grow from USD 508.2 million in 2024 to approximately USD 1009.1 million by 2034, registering a CAGR of 7.1% during the forecast period.

- Injection molding emerged as the leading processing technology, accounting for over 48.7% of the global PVDF market share.

- Pellets dominated the form segment, capturing more than 41.8% of the overall market.

- Within the application segment, piping and tubing held a significant position, contributing to over 19.2% of the global PVDF market.

- The electrical and electronics sector led the end-use segment, representing more than 28.3% of the total market share.

- The Asia-Pacific (APAC) region was the dominant regional market, holding a 38.2% share, which translates to an estimated market value of USD 194.1 million in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/polyvinylidene-fluoride-market/request-sample/

Report Scope

| Market Value (2024) | USD 508.2 Million |

| Forecast Revenue (2034) | USD 1009.1 Million |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Process (Injection Molding, Extraction, Others), By Product Type (Pellets, Powder, Latex Emulsions, Films, Others), By Application (Piping and Tubing, Plumbing and Fitting, Membranes, Chemical Processing, Semiconductors, Wire and Cable, Lithium-ion Batteries, Valves, Architectural Coating, Nuclear Waste Processing, Others), By End-Use (Electrical and Electronics, Oil and Gas, Food and Beverage, Pharmaceutical, Building and Construction, Automotive, Aerospace and Defense, Metallurgical, Paper and Textile, Others) |

| Competitive Landscape | 3M, Aetna Plastics Corp., Arkema SA, Daikin Industries, Ltd, Ensinger, Gujarat Fluorochemicals Ltd., Kureha Corporation, Nanoshel LLC, Ofluorine Chemical Technology Co., Ltd., Rochling SE and Co. KG, RTP Co., Shanghai Huayi 3F New Materials Co. Ltd., Simtech Process Systems, Solvay SA, Swami Plast Industries |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153256

Key Market Segments

Process Analysis

Injection Molding commands a 48.7% share in the global Polyvinylidene Fluoride (PVDF) market in 2024, driven by its precision and suitability for high-volume production. This process excels in creating complex, high-tolerance parts with minimal waste, making it a top choice for automotive, electrical, and chemical processing industries. The rising demand for lightweight, durable components in electric vehicles and clean energy systems further strengthens its position. In 2025, Injection Molding is expected to maintain dominance, fueled by industrial growth and expanding applications in the Asia-Pacific and North America.

Product Type Analysis

Pellets lead the PVDF market with a 41.8% share in 2024, valued for their ease of processing and versatility in extrusion, injection molding, and compounding. Their uniform shape and consistent melting properties enable efficient, high-volume manufacturing for automotive, electronics, and chemical applications. With increasing demand for electric vehicle battery binders, protective coatings, and durable pipes, pellets are set to retain their strong market position into 2025, supported by widespread industrial adoption.

Application Analysis

Piping and Tubing holds a 19.2% share in the 2024 PVDF market, driven by PVDF’s superior chemical resistance, high-temperature tolerance, and durability. These properties make it ideal for fluid handling in chemical processing, water treatment, and semiconductor industries. Its non-reactive nature also boosts demand in pharmaceuticals and food processing. In 2025, this segment is poised for steady growth as industries expand and stricter environmental and safety standards drive the need for reliable, low-maintenance piping solutions.

End-Use Analysis

Electrical and Electronics dominates with a 28.3% share in the 2024 PVDF market, propelled by PVDF’s excellent electrical insulation, thermal stability, and flame resistance. It is widely used in wire coatings, connectors, and film capacitors, as well as lithium-ion battery binders and photovoltaic backsheets, aligning with the global push for renewable energy and electric mobility. As electronics trend toward miniaturization and reliability, this segment is expected to maintain strong demand.

Regional Analysis

Asia-Pacific (APAC) leads the global PVDF market with a 38.2% share, valued at USD 194.1 million in 2024. Rapid growth in electronics, automotive, chemicals, and renewable energy sectors in China, Japan, South Korea, and India drives this dominance. China’s leadership stems from its investments in clean energy and semiconductor manufacturing, bolstered by the “Made in China 2025” initiative.

India’s Production-Linked Incentive schemes support PVDF production for pharmaceuticals and water treatment. Japan and South Korea contribute through innovations in electronics and filtration membranes, with demand fueled by stringent regulations. In 2025, APAC is expected to sustain its market lead.

Top Use Cases

- Piping and Tubing: PVDF is widely used for pipes and tubes in chemical processing, water treatment, and semiconductor industries due to its excellent chemical resistance and durability. Its ability to withstand high temperatures and corrosion makes it ideal for fluid handling systems, ensuring long-term reliability in harsh environments.

- Electrical Insulation: PVDF’s superior electrical insulation properties make it a top choice for wire and cable coatings in electronics and aerospace. Its high dielectric strength and flame resistance ensure safety and performance in consumer devices, industrial systems, and high-voltage applications.

- Battery Binders: PVDF is a key material in lithium-ion battery binders, especially for electric vehicles. Its strong adhesion and chemical stability enhance battery performance and longevity, meeting the growing demand for efficient energy storage in renewable energy and mobility sectors.

- Membranes for Filtration: PVDF is used in filtration membranes for water treatment and biotechnology due to its high purity and chemical resistance. Its porous structure ensures effective separation in the pharmaceutical and food industries, supporting clean water and hygienic processes.

- Medical Devices: PVDF’s biocompatibility makes it suitable for medical implants, sutures, and drug delivery systems. Its resistance to sterilization and low reactivity ensure safe use in surgical tools and long-term implants, supporting advancements in healthcare.

Recent Developments

1. 3M

3M has been focusing on high-purity PVDF for lithium-ion batteries, supporting the EV market. They introduced new PVDF binder solutions to enhance battery performance and longevity. Additionally, 3M is investing in sustainable PVDF production to reduce environmental impact. Their innovations target energy storage and filtration applications.

2. Aetna Plastics Corp.

Aetna Plastics supplies PVDF rods, sheets, and tubes for chemical processing and semiconductor industries. They recently expanded their PVDF product line to include custom-machined components with improved thermal and chemical resistance. Their PVDF is used in high-purity fluid handling systems.

3. Arkema SA

Arkema launched Kynar PVDF with recycled content for sustainable applications. They expanded production in Asia to meet rising demand in batteries and coatings. Arkema’s PVDF is now used in 5G antenna coatings due to its weather resistance. They also focus on bio-attributed PVDF from renewable feedstocks.

4. Daikin Industries, Ltd

Daikin developed high-performance PVDF resins for lithium-ion battery binders and solar backsheets. Their new PVDF grades offer better adhesion and durability. Daikin is also researching fluoropolymer recycling to support circular economy goals in the EV sector.

5. Ensinger

Ensinger introduced PVDF-based machined parts for the medical and chemical industries. Their TECASON PVDF is used in implants and lab equipment due to its biocompatibility. They also offer PVDF piping systems for aggressive chemical environments.

Conclusion

Polyvinylidene Fluoride (PVDF) is a versatile, high-performance polymer driving innovation across industries like electronics, automotive, healthcare, and construction. Its unique properties, including chemical resistance, thermal stability, and piezoelectricity, make it essential for applications from battery binders to medical devices. With growing demand in clean energy and sustainable solutions, PVDF’s market is poised for strong growth through 2025 and beyond.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)